How to Build Multiple Income Streams: A Practical Guide

Creating multiple income streams boils down to a pretty straightforward process: figure out what skills you have that people will pay for, pick a model that can grow (like freelancing or selling digital products), and then smartly reinvest what you earn. This approach builds a financial buffer, making you less dependent on a single paycheck and setting you up for long-term wealth.

Why One Paycheck Is No Longer Enough

Relying on a single job for your financial security is an idea that's quickly becoming outdated. With the economy constantly shifting and the job market changing in the blink of an eye, diversifying your income is no longer just a clever move—it’s a modern-day necessity. The stability that a traditional career once seemed to promise just isn't a sure thing anymore.

This guide isn't about getting lost in complicated financial jargon. It’s about the real, tangible peace of mind you get from knowing your financial health doesn't hang by a single thread tied to one employer. It’s about building a safety net that catches you during life’s curveballs, whether that’s a layoff, a medical emergency, or a recession.

Active vs. Passive Income: A Simple Framework

Before we jump into the "how," it's vital to get a handle on the two main types of income you'll be building. Understanding this difference is really the first step in creating a balanced and robust financial life.

- Active Income: This is the classic "trading time for money." It’s your salary from your 9-to-5, or the fee you collect for a freelance gig. The moment you stop working, the money stops coming in.

- Passive Income: This is the holy grail for many. It takes a lot of work upfront, but eventually, it brings in money with very little day-to-day effort. Think royalties from a book you wrote, dividends from stocks, or revenue from an online course you built last year.

A huge part of building wealth is learning what is passive income and making it work for you. It’s the ultimate form of financial leverage, where your assets start doing the heavy lifting.

The core strategy is to use your main active income as seed money to build passive income streams. Over time, this shifts your entire financial model from earning based on your time to earning based on what you own.

Real-Life Examples: The Power of Diversification

Let's look at a couple of real-life examples to see how this works in practice.

Example 1: The Salaried Employee

- Sarah, a marketing manager, relies solely on her full-time salary. When her company downsizes during an economic downturn, her income drops to zero overnight. The financial stress is immediate and intense as she scrambles to find a new job.

Example 2: The Diversified Professional

- Mark, a software developer, also has a full-time job. However, he dedicates a few hours each weekend to two other streams. He runs a small tech blog with affiliate links for products he uses (a passive stream), and he takes on occasional freelance projects building websites for local businesses (an active stream). If Mark gets laid off, he's not starting from zero. His blog and freelance work provide a crucial income buffer, giving him breathing room while he searches for his next role.

This is the real power of having multiple income streams: financial resilience. It’s not just about chasing wealth; it’s about building a foundation strong enough to handle whatever life throws at you.

Finding Your First Profitable Idea

Before you jump on the latest side hustle trend making the rounds on social media, it’s worth taking a beat to look inward. The best, most sustainable income streams—the ones that stick—are almost always built on the assets you already have. I’m talking about your skills, passions, and unique experiences.

The goal isn't just about chasing a quick buck. It's about building something that actually fits into your life and feels like a natural extension of who you are. The whole process starts with a simple personal inventory. Instead of asking "What can I sell?" try asking "What problems can I solve?" or "What do I genuinely love doing?" That sweet spot where your skills, interests, and a real market need overlap? That's where the magic happens.

Map Your Personal Assets

Look, your most valuable resources aren't just what you do from 9-to-5. They're the skills you've picked up from hobbies, the knowledge you've gained from overcoming personal challenges, and the passions that genuinely excite you.

Start by mapping out these three core areas:

- Your Skills: What are you legitimately good at? Think way beyond your job title. Are you the friend everyone asks to organize their messy spreadsheets? A natural public speaker? A patient teacher? Or maybe you're just really good at fixing things.

- Your Passions: What do you do for fun, with no expectation of getting paid? This could be anything from gardening and baking to playing video games and coding. Passions are goldmines because the motivation is already built-in.

- Market Problems: What do people complain about? Really listen during conversations with friends and family. Pay attention to the frustrations you see bubbling up on social media feeds or forums. Every single problem is a potential business idea in disguise.

