Best Ways to Invest Cash: Maximize Your Returns

Table of Contents

At Everyday Next, we get it — you want your money to pull its weight (and then some). Let’s face it: cash sitting around is about as useful as a screen door on a submarine if it’s not working for you. Investing wisely… yeah, that’s the name of the game if you’re aiming for serious financial growth and a future with more options than a coffee shop menu.

So, in this guide, we’re diving into the top ways to put your cash to work (and work hard). We’re talking strategies to boost your returns while keeping an eye on risk — because nobody wants to roam around Moneyland without a map, right? Whether you’re just starting to invest or you’ve been around the portfolio block a few times, get ready to upgrade your investment game.

What’s Your Investment Style? Tailoring Your Approach

Time Horizon: Short-Term vs. Long-Term

Alright, quick reality check-your investment timeline, that’s your roadmap. Are you in it for a two-year dash to save for a down payment or the marathon quest for a retirement nest egg? Short-term goals (think: under 5 years) generally call for playing it safe-high-yield savings accounts, maybe some short-term bonds. But if you’re talking long-term, go ahead and spice things up, maybe stocks or real estate. Big risk, potentially big rewards, right?

Consider the 60/40 portfolio-60% in stocks, 40% in bonds. It’s the gateway drug for many investors. But hey, here’s the kicker: one-year returns? Volatile-like a cat on a hot tin roof. Ten-year returns? Much smoother ride.

Gauging Your Risk Tolerance

What’s your pain threshold? If the market roller coaster makes your palms sweat, maybe dial it down a notch. But if you can keep your poker face when the market goes haywire, you might be the “bring it on” type.

Quick gut check: Picture this-your $10,000 investment sinks to $8,000. Panic sell? Hang tight? Or high-five yourself for a new buying opportunity? Your knee-jerk reaction here-it holds the key to your risk tolerance.

Diversification: Spreading Your Investments

Here’s another nugget-spread it around. Different asset classes, folks. Stocks, bonds, real estate, maybe even mix in a little pepper of alternative investments. It’s all about smoothing out the ride over time.

Evolving Your Strategy

Heads up-your investment strategy is not a “set it and forget it” deal. As life evolves, tweak things. Revisit your risk profile regularly to keep your portfolio dancing in tune with your goals and current market conditions.

And as we cruise further, buckle up. Let’s dive into specific investment avenues that can help you juice those returns, all custom-tailored to your unique style and goals.

Where to Park Your Cash for Maximum Growth

High-Yield Savings Accounts: Your Money’s New Best Friend

High-yield savings accounts offer significantly better interest rates than traditional savings accounts. So, February 2025 rolls around, and what do we have? Well, we’ve got a national average of 0.61 percent APY, thanks to Bankrate’s deep dive as of the week of Feb. 10, 2025.

Now these accounts – they’re like your cash’s safety net, FDIC-insured up to $250,000. Definitely a cozy spot for your hard-earned Benjamins. Plus, you can tap into your funds pretty easily (something to appreciate compared to other options). Just a heads-up, though – those interest rates? Yeah, they’re like the weather, fluctuating with whatever the Federal Reserve decides.

Certificate of Deposit (CD) s: Lock It Up for Higher Returns

If you’re not afraid to lock your money away for a bit, CD (Certificate of deposits) are calling your name. CDs offer fixed interest rates for specific terms, usually stretching from three months to five years.

