Finding the 7 Best Savings Account Interest Rates for Maximizing Your Growth

Letting your money idle in a traditional savings account means you're missing out on significant, risk-free earnings. While the national average savings rate often hovers near zero, high-yield savings accounts offer a potent alternative, allowing your cash to grow substantially faster. The challenge is navigating the crowded market where rates fluctuate and offers vary widely. Finding the best savings account interest rates requires sifting through dozens of banks, each with different terms, fees, and digital experiences.

This guide is designed to solve that problem. I've done the heavy lifting to bring you a clear, authoritative roundup of today's top-tier savings accounts and the platforms that help you find them. You won't find generic advice here. Instead, you'll get a direct comparison of the highest annual percentage yields (APYs) available right now from institutions like Ally Bank and Discover Bank, as well as aggregators like Bankrate and NerdWallet. To truly understand where to find the best rates, it's beneficial to consider the broader financial landscape, including the impact of interest rates on bank profitability.

We’ll break down each option with essential details: current APYs, minimum deposit requirements, monthly fees (or lack thereof), and how to access your funds. With direct links and screenshots, you can see exactly how each platform works before you commit. Whether you're building an emergency fund, saving for a home, or just making your cash work harder, this article will provide the actionable information you need to choose the perfect account and start earning more today.

1. Bankrate

If your goal is to quickly find and compare some of the best savings account interest rates available nationwide, Bankrate is a powerful and reliable starting point. Rather than being a bank itself, it functions as an expert financial comparison platform. Its editorial team constantly tracks, vets, and ranks high-yield savings accounts, presenting the data in easy-to-digest formats. This makes it an essential tool for anyone serious about maximizing their savings potential.

What makes Bankrate so effective is its commitment to providing fresh, actionable data. The rate tables are regularly updated and clearly date-stamped, so you can trust you're looking at current Annual Percentage Yields (APYs). This timeliness is crucial in a market where interest rates can fluctuate. The platform simplifies the complex process of choosing an account by laying out the most important details side-by-side.

Key Features and User Experience

Bankrate excels in user-friendliness. The interface is clean, allowing you to filter results based on your specific needs, such as finding accounts with no minimum deposit or from credit unions only. Each listing provides the critical data points you need to make an informed decision:

- Current APY: The most prominent feature, letting you see the potential return on your savings.

- Minimum Deposit to Open: Helps you find accounts that match your initial savings amount.

- Monthly Fees: Clearly states if an account has recurring fees and how to waive them.

The site provides direct "Open Account" links that take you to the financial institution's website, streamlining the application process. This integration, combined with expert reviews and analysis, offers a comprehensive one-stop-shop experience. Finding the right account is one thing; funding it effectively is another. To get the most out of your new high-yield account, it helps to have a solid financial plan in place; you can learn how to create a monthly budget to ensure you're consistently contributing to your savings.

Pros and Cons

Like any platform, Bankrate has its strengths and weaknesses. Understanding them helps you use the tool more effectively.

Pros:

- Frequently Updated: The date-stamped pages give you confidence that the rate information is current.

- Easy Comparisons: The side-by-side table format is perfect for quick, at-a-glance decision-making.

- Expert Analysis: Combines hard data with dependable editorial reviews and insights, adding valuable context.

Cons:

- Sponsored Listings: Some featured accounts may be from partners, so it's wise to review the entire list.

- Not Exhaustive: While comprehensive, the platform does not cover every single bank and credit union in the market.

Website: https://www.bankrate.com/banking/savings/rates/

2. NerdWallet

For those seeking both high-level comparisons and in-depth analysis, NerdWallet is a top-tier financial resource. Like Bankrate, it’s not a bank but a trusted personal finance company that provides expert-driven reviews and up-to-date data on financial products. Its strength lies in combining curated "Best of" lists with deep-dive reviews, giving you a complete picture of not just the rates, but the banks behind them. This makes it an invaluable resource for finding the best savings account interest rates with confidence.

What sets NerdWallet apart is its commitment to consumer education. It doesn't just present a list of numbers; it offers plain-English explainers and provides crucial context, such as how the listed APYs compare to the national average. This approach empowers you to understand why a particular account is a good choice, not just that it has a high rate. The platform's transparent dating of rate data ensures you are making decisions based on current information, which is vital in a dynamic interest rate environment.

