How to Build an Emergency Fund: A Step-by-Step Guide for Financial Security

Building an emergency fund is a critical step toward financial stability. The process is straightforward: set a clear, personalized goal based on your essential expenses, automate regular contributions from your income, and keep the money in a safe, accessible account. Think of this dedicated reserve as your first line of defense against unexpected financial shocks. It's the buffer that keeps you out of high-interest debt and provides peace of mind, making it a non-negotiable prerequisite before pursuing other major financial goals like investing or paying down low-interest debt.

Why an Emergency Fund Is Your Financial Foundation

Picture this: your car's transmission fails unexpectedly, or a surprise medical bill lands in your mailbox, and your entire budget is thrown into chaos. This isn’t a far-fetched scenario; it's a reality that forces many people into high-interest debt when they can least afford it. According to a recent Bankrate.com report, 57% of U.S. adults are uncomfortable with their level of emergency savings.

An emergency fund is your financial shield against this chaos. It's a dedicated cash reserve that provides stability and genuine peace of mind when life inevitably throws you a curveball.

Defining a True Financial Emergency

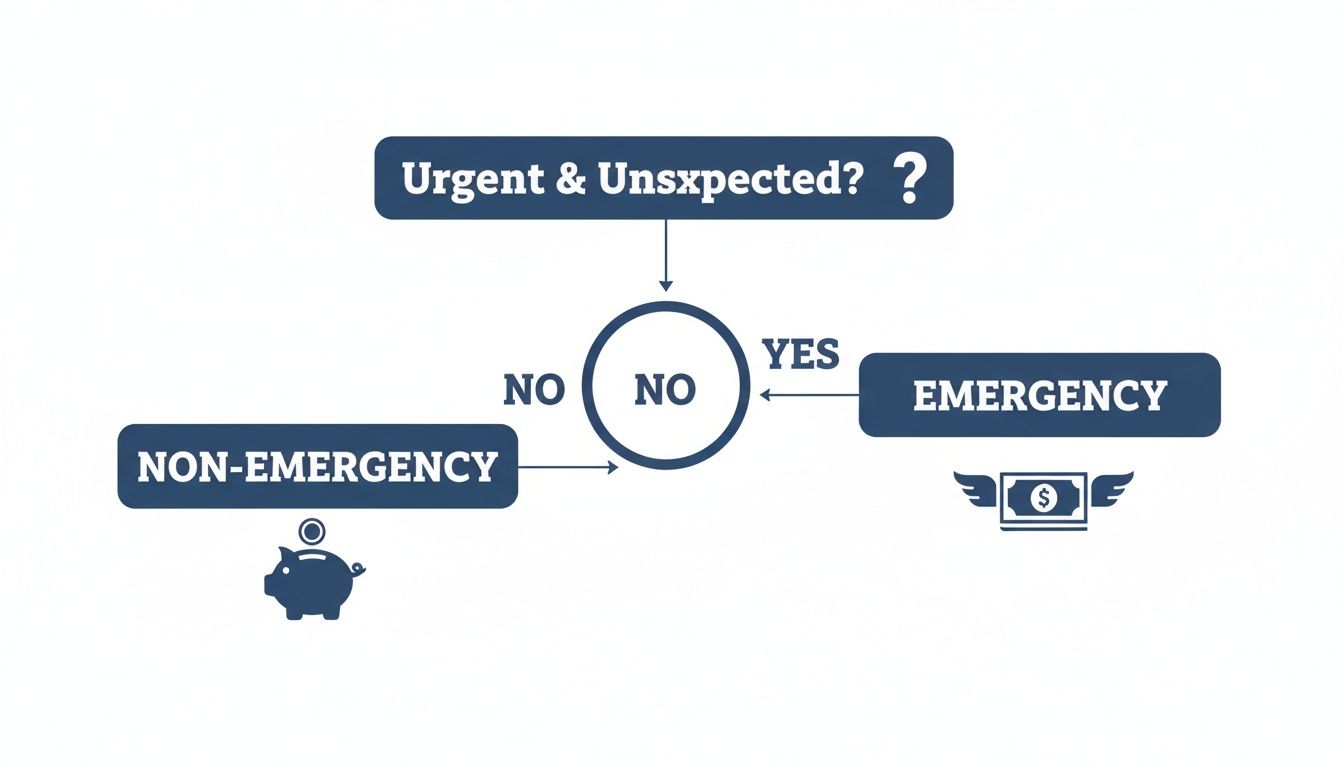

So, what actually counts as an emergency? The simplest way to think about it is any expense that is both unexpected and urgent. This isn't your fund for a planned vacation or holiday shopping. It’s for the serious stuff that could derail your finances if you weren’t prepared.