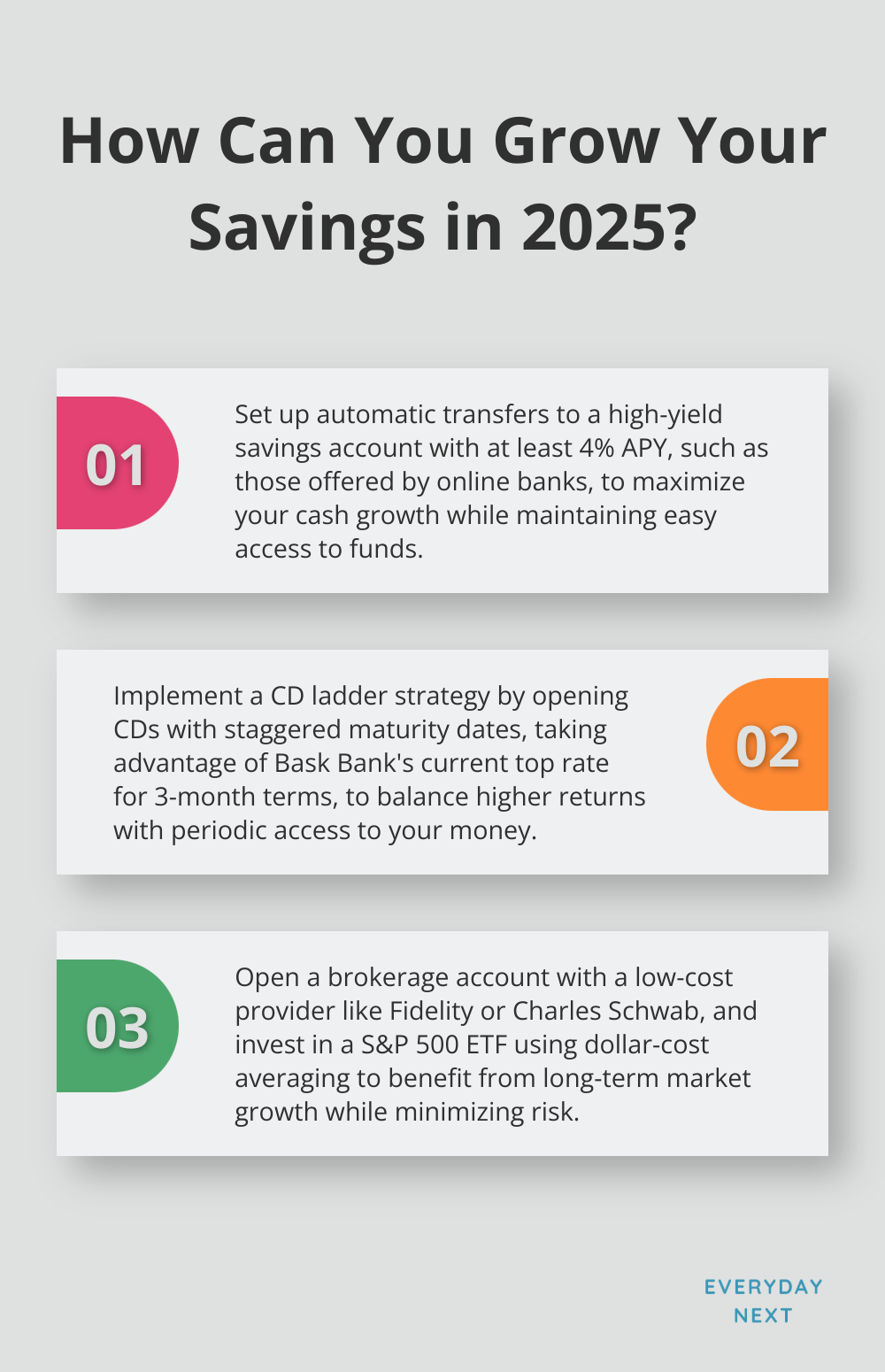

At the moment, some CD rates are flaunting over 4 percent APY. Bask Bank is leading the pack with a top rate for a 3-month term, outperforming average rates for longer terms.

Maximizing Your Returns: Tips and Tricks

- Go on a rate hunt. Online banks are where it’s at for killer rates on high-yield savings and CDs. Hit up comparison sites for the latest scoop.

- Try out a CD ladder strategy. It’s like spreading your eggs across various baskets with different timelines. Get the best of both worlds – higher rates and liquidity.

- Keep an eye out for promotional rates. Some banks get for new customers’ attention with temporary boosts. But, caution! Fine print’s there for a reason – check those requirements and restrictions.

- Mind the minimum balance requirements. Some high-yield accounts need you to maintain a certain balance to score the advertised rate or dodge pesky fees.

- Automate transfers to your high-yield account. It’s like on autopilot savings mode, letting you ride the wave of compound interest.

