Inflation 2025 Forecast: What Slowing Prices Mean for Your Money

Inflation 2025 is a hot topic right now. Everyone feels its impact, whether you’re shopping for groceries, planning a vacation, or saving for the future. When prices go up, your money simply doesn’t go as far. But the good news is that this year, inflation is finally showing signs of slowing. So, what does that mean for your money? Let’s explore what’s driving this shift and how it affects savings, investments, and your daily life.

What Is Inflation, and Why Does It Matter in 2025?

Inflation means prices go up over time. It happens when the cost of goods and services increases. That affects how much you can buy with the same amount of money. Over the past few years, prices jumped fast, people felt it at the gas pump, in grocery stores, and while paying rent. But in 2025, things are changing. Inflation 2025 is still around, but it’s not Rising As Quickly. Experts say the pace is slowing.

And that can be a big relief. Why does this matter? Because when prices don’t climb as fast, your money keeps its value longer. A dollar today is still worth almost a dollar next month. This change makes it easier to plan, save, and invest wisely.

Why Is Inflation 2025 Slowing Down?

So, what’s behind the shift in inflation 2025? Several trends are working together to bring prices under control:

- Supply chains are recovering: After years of delays, products are moving faster again.

- Interest rates are higher: Central banks raised rates to cool down spending.

- Consumers are spending less: With credit more expensive, people are holding back.

- Energy prices are stable: Oil and gas costs aren’t spiking like they did before.

- Global demand is easing: As economies adjust, pressure on prices has reduced.

All of this has helped slow inflation. But it’s worth noting, nothing is guaranteed. A new global event or economic shock could quickly shift the outlook again.

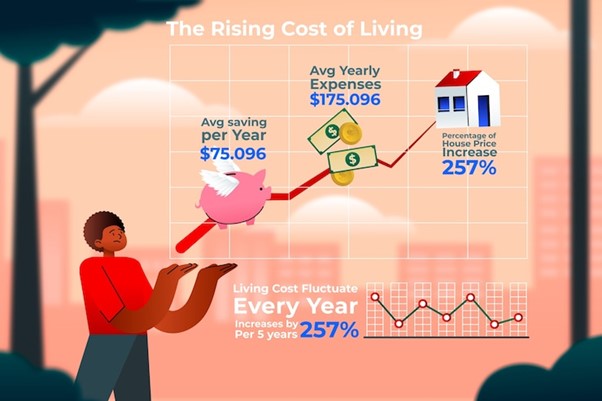

Real-World Impact: How Slowing Inflation Helps Your Savings

In 2022, people watched their savings shrink in value as inflation ran over 8%. Imagine having $10,000 saved; if inflation were at 8%, the Buying Power of that money would drop fast. But now, with inflation 2025 expected to be closer to 2%, that same money loses much less value over time. This change protects savers. Your cash isn’t melting away month by month. It also gives banks room to offer better interest rates. Still, be smart about it. A savings account earning less than inflation won’t help you grow your wealth. Consider options like high-yield accounts or certificates that offer better returns.

Investments and Inflation 2025: A New Balance

Is this the end of high inflation 2025? Not quite. But investors are breathing easier. When inflation slows, the stock market often finds some balance. Companies aren’t as burdened by rising costs, which can lead to more profits. Bond markets also benefit if inflation is under control, and fixed-income investments hold more value. But not all assets thrive in this environment. Gold, for example, is often a hedge against fast inflation.

With slower Price Growth, its shine may fade a bit. The key takeaway? Inflation 2025 gives investors a chance to rethink their strategy. You may not need to play defense as much this year. Instead, it might be time to look for steady growth and low-risk options that perform well when the economy is stable.

Everyday Spending: Will Your Bills Feel Lighter?

Most people don’t think about inflation in economic terms, they feel it when buying dinner or filling the gas tank. In 2022, many families saw grocery bills jump by over 10%. But with inflation 2025 expected to stay around 2%, that $100 grocery trip might now only cost $102, not $110. That’s a big difference. This slower pace helps you manage a budget. It means you might not have to stretch your paycheck so thin. And with stable prices, you can plan bigger expenses with more confidence.

Smart habits still matter. Here are a few ways to stay ahead:

- Buy in bulk when prices are steady

- Shop during seasonal sales

- Plan your meals to avoid impulse buying

- Choose local products that cost less

- Prioritize needs over wants in your monthly budget

Even if inflation 2025 slows, keeping control of your spending is always a smart move.

Preparing for Inflation 2025: Tips That Work

The future isn’t set in stone. But you can still take steps to protect your finances this year. Start by reviewing your budget. See where your money goes and find spots to save. Even small cuts can add up. Next, build or grow an emergency fund. Aim for at least three months of expenses. It’s peace of mind if prices suddenly jump again. Look for a mix of assets that perform well in calm markets. Consider Stocks with steady earnings, bonds with solid returns, and maybe a touch of real estate.

Finally, stay informed. Follow inflation reports and expert opinions. For example, according to a recent note from the IMF, “Global inflation 2025 pressures are easing, but vigilance remains key.” That kind of insight helps you make smarter choices.

Conclusion: What Slowing Prices Mean for You

The inflation 2025 forecast gives us something we haven’t had in a while: hope for stability. Slower inflation means your money goes further. It helps with savings, makes investing safer, and takes the pressure off day-to-day expenses. Still, don’t assume everything is fixed. Inflation 2025 could rise again if conditions change. But for now, there’s room to breathe. Stay ready. Stay informed. And take this chance to build a stronger financial future.

FAQ’s

1. What is inflation in simple words?

Inflation means prices go up over time. You need more money to buy the same things.

2. Why is inflation slowing down in 2025?

Prices are rising more slowly because supply chains are better, and people are spending less.

3. How does slowing inflation help my savings?

Your savings lose value more slowly. Your money keeps more of its power.

4. Will I spend less on groceries and fuel in 2025?

You may not spend less, but prices won’t rise as fast as before.

5. How can I protect my money in 2025?

Make a budget, save more, and invest smart. Watch the news for changes.