A Simple Beginner Investing Guide to Building Wealth

Imagine your money working for you around the clock, even while you sleep. That’s the real power of investing. It’s not some exclusive game for Wall Street suits; it's a practical tool anyone can use to hit their biggest financial goals. This guide is here to show you exactly how to get started.

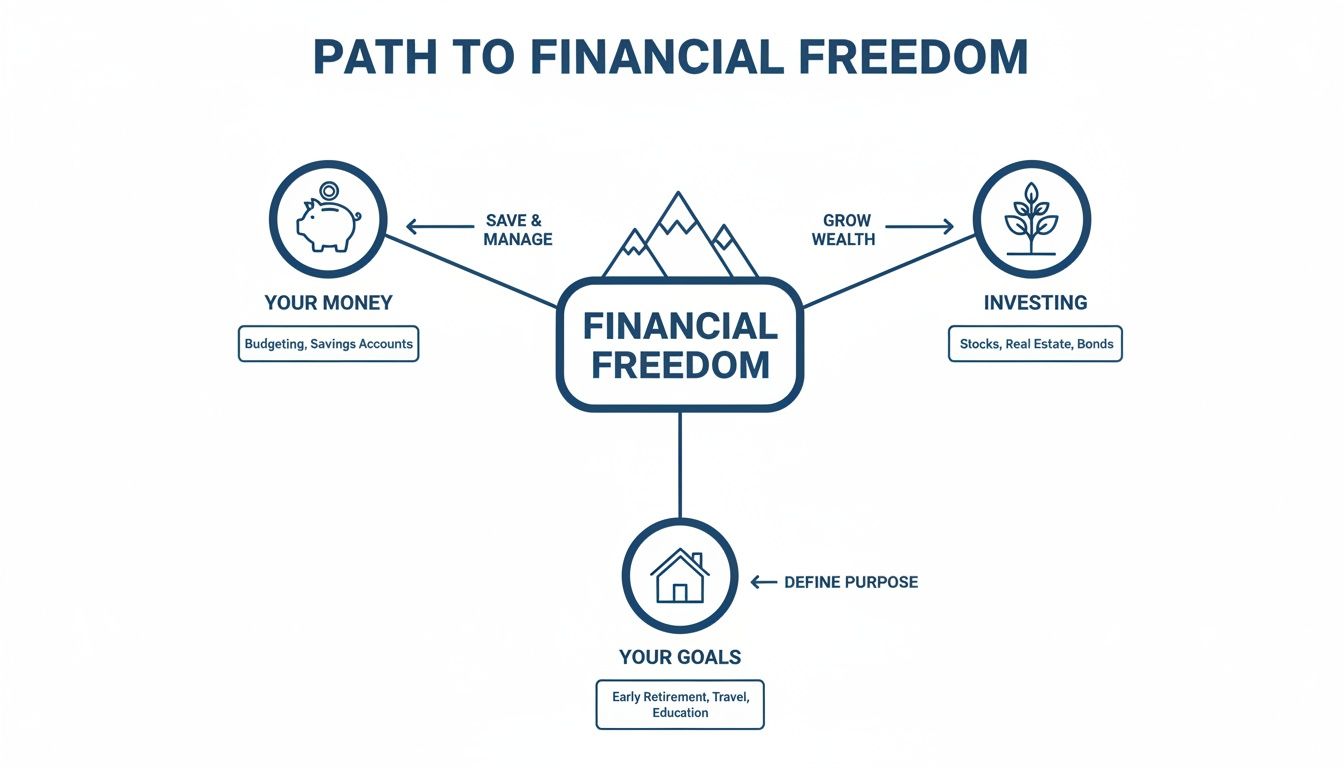

Why Investing Is Your Path to Financial Freedom

Think of investing like planting a tree. You start with a small seed—your initial investment. With time and patience, that seed sprouts and grows. Before you know it, that tree is strong enough to produce its own fruit and more seeds. This is compounding in action, where your earnings start generating their own earnings. It's the secret sauce to building real, lasting wealth.

