Will There Be a Recession in 2025?

Table of Contents

The global economy—definitely on some wobbly legs right now—and folks everywhere are scratching their heads, wondering… is a recession sneaking up on us? At Everyday Next, we’re keeping an eagle eye on those economic breadcrumbs (GDP, unemployment… you know the drill) that might tip us off to a 2025 nosedive.

We’re digging into the juicy stuff: GDP growth, unemployment rates—yes, those—and inflation trends, to stitch together a no-nonsense picture of what might be coming our way. Plus, we’ll chat about what the experts are murmuring and toss around potential risk factors so you can get your ducks in a row for whatever economic curveballs might be rolling our way.

Economic Pulse Check 2025

GDP Growth: Positive but Decelerating

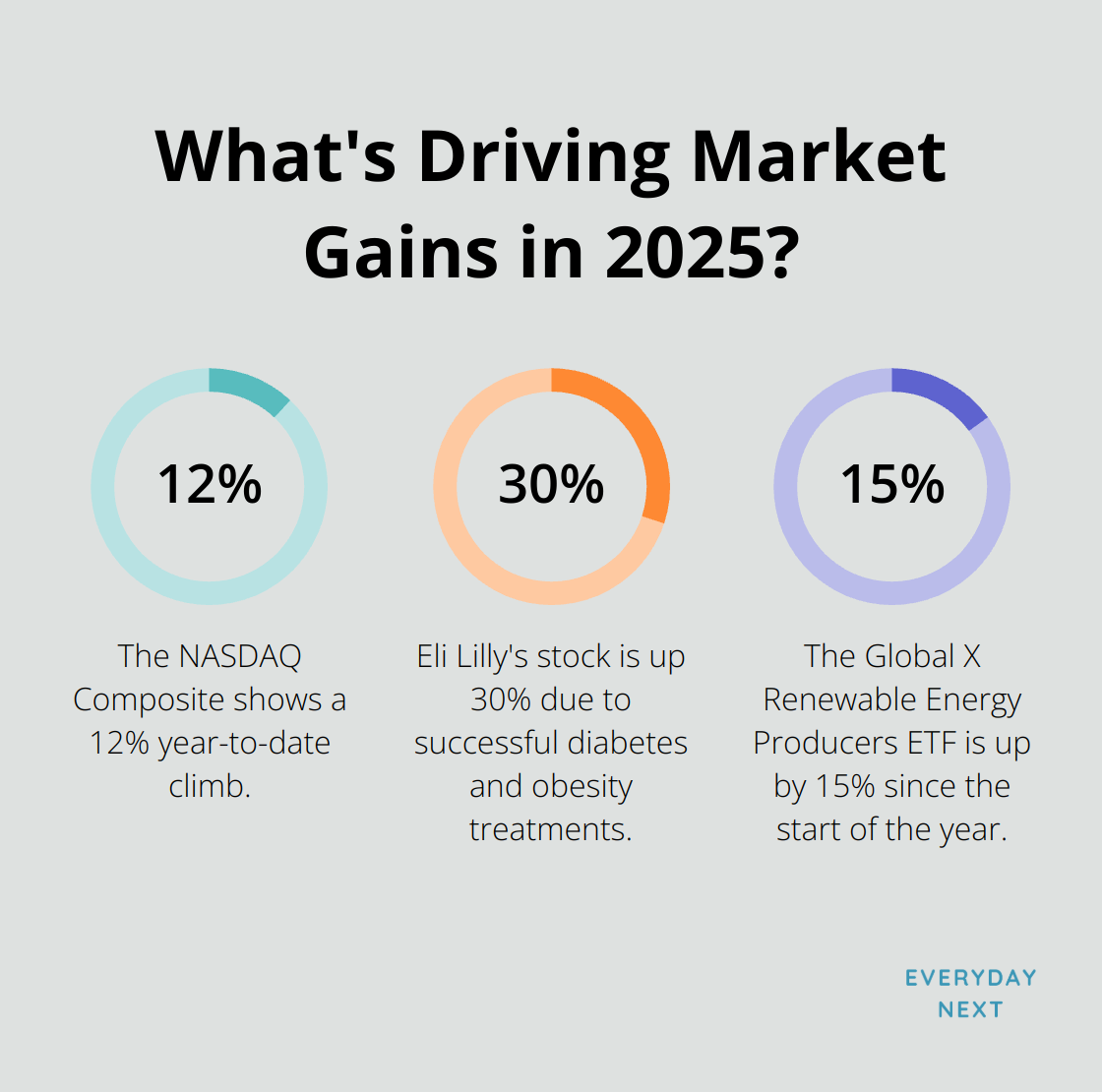

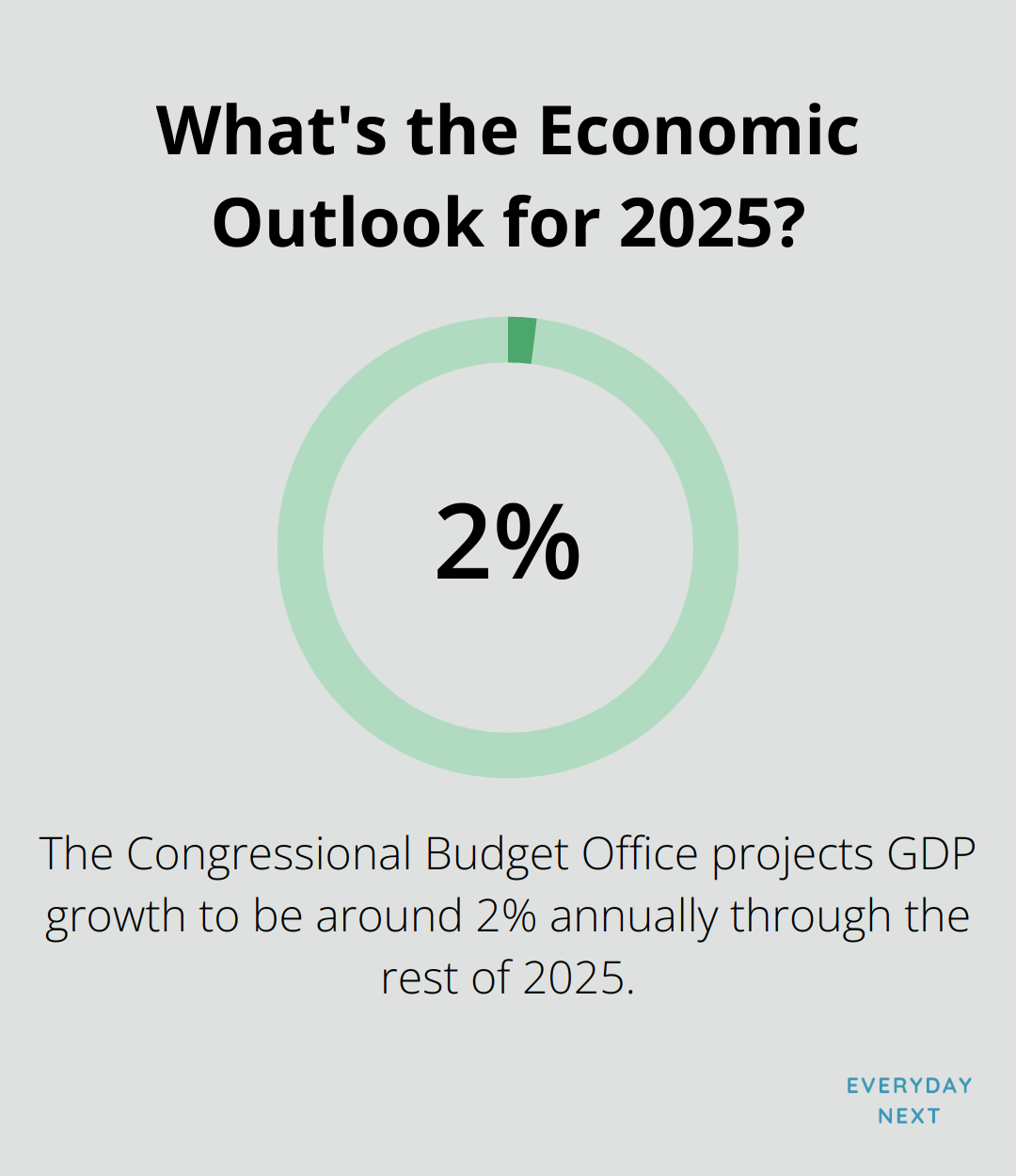

So, here’s the deal – the U.S. GDP growth rate has hit the brakes, sliding from 3.1% in late 2024 to 2.1% in 2025. What does this mean? A cooling economy. But hey, it’s still above water. The folks over at the Congressional Budget Office are waving their magic wands and projecting growth to hover around 2% annually through the rest of 2025. Yawn… a steady (if not quite thrilling) economic train chugging along.

