Real Estate vs. Stock Market: Which Path Builds More Wealth?

Deciding between investing in real estate or the stock market is a fundamental question for anyone looking to build wealth, and honestly, there's no single right answer. The best path depends entirely on your personal financial goals, how much risk you're comfortable with, and how actively you want to manage your investments.

If you like the idea of owning a physical asset that generates monthly income and offers unique tax advantages, real estate might be your game. But if you value high liquidity, low barriers to entry, and a more hands-off approach to long-term growth, the stock market is likely a better bet. This guide will provide a detailed, evidence-based comparison to help you make an informed decision that aligns with your personal financial journey.

Choosing Your Path to Building Wealth

Figuring out where to put your hard-earned money is a huge financial decision. For generations, both real estate and the stock market have proven they can build serious wealth, but they get you there in completely different ways. Understanding those differences is the first step to creating a plan that actually works for you.

This isn't about crowning one as the ultimate winner. It’s about finding the right tool for your specific job. Your choice will come down to a few personal questions:

- What are your financial goals? Are you playing the long game for appreciation, or do you need steady income right now?

- How much risk can you stomach? Does the thought of a stock market dip make you anxious, or does the idea of a midnight call about a broken pipe sound worse?

- How much time do you have? Do you enjoy a hands-on project, or would you rather set your investments on autopilot?

- What’s your starting capital? How much cash can you realistically put down upfront?

This guide cuts through the noise to give you a clear, honest look at both options. We'll dig into everything from historical performance and tax perks to the real costs and effort involved. Once you understand what makes each one tick, you can build a smarter, more resilient plan for building wealth. For a deeper dive into the basics, check out our guide on foundational investing strategies for beginners.

At a Glance: Comparing Real Estate and Stocks

Before we get into the weeds, let's start with a simple breakdown of the core differences. Think of this table as a quick cheat sheet for these two powerful wealth-building engines.

| Feature | Real Estate Investing | Stock Market Investing |

|---|---|---|

| Asset Type | Tangible, physical asset (land & buildings) | Intangible, ownership shares in a company |

| Primary Returns | Rental income (cash flow) & appreciation | Dividends & capital gains (appreciation) |

| Liquidity | Low; selling can take weeks or months | High; can buy or sell shares instantly |

| Entry Cost | High; requires significant down payment | Low; can start with a very small amount |

| Leverage | High; can use mortgages to control large assets | Low; margin loans are risky and less common |

| Management | Active; requires hands-on management or fees | Passive; requires minimal ongoing effort |

A Deep Dive Into Historical Performance And Returns

When you're deciding between real estate and the stock market, looking back at how they've performed over the years is one of the best ways to set realistic expectations. Both have made people a lot of money, but they achieve this through different mechanisms. One relies heavily on compounding growth and broad economic expansion, while the other is a game of appreciation, cash flow, and leverage.

The stock market, usually tracked by the S&P 500, has historically been a powerhouse for growth. It's fueled by corporate profits, innovation, and the overall expansion of the global economy. The real magic here is compounding—your dividends get reinvested to buy more shares, which then earn their own dividends, creating a snowball effect that can lead to massive growth over decades.

Real estate builds wealth differently. It's a mix of the property's value going up (appreciation), the rental income you collect every month (cash flow), and your tenants effectively paying down your mortgage for you. The appreciation might not be as explosive as a hot stock, but having a physical asset that generates income offers a unique kind of stability and control.

The Numbers Behind Long-Term Growth

Let's get into the hard data. If you look at the period from 1992 to 2024, the S&P 500 clearly outpaced U.S. home prices. Stocks delivered an average annual return of 10.39%, whereas residential real estate saw a more modest 5.5%. After you account for inflation, that's a 7.66% real return for stocks, compared to just 2-2.5% for homes.

To make that concrete, if you had invested $100,000 in 1992, it would have grown to over $1.5 million in the stock market by 2024. That same $100,000 put into an average home would be worth around $400,000.

But that's not the full picture. These numbers don't factor in the secret weapon of real estate: leverage. Using a mortgage to buy a property means you control a large asset with a small amount of your own money. Furthermore, other forms of real estate, like private commercial properties and REITs, can close that performance gap significantly.

