What Are Index Funds and How Do They Build Wealth?

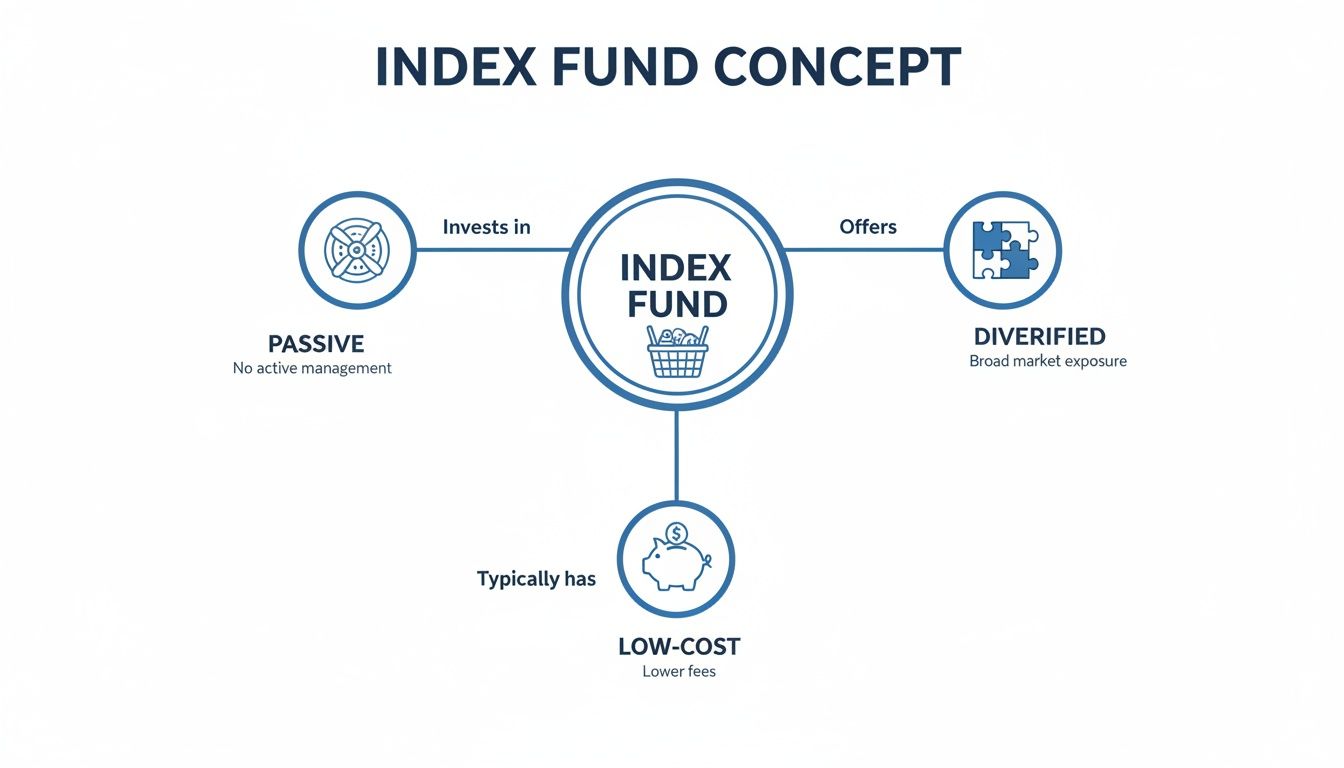

So, what exactly is an index fund?

Think of it as a basket of investments that holds all the stocks or bonds from a specific market index, like the famous S&P 500. Instead of trying to pick individual winners and losers, you're buying one fund that simply aims to match the performance of the entire market it follows. It's a straightforward, low-cost way to get a slice of the whole pie.

Understanding the Core Idea of an Index Fund

Let’s use an analogy. Imagine you want to bet on a horse race. You could spend all your time studying every horse, jockey, and track condition, trying to pick the one that will win. That's a lot of work, and there’s a good chance you'll get it wrong.

