How to Build Wealth in Your 30s: A Practical Guide for a Secure Future

Your 30s are where wealth-building gets real. This is the decade where your growing income can finally start working for you in a big way, but only if you have a plan. It's all about one core idea: making the gap between what you earn and what you spend as wide as possible, then putting that extra cash to work.

Why Your 30s Are the Prime Time for Building Wealth

If you feel like you're late to the party because you didn't start investing in your 20s, relax. Your 30s are actually a financial sweet spot. You're likely earning more than ever before, but you still have decades ahead for your money to grow. This is the time to shift from just putting money aside to strategically building real, lasting wealth.

Real progress isn’t just about getting a raise—it’s about what you do with that extra income. Making smart, intentional choices now is a gift to your future self. After all, there's a lot more to it than just numbers in an account, which is something you can explore further in our guide on why building wealth isn't just about money.

The Hard Numbers: Where People Actually Stand

Let's get real for a second. While the potential in your 30s is massive, the stats show a lot of people are just getting by.

Data from the Federal Reserve's latest Survey of Consumer Finances shows the median net worth for people under 35 is only $39,000. That number jumps to $135,600 for the 35-44 age group.

What makes the difference? It's not luck. It's the disciplined habit of saving and investing 15-20% of your income, year in and year out. That one habit is the single biggest factor separating those who build wealth from those who don't.

Key Takeaway: Your 30s aren't about playing catch-up; they're about getting ahead. You have a powerful combination of rising income and a long investment runway that you won't have forever.

Your 30s Wealth Building Action Plan at a Glance

To make this all feel a bit more concrete, here’s a quick-reference table that lays out the game plan. This is your roadmap for the decade—the core moves that will have the biggest impact.

| Action Area | Target/Goal | Why It Matters Now |

|---|---|---|

| Savings Rate | 15-20% of Pre-Tax Income | Establishes a powerful habit that fuels all investment goals. |

| Emergency Fund | 3-6 Months of Essential Living Expenses | Creates a financial buffer to prevent derailing your progress. |

| Retirement Savings | Maximize 401(k) match, then fund a Roth IRA | Takes advantage of free money and powerful tax-free growth. |

| Debt Management | Aggressively pay off debt with >6-7% interest | Frees up cash flow to accelerate your investment contributions. |

Think of this table as your checklist. We'll dive into each of these areas in more detail, but keeping these targets in mind will keep you focused on what truly moves the needle.

Mastering Your Money to Build a Strong Foundation

It's tempting to jump straight into the exciting stuff—aggressively investing, buying real estate, chasing big returns. But doing that without mastering your cash flow first is like trying to build a skyscraper on a foundation of sand. Before you can truly start building wealth in your 30s, you have to forge a rock-solid financial base.

This all comes down to getting total control over your money. We're talking about budgeting, creating a safety net with an emergency fund, and protecting your future with the right insurance.

This foundational work isn't about restriction; it's about creating the stability you need to take smart, calculated risks later on. Think of it as the boring but essential groundwork that allows your wealth to grow, uninterrupted, for decades to come.

Crafting a Budget That Actually Works

Let's be honest, the word "budget" makes most people cringe. It brings to mind restrictive spreadsheets and cutting out all the fun. A much better way to look at it is as a conscious spending plan—a tool that actively directs your money toward what you value most, including your future self.

For a deep dive, check out our guide on how to create a monthly budget you'll actually stick with.

The popular 50/30/20 rule is a fantastic starting point, but it really needs a tweak for your 30s, when your earning power is taking off.

- 50% for Needs: This covers the essentials like housing, utilities, transportation, and groceries.

- 30% for Wants: Think dining out, hobbies, streaming services, and travel.

- 20% for Savings & Debt Repayment: This is the engine of your wealth-building plan.