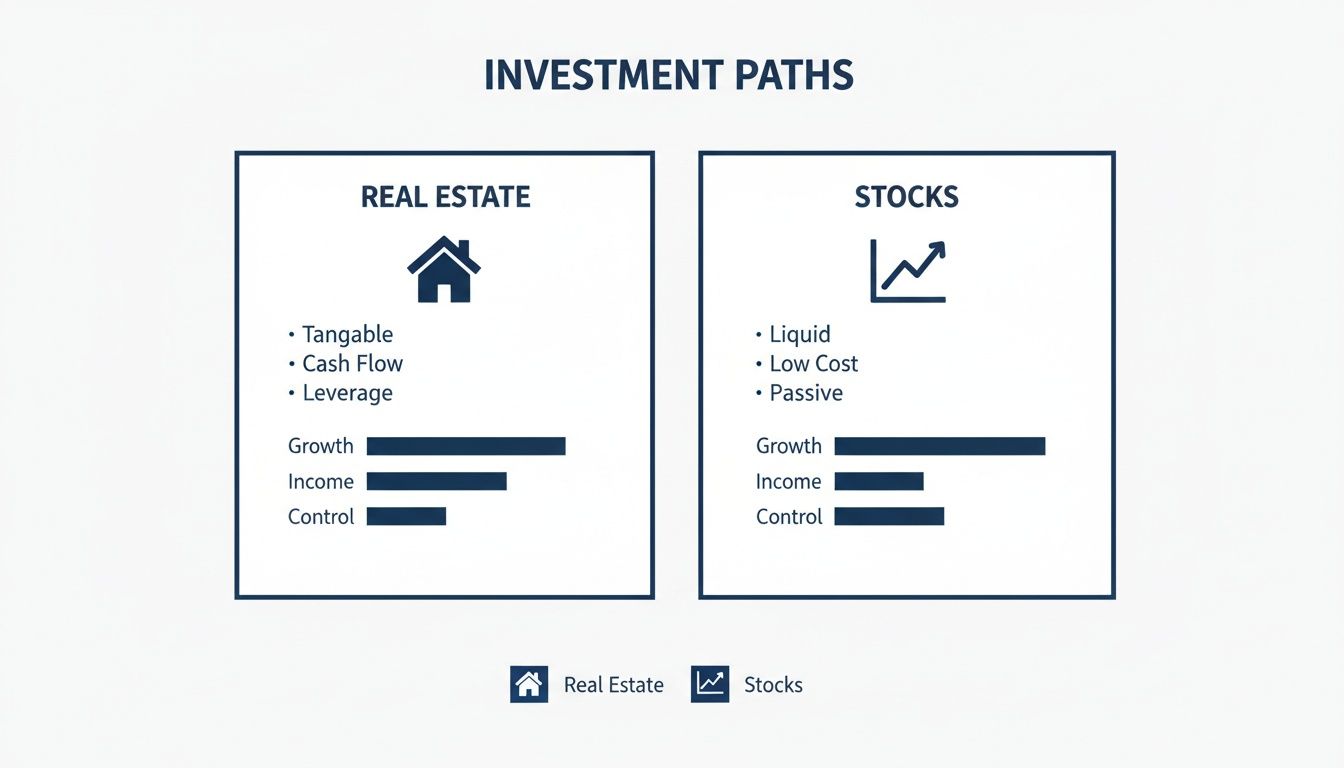

This chart helps visualize the two distinct paths and what they offer.

As you can see, stocks give you an easy, hands-off experience with great liquidity. Real estate gives you a tangible asset you can control, complete with a steady stream of cash flow.

Real-Life Examples: Two Investors, 20 Years

Averages are helpful, but let's see how this plays out for two different investors starting with the same amount of capital.

Investor A: Sarah, the Stock Market Investor

Sarah invests $50,000 into a low-cost S&P 500 index fund. She decides to let it grow without adding more funds, reinvesting all dividends.

- Initial Investment: $50,000

- Strategy: Buy and hold, reinvest dividends.

- Assumed Annual Return: 10% (historical average)

- Result after 20 years: Her investment would grow to approximately $336,375. This growth is entirely passive, requiring no management on her part.

