A Comprehensive Guide to 529 College Savings Plans

Think of a 529 college savings plan as a specialized investment account for education, much like a 401(k) is for retirement. Sponsored by states, these plans are laser-focused on covering future educational costs and come with significant tax advantages. Contributions can grow and be withdrawn completely tax-free when used for qualified education expenses, making them one of the most powerful tools for families planning for the future.

What Exactly Is a 529 College Savings Plan?

At its core, a 529 plan is an investment account designed to help families save for education. The name comes from Section 529 of the IRS tax code that established these accounts.

The concept is simple: you contribute after-tax money, select from a range of investment options, and let the funds grow over time. The primary benefit lies in its tax-advantaged structure, which allows your savings to compound more effectively than in a standard brokerage or savings account.

Who Can Open and Use a 529 Plan?

One of the most appealing features of 529 plans is their flexibility regarding ownership and beneficiaries.

- The Account Owner: Any U.S. citizen or resident alien who is at least 18 years old can open an account. This includes parents, grandparents, aunts, uncles, and even family friends. You can also open an account for yourself if you plan to pursue further education.

- The Beneficiary: This is the future student for whom the money is being saved. It can be a child, grandchild, another relative, or even yourself. There are no strict relationship or age requirements.

As the account owner, you maintain full control. You manage the investments, decide when to withdraw funds, and can even change the beneficiary to another eligible family member if the original student’s plans change.

The Power of Tax-Free Growth

The single most significant reason to use a 529 college savings plan is its tax advantage, which truly distinguishes it from other savings vehicles.

Many plans offer a triple-tax benefit: your contributions may be deductible on your state income taxes, your investments grow completely sheltered from federal and state taxes, and withdrawals for qualified expenses are 100% tax-free at both the federal and state levels.

This powerful combination accelerates the compounding of your savings. It’s no surprise that these plans have become a cornerstone of education funding, with families holding over $525 billion across more than 17 million 529 accounts.

Pairing this long-term savings strategy with early financial literacy is a recipe for success. That’s why it’s also a great idea to learn how to teach kids about money to build a solid foundation for their future.

Comparing the Two Types of 529 Plans

When you explore 529 college savings plans, you'll discover two primary types: College Savings Plans and Prepaid Tuition Plans. They operate very differently, and understanding these differences is crucial for choosing the right one for your family.

Think of a College Savings Plan as a dedicated investment account for education. You contribute money that is invested in market-based portfolios, much like a 401(k), giving it the potential to grow over time. This option offers flexibility and higher growth potential.

A Prepaid Tuition Plan, in contrast, functions more like a contract. You purchase tuition "credits" at today's prices to be used for future education. This route offers predictability and security, shielding you from tuition inflation.

College Savings Plan vs. Prepaid Tuition Plan

The right choice depends on your comfort level with market risk versus institutional restrictions. A savings plan offers the potential upside of market growth, while a prepaid plan provides peace of mind against rising tuition costs. This table breaks down the key differences.

| Feature | College Savings Plan | Prepaid Tuition Plan |

|---|---|---|

| How It Works | Invests your contributions in market-based portfolios (e.g., mutual funds, ETFs). | Lets you pre-purchase tuition "credits" or certificates at today's rates. |

| Flexibility | High. Funds can be used at nearly any accredited college, university, or trade school worldwide. | Low. Generally restricted to a network of participating (often in-state, public) colleges. |

| Covered Expenses | Broad. Covers tuition, fees, room and board, books, computers, and other required supplies. | Narrow. Typically only covers tuition and mandatory fees. Room and board are usually not included. |

| Investment Risk | You assume market risk. The account value can fluctuate with investment performance. | Low to none. The plan sponsor assumes the risk of tuition inflation, guaranteeing your credits. |

| State Residency | No residency requirements. You can open a plan in any state. | Often requires the owner or beneficiary to be a resident of the sponsoring state. |

| Best For | Families wanting flexibility for any school and coverage for all major educational costs. | Families who are certain their child will attend an in-state public university and want to hedge against inflation. |

For many, getting comfortable with these investment concepts is a journey. If you're just starting out, you might find our guide on how to start investing in index funds helpful, as it explains some of the basic principles that apply here, too.

Real-Life Scenarios

Seeing how these plans work for different families can clarify the choice.

Scenario 1: The Garcia Family Chooses a College Savings Plan

The Garcias have a newborn daughter, Sofia. They don't know where she'll want to attend college in 18 years—it could be an in-state public university, a private liberal arts college, or even a school abroad. They also want to ensure her housing and meal plan are covered.