Job Market: Strong with Underlying Concerns

Job growth slowed in January 2025, but – plot twist – revised data shows more gigs were added in November and December last year than we thought. Boom. This trend, however, whispers that there’s some turbulence lurking beneath the seemingly smooth surface of the job market. Stay tuned…

Inflation: Cooling but Persistent

Inflation-our old frenemy-has chilled a bit since its 9.1% peak in 2022 but still refuses to play nice with the Fed’s 2% target. As of November 2024, the consumer price index clocked in at 2.7% and the core PCE price index nipped its heels at 2.8%. Translation? Inflation’s still a stubborn player in town, not quite galloping but sure not fading quietly either.

Market Volatility: Investor Uncertainty Rises

Fasten your seatbelts because the stock market is on a roller coaster ride, showing off some wild swings in 2025. Investor jitters are on the rise – the VIX index (aka the “fear gauge”) keeps showing spikes, often giving us a heads up that something’s cooking with the Economic Policy Uncertainty index creeping upwards. Translation? Investors are on edge, sniffing for risks – blame it on fears of slowing growth and those pesky policy maneuvers.

Put these indicators together and – voilà – we’ve got an economy playing the waiting game at a crossroads. Not saying a recession’s knocking on our door just yet, but it’s wise to have your umbrella handy for any economic drizzle that might come our way. The next section? We’re diving into what factors could shove the economy into a recession pit in 2025. Stay curious.

Recession Red Flags for 2025

The economic landscape … it shifts. And with it, a slew of factors that make you scratch your head and wonder-are we on the brink of a recession in 2025? Let’s break down the chaos and confusion.

Trade Wars and Supply Chain Chaos

Global trade tensions? Oh, they’re heating up like a microwave burrito. The U.S. and China-still not BFFs. Thanks to the Biden administration sticking with Trump’s tariffs, we’re seeing ripple effects-like a stone tossed in a pond. The U.S. slapped tariffs on nearly $400 billion of goodies back in 2018-2019 … and surprise! They’re mostly still in play. Consumers? They’re feeling the pinch, which could mean less splurging and more penny-pinching.

Now add supply chain woes to the mix. The Panama Canal drought has left water levels high and dry-literally. Ships are rerouting, delays are piling up, and costs are skyrocketing. Brace yourselves for price hikes on everything from your favorite gadgets to your grocery cart items.

Fed’s Tightrope Walk

The Federal Reserve? Picture them as a trapeze artist juggling inflation and recession like a clown juggling flaming torches. Inflation’s cooled a bit, but still hovering above that comfortable 2% mark. The dot plot whispers sweet nothings about two potential rate cuts in 2025, but those won’t help if the economy’s too sluggish to dance.

The yield curve, folks, is a funhouse mirror. As of February 2025, the 10-year Treasury yield is playing limbo under the 2-year yield, a move that’s been the Harbinger of Doomsday … or, at least, recessions for the past 50 years.

Consumer Confidence Wobbles

Consumer spending-it’s the MVP of the U.S. economy, but it’s staggering like a tipsy partygoer. The University of Michigan’s Consumer Sentiment Index took a nosedive to 76.9 in January 2025, dropping from 81.3 in December 2024. It’s like watching your favorite team blow their lead-we’re talking job anxiety and wallet worries.

Credit card debt? Sky-high at $1.13 trillion in Q4 2024, says the Federal Reserve Bank of New York. With interest rates doing their best stalled car impression-going nowhere fast-consumers can’t keep up, which could mean tightening the purse strings.