Here's the key, though: as your income grows, you have to fight the urge to let your "Needs" and "Wants" grow right along with it. If you land a $10,000 raise, the goal isn't to suddenly start spending $8,000 more. The real power move is to funnel that $8,000 of the raise directly into savings and investments. That’s how you turn that 20% savings rate into 25% or even 30% and seriously accelerate your progress.

Building Your Financial Firewall: The Emergency Fund

Your emergency fund is the non-negotiable barrier between you and financial disaster. It’s what keeps a surprise $2,000 car repair or an unexpected medical bill from derailing everything, forcing you to sell investments at a loss or rack up high-interest credit card debt.

The goal is to have three to six months of essential living expenses tucked away. Notice I said essential expenses, not your full income. This is the bare-minimum amount you need to cover housing, food, utilities, and insurance if your income suddenly stopped.

Where you keep this money matters. A lot.

| Savings Vehicle | Accessibility | Growth Potential | Best Use for Emergency Fund |

|---|---|---|---|

| High-Yield Savings Account | High | Modest | This is the ideal choice. Your money is safe, liquid, and earns more interest than a typical account. |

| Traditional Savings Account | High | Very Low | A fine place to start, but you're actively losing purchasing power to inflation here. Move your funds ASAP. |

| Money Market Account | High | Modest | Another strong option, often with handy features like check-writing or a debit card. |

| Investing the Fund | Low | High | Avoid this at all costs. The risk of the market taking a nosedive right when you need the cash is far too great. |

Here's a real-life example: Sarah, a 34-year-old graphic designer, had a $15,000 emergency fund. When she was unexpectedly laid off, that fund covered her rent and essentials for four solid months. It gave her the breathing room to find a new job she actually loved instead of just taking the first panicked offer that came along. That’s the real power of a financial firewall.

Protecting Your Greatest Asset: Your Ability to Earn

Finally, a solid foundation means managing personal risk. You can save and invest perfectly, but one catastrophic event could wipe it all out in an instant. This is where insurance comes in—it’s your ultimate defense.

For most of us in our 30s, two types of insurance are absolutely critical:

- Disability Insurance: This protects your income if you get sick or injured and can't work. Your ability to earn an income is your single greatest wealth-building tool. This insurance protects it.

- Term Life Insurance: If you have anyone who depends on your income—a spouse, kids, or even aging parents—this is non-negotiable. It’s remarkably inexpensive when you're young and healthy and provides a vital safety net for the people you love.

Once you have a budget directing your income, an emergency fund to handle surprises, and insurance to protect against disaster, you’ve built the launchpad. Now, you’re ready to really start building wealth.

Firing Up Your Investment Engine

If your budget and emergency fund are the foundation of your financial house, then investing is the engine that actually builds it. Your 30s are when this engine can truly roar to life, transforming your consistent savings into real, long-term wealth. The trick is to be smart and strategic, starting with the accounts that give you the biggest leg up.

A lot of us spent our 20s digging out from student debt or just getting our careers off the ground, so it's easy to feel behind. But your 30s are the prime time for a powerful financial comeback. Federal Reserve data highlights this perfectly: while the net worth of folks aged 35-44 cratered by 54% after the 2007 crisis, a significant recovery has taken place.

By 2022, the net worth for those under 35 had doubled to $39,000, fueled by a mix of forced savings and asset growth. The secret to riding this wave is to invest aggressively during your peak earning years, a time when incomes often jump 10-15% annually. You can explore the full analysis on FinancialAHA.com to see the generational data for yourself.

The Right Accounts, In the Right Order

Not all investment accounts are created equal. To build wealth efficiently in your 30s, you need a game plan that maximizes tax benefits and grabs every bit of free money available.

Think of it as a waterfall. Your first dollars go into the most valuable bucket, and once it's full, you move to the next.

Your 401(k) Up to the Employer Match: This is non-negotiable. If your company offers a match—say, they kick in 50 cents for every dollar you contribute up to 6% of your salary—you must contribute enough to get the full amount. Not doing so is literally walking away from a 100% return on your money. It's the best deal in finance.