They opt for a College Savings Plan and set up automatic monthly contributions into an age-based investment portfolio.

- The Outcome: Their investments grow significantly over 18 years. When Sofia is accepted to her dream out-of-state university, the Garcias use the 529 funds to pay for her tuition, dorm, meal plan, and a new laptop for her classes, all completely tax-free. The flexibility was essential to meeting their goals.

Scenario 2: The Chen Family Chooses a Prepaid Tuition Plan

The Chens live in a state with a strong public university system and are confident their son, Leo, will attend one of them. Their primary concern isn't market volatility but the steady, rapid increase in tuition costs.

They enroll in their state’s Prepaid Tuition Plan and purchase four years of tuition credits at current rates.

- The Outcome: By the time Leo enrolls in college, tuition at the state's flagship university has nearly doubled. However, the Chens are unaffected by this inflation. Their prepaid plan covers 100% of his tuition and fees, saving them thousands of dollars and providing invaluable peace of mind.

The Real Payoff: Your Tax and Financial Aid Edge

While watching your college fund grow is rewarding, the true power of a 529 college savings plan lies in its tax and financial aid advantages. These benefits allow you to keep more of your money and can help preserve your child's eligibility for financial aid.

The "triple-tax benefit" works like this:

- State Tax Deduction/Credit: Over 30 states offer a state income tax deduction or credit for contributions made to their 529 plan, providing an immediate financial reward.

- Tax-Deferred Growth: Your investments grow free from federal and state income taxes. Unlike a standard brokerage account, you won't pay annual capital gains taxes, allowing your money to compound faster.

- Tax-Free Withdrawals: Your withdrawals are 100% free from federal and state income tax when used for qualified education expenses.

Example: The Miller Family's Smart Savings

The Millers live in a state offering a 529 tax deduction. They open a plan for their newborn, Alex, and contribute $5,000 annually.

- Their state has a 5% income tax rate.

- Their contribution results in a state tax savings of $250 each year ($5,000 x 0.05).

- Over 18 years, this amounts to $4,500 in state tax savings alone.

This immediate return, combined with 18 years of tax-free growth and tax-free withdrawals, creates a massive financial advantage.

How 529s Impact Financial Aid (Hint: It's Good News)

A common concern for parents is whether saving for college will reduce their child’s financial aid eligibility. Fortunately, 529 plans are structured to minimize this impact.

On the Free Application for Federal Student Aid (FAFSA), a parent-owned 529 plan is considered a parental asset. This is beneficial because parental assets are assessed at a much lower rate than assets owned by the student.

Under current FAFSA rules, parental assets reduce aid eligibility by a maximum of 5.64%. This means that for every $10,000 in a 529 account, your child's eligibility for federal aid is reduced by only $564 at most. In contrast, a savings account in the student's name is assessed at 20%, reducing aid by $2,000 for the same amount.

Fitting these contributions into your family finances is key. If you're looking for ways to make it work, it helps to learn how to create a monthly budget to see where a 529 fits in.

A Big Win for Grandparent-Owned Plans

Recent changes to FAFSA rules have been a game-changer for grandparents who want to help. Previously, withdrawals from a grandparent-owned 529 were counted as student income, which could significantly reduce the student’s aid award the following year.

The FAFSA Simplification Act eliminated this problem. Starting with the 2024-2025 school year, distributions from a grandparent's 529 plan (or any non-parent plan) are no longer reported on the FAFSA. This allows grandparents to contribute generously from their 529s without negatively affecting their grandchild's financial aid package.

How to Choose Your Investment Strategy

You don't need to be a financial expert to manage the investments in a 529 college savings plan. Most plans are designed for long-term savers, not day traders. The primary goal is to select an approach that matches your risk tolerance and your child's time horizon until college.