Investor B: Mike, the Real Estate Investor

Mike uses the same $50,000 as a 20% down payment on a $250,000 rental property.

- Initial Investment: $50,000 (for a $250,000 asset)

- Strategy: Buy, rent out, and hold.

- Monthly Net Cash Flow: $300 (after mortgage, taxes, insurance, and maintenance)

- Annual Cash Flow: $3,600

- Assumed Annual Appreciation: 4%

- Result after 20 years: The property would be worth nearly $548,000. Over 20 years, he would have also collected $72,000 in cash flow (not accounting for rent increases) and paid down a significant portion of the mortgage principal, building substantial equity.

In this specific example, the real estate investor comes out ahead on paper, mainly because of leverage and cash flow. Of course, this doesn't include the headaches of being a landlord. For a closer look at how these assets stack up, particularly in the short-term rental space, this analysis of Airbnb Rentals vs. Stock Market: Better Returns? is incredibly useful.

Key Takeaway: The stock market is brilliant for passive, compounding growth that builds wealth over the long haul. Real estate shines when you use leverage to control a larger asset and generate consistent income. The right choice really comes down to whether you want hands-off growth or hands-on control of your asset.

Comparing The Core Investment Characteristics

To make the right call between real estate and the stock market, you have to look past the surface-level pros and cons and really get into the weeds of how each one works. They operate in completely different worlds, each with its own set of rules for winning.

Let’s break down the core factors that will define your experience as an investor. We'll look at things like liquidity, volatility, cash flow, and the game-changing power of leverage. Getting a handle on these concepts is the only way to match your investment strategy to your financial goals and, just as importantly, your lifestyle.

Liquidity And Transaction Costs

One of the sharpest contrasts between these two is liquidity—how fast you can turn your investment back into cash. The stock market is the clear winner here. You can sell shares in a company or an ETF and have the money in your account in a couple of business days, often with zero commission. That’s a huge advantage if you need to react to market shifts or just need cash, fast.

Real estate, on the other hand, is notoriously illiquid. Selling a property isn’t a quick click; it’s a whole process. You have to find a real estate agent, list the property, show it to potential buyers, negotiate offers, and go through escrow. This can easily drag on for months. If you think you might need sudden access to your capital, this slow pace is a major factor to consider.

The costs to buy and sell are also worlds apart.

- Stocks: Most major brokerage platforms now offer $0 commission trades. Your main cost is often the expense ratio on a mutual fund or ETF, which for a simple index fund is incredibly low (e.g., 0.03%).

- Real estate: Getting out of a property investment will cost you. Realtor commissions alone can run 5-6% of the sale price, and that's before you add in closing costs, lawyer fees, and any last-minute repairs to get the deal done.

Volatility And Tangibility

Volatility is just a fancy word for how much an asset's price bounces around. The stock market is famous for its daily ups and downs, driven by everything from economic reports to investor sentiment. It can feel like a rollercoaster, but that is the nature of a highly liquid, publicly traded market.

Real estate values tend to be much less jumpy in the short term. There’s no ticker symbol flashing a new price for your house every second of the day. This sense of stability comes from its tangible nature—you can literally see and touch it, which gives a psychological comfort that a line on a chart just can't match.

The Power of Leverage: This is where real estate has a unique and powerful edge. You can use a mortgage to control a very expensive asset with a relatively small down payment. This magnifies your potential returns on your own cash in a way that’s incredibly difficult (and risky) to do in the stock market.

Cash Flow Generation And Management Effort

The holy grail for many real estate investors is cash flow. That monthly rental income, after you've paid the mortgage, taxes, insurance, and repairs, can become a steady, reliable source of passive income. It's a direct and consistent benefit that stock investors only see through dividends, which are usually much smaller and paid less frequently.

Of course, that income doesn't just appear out of thin air. Managing a property is an active role. You're the one finding tenants, chasing down rent, and fixing the toilet at 2 AM. You can hire a property manager to handle the day-to-day, but their fees will eat into your profits.

Stocks, especially broad-market index funds, are the definition of a passive investment. Once you buy them, there's practically nothing to do. If you want to dive deeper into the nuts and bolts of property ownership, our https://everydaynext.com/real-estate-investment-guide/ covers it in detail.