Or, you could place a small bet on every single horse in the race. You won't get a massive payout from a single longshot winner, but you're guaranteed to own a piece of the winning horse, and your overall result will match the average performance of the entire field.

An index fund does the same thing with stocks. It follows a "buy the whole market" strategy. This hands-off approach is called passive investing because the goal isn't to beat the market—it's to be the market. There's no star fund manager making gut calls or bold predictions. The fund is simply built to mirror its chosen index automatically.

Key Takeaway: The philosophy is simple but powerful: owning a tiny piece of everything is a more reliable long-term strategy than trying to guess which individual stocks will take off.

Why Is This Approach So Popular?

Index funds have become a go-to for investors for a few very good reasons. The biggest one is instant diversification. When you buy just one share of an S&P 500 index fund, you immediately own a small part of 500 of the biggest companies in the United States. To learn more, check out our guide on how to diversify your portfolio.

This built-in diversification is a huge safety net. If one or two companies in the index have a bad year, their poor performance is balanced out by the hundreds of other companies that are doing just fine. It smooths out the ride and reduces the risk that comes from putting all your eggs in one or two baskets.

To make it even clearer, let's break down the essential features of an index fund. The table below gives you a quick snapshot of what defines them.

Index Fund Key Characteristics at a Glance

| Characteristic | Description |

|---|---|

| Investment Goal | To match the performance of a specific market index (e.g., S&P 500), not to beat it. |

| Management Style | Passive. The fund automatically buys the stocks or bonds in its target index. |

| Typical Cost | Very low fees (low expense ratios) because there's no active fund manager making decisions. |

| Core Benefit | Instant diversification across hundreds or thousands of securities within one investment. |

In the end, this simple idea has opened up the world of investing to millions. Instead of trying to find that one needle in a haystack, an index fund lets you buy the whole haystack.

How an Index Fund Works Behind the Scenes

The real beauty of an index fund is how simple it is. It’s not trying to outsmart the market with a star fund manager making brilliant stock picks. Instead, it just follows a set of rules, like a recipe, to perfectly copy a specific market index. Before we dive in, it helps to have a handle on the basics of the stock market to see how it all fits together.

Think of an index like the S&P 500 as a list of the 500 biggest public companies in the U.S. The index fund’s job is to buy stock in all 500 of them. But it doesn't buy the same amount of each. It uses a method called market-capitalization weighting. All that means is that bigger companies get a bigger piece of the pie.

So, if you put $100 into an S&P 500 index fund, your money isn't split into 500 equal parts. A giant like Microsoft might get $7 of your investment, while one of the smaller companies on the list might only get a few cents. This way, the fund's performance naturally moves in lockstep with the market's heavyweights.

Following the Market's Blueprint

An index isn't set in stone, so the fund has to adapt. This is where the "passive" part really comes into play. If a company does well and its value grows, its slice of the index gets bigger. The fund sees this and automatically buys more of its stock to keep everything in the right proportion. No human intervention needed.

This simple, hands-off approach is what makes index funds so powerful.

As you can see, the whole system is built on being passive, diversified, and cheap—all because it just follows the rules.

The Art of Automatic Rebalancing

So, what happens when a company gets kicked out of the index and another one is added? This happens all the time. The fund has to adjust its holdings to match the new list.

This process is called rebalancing, and it’s a pretty straightforward, automated affair:

- Index Change Announced: The index provider, like Standard & Poor's, announces that Company X is joining the index and Company Y is leaving.

- Fund Adjusts Holdings: On autopilot, the index fund sells all its shares of Company Y.

- New Holdings Purchased: It then takes that cash and buys shares of the new company, Company X.

Just like that, the fund is once again a perfect mirror of the index. It all happens systematically, keeping the fund aligned without a manager ever having to make a judgment call. If you want to see how this works for one of the most popular indexes, check out our guide on investing in an S&P 500 index.