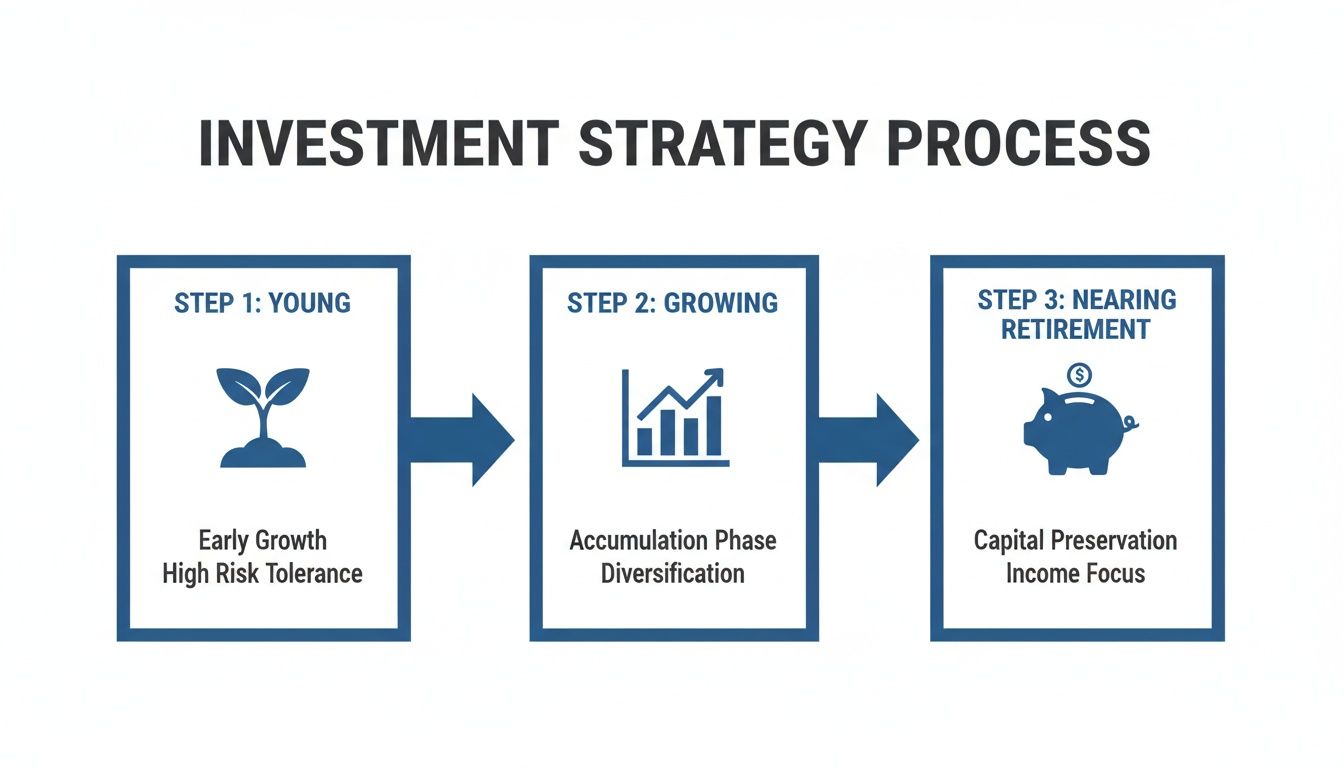

The most popular choice is the age-based portfolio (also known as a target-date portfolio). This is a "set it and forget it" strategy that automatically adjusts its investment mix over time.

When your beneficiary is young, the portfolio is aggressive, with a high allocation to stocks to maximize long-term growth. As college enrollment approaches, the portfolio automatically shifts toward more conservative investments like bonds and cash to protect your accumulated earnings. This hands-off approach helps lock in gains when you need the money most.

Taking a Hands-On Approach with Static Portfolios

If you prefer more direct control over your investments, a static portfolio may be a better fit. Unlike age-based options, a static portfolio maintains a fixed asset allocation that you select.

These portfolios are typically offered in several risk-based categories:

- Aggressive Growth: Composed almost entirely of stocks, this option is for those seeking the highest growth potential and who are comfortable with market volatility.

- Moderate Growth: A balanced mix of stocks and bonds, offering a middle ground between growth and stability.

- Conservative/Income: Primarily invested in bonds and cash equivalents, focusing on capital preservation over growth.

This approach is suitable for savers who are confident in managing their own investments and are willing to periodically rebalance their portfolio. If this describes you, our guide on investing strategies for beginners can provide valuable foundational knowledge.

Understanding and Minimizing Fees

Fees can silently erode your 529 plan's growth over time. Even small differences in fees can have a significant impact on your final balance after more than a decade of saving.

A 529 plan's total annual fee is often expressed as an expense ratio. This single percentage includes all management and administrative costs and is deducted from your returns each year. A lower expense ratio means more of your money stays invested and working for you.