Corporate Debt Time Bomb

Corporate debt? Yeah, that’s the ticking time bomb in our economic basement. U.S. corporate debt ballooned to a staggering $11.2 trillion by March 2021-about half the size of the U.S. economy. Gulp.

And tech? Once the golden goose, it’s looking a bit more like a lame duck. Those tech darlings scooped up cheap loans like kids at a candy store during low-interest days, and now they’re staring down the barrel of higher refinancing costs. A wave of defaults here could send tremors through the whole economy.

These indicators? They’re the economic equivalent of storm clouds gathering. Pay attention to what the experts say about these signals … the future of the U.S. economy might depend on it.

What Do the Experts Say About a 2025 Recession?

Alright, folks – crystal balls are hazy, the economy’s a mystery wrapped in an enigma, but let’s see what the so-called “experts” have to say about the 2025 recession dance. We’ve gathered a smorgasbord of thoughts from top economic minds and financial giants to piece together a somewhat clearer picture here.

Mixed Signals from Economic Oracles

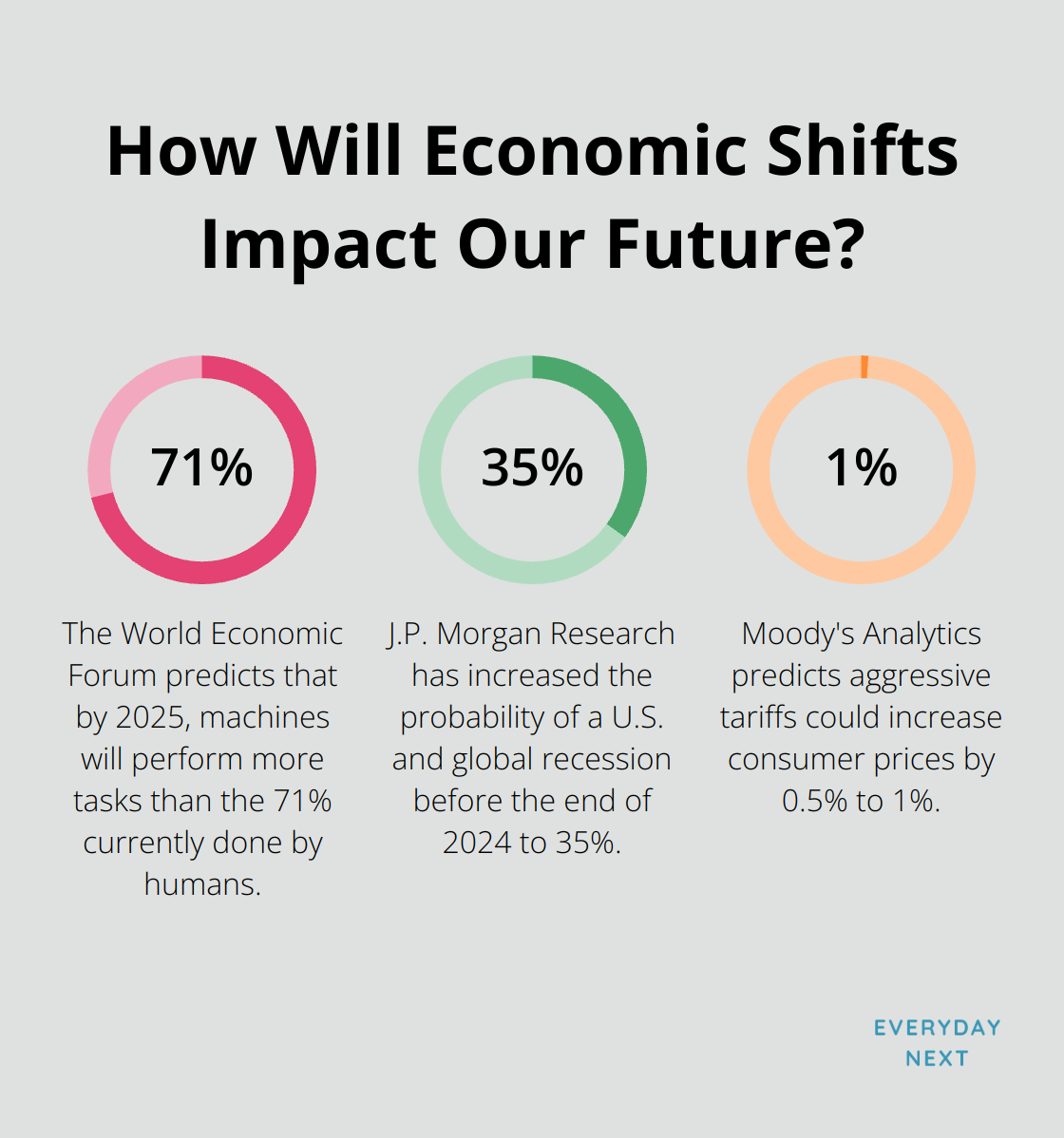

So, J.P. Morgan Research has bumped up the chances of the U.S. and global economy throwing a temper tantrum before the end of 2024 to 35% – up from 25% earlier. They’re betting on sturdy consumer spending (yeah, those shopping sprees might save us) and a rock-solid job market. Not everyone’s buying it though.

Meanwhile, The New York Federal Reserve – those number wizards – are waving a 29.4% red flag on a downturn within the next year. Sure, it’s something to chew on, but hey, it’s down from a nail-biting 60% peak back in late 2023.

Then there’s Goldman Sachs, wearing their rose-colored glasses, pegging the odds of a recession at a cool 15% for 2025. They’re betting big on mellowing inflation and a potential soft landing to keep things breezy.

Historical Patterns and Modern Twists

Recessions, like your favorite playlist, kind of show up every 5-10 years. Last official visit was April 2020. So, maybe we’re due? But hold on – the crazy ride of the pandemic-upended recession and bounce-back recovery has pretty much thumbed its nose at history’s playbook.

The yield curve inversion deal – which has been the economic crystal ball of sorts – has been chilling since July 2022. Normally means a recession is looming. But the economy’s been shaking its groove thing, beating expectations, causing some smart folks to scratch their heads over this old trusty predictor in today’s world.