Real-Life Example: Let's say you invest $500 per month starting at age 25. Assuming an average annual return of 8%, by the time you're 65, that consistent investment could grow to over $1.7 million. Someone who waits until 35 to start the exact same plan would end up with only around $750,000. That decade of compounding makes a million-dollar difference.

The goal isn't just to pile up cash. It’s about what that money empowers you to do. Investing is your most direct route to true financial independence, giving you the freedom to live life on your own terms. We actually dive deep into this concept in our guide on how to achieve financial independence.

You Are Not Alone on This Journey

If you feel like you're starting from square one, you're in good company. Investing used to be intimidating and expensive, but those days are long gone. You no longer need a huge pile of cash or a personal broker just to get in the game.

A whole new generation of investors is taking control of their money. Recent stats show the average beginner investor is just 33.3 years old, and a whopping 47% of new investors are between 18 and 30. The best part? Most are self-taught, using online resources just like this one. It’s proof you don’t need a finance degree to start building wealth. You can see more about how beginners are shaping the market on Bankrate.com.

What You Will Learn in This Guide

This guide is your complete roadmap. We'll take you from the absolute basics to making your first investment with confidence, breaking everything down into simple, actionable steps.

Here’s a sneak peek at what we’ll cover:

- Core Investment Options: We’ll explain stocks, bonds, and funds in plain English.

- Opening Your Account: A step-by-step walkthrough to get you set up fast.

- Building Your First Portfolio: Simple, effective templates you can use right away.

- Managing Your Mindset: How to stay cool and focused when the market gets shaky.

- Avoiding Common Mistakes: Learn from others' missteps to keep your money safe.

By the time you finish this guide, you won't just understand investing—you'll be ready to take action and start building a more secure financial future.

Understanding Your Core Investment Options

Jumping into the world of investing can feel a little intimidating, but the basic ideas are actually pretty straightforward. At its core, investing just means putting your money into things (called assets) that have a good chance of growing in value over time.

Think of these assets as the foundational ingredients you'll use to cook up your financial future. Let's get to know the main building blocks, without any of the confusing Wall Street jargon.

This map gives you a great visual for how getting a handle on your money and investing smartly are the key steps on your path to financial freedom.

The Main Types of Investments

For most people starting out, the investing universe really boils down to three main choices. Each one plays a unique role in building a solid portfolio.

- Stocks (also called Equities): When you buy a stock, you're buying a tiny piece of ownership in a public company, like Apple or Amazon. If that company does well and its profits increase, the value of your piece—your share—can go up. Stocks offer the highest potential for growth over the long run, but they also come with the most ups and downs.

- Bonds (also called Fixed-Income): Buying a bond is essentially like loaning money to a government or a big corporation. In exchange for your loan, they promise to pay you regular interest payments for a certain period, and then give you your original investment back at the end. Bonds are generally much safer than stocks and are great for providing a predictable stream of income.

- Funds (ETFs & Mutual Funds): This is where it gets really simple. Funds are like pre-packaged collections that hold dozens, hundreds, or even thousands of different stocks and bonds all in one place. They give you instant variety and are a fantastic, low-cost way for beginners to get started. For a deeper dive, check out our guide on how to start investing in index funds.

To help you see how these pieces fit together, here's a quick comparison of the core investment types you'll encounter.

Comparing Core Investment Types for Beginners

This table breaks down the most common assets side-by-side. Use it to get a feel for their risk levels, return potential, and who they're generally best suited for.

| Investment Type | What It Is | Typical Risk Level | Potential Return | Best For |

|---|---|---|---|---|

| Stocks | A share of ownership in a single company. | High | High | Long-term goals (10+ years) for investors comfortable with volatility. |

| Bonds | A loan to a government or corporation for interest. | Low to Medium | Low to Medium | Balancing a portfolio, generating stable income, and short-term goals. |

| Funds (ETFs/Mutual) | A basket containing a mix of many stocks and/or bonds. | Varies (Low to High) | Varies | Beginners seeking instant diversification and a simple, low-cost approach. |

As you can see, funds are often the perfect starting point because they automatically handle the heavy lifting of diversification for you.

Risk and Reward: The Travel Analogy

Every single investment comes with some level of risk, and that risk is almost always connected to its potential for reward. It’s a fundamental trade-off.

