How to achieve financial independence: Practical steps to secure lasting wealth

Financial independence isn't some far-off dream reserved for the ultra-wealthy. It's the point where your assets—your investments, real estate, or business ventures—generate enough income to cover all your living expenses. You're no longer dependent on a paycheck.

It's about creating a system where your money finally works for you, giving you the freedom to decide how you spend your days. Whether you want to retire early, launch a passion project, or just work less, this guide lays out a clear, actionable path to get you there.

Your Journey to Financial Independence Starts Now

This isn't about getting rich quick or hoping for a lottery win. True financial independence happens when your assets can sustain your lifestyle, forever freeing you from the need for a traditional job. It’s the ultimate form of personal freedom.

Let's look at a real-world scenario. Alex and Sarah, a couple in their early thirties, began their journey with $60,000 in student debt and a combined income of $95,000. Like many, they felt stuck in the paycheck-to-paycheck cycle. But by committing to a focused strategy, they managed to reach financial independence in just under 12 years.

There was no magic involved—just a methodical, repeatable process. They followed a clear roadmap that anyone can adopt, and this guide breaks down their success into a practical framework.

The Four Pillars of Financial Freedom

Reaching this goal hinges on mastering four core areas. Think of them as the legs of a sturdy table; you need all four for stability and long-term success.

- Mapping Your Financial Landscape: First things first, you need to know where you stand. This means taking a brutally honest look at your net worth, income, and expenses. You can't chart a course to your destination without knowing your starting point.

- Creating a Powerful Cash Flow Engine: The engine of wealth building is surprisingly simple: spend less than you earn. We'll dig into high-impact strategies to widen that gap, turning your income into a powerful tool for building wealth.

- Making Money Work for You: Saving alone won't cut it. Thanks to inflation, your cash loses value over time. You have to invest, putting your money to work so it can grow and compound. This section will demystify investing for the long haul.

- Accelerating Your Timeline: Once you have a solid system in place, it's time to add fuel to the fire. By strategically increasing your income through side hustles or career growth, you can dramatically shorten your path to FI.

This journey is more than just a financial exercise; it's a fundamental shift in your relationship with money and time. Understanding why building wealth isn't just about money can provide the deep motivation needed to stay the course.

We're going to skip the confusing jargon and complicated theories. This is about a clear, achievable path that puts you squarely in control of your financial future.

Finding Your 'Why' and Calculating Your FI Number

The path to financial independence doesn't start with a budget or an investment account. It starts with a simple, powerful question: Why?

What does financial freedom actually look like for you? Without a deeply personal reason pulling you forward, the discipline needed will feel like a sacrifice, not an opportunity.

Maybe your "why" is the freedom to walk away from a soul-crushing job. Perhaps it’s the ability to travel the world on your own terms, or just the simple peace of being fully present with your family every single day. This is the fuel that keeps you going long after the initial excitement wears off. If you're struggling to pin it down, you might find some clarity in this guide to finding your purpose.

Your "Why" isn't just a feel-good exercise; it's the anchor that holds you steady during market downturns and the compass that guides your daily spending decisions. It transforms saving from an act of deprivation into an act of liberation.

Once you have that motivation locked in, it’s time to turn that dream into a real, tangible number: your FI Number. This is the total amount of invested assets you need to cover your living expenses for the rest of your life, without ever having to work for money again.

Calculating Your Target FI Number

The most straightforward way to ballpark your FI Number is with the 4% Rule. This is a well-regarded guideline suggesting you can safely withdraw 4% from your investment portfolio each year in retirement without running out of money.

To find your target, you just flip the math.

Your Annual Expenses x 25 = Your FI Number

It’s that simple. This formula is the bedrock of planning for financial independence. If you figure out your family needs $60,000 a year to live the life you want, your target FI Number is $1,500,000 ($60,000 x 25). Suddenly, the goal isn't some fuzzy concept; it's a clear finish line.