The most successful side hustles I've seen almost always start by solving a problem the founder ran into themselves. Your own frustrations are an incredible source of inspiration because you already understand the customer's pain point inside and out.

From Skill to Service

Once you've got a list of skills and passions, the next step is to figure out how to connect them to something people will actually pay for. This doesn't need to be some grand, complicated plan. You're just looking for the overlap.

For instance, maybe you’re a hyper-organized person who geeks out on creating efficient systems. That one skill could easily spin off into several different income streams. Our guide on how to start a side business dives much deeper into how you can test these ideas before going all-in.

Here’s a quick look at how a single skill can be leveraged in totally different ways:

The Skill-to-Stream Multiplier

| Core Skill | Active Income Stream (Service) | Passive Income Stream (Product) |

|---|---|---|

| Graphic Design | Freelance logo design for local businesses. | Selling pre-made social media templates on Etsy. |

| Personal Finance | One-on-one budget coaching sessions. | Creating and selling a downloadable budget spreadsheet. |

| Creative Writing | Writing blog posts or newsletters for clients. | Publishing a short e-book or a collection of poems. |

| Gardening Expertise | Offering local garden consultation services. | Creating a digital guide on "Beginner's Vegetable Gardening." |

The point of this exercise isn't to land on the "perfect" idea on your first try. It’s about brainstorming a list of possibilities that feel authentic to you. By starting with what you already know and love, you're building a foundation that's far less likely to lead to burnout.

Choosing the Right Income Streams for You

So you've brainstormed a list of ideas based on what you know and love. Great. Now comes the hard part: figuring out which of those paths are actually worth walking down. This is where we get real about what it takes to make money with some of the most popular income streams out there.

Let's be honest, not all income streams are built the same. Some demand a hefty chunk of cash to get started, while others will eat up your most valuable asset—your time. Getting clear on these trade-offs is everything. You need to pick a path that actually fits your life, your wallet, and your goals.