The Bottom Line: An index fund's job is methodical, not emotional. It’s a disciplined process of mirroring, weighting, and rebalancing that takes the human guesswork out of investing and ensures your money moves with the market.

Index Funds vs. Actively Managed Funds

When it comes to investing, you really have two main paths to choose from: passive or active. Index funds are the champions of the passive approach—their goal is simply to match the market's performance. On the other side, you have actively managed funds, which aim to do one thing: beat the market.

This single difference in philosophy creates a ripple effect, influencing everything from cost and performance to your overall investment strategy.

An actively managed fund is like hiring a world-class chef. This chef—the fund manager—and their team of analysts spend their days researching companies, poring over economic data, and hand-picking stocks they believe will outperform. They’re constantly buying and selling, trying to get an edge. Of course, all that expertise comes at a premium.

An index fund, however, is more like using a trusted recipe from a cookbook. There's no creative genius in the kitchen. The fund simply buys all the ingredients (stocks) listed in the recipe (the index) in the exact proportions required. It’s a straightforward, automated process that doesn't need much human oversight, and that’s where its biggest advantage lies.

Why Costs and Fees Are a Game-Changer

The most critical difference between these two styles really comes down to cost. Active management is expensive. You're paying for the manager's salary, their research team, and all the trading they do. These costs are bundled into the fund's expense ratio, which can easily range from 0.50% to 1.50% per year, sometimes even more.

Index funds, thanks to their automated "follow the recipe" approach, have incredibly low operating costs. Their expense ratios are often tiny, typically falling between 0.03% and 0.20%. A 1% difference might not seem like a big deal, but over a few decades, it can take a massive bite out of your returns.

Real-Life Example: The High Cost of Fees

Let's imagine two friends, Alex and Ben, each investing $10,000. We'll assume both investments earn a solid 8% annual return before fees over 30 years.

- Alex invests in a low-cost S&P 500 index fund with a 0.03% expense ratio.

- Ben chooses an actively managed large-cap fund charging a 1.00% expense ratio.

After 30 years, Alex’s investment has grown to approximately $99,800. Ben’s portfolio, despite earning the same return before fees, is only worth about $75,200. The seemingly "small" fee difference ultimately cost Ben over $24,600—the price of a new car. That's the brutal power of compounding fees.

The Performance Showdown: Does Active Management Pay Off?

So, are those higher fees for active funds actually worth it? Overwhelmingly, the data says no. While a few star managers might beat the market for a year or two, the vast majority fail to keep up over the long haul, especially once you account for their higher fees.

Year after year, reports from firms like S&P (the SPIVA Scorecard) show that 80-90% of active fund managers underperform their benchmark indexes over 10 to 15-year periods. This reality is what's fueling the massive shift toward passive investing. Just look at the numbers from last December: index funds tracking U.S. stocks pulled in $92.53 billion, while their active counterparts saw $73.28 billion flow out the door. The trend is undeniable. You can dive deeper into this data yourself by checking out research from the Investment Company Institute.

To make it crystal clear, let's break down the key differences in a simple table.

Comparison: Index Funds vs. Actively Managed Funds

| Feature | Index Funds (Passive) | Actively Managed Funds (Active) |

|---|---|---|

| Investment Goal | Match the performance of a market index. | Beat the performance of a market index. |

| Management | Computer-driven, follows a set of rules to replicate an index. | Human fund managers make buy/sell decisions based on research and analysis. |

| Expense Ratios | Very low (e.g., 0.03% – 0.20%). | Higher (e.g., 0.50% – 1.50% or more). |

| Performance | Guaranteed to match the market's return, minus tiny fees. | Performance varies widely; most fail to beat their benchmark over the long term. |

| Turnover | Low, as holdings only change when the index changes. | Can be high, as managers actively trade securities. |

| Tax Efficiency | Generally more tax-efficient due to low turnover. | Less tax-efficient due to frequent trading, which can generate capital gains distributions. |

For most of us investing for the long term, the case is pretty clear. The low-cost, disciplined, and straightforward approach of index funds offers a reliable and proven way to build wealth by simply harnessing the power of the market itself.