Key Features and User Experience

NerdWallet is designed to be approachable and easy to navigate. The interface cleanly presents its ranked picks for the best high-yield savings accounts, allowing users to quickly assess their options. Each listing in their comparison tables highlights the essential details needed for a smart decision:

- Current APY: The rate is prominently displayed, often with a note on whether it’s above the national average.

- Minimums and Requirements: Clearly outlines any minimum opening deposits or balance requirements to earn the stated APY.

- In-Depth Reviews: A "Read Review" link accompanies each listing, taking you to a comprehensive analysis of the bank’s features, pros, and cons.

The platform excels at distilling complex financial information into digestible insights. Its detailed reviews often cover aspects like a bank's mobile app usability, customer service reputation, and unique account features. This thorough, multi-faceted approach ensures you're not just chasing the highest number but finding an account that genuinely fits your financial life and preferences.

Pros and Cons

Understanding NerdWallet's model helps you leverage its content effectively while being a savvy consumer.

Pros:

- Strong Reputation: NerdWallet is a well-respected source for financial information, known for its editorial integrity.

- Helpful Reviews: The detailed, easy-to-read provider reviews offer valuable context beyond the numbers.

- Clear Presentation: Account requirements, such as deposit thresholds or fee structures, are presented clearly.

Cons:

- Partner-Focused: Many recommendations are from partners, which can influence placement on "Best of" lists.

- Not a Complete Market View: The lists are comprehensive but do not include every single bank or credit union available.