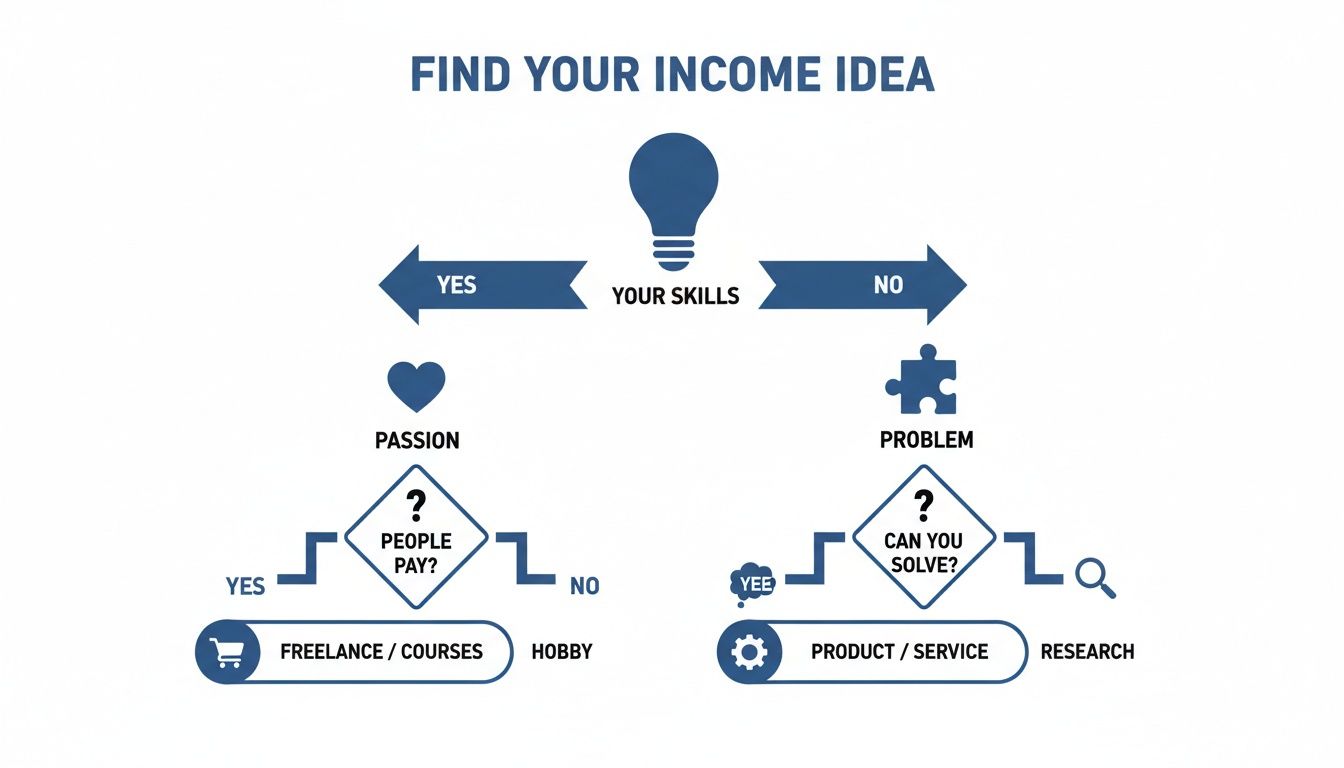

This simple flowchart can help you see how your skills and interests can connect to a real, profitable idea.

As you can see, the sweet spot is where what you're good at and what you enjoy doing overlaps with a problem you can solve for other people.

An Honest Look at Popular Income Models

Let's break down a few of the most common ways people build extra income. I'll give you the real scoop on startup costs, how long it actually takes to see cash flow, and the skills you can't fake.

Freelancing and Consulting

This is almost always the quickest way to bring in extra money. Why? Because you're selling a skill you already have. If you’re a writer, graphic designer, or project manager, there are people right now willing to pay for your help.

- Startup Costs: Dirt cheap. You can often get going for less than $100, which covers a basic portfolio site and maybe a software subscription.

- Time to First Dollar: It can be incredibly fast. If you have a decent network, you could land your first paid gig in a week or two.

- Required Skills: Beyond your core expertise, you need to be a solid communicator and project manager. And you absolutely have to get comfortable with selling yourself.

Creating and Selling Digital Products

Think ebooks, online courses, or design templates. You do the heavy lifting upfront to create one amazing asset, then you can sell it over and over again. The initial work is a grind, but the passive income potential down the road is huge.

- Startup Costs: This can vary. A simple ebook might cost you next to nothing, but a high-quality video course with professional editing could run you over $1,000.

- Time to First Dollar: Be patient. This is a game of weeks or, more realistically, months. You have to create the product and build an audience to sell it to.

- Required Skills: You need to be a genuine expert on your topic. You'll also need content creation skills (writing, video, design) and a solid grasp of digital marketing to get the word out.

E-commerce and Dropshipping

This means selling physical stuff online. You can either manage your own inventory or use a dropshipping model where another company handles all the shipping and handling. With platforms like Shopify and Etsy, it’s never been easier to open a digital storefront.

- Startup Costs: Moderate to high. Even if you're dropshipping, plan on spending $500 – $2,500 for platform fees, marketing, and testing out your first few products.

- Time to First Dollar: You might see your first sale in a few weeks, but don't confuse that with profit. It often takes months of tweaking ads and products to become consistently profitable.

- Required Skills: Finding good products, building a brand, running digital ads (especially on social media), and handling customer service are all non-negotiable.

Picking the right expansion strategy is key. For e-commerce sellers, for example, relying on one platform is risky. Smart brands are always diversifying revenue streams to create a more stable and scalable business.

Comparing Your Options Side-by-Side

Sometimes the best way to make a decision is to just lay it all out on the table. This chart breaks down the most important factors to help you compare different income-generating models at a glance.