Tech’s Double-Edged Sword

Tech – it’s that frenemy of progress. AI and automation are cranking up productivity but could leave some folks jobless out in the cold. The World Economic Forum’s crystal ball says by 2025, our metal friends will take over more tasks than humans, as opposed to the 71% humans are doing now.

This could stir some short-term chaos on the job front – yet it might also whisk up whole new job markets and industries, balancing out the doom and gloom in the grand scheme of things.

Political Wildcards and Policy Shifts

Ah, politics – always the wild card in this game. The 2024 U.S. election has tossed fresh uncertainties into the mix. The Trump administration’s head-scratchers (stricter immigration, tariff roulette) could rattle the economic stability boat.

Moody’s Analytics’ crystal ball sees aggressive tariffs pushing consumer prices up 0.5% to 1% – potentially throwing more fuel on the inflation fire and giving the Fed another headache in their price stability balancing act.

And let’s not forget the chatter around shaking up corporate tax rates and regulations – that could definitely sway boardroom decisions and leave a mark on economic growth coming down the 2025 road.

Final Thoughts

So, here we are-America’s economy, smack dab at a crossroads. Mixed messages? Conflicting opinions? You bet. Welcome to 2025. Resilient GDP growth? Check. Strong job market? Double-check. Inflation chilling out a bit? Absolutely. But don’t get too comfy-risks are lurking. Global trade tensions, anyone? Maybe some supply chain snafus? Oh, and let’s not forget the Federal Reserve doing a tightrope act. All this chaos makes the recession chatter for 2025… well, intriguing.

Experts say there’s a 15-35% chance of a recession next year. What do you do? Get ready. Build up that emergency fund, slash high-interest debt like it’s out of style, and diversify where your money comes from. Companies should keep an eye on efficiency, stack some cash reserves, and stay nimble because, let’s face it, the market is a shapeshifter.

Over at Everyday Next, we’ve got your back with personal finance, career development, and business strategy tips to help you dance through the uncertainty. Our platform-your go-to for insights on handling your finances and grabbing opportunities in a flip-flopping economy. Economic cycles? They’re like the changing seasons. But with the right know-how and some solid prep, you can set yourself up to win, no matter what curveball 2025 throws your way.