Max Out a Roth IRA: Once you’ve secured the full 401(k) match, your next stop is a Roth IRA. You contribute with after-tax money, which feels like a small sting now, but the payoff is huge: every single dollar you withdraw in retirement is completely tax-free. That tax-free growth is an incredibly powerful force over decades.

The HSA: Your Secret Weapon: If you have a high-deductible health plan, the Health Savings Account (HSA) is a triple-threat powerhouse. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. Many savvy investors use it as a stealth retirement account, paying for minor medical costs out-of-pocket today and letting their HSA balance grow untouched for the long haul.

My Pro Tip: After you’ve funded these three accounts in this exact order, circle back to your 401(k). If you still have money to invest, work on maxing it out. Only after all that should you start thinking about a standard taxable brokerage account.

Comparing Key Retirement Accounts For Your 30s

Seeing the key differences side-by-side really helps clarify why this contribution order is so effective. Each account plays a specific, powerful role in your overall wealth-building strategy.

| Account Type | Contribution Limit (Annual) | Tax Advantage | Best For |

|---|---|---|---|

| 401(k) | $23,000 | Tax-deferred growth; contributions can be pre-tax. | Nailing the employer match and making large, automated contributions directly from your paycheck. |

| Roth IRA | $7,000 | Tax-free growth and tax-free withdrawals in retirement. | Securing a pot of tax-free money for retirement and having more investment flexibility. |

| HSA | $4,150 (Self) / $8,300 (Family) | Triple Advantage: Tax-deductible, tax-free growth, tax-free withdrawals. | Covering future healthcare costs and serving as a supercharged, tax-advantaged retirement account. |

This deliberate approach ensures you’re not just saving, but saving in the most tax-efficient way possible, which dramatically accelerates your growth over time.

Keep It Simple: The Three-Fund Portfolio

Investing doesn’t have to feel like rocket science. With decades of growth ahead of you, a simple, low-cost "three-fund portfolio" is one of the most effective and easy-to-manage strategies out there. It gives you instant, broad diversification across the entire global market.

Here’s all it takes:

- A U.S. Total Stock Market Index Fund: This gives you a tiny slice of thousands of U.S. companies, from the Apples and Amazons to the small up-and-comers.

- An International Total Stock Market Index Fund: This provides exposure to thousands of companies across both developed and emerging markets outside the U.S.

- A U.S. Total Bond Market Index Fund: This adds a layer of stability to your portfolio, acting as a crucial shock absorber during the inevitable stock market downturns.

For a great walkthrough of how this works in practice, check out our complete guide on how to start investing in index funds.

A Real-World Look:

Let's imagine Alex, who is 35 and has a good 25-30 years until retirement. A perfectly sensible—and aggressive—allocation for Alex would look something like this:

- 60% in a U.S. Total Stock Market Index Fund

- 30% in an International Total Stock Market Index Fund

- 10% in a U.S. Total Bond Market Index Fund

This mix is built for growth but is still diversified enough to handle market bumps. The best part? You can set up automatic contributions from every paycheck and let it run on autopilot. This "set it and forget it" approach is how you consistently build wealth without getting caught up in the daily noise.

To really put your investment engine into overdrive, the next level is to build passive income streams that feed your portfolio automatically.

The Debt vs. Investing Dilemma: Where Should Your Money Go?

This is the big one. You've got some extra cash at the end of the month, and you're stuck. Should you hammer away at that student loan, or is it time to start putting that money to work in the market? It’s a classic financial tug-of-war, and it can feel totally paralyzing.

But it doesn't have to be. There’s a surprisingly simple way to cut through the noise and make the right call for your money.

The secret? Let the interest rate be your guide. Your goal is to send your dollars where they'll have the biggest impact. Sometimes that means wiping out a debt that’s working against you, and other times it means investing for the long haul.

The Litmus Test: Is Your Debt 'Good' or 'Bad'?

First things first: not all debt is the same. Some debt is a five-alarm fire, while other debt is more like a slow burn you can manage. Knowing the difference is everything.