Comparing Popular Income Streams

| Income Stream | Initial Investment | Time Commitment | Passive Potential | Scalability | Best For… |

|---|---|---|---|---|---|

| Freelancing | Low (<$100) | High (Active) | Low | Moderate | Those needing quick cash with an existing skill. |

| Digital Products | Low to Moderate | High Upfront | High | High | Experts who can create content once and sell it forever. |

| Affiliate Marketing | Low (<$200) | Moderate | High | High | Content creators with a niche audience. |

| Dividend Investing | Varies (Scalable) | Low | Very High | High | Those with capital to invest for long-term passive growth. |

| Rental Real Estate | High (>$20k) | Low to Moderate | High | Moderate | Investors comfortable with high entry costs and property management. |

| E-commerce | Moderate to High | High (Active) | Moderate | High | Entrepreneurs skilled in branding, marketing, and logistics. |

What this table makes clear is that there's no "perfect" income stream—just the one that's perfect for you, right now. If you've got more time than money, freelancing is a fantastic place to start. If you have capital to invest but are short on time, dividend stocks might be your best bet.

For a deeper dive, check out some other great passive income ideas for beginners.

Testing Your Idea With Minimal Risk

Before you go all-in on an idea, you have to test it. Don't spend six months and thousands of dollars building something nobody wants. The smart move is to create a "Minimum Viable Product" (MVP) to see if people will actually pull out their wallets.

- For a Digital Product: Instead of a massive 20-lesson course, offer a paid 90-minute workshop or a detailed guide on one specific part of your topic.

- For Freelancing: Find a few "beta" clients and offer your service at a discount in exchange for a great testimonial.

- For E-commerce: Don't buy 500 units of a product. Start by dropshipping a few different items with a small ad budget to see what sells.

This validation stage isn't just a step; it's the step. It’s what turns your hunch into a proven business concept and dramatically increases your odds of success down the line.

From Side Hustle to Sustainable System

Let's be honest, a great idea is just the starting point. Turning that spark into a reliable income stream is where the real work begins, and it’s not about luck—it’s about building a smart system. The challenge is to create a structure that can run efficiently, grow predictably, and eventually operate without your constant hands-on effort.

This is how you move from a scattered side hustle to a genuine business asset. It means setting up dead-simple financial tracking, making a smart choice about your business structure, and building efficiency into your process from day one. Your goal isn't to create another job for yourself; it's to build something that can grow beyond you.

Laying the Financial Foundation

You can't scale what you can't see. Before you even think about growth, you need clarity on your numbers. The very first step is to treat your new income stream like a real business, even if it's only making a few bucks a month. That means getting its finances out of your personal accounts immediately.

Go open a dedicated business checking account. Seriously. This one simple move makes tracking income and expenses a thousand times easier and is a non-negotiable for tax time. You don't need fancy accounting software just yet; a basic spreadsheet is perfectly fine to get started.

At a minimum, your spreadsheet should track:

- All Revenue: Every dollar that comes in, with a note on where it came from.

- All Expenses: Every single cost, from software subscriptions to shipping supplies.

- Profit: The simple, beautiful calculation of Revenue – Expenses.

This basic setup is your dashboard. It gives you a real-time snapshot of your project's health, showing you what’s actually working and where your money is disappearing. This is the data you'll need to make smart decisions down the road.

Choosing a Business Structure

As your income starts to grow, you'll need to think about a formal business structure. This decision affects everything from your personal liability to how you file taxes. It sounds intimidating, but for most people starting out, the options are pretty straightforward.

Look, don't get hung up on this at the beginning. A Sole Proprietorship is the default for most people starting a side project. It’s the simplest path forward. You only really need to think about forming an LLC once your income becomes significant and you want to protect your personal assets from any business debts or liabilities.

Here’s a quick breakdown of the most common choices for a new venture.

| Structure | Setup Simplicity | Liability Protection | Tax Filing |

|---|---|---|---|

| Sole Proprietorship | Very Easy (It's automatic, no paperwork) | None (Your personal assets are at risk) | Simple (Filed right on your personal return) |

| LLC | Moderate (Requires state filing and fees) | Strong (Separates personal and business assets) | Flexible (Can be taxed like a sole prop or corp) |

Once you're making consistent money, having a chat with a tax professional is a great idea. But don't let this step paralyze you before you've even started.