Exploring the Different Types of Index Funds

It's a common mistake to think all index funds are the same. That's a bit like saying all cars are identical. They might all be designed to get you from point A to point B, but they come in different models built for very different jobs.

Understanding these variations is key. It's the difference between just owning "the market" and thoughtfully building a portfolio that truly fits your financial goals. Think of it like a chef stocking a pantry—you need different ingredients to create a well-balanced meal.

Each type of index fund gives you a slice of a different part of the global economy, from the biggest U.S. giants to international markets or even specific industries. By learning how to combine these building blocks, you can craft a strategy that's both durable and perfectly aligned with where you want to go.

Let's dive into the main categories you'll come across.

Broad Market and Market-Cap Funds

For most people, the journey begins with a broad market fund. This is the classic, "own-it-all" choice for a country's stock market. A Total Stock Market index fund, for instance, aims to hold a tiny piece of every single publicly traded company in the U.S.—large, medium, and small.

A slightly more focused, but hugely popular, alternative is a market-cap fund. These funds target companies based on their size (their market capitalization). The most famous example here is an S&P 500 index fund, which holds stock in the 500 largest and most influential companies in the United States.

The returns from these core funds can be immense. To give you an idea, index funds were a major driver of the S&P 500's recent 16.39% annual return (17.88% with dividends), which created a staggering $8.633 trillion in new shareholder value. At the same time, international index funds tracking non-US stocks also delivered impressive gains. You can find more insights on this in iShares' 2025 ETF market trends report.

Here’s a simple way to see the difference:

| Fund Type | What It Tracks | Example Fund |

|---|---|---|

| Broad Market Fund | The entire U.S. stock market (large, mid, and small companies). | Vanguard Total Stock Market Index Fund (VTSAX) |

| Large-Cap Fund | The 500 largest U.S. companies (the S&P 500 Index). | Fidelity 500 Index Fund (FXAIX) |

International and Bond Index Funds

A truly well-built portfolio rarely stops at its home country's borders. That's where international index funds come in. They give you a stake in both developed and emerging economies all over the world, from Europe to Asia. This global exposure is a powerful way to diversify, as different markets often move in different cycles.

Then you have bond index funds, which play a completely different role. If stock funds are the engine for growth, bond funds are the brakes and suspension system—built for stability and income. They invest in a mix of government and corporate bonds, providing a crucial anchor for your portfolio when the stock market gets choppy.

Sector-Specific Funds

Ready to make a more targeted bet? Sector funds let you invest in specific industries, tracking indexes focused on areas like technology, healthcare, or energy.

A sector fund allows you to overweight a part of the economy you believe has strong growth potential, but it also comes with higher risk because it’s far less diversified than a broad market fund.

For example, a tech sector fund might follow the Nasdaq-100 index, which is packed with innovative tech giants. If that sounds interesting, you might want to learn more about what the QQQ ETF is and how it follows this specific index.

A word of caution: these funds are best used as smaller, "satellite" positions around a solid core of broad market funds.

How to Invest in Your First Index Fund

Alright, let's turn theory into action. Buying your first index fund is simpler than you might think, and it's the first real step toward building wealth over the long haul. The whole process boils down to getting the right account set up and then knowing a few key numbers to look for.

First things first, you need a place to hold your investments. This is called a brokerage account. Think of it like a bank account, but instead of just holding cash, it holds stocks, bonds, and—you guessed it—index funds. For anyone just starting out, your best bet is to go with a big, reputable, low-cost brokerage.

Some of the most popular and trusted names are:

- Vanguard: They practically invented the index fund. Their unique investor-owned setup means their fees are consistently some of the lowest in the business.