- Sudden Job Loss: This fund keeps you afloat, covering essentials like your mortgage and groceries while you find your next role.

- Unexpected Medical Bills: For that ER visit or urgent procedure your insurance doesn't fully cover.

- Urgent Home Repairs: Think a leaky roof in a rainstorm or a dead furnace in the middle of winter.

- Major Car Trouble: For that big, necessary repair that keeps you on the road and getting to work.

An emergency fund is more than just money in an account—it's an empowerment tool. It gives you the freedom to make decisions based on what's best for you, not out of desperation.

This cash cushion is the absolute first step in any solid financial plan. It gives you the firm footing you need before you can confidently start investing, saving for retirement, or tackling other long-term goals. Without it, any progress you make elsewhere is just too fragile, constantly at risk from a single, unplanned event.

The Cornerstone of Financial Wellness

Building this fund is a critical move toward real financial stability. It's the buffer that turns a potential crisis into a manageable inconvenience, letting you handle setbacks without reaching for credit cards or high-interest loans.

This kind of preparedness is a huge part of learning how to achieve financial independence, as it creates the secure base from which all other financial growth is built.

Ultimately, an emergency fund delivers something priceless: peace of mind. Knowing you have that financial backup lets you navigate life’s uncertainties with confidence, secure that you’re ready for whatever comes your way.

Calculating Your Personal Emergency Fund Target

Figuring out how much to save for an emergency fund isn't a one-size-fits-all deal. It's about creating a financial cushion that makes sense for your life. The whole process kicks off with a brutally honest look at your essential monthly expenses—the bills you absolutely have to pay to keep the lights on and a roof over your head.

This isn't about budgeting for your Netflix subscription or weekly pizza night. We're talking about the bare-bones costs of living. Think of it as your financial survival number.

Identifying Your Core Expenses

First things first, you need to add up every single non-negotiable expense you have in a typical month. This number is the foundation for everything else.

Your list of must-pays should include:

- Housing: Rent or mortgage payment.

- Utilities: The basics like electricity, water, gas, and internet.

- Food: A realistic grocery budget (not eating out).

- Transportation: Car payments, insurance, and gas, or your public transit pass.

- Insurance: Health, life, and home or renters insurance premiums.

- Minimum Debt Payments: The absolute lowest amount you must pay on loans or credit cards.

Add all those up. That’s your total for monthly essentials. With prices always shifting, it's also smart to keep an eye on things like the inflation 2025 forecast to make sure your estimates will hold up.

Applying the 3-6-9 Month Rule

Once you have your monthly essentials number, it’s time to decide how many months of coverage you need. The "3-6-9 month" rule is a fantastic, straightforward framework to help you land on the right target based on how stable your life and income are.

So, what actually counts as an "emergency"? It's easy to blur the lines, but this flowchart makes it crystal clear.

The takeaway here is simple: if an expense is both urgent and unexpected, it’s a true emergency. If it’s not, that money should probably come from your regular budget.

Key Takeaway: Your emergency fund target isn't some random number. It's a personalized safety net, directly tied to your essential living costs and life circumstances, built to shield you from financial shocks.

Emergency Fund Goals Based on Your Lifestyle

To make this even more practical, let’s see how this rule plays out for different people in the real world. Your recommended savings goal can vary dramatically based on your job stability and family situation.

Use this table to find your recommended savings target based on your employment and household situation.

| Lifestyle Scenario | Monthly Essentials | Recommended Savings Duration | Total Emergency Fund Goal |

|---|---|---|---|

| Stable Dual-Income Couple | $3,500 | 3 Months | $10,500 |

| Single Parent with One Child | $2,800 | 6 Months | $16,800 |

| Freelancer with Variable Income | $3,200 | 9 Months | $28,800 |

| Small Business Owner | $4,500 | 9-12 Months | $40,500 – $54,000 |

As you can see, your level of stability is the deciding factor. A dual-income household has a natural buffer if one partner loses their job, so a three-month fund is a solid goal. On the other hand, a freelancer or small business owner with an unpredictable income needs a much bigger cushion—often nine months or more—to ride out the slow periods without panicking.