Bad Debt: This is the expensive stuff. Think credit card debt, personal loans, or any loan with an interest rate above 6-7%. This kind of debt is actively costing you money and holding you back. It needs to be your number one priority.

Good Debt: This is usually low-interest debt tied to an asset that can grow in value, like a mortgage with a 3-4% rate. While it’s still something you owe, the low cost means you aren't in a frantic rush to pay it off.

The logic here is rock-solid. Paying off a credit card with a 21% interest rate is the same as getting a guaranteed 21% return on your money. You can’t find that in the stock market. It's a no-brainer.

Key Takeaway: If your debt's interest rate is higher than the 7-8% you might reasonably expect from long-term investing, focus on paying down that debt. It's the best financial move you can make.

Running the Numbers: A Tale of Two 30-Somethings

Let’s see how this plays out with a real-world example. Imagine two friends, Maya and Ben, who each have an extra $500 a month.

- Maya has a $30,000 student loan at 7.5% interest.

- Ben has a $250,000 mortgage at 3.5% interest.

What should they do? The numbers make it clear.

| Scenario | Decision & Rationale | Long-Term Impact |

|---|---|---|

| Maya (7.5% Debt) | Pay Down Debt Aggressively. Her 7.5% interest rate is a guaranteed loss. By paying it off, she gets a guaranteed 7.5% "return" on her money—better than she's likely to see in the market, on average. | She wipes out her high-interest loan years sooner, freeing up a huge chunk of her income to pour into investments later. |

| Ben (3.5% Debt) | Prioritize Investing. With a low 3.5% mortgage rate, his money has more earning potential in a diversified investment portfolio. Historically, the market has returned more than that. | His net worth grows faster because his investment gains outpace what his mortgage is costing him in interest. |

This simple framework helps you stop guessing and start making confident, strategic moves with your money. For a more detailed breakdown, our guide covers all the key factors in deciding whether to pay off a mortgage or invest.