- Fidelity: A fantastic all-around choice with a massive selection of funds. They even offer their own line of ZERO expense ratio index funds and have no minimums to get started.

- Charles Schwab: Another industry giant that offers a great mix of low-cost funds, powerful tools, and top-notch customer service.

Opening an account with any of these is a straightforward online process, not much different from signing up for a new bank account. Once you've linked your bank and transferred some money in, you’re ready to pick your fund.

Choosing the Right Fund Structure: Mutual Fund vs. ETF

When you start looking, you’ll notice index funds come in two main flavors: mutual funds and Exchange-Traded Funds (ETFs). They might track the very same index, like the S&P 500, but the way you buy and sell them is a little different.

Here’s a quick comparison to help you decide:

| Feature | Index Mutual Fund | Index ETF (Exchange-Traded Fund) |

|---|---|---|

| Trading Style | Priced once per day, after the market closes. | Trades like a stock all day long while the market is open. |

| Minimum Investment | May have a minimum (e.g., $1,000), though many are lower or waived. | Can buy just one share, or even a fraction of one, for a very low starting cost. |

| Automation | Excellent for setting up automatic, recurring investments of a specific dollar amount. | Automation is possible but can sometimes be less direct than with mutual funds. |

| Best For | "Set-it-and-forget-it" investors who want a simple, automated savings plan. | Investors who want more trading flexibility or need to start with a very small amount. |

Honestly, you can’t go wrong with either, and the choice often just comes down to what feels right for you. If your goal is to automatically invest $100 every payday without thinking about it, a mutual fund is a dream. If you only have $20 to start with, an ETF makes it possible.

For a more detailed walkthrough on getting started, check out our dedicated guide on how to start investing in index funds.

What to Look For Before You Buy

With thousands of options out there, it’s easy to get overwhelmed. Just keep your focus on these three things, and you'll make a solid choice.

- The Expense Ratio: This is the big one. It's the tiny annual fee the fund company charges for managing everything. Your job is to find a fund where this number is as close to zero as possible. For any basic U.S. stock index fund, you should be looking for something under 0.10%.

- The Underlying Index: Know what you’re actually buying! A fund tracking a broad, diversified index like the S&P 500 or a Total Stock Market Index is a fantastic and reliable starting point for most new investors.

- Tracking Error: This is a fancy term for "how well does the fund do its job?" A low tracking error means the fund is sticking to its benchmark index like glue, which is exactly what you want.

Investor's Rule of Thumb: If you're ever stuck between a few good options, just go with the one that has the lowest expense ratio. Over decades of investing, keeping your costs down is one of the single most powerful things you can do to grow your money.

Common Index Fund Investing Mistakes to Avoid

The beauty of index fund investing is its simplicity. But making that simplicity work for you takes discipline. It's surprisingly easy to fall into a few classic behavioral traps that can derail your long-term growth, even for experienced investors. Knowing what these pitfalls look like is the best way to steer clear of them.

Trying to Time the Market

The biggest temptation? Trying to time the market. We all have that little voice in our head telling us to sell just before a crash or buy at the absolute bottom. The hard truth is, no one can do this consistently. It's a fool's errand.

More often than not, investors who try to play this guessing game do the exact opposite of what they should: they sell low and buy high. The real damage isn't just one bad trade; it's all the powerful growth you miss while you're sitting on the sidelines, waiting for the "perfect" moment that never comes.

Overreacting to Market Volatility

Panic selling is market timing's ugly cousin. The market will have bad years—that's a guarantee. When the news gets scary and you see red in your portfolio, the instinct to sell everything and "stop the bleeding" can be overwhelming.

Giving in to that fear is one of the most destructive things you can do. Selling during a downturn just locks in your losses. It also means you’ll miss the recovery that historically follows. Successful investing is about having a steady hand and a long-term view.

Investor's Insight: Some of the market's best days happen right after its worst days. If you're not invested, you miss the rebound entirely.