By taking the time to calculate your specific target, you turn a vague, intimidating idea into a clear and achievable financial goal.

Actionable Strategies to Build Your Fund Faster

Knowing your target number is one thing, but actually putting the money aside is where the real work begins. The single most effective habit you can build here is to pay yourself first. This isn't just a catchy phrase; it's a fundamental shift in how you view your money.

Instead of waiting to see what's left at the end of the month, you prioritize your emergency savings the moment your paycheck hits. The easiest way to make this happen is to set up an automatic transfer from your checking to your savings account for every payday. Treat it like any other non-negotiable bill—because your future security is just that important.

Find and Plug Your Cash Leaks

Most of us have "cash leaks"—those small, almost invisible expenses that slowly drain our accounts. Think forgotten subscriptions, that daily coffee habit, or impulse buys that feel insignificant at the time. Finding these leaks is like discovering free money you didn't know you had.

A simple 30-day spending audit can be incredibly revealing. I always recommend using a tool like Mint or YNAB (You Need A Budget) to track and categorize every dollar. You might be shocked at where your money is really going.

- Real-Life Example: Sarah, a graphic designer, did this audit and found she was spending $75 a month on three streaming services she barely touched. Add another $80 a month for weekday lunches. By canceling two services and packing lunch three times a week, she freed up over $100 a month—that's $1,200 a year—that went straight into her emergency fund without a dramatic lifestyle change.

This isn't about depriving yourself. It's about being intentional. Making conscious spending choices that align with your bigger goals is a perfect example of how small micro-habits that transform your life can have a massive financial impact.

Automate and Accelerate Your Savings

Automation is your best friend. But once you have that baseline transfer set up, look for ways to accelerate your progress.

- The Windfall Strategy: Get a tax refund, a bonus at work, or a cash gift? Your first instinct should be to send a huge chunk—if not all of it—directly to your emergency fund. This is the financial equivalent of a turbo-boost, helping you hit your goal months or even years faster.

- The "Round-Up" Method: Many banking apps have features that round up your debit card purchases to the nearest dollar and sweep the change into savings. It’s painless. Those little bits of change can easily add up to $30-$50 per month without you even feeling it.

It's a tough pill to swallow, but recent data from the Federal Reserve website shows that nearly four in ten adults wouldn't be able to cover a $400 emergency expense using cash or its equivalent. For someone earning $60,000 a year, automating just 10% ($500/month) builds a $3,000 starter fund in only six months.

Boost Your Income to Turbocharge Your Goal

You can only cut your expenses so much. Your earning potential, on the other hand, is limitless. Even a small income boost dedicated entirely to your emergency fund can make a huge difference. This doesn’t have to mean a stressful second job.

Quick Guide to Boosting Your Income

| Strategy | Time Commitment | Potential Impact | Best For… |

|---|---|---|---|

| Negotiate a Raise | Low (Just the prep work) | High (Permanent boost) | Salaried employees with a proven track record. |

| Freelance Your Skills | Moderate (5-10 hrs/week) | Medium to High (Variable) | Anyone with a marketable skill (writing, design, coding, etc.). |

| Gig Economy Work | Flexible (1-5 hrs/week) | Low to Medium (Hourly) | People needing flexible, immediate cash (think pet-sitting or deliveries). |

- Real-Life Example: Maria, a marketing manager, spent a few hours putting together a document outlining her recent accomplishments and successfully negotiated a 5% raise. That added an extra $250 per month to her paycheck, which she funneled directly into savings. She hit her six-month emergency fund goal two months ahead of schedule.

Whether you're trimming the fat from your budget, setting up smart automations, or finding ways to earn more, the secret is consistency. Every small step, taken over and over, builds the financial foundation you need to handle anything that comes your way.

Choosing the Right Home for Your Emergency Savings

Deciding where to stash your emergency fund is just as important as saving the money itself. It’s a balancing act. You need a place that’s safe, easy to access when you’re in a pinch, and hopefully, earns a little something on the side. Get one of these wrong, and your safety net could have a gaping hole right when you need it most.

The ideal account is pretty straightforward. It absolutely has to be safe, which means it's insured by the FDIC (for banks) or NCUA (for credit unions). It also needs to be liquid—you should be able to get your hands on the cash within a day or two without paying hefty penalties. Lastly, it ought to offer a reasonable return to help your savings fend off inflation.