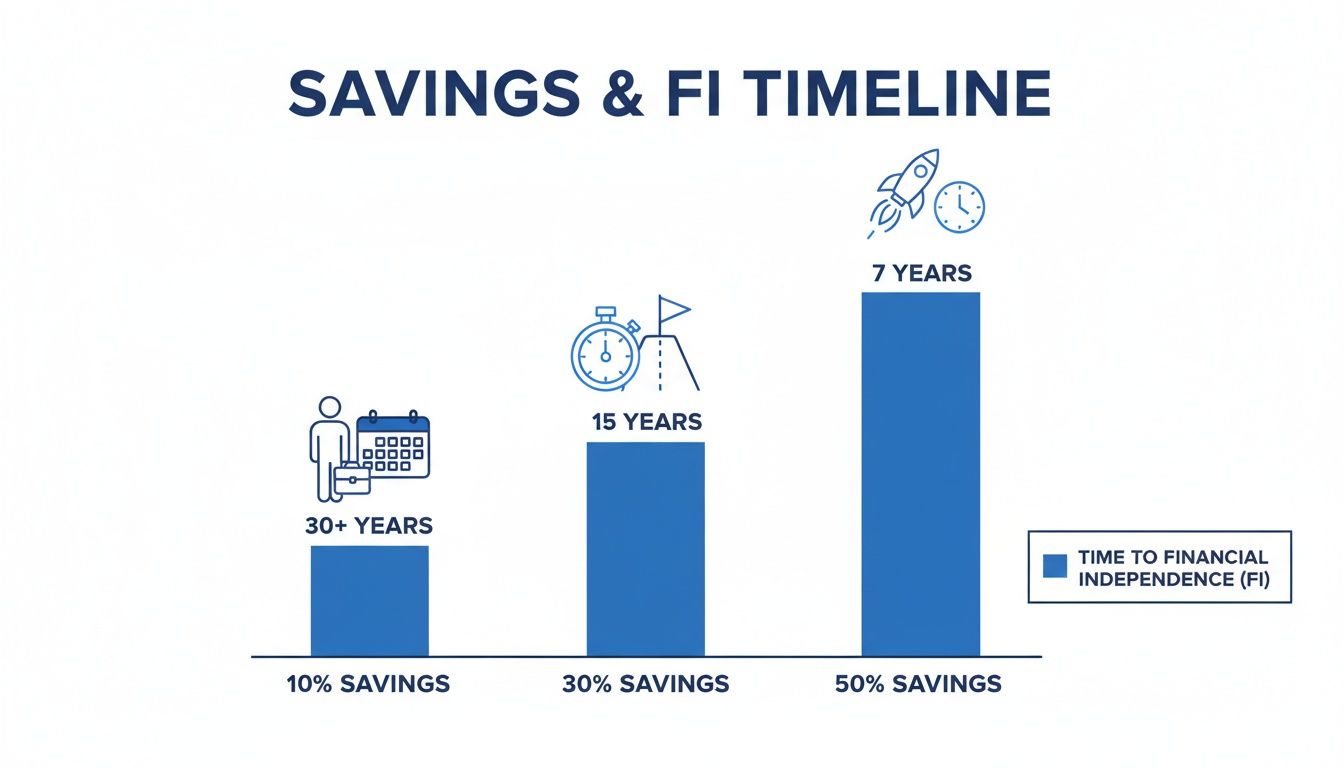

How Your Savings Rate Changes Everything

Knowing your number is a great first step, but the real lever you can pull is your savings rate—the percentage of your after-tax income you save and invest. This single metric has a bigger impact on your timeline than anything else.

Why is it so powerful? Because a higher savings rate does two things at once:

- It pumps more money into your investments every month, making them grow faster.

- It proves you can live happily on less, which directly lowers your target FI Number.

This one-two punch dramatically shortens your journey. Someone saving 10% of their income is probably looking at a traditional 40-year career. But someone saving 50%? They could be financially independent in under 15 years.

This table really drives the point home.

How Your Savings Rate Impacts Your FI Timeline

This table shows how quickly you can reach financial independence based on the percentage of income you save, assuming a 7% average annual return on your investments.

| Savings Rate | Years to FI |

|---|---|

| 10% | 45 Years |

| 20% | 31 Years |

| 30% | 22 Years |

| 40% | 17 Years |

| 50% | 13 Years |

| 60% | 9 Years |

As you can see, even a modest bump in your savings rate can shave years—sometimes decades—off your working life. This isn't about living on ramen noodles; it's about being intentional. The next sections will dig into the practical strategies for widening that gap between what you earn and what you spend, making these higher savings rates completely achievable.

Mastering Your Cash Flow to Build Momentum

The entire concept of financial independence boils down to one simple, powerful truth: you have to spend less than you earn and invest the difference. That's it. The bigger the gap you can create between your income and your expenses, the faster you'll get there. This isn't about self-deprivation; it's about being intentional with your money.

A lot of people get stuck chasing tiny, frustrating cuts—like giving up a daily coffee—that barely move the needle. You can drive yourself crazy with that stuff. A far more effective path is to focus on the big, high-impact wins where most of our money actually goes.