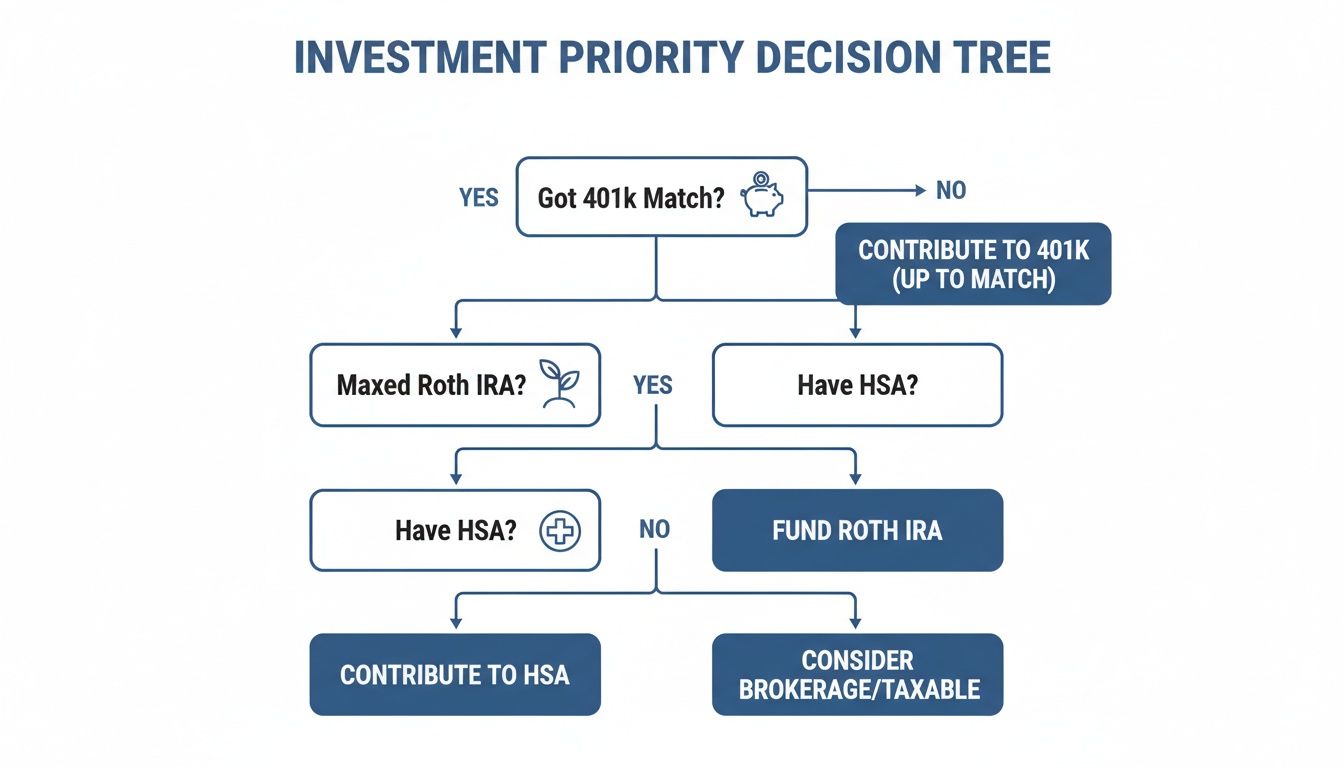

A Visual Guide to Your Investment Priorities

Once you've put out any high-interest debt fires, it's full steam ahead on investing. But where do you start? This flowchart lays out the exact order of operations so you can make sure you’re capturing every tax advantage and free-money opportunity.

It’s a simple but incredibly powerful sequence. Always grab your full 401(k) match first—it's free money. Then, max out your tax-advantaged accounts like a Roth IRA or HSA before you even think about putting a dollar into a regular brokerage account.

Boost Your Income: The Ultimate Wealth Accelerator

Smart saving and investing are absolutely the foundation of a solid financial plan. But let's be honest—the fastest way to really move the needle on your wealth in your 30s is to earn more money. This decade is often your peak for career growth, making it the perfect time to go all-in on increasing your income.

Think of it this way: getting a 10% return on your investments is a huge win. But landing a 15% raise at work? That has an immediate, massive impact on your monthly cash flow. More income means more fuel for your investment engine, and that’s how you seriously shorten the timeline to your financial goals.

Squeeze More Out of Your Day Job

Before you start looking for extra work, the most effective thing you can do is maximize what you're earning from your 9-to-5. This means getting comfortable talking about your value and learning to negotiate for what you're actually worth.

A well-planned salary negotiation can be life-changing. Here’s how to build a rock-solid case for a raise:

- Do Your Homework: Jump on sites like Glassdoor, Levels.fyi, and Payscale. Find out what the market rate is for someone with your role, experience, and location. Knowledge is power here.

- Keep a "Win" File: Start a running log of your accomplishments, positive feedback from managers or clients, and any projects where you went above and beyond. The key is to quantify your impact with hard numbers whenever you can.

- Tell a Story: Don't just ask for more money. Frame your request around the value you deliver to the company. Connect your specific achievements directly to how they helped the team or the business succeed.

If you want to really supercharge your career path, consider investing in professional development. This could mean finding a mentor or even hiring a career coach to help you map out your next move.

Turn Your Skills into a Side Hustle

Once you feel good about what you're earning at your main job, creating another income stream can pour gasoline on your wealth-building fire. The trick is to find a side hustle that plays to your existing strengths. This cuts down the learning curve and gets you earning faster.

This isn't about grinding 80 hours a week and burning out. It’s about being smart and monetizing the skills you already have.