Automate and Outsource Your Way to Growth

The only way to scale an income stream without burning yourself out is to systematically remove yourself from the day-to-day grind. This is where automation and outsourcing become your best friends. The mission is to build a system that runs on its own processes, not on your personal hustle.

First, hunt down the repetitive tasks in your workflow. These are perfect candidates for automation.

- Email Marketing: Use a tool like Mailchimp or ConvertKit to automatically send a welcome series to new subscribers.

- Social Media: Schedule all your posts weeks in advance with a platform like Buffer or Later.

- Client Onboarding: Create templates for your proposals, contracts, and welcome emails so you’re not starting from scratch every time.

After you've automated everything you can, look at the tasks that need a human touch but don't necessarily need your touch. This is where you bring in help. Sites like Upwork and Fiverr are fantastic for finding affordable freelancers for things like graphic design, video editing, or virtual assistant work.

This strategy of building systems isn't new. In fact, if you look at established industries, stability comes from having multiple revenue pillars. The World Press Trends Outlook 2025-2026 found that successful media companies now rely on three distinct pillars—print, digital, and other sources like events—with these alternative streams now making up over 25% of their total income. You can learn from this three-pillar revenue model and apply that same diversification logic to your own financial life.

How to Manage Your Growing Income Portfolio

Adding new income streams is exciting, but it brings a whole new layer of complexity. Suddenly, you’re not just a freelancer or an investor—you’re the CEO of your own personal finance company. The real trick isn't just starting these streams; it's managing them smartly for the long haul.

This isn't something you can "set and forget." Think of it as actively tending a garden. You have to monitor, reinvest, and prune each stream to build real, lasting financial resilience. The goal is a system that works for you, not one that has you constantly putting out fires.

Tracking the Health of Each Stream

Forget about drowning in monster spreadsheets. To really get a handle on your growing portfolio, you just need to track a few core metrics for each income stream. This keeps you in the loop without giving you a bad case of analysis paralysis.

For each stream, set up a simple tracker—a basic spreadsheet or even a dedicated notebook will do—and check these vital signs once a month:

- Gross Revenue: The top-line number. How much cash did this stream bring in before any expenses?

- Net Profit: The bottom-line number. What’s left after you subtract all the costs? This is your real take-home pay.

- Time Invested: Be honest with yourself. How many hours are you really putting into this each week or month?

- Profit Per Hour: Here's the magic number. Just divide your Net Profit by the hours you invested. This tells you how efficient your efforts truly are.

Looking at the hard data takes the emotion out of your decisions. You might feel like your freelance gig is your biggest moneymaker, but the numbers could easily show that your small digital product is actually giving you a much better return on your time.

Smart Reinvestment and Tax Planning

Your profits are the fuel for more growth. One of the smartest things you can do is have a clear plan for putting a chunk of your earnings right back into your income streams. This is how you create a powerful compounding effect that really speeds things up.

A great, simple framework to start with is the 50/30/20 rule for side income:

- 50% for Reinvestment: Funnel half your net profits back into growth. This could mean buying better equipment for your side hustle, running some ads for a digital product, or investing in a course to sharpen your skills.

- 30% for Taxes: Don't get caught off guard. Since this income isn't taxed at the source like a W-2 paycheck, you have to be disciplined and set this money aside.

- 20% for You: This is your reward! Use it to smash debt, pad your savings, or just enjoy the results of your hard work.

Getting a handle on your taxes is absolutely non-negotiable. Once you start earning from multiple sources, you'll likely need to pay quarterly estimated taxes to the IRS to avoid penalties. Seriously consider talking to a tax pro once your side income becomes significant—it's an investment that pays for itself.

The Quarterly Portfolio Review

Just like any investment portfolio, your collection of income streams needs a regular check-up. I've found a quarterly review hits the sweet spot—it's frequent enough to make timely adjustments but not so often that it feels like a chore.

Once every three months, sit down and ask yourself these questions for each stream:

- Is it meeting my goals? Check your metrics. Is the profit what you expected? Is the time commitment still manageable?

- What's the biggest headache? Pinpoint the main thing holding it back. Is it a struggle to find clients, a marketing bottleneck, or just a workflow that isn’t clicking?