Core Investment Factors: Real Estate vs. Stock Market

To pull all these points together, here's a straightforward, side-by-side comparison. This table highlights the defining features of real estate and stock market investments to help guide your strategic choice.

| Investment Factor | Real Estate Investing | Stock Market Investing |

|---|---|---|

| Liquidity | Very low; selling can take months. | Very high; can sell in seconds. |

| Leverage | High; mortgages are a standard tool. | Low; margin loans are risky and uncommon. |

| Volatility | Low short-term price fluctuation. | High daily price fluctuation. |

| Cash Flow | High potential via monthly rental income. | Lower potential via quarterly dividends. |

| Management | Active; requires hands-on effort or fees. | Passive; requires minimal ongoing effort. |

| Transaction Costs | High; commissions and fees can exceed 6%. | Very low; often zero commission on trades. |

Seeing these differences laid out makes it easier to understand which path aligns better with your goals and personality.

When you're looking at different ways to get into real estate, it's important to know the landscape. For example, understanding the difference between real estate syndication vs. REITs can help you find a more passive approach to property investing if being a landlord isn't for you.

Taxes, Leverage, and the Real Costs: What You Actually Keep

Your real return isn't the number you see on a statement; it's what's left in your pocket after taxes, leverage, and all the hidden costs are factored in. These details are where the real estate vs. stock market debate gets interesting, and they can completely change which investment comes out on top for you.

Real estate plays by a different set of tax rules, and frankly, they can be incredibly generous for investors. With stocks, you’re mostly thinking about capital gains and dividends. But property ownership opens up a whole playbook of deductions that can seriously shrink your tax bill.

The Tax Advantages of Real Estate

The MVP of real estate tax breaks is depreciation. This is a fantastic concept: the IRS allows you to deduct a portion of your property's value from your rental income each year to account for wear and tear, even as the property is actually going up in value. It’s a "phantom expense" that can make a property that's putting cash in your pocket look like a loss on paper for tax purposes.

And it doesn't stop there. You can also deduct:

- Mortgage Interest: The interest portion of your loan payment is a write-off.

- Property Taxes: Your annual bill to the city or county is deductible.

- Operating Expenses: Think insurance, repairs, property management fees—it all comes off your taxable income.

- 1031 Exchange: This is a game-changer. It lets you sell a property and roll the profits into a new, similar property, deferring capital gains taxes over and over again.

Stock investors, on the other hand, are primarily looking at capital gains taxes when they sell for a profit and taxes on any dividends they receive. The long-term capital gains rates are more favorable than ordinary income tax rates, but you just don't get the same continuous stream of deductions that real estate offers.

How Leverage Multiplies Your Money

If real estate has a superpower, it's leverage. It’s the simple idea of using the bank's money (a mortgage) to control a large, expensive asset with just a fraction of your own cash. This is how you can get truly outsized returns.

Let’s make this real with a quick example.

Real-Life Example: Leverage in Action

Say you buy a $300,000 house with a 20% down payment, which is $60,000 of your own money. The house appreciates by a modest 5% in the first year. That’s a $15,000 increase in value.But you didn't invest $300,000; you only put in $60,000. So your return on that invested cash is a whopping 25% ($15,000 gain / $60,000 cash). And that's before you even count the cash flow from rent or the fact that your tenant is paying down your mortgage for you.

You just can't replicate that kind of power safely in the stock market. Sure, you can borrow on margin, but it’s incredibly risky and not a strategy most long-term investors should even consider.

Uncovering the True Costs of Ownership

Finally, you have to be honest about the costs. Every investment has them, but they show up in very different ways. Understanding these expenses is often the key to deciding whether to pay off your mortgage or invest in other assets.