A simple way to think about it is with a travel analogy.

Investing in stocks is like an adventurous mountain climb. The path is steep and can be shaky (higher risk), but the view from the summit (potential reward) is spectacular. Investing in bonds, on the other hand, is like a scenic coastal drive—a much safer, more predictable journey with pleasant, steady views along the way.

Your job isn't to avoid risk completely. That’s impossible. Instead, it’s about choosing the right level of risk for your personal goals and your timeline. A 25-year-old saving for retirement in 40 years can easily afford the "mountain climb." But someone saving for a house down payment in three years would be much better off taking the "coastal drive."

Why Diversification Is Your Golden Rule

You’ve probably heard the old saying, "Don't put all your eggs in one basket." In the investing world, this is the single most important rule to live by. We call it diversification.

It simply means spreading your money across many different types of assets.

If you only own stock in a single company and that company hits a rough patch, your whole investment takes a nosedive. But if you own a mix of stocks from different industries, some international companies, and a variety of bonds, a slump in one area is often balanced out by strength in another.

This is exactly why funds are such a game-changer for new investors—they make it incredibly easy to be diversified from day one.

How to Open Your First Investment Account

This is where the rubber meets the road. All the theory we've discussed is about to become real. Moving from learning about investing to actually doing it can feel like a huge leap, but I promise, opening your first account is far simpler than you think. Let's walk through it together, step-by-step.

Before you can buy a single stock or fund, you need a place to actually hold them. This "place" is your investment account, and picking the right one comes down to what you're trying to achieve with your money.

It's no secret that financial literacy can be a major hurdle. In fact, only 33% of adults worldwide are considered financially literate. That knowledge gap can feel intimidating. We see that while 70% of retail investors are under 45 and eager to get started, many feel they don't have the right tools or knowledge.

The good news? It’s never been easier to bridge that gap. A surprising 44% of new investors are turning to resources like YouTube to learn the ropes. Getting a handle on the different account types is one of the most important first steps you can take toward investing with real confidence. You can find more insights on these global investment trends on unctad.org.

Choosing the Right Investment Account

So, where do you start? For most people dipping their toes into investing, it boils down to a few common account types. Each has its own purpose and, more importantly, its own set of tax rules. This table breaks down the main players to help you figure out what makes the most sense for you.

| Account Type | Primary Purpose | Key Tax Advantage | Who It's For |

|---|---|---|---|

| Brokerage Account | General investing and wealth building with no contribution limits. | Flexible access to your money at any time. | Anyone wanting to invest for non-retirement goals like a house or a car. |

| Roth IRA | Saving for retirement with tax-free growth and withdrawals. | You pay taxes on contributions now, and qualified withdrawals in retirement are 100% tax-free. | Individuals who expect to be in a higher tax bracket in the future. |

| 401(k) / 403(b) | Saving for retirement through an employer-sponsored plan. | Contributions are often tax-deductible, lowering your taxable income today. | Employees whose company offers a retirement plan, especially with an employer match. |

Keep in mind, you don't have to pick just one. A smart strategy often involves using a combination of these. For example, you might contribute to your 401(k) to get that valuable employer match, fund a Roth IRA for its tax-free retirement perks, and use a separate brokerage account for goals you have before retirement.

Your Step-by-Step Account Opening Checklist

Opening an account is surprisingly fast—you can usually get it done in less than 30 minutes from your couch. Big, reputable firms like Fidelity, Vanguard, and Charles Schwab have made the whole process incredibly user-friendly. And if you're also curious about digital assets, it's a good time to learn what a crypto exchange is and how to choose one.

Ready to get it done? Just follow this simple checklist.

- Choose Your Broker: Pick a well-known, low-cost brokerage firm. For beginners, any of the major players will offer everything you need, like zero-commission trades for stocks and ETFs.

- Select Your Account Type: Using the table above as your guide, decide if you're opening a standard brokerage account, a Roth IRA, or something else.

- Gather Your Information: You'll need a few pieces of personal information handy to fill out the online application.