For most people, a high-yield savings account (HYSA) is the clear winner. These accounts, usually offered by online banks, hit all the right notes. Their interest rates often blow traditional brick-and-mortar banks out of the water, sometimes by more than 10 times. If you want to see just how much of a difference that can make, check out our deep dive on maximizing your cash with high-yield savings accounts.

Comparing Account Options For Your Emergency Fund

While HYSAs are an excellent choice, they aren't the only game in town. It’s worth looking at all your options to see what clicks for you. Here’s a quick rundown to help you compare.

The table below breaks down where to store your emergency savings based on accessibility, how much interest you can earn, and overall safety.

| Account Type | Pros | Cons | Best For |

|---|---|---|---|

| High-Yield Savings Account (HYSA) | Excellent interest rates, FDIC-insured, fully liquid. | Often online-only, so transfers might take a day or two. | Savers who want their money to grow without sacrificing access. |

| Money Market Account (MMA) | Competitive interest rates, FDIC-insured, often comes with a debit card or checks. | May require a high minimum balance to avoid fees or earn the best rates. | People who want the convenience of check-writing with solid interest. |

| Traditional Savings Account | Extremely accessible at your local branch, FDIC-insured. | Very low interest rates that lose purchasing power to inflation. | Someone just starting out who really values in-person banking. |

| Certificates of Deposit (CDs) | Higher, fixed interest rates for a set term. | Your money is locked up; you'll face steep penalties for early withdrawal. | Not a good fit for a primary emergency fund. You need liquidity. |

Ultimately, the goal is to find an account that feels right for your situation and won't get in your way when you need to access your money.

The Power of Separation

Here’s a simple but powerful strategy: keep your emergency fund at a completely separate bank from your day-to-day checking account. This creates a psychological and practical barrier that prevents casual withdrawals.

When your emergency cash is out of sight, it’s out of mind. You won't see that big, tempting balance every time you log in to pay a bill, which drastically cuts down on the urge to dip into it for a flash sale or a fancy dinner. It forces you to be deliberate.

The growth in a high-yield account isn't just pocket change. In a high-rate environment, some accounts can hit 5% APY or more. That can turn a $10,000 balance into $10,500 in a single year, with zero effort. This growth is a critical defense against inflation, especially when so many households are vulnerable.

This separation reinforces what the fund is for: true emergencies only. The minor hassle of transferring money between banks is actually a feature, not a bug—it's one more layer of protection for your financial peace of mind.

When to Use and How to Replenish Your Fund

Finally getting your emergency fund fully stocked is a huge win. Seriously, take a moment to appreciate it. You’ve built a powerful financial shield against whatever curveballs life decides to throw your way.

But now comes the tricky part: knowing exactly when to use it and, just as importantly, how to build it back up again.

This isn’t just another savings account. Think of it as a highly specialized tool in your financial toolkit. It’s strictly for expenses that are both unexpected and urgent. A flash sale on that gadget you’ve been eyeing? Not an emergency. Getting a pink slip at work? That’s exactly what this money is for. If you start dipping into it for non-essentials, you’re defeating the whole purpose and leaving yourself exposed when a real crisis hits.

Defining a True Emergency

Before you even think about touching a dollar, you need to be brutally honest with yourself and ask two key questions: Is this expense absolutely necessary right now, and was it completely unavoidable?

Let's walk through a few real-world examples to make the distinction crystal clear.

| Situation | Emergency Fund Use? | Explanation |

|---|---|---|

| Your car's transmission dies, and it’s your only way to get to work. | Yes | This is a textbook emergency. It's unexpected, urgent, and essential for keeping your income flowing. |

| You want to book a last-minute flight for a spontaneous vacation. | No | This is a classic "want," not a "need." Fun money or a dedicated travel fund should cover this, not your safety net. |

| A pipe bursts under your sink and is flooding the kitchen. | Yes | You have to act fast to prevent more costly damage. This is a perfect use of the fund. |

| Your best friend is having a destination wedding next year. | No | While it’s a big deal, it's not a surprise. This is an event you can (and should) budget for over time. |

The Replenishment Plan

If you have to use your emergency fund, don't beat yourself up. It did exactly what it was designed to do! But as soon as the dust settles, your number one financial priority shifts to rebuilding that safety net. Don’t put it off. You need to get back to it with the same focus and energy you had when you first built it.