The Power of Compound Interest

Compound interest – that magical ingredient that turns saving into wealth-building. When your interest starts generating interest, the magic happens, and your money takes off. Say you throw $10,000 into a high-yield savings account at a 5% APY. Five years later, you’re looking at $12,762.82 (with monthly compounding).

Balancing Safety and Growth

Sure, high-yield savings accounts and (Certificate of deposit) CDs won’t turn you into a millionaire overnight, but they’re rock-solid ways to grow your cash safely and steadily. Perfect for emergency funds, short-term goals, or a nice conservative chunk of a diversified investment portfolio.

Looking ahead, maybe you’ll want to spice things up with more aggressive strategies that pack a punch with higher returns (and, yep, more risk). The stock market and Exchange-Traded Funds (ETFs) are waiting, with potential for those ready to ride the waves of volatility for greater rewards.

Stocks and ETFs: Supercharge Your Cash

The Stock Market Jungle

Alright, so you’re dipping your toes into the stock market? Brave soul. Here’s the lowdown: Buying individual stocks is like owning a slice of a business pie. If that pie rises (and doesn’t crumble), your wallet gets a little fatter. But – and it’s a big but – choose poorly, and your money might vanish into thin air. Seriously. That’s why a bunch of folks sprinkle their cash across different stocks like seasoning, to dodge the risk of burning it all.

You’ve probably heard the S&P 500 has delivered a sweet average annual return of about 10%. Long-term, mind you. But let’s not kid ourselves – history isn’t a crystal ball for the future.

First step: Open a brokerage account. Fidelity, Charles Schwab, Robinhood – the usual suspects. Each has its quirks and costs. So, a little comparing won’t hurt.

ETFs: Easy Diversification

Enter ETFs – the jack-of-all-trades in the investing world. Think of them as investment cocktails trading on exchanges, just like stocks. Instant diversification with potentially fewer bucks thrown down than picking individual stocks.

An S&P 500 ETF gives you a ticket to ride with giants such as Apple, Microsoft, and Amazon. One click, and you’re diversified. Boom.

On average, passive ETFs charge a mere 0.12% (that’s as of February 2025, shoutout to Morningstar). For every $10,000? You’re out just $12 in fees each year. Not too shabby.

Strategies for Stock and ETF Investing

Now, about dollar-cost averaging – the unsung hero of investment strategies. Instead of playing the “guess the market” game, you plunk down a consistent amount into stocks or ETFs. Rain or shine. It’s like smoothing the rollercoaster ride of market ups and downs.

Wanna boost your cash flow? Check out dividend-paying stocks and ETFs. While the S&P 500’s dividend yield pegs at 1.27%, some individual stocks and specialized ETFs shoot for the stars with higher yields.

Chasing growth? Sector-specific ETFs – your best bet. Take a peek at technology and healthcare. They’ve been the rock stars recently. But hey, with great returns comes great risk.

Research. Research. Research. You can’t emphasize this enough, folks. Dive into resources like Morningstar or Yahoo Finance. Get the 411 on a company’s financial mojo or an ETF’s track record.

Think about taxes too. ETFs in taxable accounts? Generally more tax-efficient than their mutual fund siblings. For saving up for the golden years, eyeball those tax-advantaged accounts like IRAs or 401(k)s. Go on, give your future self a high five.

Final Thoughts

So, putting your cash to work wisely-what does it do? It nudges you toward financial growth and security. We’ve talked about a buffet of options, from those high-yield savings accounts (the easy-lifers) to stocks and ETFs. Each one has its own flavor of benefits and risks, depending on what you’re aiming for. Your investment game plan? It needs to match up with your goals and how much risk you can handle. Diversification-that’s your safety net, balancing those rollercoaster returns with the unknowns.

Now, here’s the thing: you gotta keep tweaking and adjusting your strategy. Life changes, markets shift… stay adaptable. If you’re spooked by risk, start easy-traditional savings accounts. Or maybe you’re up for a little adventure and wanna try ETFs? They’re like a nice middle ground. As you get savvier, more complex strategies can make an appearance on your radar.

At Everyday Next, they’ve got your back in this financial game. Offering the tools and think pieces to steer you toward a financial upswing, whether you’re a newbie or a seasoned pro adjusting your plan. Take that leap today-watch how your money starts hustling for you.