- Social Security Number or Taxpayer ID

- Driver's License or other government-issued ID

- Your address and contact info

- Your employment status and income

- Fund Your Account: The last step is connecting your bank account to transfer in your starting funds. Just grab your bank's routing and account numbers. Most brokers have no minimum deposit anymore, so you can start with whatever amount you're comfortable with.

Key Takeaway: The most important step is simply starting. Don't get stuck worrying about making the "perfect" choice. Opening an account is a simple action that officially puts you on the path to building your financial future.

Once your account is open and funded, you're officially an investor. But before you start buying, make sure your financial foundation is solid. This is a great time to check out our guide on how to build an emergency fund. Having that safety net in place means you won't have to sell your investments at a bad time if an unexpected expense pops up.

Creating Your First Investment Portfolio

Alright, your account is open and funded. Now for the exciting part—deciding what to actually buy. This is where you build your portfolio, which is simply the collection of all your investments. Forget the Wall Street hype; this is less about finding the next hot stock and more about building a smart, balanced mix of assets that work for you.

The single most important idea to grasp here is asset allocation. Think of it as a recipe. It's how you decide to divide your money between different ingredients, like stocks and bonds, based on your personal goals and how much risk you're comfortable with.

Believe it or not, research consistently shows that getting this allocation right is responsible for the vast majority of your long-term results. It's far more important than trying to time the market or pick individual winners.

Simple Portfolio Templates for Beginners

You absolutely do not need a complicated strategy to be a successful investor. In fact, when you're starting out, simple is almost always better. A fantastic way to build a solid portfolio is by using just a handful of low-cost, broadly diversified Exchange-Traded Funds (ETFs).

Here are three simple, ready-to-use templates. You can create any of these portfolios by buying just two or three different ETFs according to the percentages shown.

| Portfolio Type | Best For | Stock Allocation | Bond Allocation | Example ETF Mix |

|---|---|---|---|---|

| Conservative | Investors with a low risk tolerance or a shorter timeline (under 5 years). | 40% | 60% | 40% Total Stock Market ETF, 60% Total Bond Market ETF. |

| Moderate | Investors with a balanced approach and a medium-to-long timeline (5-10+ years). | 70% | 30% | 50% Total US Stock ETF, 20% Total International Stock ETF, 30% Total Bond Market ETF. |

| Aggressive | Younger investors with a high risk tolerance and a long timeline (10+ years). | 90% | 10% | 60% Total US Stock ETF, 30% Total International Stock ETF, 10% Total Bond Market ETF. |

These simple frameworks give you instant diversification across thousands of different companies and bonds, building you a strong foundation from day one. To dig deeper, you can explore other investing strategies for beginners.

The Power of Dollar-Cost Averaging

So you have a model portfolio picked out. Now what? Do you dump all your money in at once? For most people, a much smarter and less stressful approach is dollar-cost averaging.

This strategy just means investing a fixed amount of money at regular intervals—say, $100 every single month—no matter what the market is doing. It's a simple idea with some serious benefits.

- It Tames Your Emotions: When you automate your investing, you remove the temptation to guess, fear, and panic. You won't be tempted to sell everything when prices dip or get greedy when they soar.

- You Buy More When Prices Are Low: This is the real magic. When the market is down, your fixed dollar amount automatically buys more shares of your investment. When prices are high, it buys fewer. This naturally helps you "buy low" over the long run without even trying.

Here’s how it works: Imagine you commit to investing $100 a month into an ETF. In January, the price is $50, so your $100 buys two shares. But in February, the market dips and the price drops to $40. Your same $100 now buys 2.5 shares. You automatically took advantage of the discount without a second thought.

This disciplined, set-it-and-forget-it approach is one of the most reliable ways to build wealth. It turns market ups and downs from something to fear into an opportunity to build your position at a better average price—a true cornerstone of smart investing.

How to Stay Calm When the Market Fluctuates

Let’s be honest: the stock market is going to have its ups and downs. That’s a guarantee. Scary headlines will scream about crashes, and red arrows will flash across your screen. This is just part of the deal, but how you react in these moments will define your success more than anything else.