Optimize the “Big Three” Expenses

For most of us, the vast majority of our spending is soaked up by just three categories: housing, transportation, and food. Making a significant change in just one of these areas can free up hundreds, if not thousands, of dollars every single month. That’s cash you can immediately put to work building your wealth.

- Housing: This is usually the biggest line item on anyone's budget, which means it also holds the biggest opportunity for savings. Think about "house hacking"—renting out a spare room or buying a duplex and letting a tenant cover most of your mortgage. A friend of mine did this in his mid-20s with a triplex. The rent from the other two units paid his entire mortgage and then some. He effectively lived for free and even generated a small income.

- Transportation: The sticker price is just the beginning. When you factor in insurance, gas, maintenance, and the silent wealth-killer called depreciation, the average car can easily cost over $10,000 per year. Could your family get by with one car instead of two? Could you bike or use public transit a few days a week? Getting this expense under control is a massive financial lever.

- Food: This doesn't mean you have to survive on ramen. But strategic grocery shopping and planning your meals can save you thousands annually. It’s about cutting down on food waste, cooking at home more often, and dialing back the expensive convenience of takeout and restaurant meals.

By attacking these "Big Three," you can dramatically boost your savings rate without the misery of a thousand tiny sacrifices.

This chart really drives the point home. It shows just how powerful a higher savings rate is in shortening your timeline to FI.

Look at that difference. Jumping from a 10% to a 50% savings rate can literally shave more than two decades off your working career.

Systematize Your Savings and Tackle Debt

Once you’ve opened up that gap between income and spending, the next move is to make your progress automatic. Set up automated transfers from your checking to your investment and savings accounts for the day you get paid. This "pay yourself first" strategy is a game-changer because it prioritizes your goals before you even have a chance to spend the money.

As you build up your cash reserves, make sure that money is pulling its weight. You can learn how to maximize your cash in high-yield savings accounts to earn a decent return on your emergency fund and short-term savings.

At the same time, you need a clear plan to wipe out any high-interest debt, which is like an anchor dragging on your progress. The two most popular methods for this are the Debt Snowball and the Debt Avalanche.

Key Insight: Choosing how to pay off debt is as much a psychological decision as it is a mathematical one. The "best" plan is simply the one you'll actually stick with until you're debt-free.

So, which one is right for you? It really depends on your personality and what keeps you motivated.

Debt Payoff Strategies: Debt Snowball vs. Debt Avalanche

A comparison of the two most popular debt repayment methods to help you decide which approach is right for your financial situation and personality.

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Core Principle | Pay off debts from the smallest balance to the largest, regardless of interest rate. | Pay off debts from the highest interest rate to the lowest, regardless of balance. |

| Main Advantage | Psychological Wins: Paying off small debts quickly creates momentum and motivation to keep going. | Mathematical Efficiency: Saves the most money on interest over the long term. |

| Best For | People who thrive on quick, tangible wins to stay motivated and build positive financial habits. | People who are disciplined, numbers-driven, and laser-focused on minimizing the total cost of their debt. |

| Real-Life Example | You have a $500 credit card, a $3,000 personal loan, and a $10,000 car loan. You'd focus all extra payments on the $500 card first. | With the same debts (and assuming the personal loan has the highest interest rate), you'd throw all your extra cash at the $3,000 loan, even if the car loan is larger. |

Ultimately, both paths lead to the same destination: being debt-free.

By mastering your cash flow—through smart cuts to your biggest expenses and a strategic plan for debt—you create the powerful momentum you need to accelerate your journey to financial independence.

Building Your Wealth Engine Through Smart Investing

Saving diligently is the foundation, but it's only half the battle. To truly get ahead, your money needs to work just as hard as you do. This is where investing comes in, transforming your savings from a static pile of cash into a dynamic wealth-building engine.

Forget about picking the next hot stock or trying to time the market—that’s a gambler's game. For most of us on the path to financial independence, the real secret is consistent, long-term growth powered by simple, proven strategies.

It's about creating a disciplined, automatic investing plan that quietly builds your wealth in the background, day in and day out.

The Power of Low-Cost Index Funds

For the vast majority of people pursuing FI, the most effective tools in the arsenal are low-cost index funds and Exchange-Traded Funds (ETFs). Think of an index fund as a single basket holding tiny slices of hundreds, or even thousands, of different companies—like the entire S&P 500.

This approach is brilliant for two reasons:

- Instant Diversification: You're not betting the farm on just a handful of companies. Instead, you own a piece of the entire market, which dramatically smooths out the ride and reduces your risk.

- Rock-Bottom Costs: Because these funds are passively managed, their fees (called expense ratios) are incredibly low. This might not sound like a big deal, but over decades, those tiny fees can compound into tens of thousands of dollars that stay in your pocket, not someone else's.