Website: https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

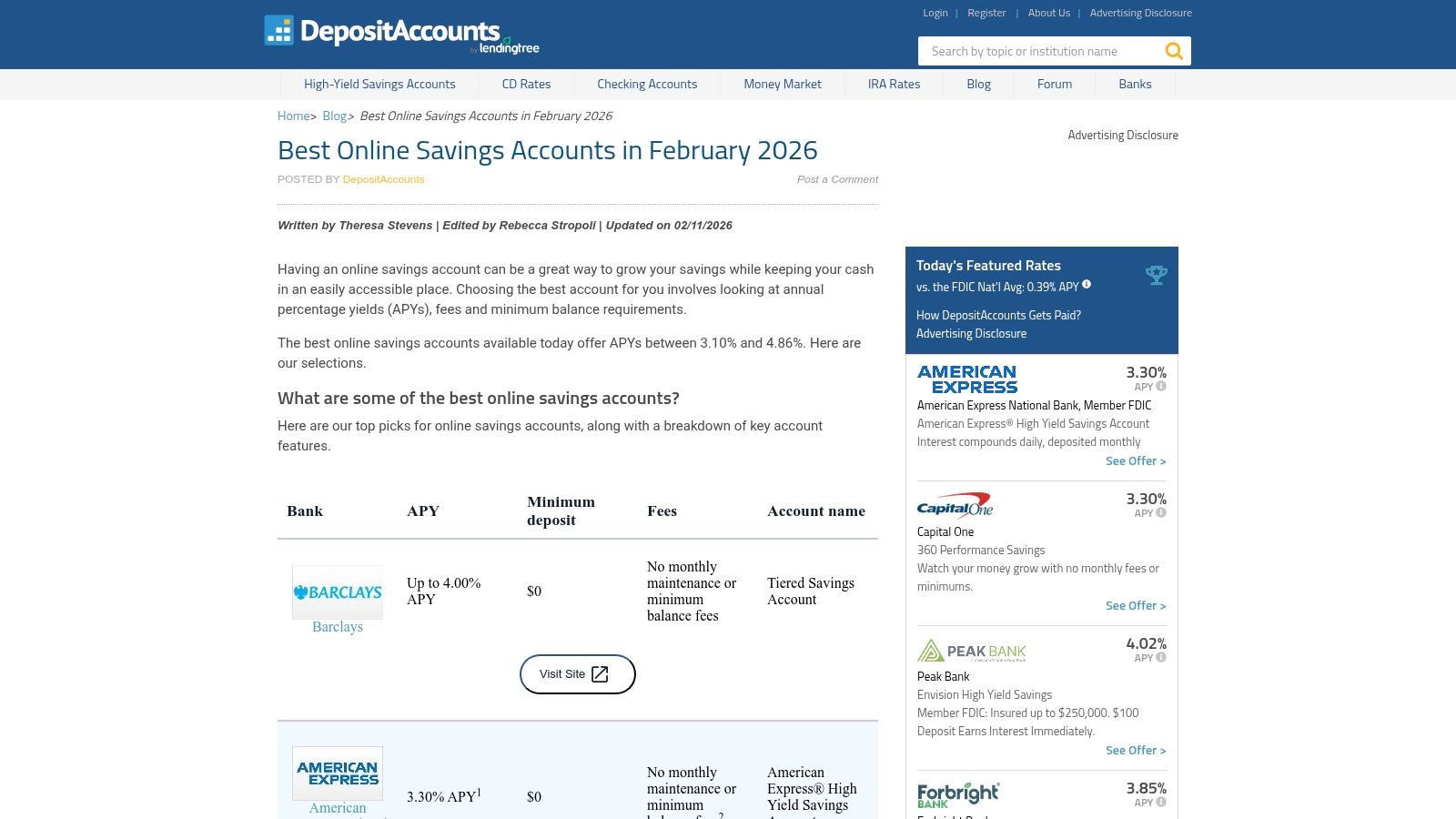

3. DepositAccounts (by LendingTree)

For savers who want to go beyond the headlines and dive deep into rate history and community insights, DepositAccounts by LendingTree is an invaluable resource. Unlike broader financial comparison sites, its primary focus is on deposit products like savings accounts, CDs, and money market accounts. This specialization allows it to offer a granular level of detail, including historical rate changes and a vibrant user community that often spots trends before they become mainstream news.

What truly sets DepositAccounts apart is its blend of editorial curation and community-driven intelligence. While the site publishes its own "best of" lists, its real power lies in the forums where everyday savers share real-time updates on rate hikes and drops. This crowd-sourced information provides a powerful, on-the-ground perspective, making it a go-to platform for serious rate-chasers who want to find the absolute best savings account interest rates.

Key Features and User Experience

DepositAccounts provides a suite of tools designed for the meticulous saver. The platform tracks thousands of financial institutions, from large online banks to small local credit unions, and presents the data in a clear, accessible format. Key features that enhance the user experience include:

- Historical Rate Charts: View a bank’s past APY performance to see if its high rates are a recent promotion or a long-term trend.

- Community Forums: Engage with other savers in active discussion threads to learn about unadvertised rate changes or new account offerings.

- Detailed Bank Profiles: Each institution has a dedicated page with product listings, customer reviews, and financial health ratings.

The site is less about a flashy interface and more about data depth. Navigating the bank profiles and community forums is straightforward, empowering you to conduct thorough research. Gaining this level of insight is a key step, and you can learn more about how to improve financial literacy to make even more informed decisions with the data you gather here.

Pros and Cons

DepositAccounts offers a unique angle on finding the best rates, but it's important to understand its specific strengths and limitations.

Pros:

- Deep, Deposit-Account Focus: Specializes in savings products, providing more historical context than general finance sites.

- Active Community: The forums often surface rate changes faster than official announcements.

- Granular Bank-Level Tracking: Excellent for users who enjoy researching and monitoring specific institutions.

Cons:

- Variable Community Quality: Forum posts can be insightful but may also contain unverified information or personal opinions.

- Not All Data is Real-Time: While the community is fast, not every product rate is independently verified by the platform instantly.

Website: https://www.depositaccounts.com/blog/best-online-savings-accounts.html

4. Raisin (U.S.)

Raisin offers a unique approach to finding the best savings account interest rates by functioning as a savings marketplace. Instead of being a bank, it provides a single online platform where you can access and manage high-yield savings accounts and CDs from a curated network of FDIC- and NCUA-insured partner banks and credit unions. This model simplifies the process of "rate chasing," allowing you to move your money to higher-yield products without opening new accounts at different institutions each time.