Comparing High-Value Side Gigs

Different side hustles fit different people. Think about what works for your skills, your schedule, and what you want to achieve.

| Side Hustle Type | Potential Earnings | Time Commitment | Key Skill Required |

|---|---|---|---|

| Freelance Consulting | High | Flexible | Deep expertise in your professional field (e.g., marketing, finance, HR). |

| Skilled Services | Medium-High | Project-Based | Specific technical abilities like coding, graphic design, or video editing. |

| Content Creation | Low to High | Consistent | Strong writing, communication, or expertise for blogging or social media. |

Let's look at a real-world example. A 32-year-old software developer I know brings in an extra $1,500 a month doing small freelance coding projects for local businesses. Here's the critical part: instead of just letting that cash mix with his regular spending, he sends 100% of it straight to his brokerage account.

That simple move adds an extra $18,000 to his investments every single year, dramatically accelerating his journey to financial independence. That is how you build serious wealth in your 30s.

Frequently Asked Questions (FAQ)

1. How much should I have saved by age 35?

The general guideline is to have one to one-and-a-half times your annual salary saved by age 35. However, focusing on your savings rate is more important than a specific number. Consistently saving 15-20% of your pre-tax income will put you on an excellent path to wealth, regardless of your starting point.

2. Is it too late to start investing in my 30s?

Absolutely not. Your 30s are a prime decade for investing. You benefit from a rising income and still have a long time horizon—roughly 30 years—for compound growth to work its magic. Starting now is far more important than worrying about not starting sooner.

3. Should I try to pick individual stocks or just use index funds?

For the vast majority of people, low-cost, broadly diversified index funds are the most effective and reliable choice. They offer instant diversification, have very low fees, and historically outperform most professional stock pickers over the long term. It's a proven strategy that saves you time and reduces risk.

4. How can I save for a house and retirement simultaneously?

The key is to automate your savings into separate "buckets." First, ensure you're contributing enough to your 401(k) to get the full employer match. After that, automate contributions toward your 15-20% retirement savings goal and a separate high-yield savings account labeled "House Down Payment." This isn't an either/or decision; it's about smart allocation.

5. What's the biggest financial mistake people make in their 30s?

The most common and damaging mistake is lifestyle inflation—letting your spending increase at the same rate as your income. To build wealth, you must consciously direct the majority of every raise, bonus, and salary increase toward your savings and investment goals. Widening the gap between what you earn and what you spend is the secret.

6. Should I pay off my student loans aggressively or invest?

Let the interest rate be your guide. If your loans have a high interest rate (above 6-7%), paying them down is a guaranteed return on your money and should be a priority. If your loans have a low interest rate (below 4-5%), you are likely to earn a higher return over the long term by investing in the stock market.

7. What is a realistic net worth goal for someone in their 30s?

Instead of chasing a specific number, focus on achieving key milestones that demonstrate progress. Good goals for your 30s include: building an emergency fund of 3-6 months of essential expenses, achieving a 15-20% savings rate, and aiming to have 1-2 times your annual salary saved by your late 30s.

8. Is buying a home a necessary part of building wealth?

While owning a home can be a great way to build wealth through forced savings and equity appreciation, it is not a requirement. Homeownership comes with significant costs like maintenance, taxes, and insurance. You can gain exposure to the real estate market through investments like Real Estate Investment Trusts (REITs) without the responsibilities of being a landlord.

9. How do I stay motivated to save when my goals seem so far away?

Automation is your best friend. Set up automatic transfers to your investment and savings accounts for every payday. This removes emotion and willpower from the equation. Additionally, track your net worth once per quarter. Watching that number consistently grow provides powerful motivation to stay the course.

10. What kind of insurance is essential in your 30s?

Insurance acts as your financial defense. The non-negotiables in your 30s are: health insurance (to prevent medical debt), disability insurance (to protect your income-earning ability), and term life insurance (if anyone depends on your income). Skipping this protection can completely derail your wealth-building plan.

At Everyday Next, we're here to give you the insights and no-nonsense guides you need to feel confident about your money, career, and life. Keep exploring our content to continue your path to financial freedom. Find more resources at Everyday Next and take your next step.