Here’s a head-to-head look at where your money goes:

| Cost Comparison | Real Estate | Stock Market |

|---|---|---|

| Transaction Fees | High: Think 5-6% for realtor commissions plus closing costs. | Very Low: $0 commissions are now standard for many brokers. |

| Ongoing Costs | Significant: Property taxes, insurance, repairs, maintenance, vacancy, HOA fees. | Low: Typically just small expense ratios for ETFs and mutual funds. |

| Management Fees | Optional: A property manager might cost 8-12% of monthly rent. | Optional: Financial advisors charge fees for managed accounts. |

While buying and selling stocks is cheap and easy, the ongoing costs of owning a property can really add up. A smart landlord always budgets for vacancies and surprise repairs to make sure the investment stays profitable for the long haul.

Which Investment Strategy Aligns With You?

The big question isn't "which investment is better?" It's "which investment is better for me?" The right answer depends entirely on you—your personality, your financial situation, and how much time and effort you're willing to put in.

To figure this out, let's look at two common investor archetypes. See which one feels more like you.

Identifying Your Investor Profile

The Hands-Off Growth Seeker

This person wants their money to grow without it becoming a second job. They value simplicity and scalability, aiming for long-term wealth accumulation that doesn't demand constant attention. The goal is to set it, forget it, and let compounding do the heavy lifting.

- Priorities: Low effort, easy access to cash (liquidity), broad diversification, and long-term compounding.

- Best Fit: The stock market, especially through low-cost index funds and ETFs.

- Why it Works: You can invest in the entire S&P 500 in a matter of minutes. There are no tenants, no toilets, and no late-night phone calls. It's the ultimate passive approach, offering instant diversification and the magic of compounding returns over decades with minimal intervention.

The Cash Flow Maximizer

This investor's main goal is to generate steady, reliable income right now. While they appreciate that the asset will grow in value over time, the real prize is the monthly check that can supplement or even replace their salary. They're often willing to get their hands dirty to make it happen.

- Priorities: Owning a tangible asset, having direct control, creating a steady income stream, and leveraging unique tax breaks.

- Best Fit: Direct real estate ownership, like buying a rental property.

- Why it Works: A solid rental property can be a cash-producing machine. As the owner, you're in the driver's seat—you can upgrade the property to increase its value, choose your tenants, and set the rent. Plus, the tax advantages, like deductions for mortgage interest and depreciation, are a huge boost to your actual returns.

For anyone serious about building multiple income streams, our guide on passive income ideas for beginners is a great next step.

The Best Answer? Probably Both.

While it’s easy to frame this as an either/or decision, the most successful investors rarely pick just one. The real power comes from combining both stocks and real estate.

Why? Because they don't move in lockstep. When the stock market is having a rough year, your rental income might be as steady as ever. This lack of correlation is the key to building a truly resilient portfolio that can weather any economic storm.

A diversified portfolio containing both real estate and stocks is often the most resilient long-term strategy. The low correlation between the two helps manage risk and achieve more stable, predictable growth through different economic cycles.

The data backs this up. Over the past 30 years, private real estate has shown a correlation of just 0.06 with stocks and -0.11 with bonds—meaning they essentially march to the beat of their own drummers. This diversification benefit is one of the most compelling reasons to include both asset classes in your long-term plan.

So, while your personal investor profile can help you decide where to start, the long-term goal for many should be a balanced approach. Combining the hands-off growth of stocks with the tangible cash flow of real estate is a proven formula for building lasting wealth.

How To Start Investing In Real Estate And Stocks

Jumping into either real estate or stocks for the first time might seem daunting, but getting started is easier than ever. Both have paths for complete beginners, from direct, hands-on investing to more passive, set-it-and-forget-it approaches. The trick is matching the right strategy to your budget, available time, and long-term goals.

For most people, the biggest hurdle with real estate is the hefty down payment. But buying a property outright is just one of many ways to get in the game.

Your First Steps In Real Estate

You don't need to be a millionaire to start investing in property. Today, there are several clever ways to get started, each with a different level of required cash and effort.

- House Hacking: This is a classic for a reason. You buy a small multi-unit building (like a duplex), live in one unit, and rent out the others. Your tenants' rent pays down your mortgage, so you get to live for cheap—or even free—while building equity. It’s an active strategy but a powerful one.

- Real Estate Investment Trusts (REITs): This is the simplest way to get exposure to real estate. Think of REITs as mutual funds for property. They are companies that own and operate income-producing real estate, and you can buy their shares on the stock exchange. It's a fantastic way to get diversification and liquidity without ever having to unclog a toilet.