Your biggest enemy as an investor isn't a bad economy or a struggling company—it's your own emotional reaction to fear. The urge to "do something" when your portfolio value drops is powerful, but the single biggest wealth-destroying mistake you can make is panic selling during a downturn.

Trusting the Process and the Data

History offers a powerful lesson in patience. Market volatility can feel unsettling, but staying the course is almost always rewarded. For instance, after a tough 2022 where the S&P 500 fell 18.1%, it came roaring back with a gain of over 21% in 2023.

Imagine a beginner who invested $10,000 at the start of 2022 and simply held on through the dip. By the end of 2023, their investment would have grown to over $12,000. That's proof that staying invested is the real path to building wealth. You can dig deeper into these market recovery insights on russellinvestments.com.

This pattern isn't a fluke; it's the nature of the market. Downturns are temporary, but long-term growth has been remarkably consistent.

Practical Strategies for Emotional Discipline

Building emotional fortitude is a skill, just like learning to analyze a fund. It means having systems in place to protect you from your worst instincts. Learning how to build emotional intelligence can be a huge asset on your investing journey.

Here are a few practical strategies to help you stay calm and focused:

- Automate Everything: Set up automatic contributions to your investment account every week or month. This takes decision-making out of the equation and ensures you consistently buy, whether the market is up or down.

- Stop Checking Your Balance: For a long-term investor, daily portfolio swings are just noise. Checking constantly only fuels anxiety. Limit yourself to reviewing your accounts maybe once or twice a year to make sure your plan is still on track.

- Focus on Your Timeline: Remember why you are investing. If your goal is retirement in 30 years, a bad month or even a bad year is just a tiny blip on a very long timeline. Keep your focus on the multi-decade horizon, not the daily news cycle.

The Golden Rule of Investing: True wealth is built through "time in the market, not timing the market." Your goal isn't to predict the next market move but to remain invested long enough to benefit from the overall upward trend of the economy.

By turning these simple ideas into habits, you can build the discipline to ignore the panic and let your investments do their work. Acknowledging that volatility is part of the game is the first step; having a plan to manage your response to it is what makes you a successful investor.

Common Beginner Mistakes and How to Avoid Them

One of the best ways to get ahead is to learn from the mistakes others have made. Getting started with investing is exciting, but a few common pitfalls can easily derail your progress. Think of this section as your guide to sidestepping those early stumbles right from the get-go.

A lot of new investors treat investing as a one-and-done task. There's this idea that you can just follow a Set It And Forget It strategy, but that’s not quite right. While automating your contributions is a smart move, completely ignoring your portfolio means you’ll miss crucial chances to rebalance or make adjustments as your life and financial goals evolve.

Chasing Hot Stocks and Market Timing

It’s so tempting to see a "meme stock" blow up on social media and want to jump in for a quick buck. Let’s be clear: that’s not investing, it’s gambling. Even the pros on Wall Street can’t consistently time the market—predicting its highs and lows—so it's a game you don't want to play.

Real-Life Scenario: Sarah saw a tech stock getting a ton of buzz online. Fearing she'd miss out, she poured a big chunk of her savings in right at the top. A week later, the hype fizzled out, and the stock tanked by 40%. She let short-term excitement distract her from the proven path of long-term, patient investing.

Overlooking Fees and Ignoring Diversification

Those small fees can seem like no big deal, but they are a massive drag on your returns over time. A seemingly tiny 1% annual management fee can eat up nearly a third of your potential gains over a few decades. It's the slow leak that sinks the ship.

Putting all your money into just a few stocks might also feel simpler, but it’s a huge risk. As we've covered, diversification is your single best defense against market swings. When one part of your portfolio is down, another can be up, smoothing out the ride.

Key Takeaway: High fees and poor diversification are the two silent killers of an investment portfolio. You can solve both problems at once by focusing on low-cost, broad-market index funds or ETFs. It's the simplest way to build a strong foundation.

Letting Emotions Drive Decisions

The market will have bad days. It's a guarantee. When it happens, your first instinct will be to sell everything to stop the pain. This is, without a doubt, the most common and destructive mistake an investor can make.