The core advantage of Raisin is its ability to give savers access to top-tier rates, often from smaller community banks and credit unions that might otherwise be difficult to find. By aggregating these offers into one place, Raisin creates a competitive environment where you can easily compare and select the best APY for your needs. This single-login convenience is a significant time-saver for anyone serious about optimizing their cash returns.

Key Features and User Experience

Raisin’s platform is designed for simplicity and efficiency. It consolidates multiple savings products into a single, user-friendly dashboard, which is ideal for managing your cash with minimal hassle. You fund a single account on the platform and then allocate those funds to various partner offers. Key features that enhance the user experience include:

- Single Dashboard: Open and manage multiple insured savings products from various banks and credit unions with one login and one consolidated statement.

- Expanded Insurance Coverage: By spreading your deposits across different partner institutions, you can extend your total FDIC or NCUA insurance coverage beyond the standard $250,000 limit per depositor, per institution.

- Low Minimums: Many of the products offered on the Raisin marketplace feature low or no minimum deposit requirements, making top rates accessible to everyone.

The platform also frequently features promotional offers and exclusive rates, giving you more opportunities to boost your earnings. Understanding these benefits is crucial if you're exploring whether high-yield savings are right for you. You can learn more about maximizing your cash in high-yield savings accounts to see how a platform like Raisin fits into a broader savings strategy.

Pros and Cons

While Raisin provides a powerful and convenient service, it’s important to understand its specific advantages and limitations before signing up.

Pros:

- Unmatched Convenience: Easily switch between higher-rate offers from different banks without enduring multiple application processes.

- No Platform Fees: Users do not pay any fees to Raisin for using the marketplace to open and manage accounts.

- Access to Top Rates: The platform often features highly competitive APYs from smaller banks that are leaders in the market.

Cons:

- Slower Fund Transfers: Moving money to and from partner accounts via the platform can take 1 to 3 business days to process.

- Indirect Relationship: You are a customer of Raisin, not a direct online banking customer of the partner bank, which may limit access to certain features like mobile check deposit.

Website: https://www.raisin.com/en-us/

5. Newtek Bank

For savers who prioritize a top-tier interest rate with minimal complexity, Newtek Bank offers a compelling high-yield savings account that consistently ranks among the market leaders. This online-only bank has gained attention for its straightforward approach, combining a highly competitive APY with user-friendly terms. Its national availability and low barriers to entry make it an excellent choice for anyone looking to make their money work harder without navigating complicated fee structures or high deposit requirements.

What makes Newtek Bank stand out is its singular focus on providing a powerful savings vehicle. The account is designed to be simple and effective, cutting out the features of traditional banking that can often lead to extra costs. By operating digitally, the bank reduces overhead and passes those savings directly to customers in the form of one of the best savings account interest rates available. This makes it an ideal, no-fuss option for building an emergency fund or saving for a major goal.

Key Features and User Experience

Newtek Bank's platform is built for simplicity and efficiency. The online interface is clean and focused, allowing you to open and manage your account with ease. Because there are no physical branches, everything from funding to monitoring your growth is handled digitally. Key details are presented clearly, so you always know where you stand:

- Competitive APY: The account's variable interest rate is frequently listed near the top of personal finance roundups.

- Low Minimum to Open: You can start earning interest with as little as $0.01, making it accessible to savers at all levels.

- No Monthly Fees: Your earnings are not diminished by maintenance fees, ensuring more of your money stays in your pocket.

The account is FDIC-insured up to the maximum legal limit, providing the same security as a traditional bank. Funding the account requires an external transfer, which is a standard practice for online banks. Pairing this high-yield account with a clear financial strategy is a powerful combination; you can explore expert advice on how to achieve financial independence to make the most of your boosted savings.

Pros and Cons

Understanding the trade-offs of Newtek Bank’s digital model helps determine if it’s the right fit for your financial needs.

Pros:

- Market-Leading APY: Offers one of the most competitive interest rates compared to many large, established banks.

- Low Barriers to Entry: With virtually no minimum deposit and no monthly fees, it's incredibly easy to get started.

- Straightforward Terms: The account is simple and transparent, without complex rules or hidden costs.

Cons:

- Digital-Only Access: There are no physical branches for in-person service or cash deposits.