- Crowdfunding Platforms: These websites let you pool your money with other investors to fund specific real estate projects. You can invest in a commercial development or an apartment complex with just a few hundred dollars, giving you access to opportunities that were once only for the super-rich.

Getting Started In The Stock Market

Getting into the stock market is incredibly simple and can be done from your phone in under an hour. The whole process really boils down to just a couple of steps.

First, you need to open a brokerage account. This is just an account with a company that gives you access to the market. After you fund it, you're ready to start investing. For many, the best place to begin is with broad-market funds. If you're new to this, it's worth learning how to start investing in index funds.

Key Insight: For most people, the winning long-term strategy isn't trying to find the next Amazon. It's about consistently putting money into low-cost, diversified index funds and letting compound growth do its magic over many years.

This disciplined approach is what truly builds wealth. Forget trying to time the market—focus on making regular contributions over a long period. This method, known as dollar-cost averaging, helps smooth out the market's ups and downs and keeps you on a steady path.

Frequently Asked Questions (FAQ)

Here are answers to the ten most common questions people ask when comparing real estate and the stock market.

1. Which investment is better for beginners?

For most beginners, the stock market is more accessible. You can start with a very small amount of money (even $10) through low-cost index funds or ETFs. It's less complex and requires no hands-on management, making it an easier first step into investing.

2. Is real estate safer than stocks?

"Safer" is subjective. Real estate is less volatile in the short term and is a tangible asset you can see and touch, which provides a psychological sense of security. However, it's illiquid and comes with risks like bad tenants and costly repairs. Stocks are more volatile but offer superior liquidity and diversification, which can be a different kind of safety.

3. Can I invest in real estate with little money?

Yes. While direct ownership requires a large down payment, you can invest in real estate with little money through Real Estate Investment Trusts (REITs) or real estate crowdfunding platforms. REITs trade on the stock market like shares, and crowdfunding allows you to pool money with others to invest in properties.

4. Which one builds wealth faster?

Historically, the stock market has offered higher average annual returns through compounding, potentially building wealth faster in a passive manner. However, real estate can generate outsized returns through leverage (using a mortgage), where a small initial investment controls a large asset. The "faster" path depends heavily on your strategy and risk tolerance.

5. What are the main tax advantages of each?

Real estate offers significant tax benefits, including deductions for mortgage interest, property taxes, operating expenses, and depreciation (a non-cash expense). Stocks offer lower long-term capital gains tax rates and the ability to defer taxes in retirement accounts like a 401(k) or IRA.

6. How much effort is required for each investment?

Direct real estate ownership is an active investment. It requires time and effort to find tenants, manage the property, and handle maintenance. The stock market, particularly through index funds, is a passive investment. Once you buy, there is little to no ongoing management required.

7. How does inflation affect real estate vs. stocks?

Both can be good hedges against inflation. Real estate values and rents tend to rise with inflation, protecting your purchasing power and cash flow. In the stock market, companies with strong pricing power can pass on increased costs to consumers, maintaining their profitability and stock value.

8. What is the biggest mistake new investors make?

For real estate, the biggest mistake is underestimating costs (maintenance, vacancy, taxes) and overpaying for a property. For stocks, the biggest mistake is emotional decision-making—panic selling during a downturn or chasing hot stocks without research.

9. Should I pay off my mortgage or invest in the stock market?

This depends on your mortgage interest rate and your risk tolerance. If your mortgage rate is low (e.g., 3-4%), you could potentially earn a higher return in the stock market (historical average of ~10%). Paying off your mortgage offers a guaranteed, risk-free return equal to your interest rate.

10. Do I have to choose between real estate and stocks?

No, and you shouldn't. The most robust investment portfolios include both. Real estate and stocks have a low correlation, meaning they don't always move in the same direction. Owning both provides diversification that can protect your portfolio from market volatility and lead to more stable long-term growth.

At Everyday Next, our goal is to give you clear, straightforward insights for building a strong financial future. Whether you're diving into stocks, real estate, or something else entirely, we're here to provide the knowledge you need. Learn more by visiting us at Everyday Next.