Here’s a simple but effective game plan to get it refilled quickly:

- Press Pause on Other Goals: This is a temporary detour. For a little while, you might need to scale back on extra investment contributions or pause making extra payments on your mortgage. The goal is to funnel every spare dollar back into your emergency fund.

- Scour Your Budget Again: Pull up your budget and look for places you can make some short-term cuts. Can you slash the restaurant budget, cancel a few streaming services, or get creative with meal planning for a couple of months? Every dollar you free up goes straight to rebuilding.

- Get Aggressive with Automation: Go into your banking app and set up a new, more aggressive automatic transfer. If you were saving $300 a month before, can you bump it up to $500 or even more until the fund is whole again?

This isn't about punishing yourself for having an emergency. It's about getting your financial security back in place as fast as possible. The peace of mind a full fund provides is worth every bit of short-term sacrifice.

Restoring your emergency fund is just as critical as building it in the first place. When you have to pull back on other goals, it can be tough to decide what gets paused. It’s a bit like the classic dilemma of whether to pay off your mortgage or invest—you have to weigh the pros and cons to see which move makes the most sense for your security right now.

Frequently Asked Questions (FAQ)

1. Should I pay off high-interest debt before starting my emergency fund?

It’s best to use a hybrid approach. First, save a "starter" emergency fund of $1,000. This small cushion prevents minor surprises from forcing you deeper into debt. Once that's in place, aggressively attack your high-interest debt (like credit cards). After that debt is gone, shift your focus to building your emergency fund to its full 3-to-6-month target.

2. How much should I save if I have an irregular income?

If you're a freelancer, gig worker, or small business owner, your income volatility requires a larger safety net. Aim for at least 6 to 9 months of essential living expenses. A great strategy is to save a high percentage of every payment you receive during high-income months to carry you through the leaner periods.

3. Is it okay to invest my emergency fund for a better return?

No. An emergency fund must be safe and liquid. The stock market is too volatile for this purpose. Imagine a recession where you lose your job and your investments are down 30% at the same time. The risk of being forced to sell at a loss is too great. A high-yield savings account is the ideal place for this money.

4. How often should I review my emergency fund goal?

Review your target at least once a year or after any major life event, such as a marriage, the birth of a child, a significant salary change, or buying a home. These events change your monthly expenses and, therefore, the size of the safety net you need.

5. What is the very first step if I have zero savings right now?

Open a separate savings account today. This action creates a dedicated home for your fund and a psychological separation from your daily spending money. Then, fund it with any amount you can—$20, $50, $100—to build momentum. The initial goal is to establish the habit.

6. Can I use a Roth IRA as my emergency fund?

While you can withdraw your direct contributions from a Roth IRA tax- and penalty-free, it should be a last resort. Every dollar you pull out is a dollar that loses decades of potential tax-free compound growth. It's far better to keep your short-term emergency savings separate from your long-term retirement investments.

7. What if my partner and I have different views on saving?

Open communication is key. Schedule a calm "money date" to discuss your financial goals and fears. Frame the emergency fund as a tool for shared security and stress reduction, not deprivation. Start with a small, achievable goal together, like saving the first $1,000, and celebrate that win to build positive momentum.

8. Does my emergency fund need to cover things like streaming services?

No. Your emergency fund should cover your "survival" budget—the bare essentials needed to live. In a true emergency like a job loss, you would cut all discretionary spending, including subscriptions, dining out, and entertainment. This keeps your savings target more realistic and achievable.

9. I received a bonus or tax refund. Should I put it all in my emergency fund?

If your emergency fund is not yet fully funded, yes. A windfall is a perfect opportunity to make significant progress toward your goal in a single step. If your fund is already complete, you can use that money to accelerate other financial goals, such as investing or paying down debt.

10. How do I stay motivated when it feels like I’m not making progress?

Motivation fades, but systems endure. First, automate your savings so progress happens without willpower. Second, break your large goal into smaller mini-milestones (e.g., $1,000, then one month of expenses) and celebrate each one. Finally, use a visual tracker—like a chart on your fridge or a simple spreadsheet—to see how far you’ve come.

At Everyday Next, we provide practical guides and in-depth analysis to help you make informed decisions about your finances, career, and life. From building your first emergency fund to understanding the latest tech trends, we're here to support your growth. Explore more insights and resources at https://everydaynext.com.