- External Transfers Required: Funding is managed through transfers from an external bank account, which may not be instantaneous.

Website: https://www.newtekbank.com/personal/high-yield-savings/

6. Ally Bank

Ally Bank stands out as a pioneering digital-only bank, building a strong reputation for combining competitive interest rates with a top-tier user experience. It's a fantastic option for savers who value convenience, 24/7 support, and clever automation tools. While not always offering the absolute highest APY on the market, its Online Savings account consistently delivers strong returns with no monthly maintenance fees or minimum balance requirements.

What makes Ally so compelling is its focus on making saving an intuitive and seamless part of your financial life. The bank has invested heavily in its digital platform, creating features that actively help users grow their money. This commitment to customer-centric design and technology makes it a reliable and powerful choice for anyone looking to find one of the best savings account interest rates without sacrificing usability.

Key Features and User Experience

Ally excels at providing a smooth, user-friendly digital banking experience. Its platform is clean, fast, and packed with genuinely useful tools designed to automate and organize your savings goals. The interest compounds daily, helping your money grow slightly faster over time.

- Automated Savings Tools: Ally offers a suite of features like Buckets for earmarking funds for specific goals, Round Ups to save spare change from purchases, and Surprise Savings which analyzes your linked checking account to find and transfer small, safe amounts of extra cash.

- No Fees or Minimums: There are no monthly maintenance fees or minimum balance requirements to worry about, making it accessible to savers at every level.

- 24/7 Customer Support: Unlike many online banks, Ally offers round-the-clock customer service through phone, chat, and email, providing peace of mind.

The robust mobile app and website make managing your money straightforward. Finding the right account is the first step, and using it effectively to build a financial safety net is the next. For those starting this journey, it helps to learn how to build an emergency fund to ensure you're prepared for unexpected expenses.

Pros and Cons

Ally's strengths lie in its blend of solid rates and exceptional service, but it's important to consider its limitations as a digital-only institution.

Pros:

- Excellent Customer Experience: Renowned for its user-friendly platform and always-available customer support.

- Helpful Automation Features: Tools like Buckets and Round Ups make it easier to save consistently without thinking about it.

- Consistently Competitive APY: Historically offers a strong rate with no balance tiers or hidden requirements.

Cons:

- Not Always the Highest Rate: While competitive, you can sometimes find slightly higher APYs at other online banks.

- No Cash Deposits: Being digital-only, there are no physical branches for in-person services like depositing cash.

- Potential Fees for Some Services: While the savings account is fee-free, certain outbound services like wire transfers may incur charges.

Website: https://www.ally.com/bank/online-savings-account/

7. Discover Bank

For those who prioritize a simple, fee-free savings experience from a large, reputable financial institution, Discover Bank's Online Savings account is a compelling option. While it may not always boast the absolute highest interest rate on the market, it provides a highly competitive APY combined with the trust and customer service excellence that Discover is known for. This makes it a strong contender for savers who value stability, ease of use, and a no-hassle approach to growing their money.

What sets Discover apart is its commitment to a straightforward, customer-friendly banking model. There are no monthly maintenance fees to worry about and no minimum deposit required to open an account, removing common barriers for new savers. As a well-established digital bank, Discover offers a robust online platform and mobile app, ensuring you can manage your savings, set up transfers, and monitor your progress anytime, anywhere.

Key Features and User Experience

Discover Bank focuses on delivering a seamless and accessible digital experience. The account opening process is quick and can be completed entirely online in minutes. Once set up, the account is FDIC-insured up to the maximum legal limit, providing essential peace of mind. Key features include:

- No Account Fees: Discover charges $0 for monthly maintenance and has no fees for insufficient funds, official bank checks, or standard incoming wires.

- $0 Minimum Opening Deposit: You can start saving with any amount, making it highly accessible for everyone.

- 24/7 Customer Service: Access to US-based customer service representatives is available around the clock, a significant benefit in the online banking space.

The platform is integrated with Discover's broader ecosystem of financial products, including credit cards, checking accounts, CDs, and personal loans. This can be a major advantage for existing Discover customers who prefer to keep their finances under one roof, simplifying money management and transfers between accounts.