Let’s see how this plays out with a real-world comparison.

| Feature | Plan A (Low-Fee) | Plan B (High-Fee) |

|---|---|---|

| Initial Investment | $10,000 | $10,000 |

| Annual Contribution | $3,000 | $3,000 |

| Annual Return (Before Fees) | 6% | 6% |

| Total Annual Fee | 0.20% | 0.80% |

| Balance After 18 Years | $105,970 | $97,450 |

| Difference (Lost to Fees) | -$3,630 | -$12,150 |

The seemingly small 0.60% difference in fees cost the family with Plan B over $8,500. Choosing a low-cost plan is one of the easiest ways to maximize your savings. As you map out your college savings plan, it's also smart to think about how it fits into an effective overall investment strategy for all your financial goals.

Getting Started with Your 529 Plan

Opening a 529 college savings plan is a straightforward process that can secure your child's educational future. Here’s how to choose a plan, open an account, and start saving.

A key feature of 529s is that you are not restricted to your home state's plan. You can research and enroll in nearly any plan nationwide, allowing you to seek out lower fees or better investment performance. However, always check if your state offers a tax deduction for contributions first, as this often makes the local plan the most attractive option.

How to Open Your Account

Opening an account is simple and can typically be completed online in about 15 minutes. You will need some basic information for yourself (the account owner) and the beneficiary.

Gather this information before you begin:

- Your Details: Name, address, date of birth, and Social Security or Taxpayer Identification Number.

- Beneficiary's Details: Their name, date of birth, and Social Security or Taxpayer Identification Number.

That's all. There are no income restrictions, and you can often start with an initial contribution as low as $25.

Funding Your 529 Plan

Once the account is open, you can begin saving. Most plans offer flexible contribution methods. The most effective strategy is setting up automatic monthly contributions from your bank account, which puts your savings on autopilot.

Many plans also offer gifting features, providing a unique link you can share with family and friends for birthdays or holidays, making it easy for them to contribute directly. If this is your first time dipping your toes into this world, our guide on how to invest money for beginners is a great place to build some foundational knowledge.

Understanding Contribution Limits

While 529 plans do not have annual contribution limits, contributions are subject to federal gift tax rules. For 2024, an individual can contribute up to $18,000 per beneficiary (or $36,000 for a married couple) without gift tax implications.

A unique feature of 529 plans is "superfunding," which allows you to make five years' worth of contributions at once. This means you can contribute up to $90,000 as an individual or $180,000 as a married couple in a single year without triggering the gift tax.

This is an excellent strategy for grandparents or anyone looking to jump-start an account with a lump sum.

Managing Your Account Long Term

Life is unpredictable, but 529 plans are designed to be flexible. If the beneficiary decides not to pursue higher education, you can change the beneficiary to another eligible family member—such as another child, a niece, or even yourself—without tax penalties.

You can also perform a tax-free rollover from one 529 plan to another, typically once every 12 months. This allows you to switch to a plan with better performance or lower fees in the future, ensuring you are never locked into a single option.

Modern Uses for Your 529 Plan Funds

The traditional view of a 529 plan as being solely for a four-year university degree is outdated. Recent legislative changes have significantly expanded the scope of 529 college savings plans, transforming them into versatile tools for a wide range of educational and financial goals.

These rule changes have broadened the definition of "qualified expenses," allowing for tax-free withdrawals for more than just college tuition.

Beyond the College Campus

The modern 529 plan can be used in several exciting ways:

- K-12 Private School Tuition: You can withdraw up to $10,000 per beneficiary per year, federally tax-free, to cover tuition at private or religious elementary and high schools.

- Certified Apprenticeship Programs: Funds can now be used to pay for fees, books, and supplies for registered apprenticeship programs, supporting skilled trades.

- Student Loan Repayments: You can use 529 funds to pay down existing student loan debt, with a lifetime limit of $10,000 for the beneficiary and an additional $10,000 for each of their siblings.

As education financing keeps evolving, new strategies are always popping up, including recent guidance on retirement plan withdrawals tied to student loan payments.

The Roth IRA Rollover: A Game-Changer

Perhaps the most significant recent enhancement to 529 plans is the introduction of the Roth IRA rollover, established by the SECURE 2.0 Act. This feature provides a valuable safety net for leftover funds, addressing the common fear of "oversaving."

Under the new rule, you can roll unused 529 funds directly into the beneficiary's Roth IRA, with a lifetime maximum of $35,000. This allows families to avoid taxes and penalties on excess funds if a child receives scholarships or chooses a less expensive educational path.

This rollover feature transforms a 529 plan from a dedicated education account into a powerful, multi-generational wealth-building tool.

There are a few key requirements: the 529 account must have been open for at least 15 years, and the funds being rolled over must have been in the account for more than five years.