The core idea is simple: You are betting on the long-term growth of the economy as a whole, not the fleeting success of a single company. This is a much more reliable path to building wealth.

Prioritizing Your Investment Accounts

Where you invest can be just as important as what you invest in. Tax-advantaged accounts are your absolute best friends on this journey, as they shield your money from taxes and let it grow much, much faster.

Think of it as a waterfall. You want to fill up the best buckets first. Here’s the order I recommend to almost everyone:

- Grab Your 401(k) Match: If your employer offers a match (e.g., they match 100% of your contributions up to 5% of your salary), contribute enough to get every last penny. This is an immediate 100% return on your investment. Seriously, it's free money—never leave it on the table.

- Max Out a Roth or Traditional IRA: Next, open an IRA and max it out. These accounts offer incredible tax benefits that you can't get in a regular brokerage account.

- Circle Back to Your 401(k): Once the IRA is full, go back to your 401(k) and contribute as much as you can, aiming for the annual limit.

- Open a Taxable Brokerage Account: Only after you’ve maxed out all your tax-advantaged options should you start investing here. To take things a step further, you can explore things like Top Real Estate Investment Tax Strategies to optimize your returns even more.

Building a Simple Three-Fund Portfolio

You don't need a complex, hedge-fund-level strategy. In fact, simpler is often better. The three-fund portfolio is a classic for a reason: it's incredibly effective and easy to manage. It gives you broad diversification across US stocks, international stocks, and bonds. If you're just getting started, our detailed guide on how to start investing can walk you through the basics.

Your personal mix will depend on your age and how comfortable you are with risk. Here’s a look at how that might play out.

Sample Three-Fund Portfolio Allocations

| Investor Profile | US Total Stock Market Index Fund | International Total Stock Market Index Fund | Total Bond Market Index Fund |

|---|---|---|---|

| Aggressive Growth (Younger Investor) | 60% | 30% | 10% |

| Moderate Growth (Mid-Career) | 50% | 25% | 25% |

| Conservative (Nearing FI) | 40% | 20% | 40% |

This "set it and forget it" approach ensures you’re properly diversified and can ride out market volatility without panicking. It's a powerful and accessible way to build your wealth engine for the long haul.

How to Accelerate Your Path with New Income Streams

A high savings rate is the bedrock of financial independence, but if you really want to put the pedal to the metal, you need to focus on growing your income. It's simple math. You can only cut your expenses so much, but your potential to earn more is practically unlimited.

The trick is to have the discipline to treat this new money differently. This isn't for lifestyle upgrades or a bigger car payment. Think of every extra dollar you earn as pure rocket fuel for your investment portfolio. When you invest it immediately, you kickstart the compounding process and can literally shave years off your journey to FI.

Active Hustles vs. Passive Income

It's really important to get your head around the two main types of extra income. They both have a place in your strategy, but one is the clear end-goal.

- Active Side Hustles: This is you trading your time for more money. It could be freelancing in your field, picking up consulting gigs, driving for Uber, or tutoring on weekends. These are fantastic for a quick and substantial cash injection.

- Passive Income Streams: This is the holy grail. It’s the money that flows in from assets you own—things like dividends from your stock portfolio, rent checks from a property, or royalties from a book you wrote.

The winning strategy? Use the cash you generate from your active hustles to build or buy assets that produce passive income. That's how you make the crucial shift from working harder to having your money work for you.

The Big Picture: Start with an active hustle to generate capital. Then, systematically funnel that capital into passive, income-producing assets. This builds a wealth engine that eventually runs on its own.

Real-World Examples of Hitting the Accelerator

Let's look at how this plays out for real people. You don't need a revolutionary idea; most people just find a way to monetize skills they already have.

Example 1: The Freelance Graphic Designer

Maria, a graphic designer, earns $70,000 a year from her day job. She decides to take on freelance clients in her evenings and weekends. By putting in about 10 hours a week, she brings in an extra $1,500 every month. Instead of upgrading her lifestyle, she invests that entire $18,000 a year into a low-cost index fund. This single strategic move is projected to cut her FI timeline by nearly eight years.

Example 2: The House Flipper

David, an electrician who’s handy with home repairs, secures a personal loan to buy a neglected property. He spends his weekends for the next six months fixing it up. After selling, he walks away with a $45,000 profit. He immediately rolls that capital into a down payment on a duplex, which now generates $400 a month in positive cash flow after all expenses, creating a new passive income stream.