Pros and Cons

Understanding the trade-offs with Discover's savings account helps you decide if it aligns with your financial goals.

Pros:

- Large, Reputable Brand: Backed by a company with a strong history of high customer satisfaction.

- Simple, Fee-Free Structure: The lack of monthly fees or minimum balance requirements makes it worry-free.

- Easy Online Opening: The streamlined application process is user-friendly and fast.

Cons:

- APY Can Trail Top Competitors: While competitive, the interest rate may not always be the highest available.

- No Physical Branches: As an online-only bank, it's not suitable for those who need or prefer in-person banking services.

Website: https://www.discover.com/online-banking/savings-account/

At-a-Glance Comparison of Top Savings Account Options

To help you quickly weigh your options, here’s a summary of the key features for each platform and bank we've reviewed. This table is designed to simplify your decision-making process.

| Feature | Bankrate / NerdWallet | Raisin Marketplace | Newtek Bank | Ally Bank | Discover Bank |

|---|---|---|---|---|---|

| Account Type | Comparison Platforms | Savings Marketplace | Direct Bank Account | Direct Bank Account | Direct Bank Account |

| Typical APY | Top-Tier (Variable) | Top-Tier (Variable) | Top-Tier | Highly Competitive | Competitive |

| Monthly Fees | N/A | None | None | None | None |

| Minimum Deposit | Varies by Bank | Often $1 | $0 | $0 | $0 |

| Key Advantage | Easy market comparison | Single-login convenience | Market-leading APY | Excellent UX & tools | Reputable brand, no fees |

| Best For | Researching options | Rate chasers | Maximizing returns | Automated savers | Brand-loyal customers |

Real-Life Savings Example: How a High-Yield Account Makes a Difference

Let's put this into perspective. Imagine you have $10,000 to save for a down payment on a car you plan to buy in one year.

- In a traditional savings account with a 0.05% APY, after one year you would earn approximately $5. Your total would be $10,005.

- In a high-yield savings account with a 4.50% APY, after one year you would earn approximately $460. Your total would be $10,460.

By choosing a high-yield account, you earned an extra $455 with zero additional risk or effort. This example clearly illustrates why ignoring high-yield savings means leaving free money on the table.

Making the Smart Choice for Your Savings

Navigating the landscape of high-yield savings accounts can feel overwhelming, but you now possess the tools and knowledge to make an informed decision. We’ve explored powerful rate-comparison platforms like Bankrate and NerdWallet, which act as your market watchdogs, constantly scanning for the top offers. We also delved into specific institutions like Ally Bank and Discover Bank, highlighting that a great rate often comes paired with robust digital tools and excellent customer service. The key takeaway is simple: finding the best savings account interest rates isn't a one-time task but an ongoing strategy.

The 'best' account is not a universal title; it’s a personal fit. Your ideal choice depends entirely on your financial habits, goals, and comfort level with different banking platforms. What works for a tech-savvy investor who prioritizes the absolute highest APY might not suit a family looking for a simple, reliable account with strong mobile features for joint savings goals.

Recapping Your Path to Higher Earnings

Let's distill our findings into actionable steps. Your journey from earning practically nothing on your savings to maximizing your returns involves a clear, proactive approach. Don't let inertia keep your money in a low-performing account at a traditional bank.

- Start with the Aggregators: Use tools like Bankrate, NerdWallet, and DepositAccounts to get a real-time, comprehensive view of the market. This is your research headquarters for identifying the current leaders in high-yield savings.

- Evaluate Your Personal Needs: Once you have a shortlist of accounts with the best savings account interest rates, filter them through your personal criteria. Ask yourself critical questions:

- Accessibility: How easily do I need to access this money? Do I need ATM access, or are online transfers sufficient?

- Digital Experience: Is a top-tier mobile app a priority for me? Do I want features like savings buckets or goal-tracking tools?

- Minimums and Fees: Am I comfortable with a minimum opening deposit, or do I need an account with no minimums and no monthly fees?

- Verify the Details: Always click through to the bank’s official website. Promotional offers can change, and it’s crucial to confirm the current APY, terms, and conditions directly from the source. Ensure any institution you choose is FDIC-insured to protect your deposits.