- What's the biggest opportunity? Where is there untapped potential? Could you raise your rates, launch a complementary product, or explore a new platform?

This review process is your command center. It gives you the clarity to decide when to double down on a winner, tweak a stream that's struggling, or cut one loose that’s just not worth the effort anymore.

This kind of strategic management is becoming the norm. The creator economy has grown up, and now nearly 70% of creators run multiple income streams to create more stability. Economic shifts pushed many away from relying on a single source, leading them to diversify with things like sponsorships, subscriptions, and direct payments. You can see more on how creators are building resilient businesses in this report on the creator economy.

Effectively managing your income streams is a cornerstone of building a truly robust financial life. You might also want to check out our guide on how to diversify your portfolio for more strategies on spreading risk and maximizing growth.

Frequently Asked Questions (FAQ)

1. What are the easiest income streams to start?

The easiest income stream is always one that leverages a skill you already possess. For example, if you're a strong writer, freelancing or starting a blog with affiliate marketing is a natural fit. If you're a talented graphic designer, selling templates or taking on design projects is a great starting point. Focus on what you know to lower the learning curve.

2. How many income streams should I aim for?

Quality over quantity is key. Start by building one additional income stream alongside your primary job. Once it's stable and requires less of your direct attention, you can consider adding a second. Most financially successful individuals have 3-5 reliable streams, not a dozen small, unstable ones.

3. Do I need a lot of money to start building multiple income streams?

Not at all. Service-based streams like freelancing, consulting, or virtual assistance can be started for under $100. The strategy is to begin with low-cost, high-skill ideas, generate profit, and then reinvest that profit into more capital-intensive streams like investing or e-commerce.

4. How do I find the time to build income streams with a full-time job?

It requires intentional time management. Start by auditing your time for a week to find hidden pockets (e.g., commute, lunch breaks). Focus on one stream at a time to avoid burnout. Leverage automation tools for repetitive tasks like social media scheduling (Buffer) or email marketing (ConvertKit) to maximize the hours you do have.

5. What is the difference between active and passive income?

Active income is earned by trading your time for money (e.g., your salary, freelance fees). If you stop working, the income stops. Passive income requires significant upfront work but eventually generates revenue with minimal ongoing effort (e.g., royalties from a book, dividends from stocks, ad revenue from a website). The ideal strategy is to use active income to fund the creation of passive income streams. For more detail, learn what passive income is.

6. How do I handle taxes for my multiple income streams?

Income from side hustles is typically not taxed at the source, so you are responsible for paying taxes on it. It's crucial to set aside a portion of your earnings (a common rule of thumb is 30%) for taxes. Once you earn over a certain threshold, you'll likely need to pay quarterly estimated taxes to the IRS. Consulting with a tax professional is highly recommended.

7. When is it safe to quit my day job?

Do not quit your job based on one good month. A reliable benchmark is when your net income from your multiple streams consistently covers your essential living expenses for at least 6-12 consecutive months. You should also have a fully funded emergency fund (3-6 months of expenses) before making the leap.

8. What is the biggest mistake people make when building income streams?

The most common mistake is trying to do too much at once. People get excited and try to launch a YouTube channel, an Etsy shop, and a freelance business all at the same time. This leads to burnout and failure across the board. The key is to focus on building and systematizing one stream until it's successful before moving on to the next.

9. Should I focus on active or passive income first?

For most people, starting with an active income stream like freelancing is the most practical approach. It generates cash flow quickly, which you can then use to live on and, more importantly, reinvest into building passive income streams (like a digital course or dividend portfolio) that create long-term wealth.

10. How can I validate my idea before investing a lot of time and money?

Create a Minimum Viable Product (MVP). Instead of building a full 10-module course, sell a 90-minute paid webinar. Instead of ordering 500 units for an e-commerce store, start with a dropshipping model to test product demand. For a service, offer a discounted rate to a few "beta" clients in exchange for testimonials. This proves people will pay for your idea before you go all-in.

At Everyday Next, we're committed to providing clear, actionable insights to help you navigate your financial journey. Explore our resources to build a more secure and innovative future, one step at a time. Visit us at https://everydaynext.com.