Picking the Right Path for You

Not all side hustles are built the same. When you're looking at different options, you need to weigh the immediate cash potential against its ability to scale over the long term.

To make an informed choice, it helps to understand what passive income is and which approaches might align with your skills and personality. Here's a quick look at some common routes.

Comparing Income Stream Options

| Income Stream | Time Commitment | Startup Cost | Scalability | Passive Potential |

|---|---|---|---|---|

| Freelancing | High (Active) | Low | Medium | Low |

| Dividend Investing | Low (Passive) | Varies | High | High |

| Rental Properties | Medium | High | Medium | High |

| Creating a Digital Product | High (Upfront) | Low | High | High |

The best path is deeply personal—it depends on your skills, how much cash you have to start, and the time you can realistically dedicate. To get more ideas, check out these 10 proven ways to generate passive income online, which cover everything from affiliate marketing to building online courses. The goal is to find something that can pour gasoline on your investment fire and get you to the finish line faster.

Frequently Asked Questions (FAQ)

1. Is the 4% Rule still safe to use?

The 4% Rule is a solid starting point for planning, suggesting you can withdraw 4% of your portfolio in the first year of retirement and adjust for inflation thereafter. However, given modern economic uncertainties, many financial planners now suggest a more conservative approach, like a 3.5% withdrawal rate, or a flexible strategy where you withdraw less during market downturns.

2. What should I do when the stock market crashes?

The most crucial—and difficult—thing to do is to stay the course and avoid panic selling. Market downturns are a normal part of investing. Selling locks in your losses and you risk missing the eventual recovery. If you are still in your accumulation phase, a downturn is an opportunity to buy assets "on sale" by continuing your regular, automated investments.

3. How much cash should I keep in an emergency fund?

While accumulating wealth, a standard emergency fund of 3-6 months of living expenses is recommended. Once you reach financial independence and are living off your investments, it's wise to hold a larger "cash cushion" of 1-2 years' worth of expenses in a high-yield savings account. This allows you to cover living costs without needing to sell investments during a market downturn.

4. What if I start my journey to financial independence late in life?

It is absolutely still possible, but it requires a more aggressive approach. If you're starting in your 40s or 50s, you'll need to focus on two things: achieving a very high savings rate (often 40%+) and maximizing your income through career advancement, negotiating raises, or building a significant side business. The principles remain the same, but the timeline is compressed.

5. Should I pay off my mortgage before I stop working?

This is a personal decision with both financial and psychological factors. Mathematically, if your mortgage interest rate is low (e.g., under 4-5%), you will likely earn a higher return by investing the extra money in the stock market. However, the psychological benefit and security of owning your home outright, with no mortgage payment, is a powerful motivator for many.

6. What's the difference between financial independence and retirement?

Financial independence means your assets generate enough income to cover your expenses, so working becomes a choice, not a necessity. Retirement is the act of choosing to stop working. Many people who achieve FI continue to work on passion projects, start new businesses, or do part-time work they love, an option often called "Barista FI" or "Coast FI."

7. Do I need to be an expert in picking stocks?

Absolutely not. The modern financial independence movement is largely built on the principle of passive investing. Instead of trying to pick individual winning stocks, the strategy relies on buying low-cost, broadly diversified index funds or ETFs that track the entire market. This approach is simpler, less risky, and has been proven to outperform most active stock pickers over the long term.

8. How does having a family affect my FI number?

Having a family increases your annual expenses, which in turn increases your target FI number (Annual Expenses x 25). You'll need to account for costs like childcare, education savings (e.g., 529 plans), and larger insurance policies. While the goal is higher, the process is the same: track expenses, maximize savings, and invest consistently.

9. What are the biggest psychological challenges on the path to FI?

Two major psychological hurdles are "lifestyle inflation" and "keeping up with the Joneses." As your income grows, there's a strong temptation to upgrade your lifestyle (nicer car, bigger house), which keeps your savings rate low. It takes discipline and a strong connection to your "why" to resist societal pressure and stay focused on your long-term goal.

10. Once I hit my FI number, how do I actually live off my investments?

You create a "paycheck" by selling a small portion of your investments periodically (e.g., monthly or quarterly) according to your withdrawal strategy (like the 4% Rule). This cash is transferred to your checking account to cover living expenses. Many people also structure their portfolio to generate income from dividends and interest, which can supplement the money they need to withdraw.

At Everyday Next, we believe that understanding the path to financial freedom is the first step toward achieving it. Our guides on wealth, investing, and personal development are designed to give you the clear, actionable insights you need to build a life of independence and purpose. Explore more at https://everydaynext.com.