Great investing is about discipline, not drama. It means having a plan and sticking with it, especially when it feels scary. History shows us that markets recover, and patience is rewarded. The best way to take emotion out of the picture? Create your plan and automate your contributions so you invest consistently, no matter what the headlines say.

Your Investing Questions Answered: Top 10 FAQs for Beginners

It's completely normal to have a few questions buzzing around your head as you get ready to dive in. Let's tackle some of the most common ones I hear from new investors. Think of this as a final, reassuring chat before you start.

1. How much money do I really need to start?

You can get started with as little as $1. Seriously. The old days of needing thousands of dollars just to open an investment account are long gone. Most modern brokers have no minimums and offer something called fractional shares. This just means you can buy a tiny slice of a huge company like Apple or Amazon for just a few bucks. The most important thing isn't the amount you start with—it's building the habit of investing regularly that truly creates wealth over time.

2. Is investing in the stock market just gambling?

Not at all. The two are worlds apart. Gambling is a short-term bet on a random outcome where the odds are stacked against you. True investing, on the other hand, is a long-term strategy. You're owning a diversified collection of assets that tap into the growth of the global economy. While there’s always risk involved, investing is based on economic growth, historical data, and a disciplined plan—not a roll of the dice.

3. What’s the best single investment for a beginner?

For most people starting out, a low-cost, broadly diversified index fund or ETF is the perfect first step. A great example is a fund that tracks the S&P 500. With one purchase, you instantly own a small piece of 500 of the largest companies in the U.S. This single investment gives you immediate diversification, has incredibly low fees, and boasts a proven track record of strong long-term growth.

4. How often should I be checking my investments?

Far less often than you think. For long-term investors, checking your portfolio daily—or even weekly—is a recipe for anxiety. It tempts you to react emotionally to the market's normal ups and downs, which often leads to bad decisions. A healthy rhythm is to review your portfolio once or twice a year. This is just a quick check-in to make sure your investments are still aligned with your goals and to rebalance if necessary. Otherwise, let your plan do the work in the background.

5. Should I only invest in stocks?

Definitely not. A truly balanced portfolio includes more than just stocks. Bonds are a key ingredient for managing risk because they tend to hold steady (or even go up) when the stock market gets choppy. This mix of stocks and bonds is called asset allocation, and it’s the bedrock of any resilient, long-term strategy.

6. What exactly are dividends?

Think of dividends as a thank-you gift from a company to its shareholders. They are small, regular cash payments that some companies share from their profits. You can take that cash, but the real power comes from automatically reinvesting it to buy more shares. This is what puts your compound growth into overdrive.

7. What's the difference between a mutual fund and an ETF?

Both are simply baskets holding many different investments, but the key difference is how they trade. Mutual funds are priced just once per day after the market closes. ETFs (Exchange-Traded Funds) trade all day long on an exchange, just like individual stocks. For most beginners, ETFs are often the better choice. They usually have lower fees, are more flexible, and tend to be more tax-efficient.

8. Do I need a financial advisor to get started?

Not necessarily. With today's user-friendly brokerage platforms and simple, low-cost index funds, it’s never been easier to build a fantastic portfolio on your own. While an advisor can be a huge help for complex financial situations, you can absolutely succeed by following the core principles in this guide.

9. What happens to my money if the market crashes?

If you own a diversified portfolio, a market crash means the value of your investments will go down—on paper. The key is to remember it’s temporary. History has shown us time and again that markets always recover. A crash only becomes a permanent loss if you panic and sell everything at the bottom. For a long-term investor, a downturn is actually an opportunity to buy great assets at a discount.

10. How do taxes on investments work?

It really depends on the type of account you're using and how long you hold an investment.

- In tax-advantaged accounts like a 401(k) or Roth IRA, your investments grow either tax-deferred or completely tax-free.

- In a standard brokerage account, you’ll pay capital gains tax when you sell an investment for a profit. The good news? If you hold that investment for more than one year, you'll typically pay a much lower long-term capital gains tax rate.

Ready to take the next step in your financial journey? At Everyday Next, we provide the insights and practical guides you need to make informed decisions about your money, career, and life. Explore our articles on wealth, tech, and personal development to keep learning and growing. Discover more at Everyday Next.