Real-Life Scenario: The Scholarship Success

Consider the Davis family, who diligently saved in a 529 plan for their daughter, Emily. When Emily earned a full-ride scholarship, they were thrilled but also left with an $80,000 529 account balance.

Previously, their options were limited to changing the beneficiary or withdrawing the funds and paying income tax and a penalty on the earnings.

Now, they have a much better strategy. Once Emily begins earning income, they can start rolling over the 529 funds into her Roth IRA. They can contribute up to the annual Roth limit each year until they reach the $35,000 lifetime maximum. This gives Emily a significant head start on her retirement savings, turning a potential "oversaving" problem into a major financial advantage.

Frequently Asked Questions (FAQ)

Here are answers to the top 10 most common questions about 529 college savings plans.

1. What happens if my child doesn't go to college?

Your money is not lost. You have several options:

- Change the Beneficiary: You can change the beneficiary to another eligible family member (another child, a niece/nephew, a grandchild, or even yourself) without tax penalties.

- Use for Other Education: The funds can be used for trade schools, vocational programs, and certified apprenticeships.

- Fund Retirement: You can roll over up to $35,000 into the beneficiary's Roth IRA over their lifetime, subject to certain rules.

- Withdraw the Funds: You can withdraw the money for non-qualified expenses. You'll pay income tax and a 10% penalty, but only on the earnings portion of the withdrawal. Your original contributions come back tax- and penalty-free.

2. Can I use a 529 plan for K-12 private school?

Yes. Federal law permits tax-free withdrawals of up to $10,000 per student per year for tuition at K-12 private or religious schools. However, not all states conform to this rule, so check your state's regulations to see if such withdrawals are also free from state income tax.

3. Am I stuck with my home state’s 529 plan?

No. You can open a 529 plan in almost any state. However, your home state may offer a state tax deduction or credit for contributions to its plan, a benefit you would likely lose by choosing an out-of-state plan. It's wise to compare the tax benefits of your state's plan against the lower fees or better investment options another state's plan might offer.

4. How much is too much to put in a 529 plan?

While there are no annual contribution limits set by the IRS, contributions are treated as gifts for tax purposes. In 2024, you can contribute up to $18,000 per person (or $36,000 for a married couple) without filing a gift tax return. You can also "superfund" an account by contributing up to five years' worth of gifts at once ($90,000 for an individual, $180,000 for a couple).

5. What exactly can we pay for with 529 funds?

Qualified higher education expenses are quite broad. Tax-free withdrawals can be used for:

- Tuition and mandatory fees.

- Room and board (for students enrolled at least half-time).

- Textbooks, school supplies, and required equipment.

- Computers, peripherals, software, and internet access.

6. Do I lose the money if my child gets a scholarship?

No. If your child receives a scholarship, you can withdraw an amount equal to the scholarship award from the 529 plan without incurring the 10% penalty. You will still owe income tax on the earnings portion of the withdrawal, but you avoid the penalty. Alternatively, you can save the funds for graduate school or transfer them to another beneficiary.

7. Can I have more than one 529 account?

Yes. You can open multiple 529 accounts for the same beneficiary. For example, parents and grandparents could each open a separate account. You can also open accounts for different beneficiaries. There is no limit to the number of accounts you can own, but total contributions to all accounts for a single beneficiary cannot exceed the plan's aggregate limit (which varies by state).

8. How are 529 plans different from Coverdell ESAs?

Both are education savings accounts with tax advantages, but they have key differences. 529 plans have much higher contribution limits and no income restrictions for the contributor. Coverdell Education Savings Accounts (ESAs) have income limitations for contributors and a low annual contribution limit ($2,000), but their funds can be used for a wider range of K-12 expenses beyond just tuition.

9. What happens to the 529 plan if the owner passes away?

If the account owner dies, control of the account typically passes to a successor owner named on the account application. If no successor is named, the new owner is often determined by the deceased owner's will or the plan's specific rules. The funds remain in the account for the beneficiary and do not have to be liquidated.

10. Can I invest in anything I want inside a 529 plan?

No. Unlike a standard brokerage account, you cannot invest in individual stocks or bonds. You are limited to the investment portfolios offered by the specific 529 plan, which typically include a range of age-based portfolios, static multi-fund portfolios, and sometimes individual mutual funds.

At Everyday Next, we provide the insights you need to make smart financial decisions for your family's future. Explore our guides to stay informed on everything from investing to personal growth. Find your next step at https://everydaynext.com.