Beyond the APY: Factors That Truly Matter

While a high annual percentage yield (APY) is the primary motivator, it shouldn’t be the only factor you consider. An account with a slightly lower rate but a superior user experience might save you time and frustration, making it a more valuable choice in the long run.

Think about the complete package. An institution like Ally Bank might offer a competitive APY combined with 24/7 customer service and an intuitive app, which could be more beneficial for someone who values support and ease of use. Similarly, a platform like Raisin gives you access to a marketplace of high-yield options, perfect for someone who enjoys actively managing their cash to chase the highest returns without opening multiple direct accounts.

Your financial situation is dynamic, and so is the market for the best savings account interest rates. The rate you lock in today might be surpassed by a competitor tomorrow. Make it a habit to review your savings account performance every six to twelve months. A quick check on one of the comparison tools we discussed can tell you if you’re still earning a competitive return. If not, don’t hesitate to move your funds. The process is typically straightforward and can be completed online in minutes, ensuring your money is always working its hardest for you.

By being proactive and aligning your choice with your personal financial goals, you transform your savings from a static pool of cash into a dynamic tool for wealth creation. You are now equipped to choose confidently, act decisively, and ensure your financial future is built on a foundation of smart, strategic saving.

Frequently Asked Questions (FAQ)

1. What is the difference between APR and APY?

APR (Annual Percentage Rate) is the simple interest rate for a year. APY (Annual Percentage Yield) includes the effect of compound interest. For savings accounts, APY is the more accurate measure of your actual earnings because it reflects interest being earned on your interest.

2. Are high-yield savings accounts safe?

Yes, as long as the bank is insured by the FDIC (Federal Deposit Insurance Corporation) or the credit union is insured by the NCUA (National Credit Union Administration). This insurance protects your deposits up to $250,000 per depositor, per institution, in the event the bank fails. All banks listed in this guide are FDIC-insured.

3. Why do online banks offer better interest rates?

Online-only banks have significantly lower overhead costs because they don't operate physical branches. They pass these savings on to their customers in the form of higher APYs and lower fees.

4. How often do interest rates change on these accounts?

Interest rates on high-yield savings accounts are variable, meaning they can change at any time. They are often influenced by the Federal Reserve's federal funds rate. Banks may raise or lower their APYs in response to market conditions.

5. Is there a limit to how many savings accounts I can have?

No, there is no legal limit to the number of savings accounts you can open. In fact, having multiple accounts can be a smart strategy for organizing your savings for different goals (e.g., emergency fund, vacation, house down payment).

6. Do I have to pay taxes on the interest I earn?

Yes, the interest earned in a savings account is considered taxable income. Your bank will send you a Form 1099-INT at the end of the year if you earn more than $10 in interest, and you must report this income on your tax return.

7. Can I withdraw my money at any time from a high-yield savings account?

Generally, yes. Savings accounts are designed to be liquid. However, some banks may limit you to six "convenient" withdrawals or transfers per month due to a former federal regulation (Regulation D), though many banks have waived this limit. Exceeding the limit might result in a fee or conversion of the account to a checking account.

8. What is the minimum amount I need to open a high-yield savings account?

This varies by bank. Many of the best accounts, including those from Ally and Discover, have a $0 minimum opening deposit. Others may require a small initial deposit, but it's often as little as $1.

9. Will opening a new savings account affect my credit score?

No. Opening a deposit account like a savings or checking account typically involves a "soft inquiry" on your credit report, which does not impact your credit score. This is different from applying for a loan or credit card, which results in a "hard inquiry."

10. What's the best strategy if I find a better interest rate after opening an account?

Don't be afraid to move your money! The process of opening a new online savings account and transferring funds is usually quick and easy. Regularly checking comparison sites like Bankrate every 6-12 months ensures your money is always working as hard as possible for you.

Ready to take the next step in optimizing your entire financial life? Finding the right savings account is a fantastic start, but it's just one piece of the puzzle. At Everyday Next, we provide the tools and insights you need to manage your money, investments, and financial goals with clarity and confidence. Explore our resources at Everyday Next to continue your journey toward financial independence.