A much better strategy is to put your investments on autopilot. This is called dollar-cost averaging, and it simply means you invest a set amount of money on a regular schedule, no matter what the market is doing.

Think about these two approaches:

- The Market Timer: You invest a lump sum, panic and sell when the market drops, then nervously wait for the "right time" to get back in—often missing the bounce back.

- The Consistent Investor: You invest $200 every single month. When prices are low, your $200 buys more shares. When prices are high, it buys fewer. Over years, this averages out your cost and lets you build wealth methodically.

If you want to explore this more, we've got a great guide on investing strategies for beginners.

Underestimating the Impact of Fees

This last mistake is quieter but just as costly: ignoring fees. Yes, index funds are famous for their low costs, but they aren't all the same. Picking a fund with a 0.50% expense ratio over one with a 0.05% fee might seem like no big deal. It is.

That tiny difference chips away at your returns year after year, and the effect of compounding makes it snowball. Over a 30- or 40-year investing journey, a seemingly small fee can easily cost you tens or even hundreds of thousands of dollars in lost growth. Always check the expense ratio—it should be one of the first things you look at.

Frequently Asked Questions About Index Funds

Here are answers to the 10 most common questions new investors have about index funds, designed to give you the confidence to get started.

1. What's the minimum amount needed to invest in an index fund?

You can start with almost any amount. While some mutual funds have minimums like $1,000, most modern brokerages let you buy fractional shares of an index ETF. This means you can get started with as little as $1.

2. Can I lose money in an index fund?

Yes. An index fund's value moves with the market it tracks. If the stock market goes down, your fund's value will go down too. However, history shows that over the long term, markets tend to recover and grow, which is why index funds are considered a long-term investment.

3. Are index funds and ETFs the same thing?

Not quite. "Index fund" describes the passive investing strategy. This strategy can be packaged in two ways: as a mutual fund or as an Exchange-Traded Fund (ETF). An ETF trades like a stock throughout the day, while a mutual fund is priced just once per day. Both are excellent low-cost options.

4. How do index funds make money?

You earn returns in two primary ways:

- Capital Appreciation: The value of the fund's shares increases as the prices of the underlying stocks in the index go up.

- Dividends: The fund collects dividends paid out by the companies it holds and distributes them to you. You can take these as cash or reinvest them to buy more shares.

5. What's the best index fund for a beginner?

For most new investors, a broad-market index fund is the perfect starting point. A fund tracking the S&P 500 (like VOO or FXAIX) or a Total Stock Market Index (like VTI or FZROX) provides instant, wide diversification at a very low cost.

6. How often should I check my investments?

Resist the urge to check daily. The short-term ups and downs of the market can cause unnecessary stress and lead to emotional decisions. A healthy approach is to review your portfolio once or twice a year to ensure your strategy still aligns with your long-term goals.

7. Should I invest in international index funds?

Yes, it's a very good idea. Adding an international index fund provides global diversification, reducing your reliance on a single country's economy. This can help smooth out your returns over time, as different world markets often perform differently.

8. What is an expense ratio and why is it so important?

The expense ratio is the annual fee a fund charges, expressed as a percentage of your investment. It's critical because fees directly reduce your returns. Even a small difference, like 0.50%, can cost you tens of thousands of dollars over an investing lifetime due to the power of compounding.

9. Is it better to hold index funds in a Roth IRA?

Using a Roth IRA to invest in index funds is a powerful combination for long-term growth. In a Roth IRA, your investments grow completely tax-free, and qualified withdrawals in retirement are also tax-free. This can significantly boost your net returns compared to a standard taxable brokerage account and is a key strategy for reaching financial independence.

10. Is it too late for me to start investing?

Absolutely not. The best time to start investing was yesterday; the second-best time is today. Thanks to the power of compounding, even small, consistent investments can grow into a significant amount over time. The key is to start now, no matter how small.