AI Stocks Boom: Investing in the Next NVIDIA (Tech Giants of 2025)

Artificial intelligence (AI) is changing the world. From smart tools to self-driving cars, AI is everywhere. But it’s not just about cool tech. It’s also creating a huge wave of growth in the stock market. In 2025, investors are racing to find the next big winner. Many are looking for “the next NVIDIA”. A company that could lead the future of AI. This is why AI stocks are booming right now. In this article, we’ll explain what Artificial intelligence stocks are, why they’re growing, which companies to watch, and how you can invest smartly. Whether you’re new or experienced, this guide will help you understand the power behind AI stocks in 2025.

What Are AI Stocks?

AI stocks are shares in companies that build or use artificial intelligence. These firms create the tools, software, or hardware that make machines smart. Some of them make chips. Others write code or run data centers. Big names like NVIDIA, Google, and Microsoft lead the AI race. But smaller companies are joining fast. They build things like AI chatbots, robots, or security tools. When you buy Artificial intelligence stocks, you’re not just investing in tech. You’re investing in the future of how we work, drive, shop, and live. That’s why interest in AI stocks is growing so quickly.

Why AI Stocks Are Booming in 2025

AI stocks are not new, but 2025 has brought them into the spotlight like never before. Here’s why they’re growing fast:

- More companies are using AI. From banks to farms, AI is solving real problems. That creates more business for AI firms.

- Better hardware is now available. Chips are faster and cheaper. That means AI can be used in more places.

- Big profits are being reported. AI companies are showing strong growth. Investors love rising earnings.

- Global competition is pushing innovation. Countries are racing to lead in AI, which fuels more demand for AI tools.

Because of these trends, Artificial intelligence stocks are now seen as a smart bet for the future. Investors want in before prices go even higher.

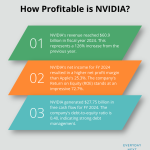

Real Example: How NVIDIA Became an AI Star

NVIDIA is one of the top AI stocks in the world. It started out making Gaming Chips. But now, it leads the market in chips that power AI tools. From 2020 to 2025, its stock price has more than tripled. Why? Because more companies need AI chips, and NVIDIA is the best at making them. NVIDIA’s success shows how fast things can change. A company that once focused on games now powers data centers, cars, and AI software. If you had bought NVIDIA shares just a few years ago, your investment could be worth a lot more today. That’s why people are looking for the next big AI stock.

Which AI Stocks to Watch in 2025?

Besides NVIDIA, there are many AI stocks gaining attention. Some are big tech names. Others are fast-growing startups.

- Alphabet (Google) uses AI for search, ads, and cloud services. It’s investing in tools like Gemini and DeepMind.

- Microsoft has added AI to Office and Bing. It also owns a big part of OpenAI, the makers of ChatGPT.

- AMD makes chips that compete with NVIDIA. It’s growing fast in the AI chip space.

- Palantir offers AI tools for defense and business. It’s gaining users in both public and private sectors.

- C3.ai is a smaller firm that builds software to help companies use AI in daily tasks.

These are just a few examples. Many other Artificial intelligence stocks are rising quietly. The best choice depends on your goals and how much risk you want to take.

How to Invest in AI Stocks Wisely

Artificial intelligence stocks can grow fast, but they can also drop quickly. It’s important to invest with care. Here are some simple steps:

- Start small if you’re new – Pick one or two AI stocks you trust.

- Look at the company’s earnings – Strong sales and smart plans are good signs.

- Check the product – Does the company use AI, or is it just hype?

- Spread your risk – Don’t put all your money in one company or one industry.

- Think long term – AI is growing fast, but real change takes time.

Some investors also choose AI-focused ETFs. These are bundles of Artificial intelligence stocks you can buy with one click. They offer more safety by spreading your money across many firms.

Risks to Know Before Buying AI Stocks

Like all investments, AI stocks come with risks. Prices can rise or fall fast. Some companies talk a lot about AI but have no real products. These stocks may not last. Also, laws about data and AI use are changing. New rules might hurt some AI firms. If a country limits how AI can be used, some businesses may slow down. Another risk is competition. Many companies are Building AI Tools. Not all of them will win. Picking the right ones is not easy. So before you invest in Artificial intelligence stocks, do your research. Understand the risks, and only invest what you can afford to lose.

Conclusion: The Future of AI Stocks

AI stocks are not just a trend. They are shaping the future of how we live and work. In 2025, this market is hot, and it’s just getting started. Companies like NVIDIA have shown what’s possible. But new leaders may rise next. That’s why smart investors are paying attention. With the right choices, Artificial intelligence stocks can be a strong part of your portfolio. But stay informed, plan wisely, and think for the long term. The AI boom is real, and it’s here to stay.

FAQs:

1. What are AI stocks?

AI stocks are shares in companies that build or use artificial intelligence tools.

2. Why are AI stocks growing in 2025?

More businesses are using AI, and tech is getting better and cheaper.

3. Is NVIDIA still a top AI stock in 2025?

Yes, NVIDIA leads in AI chips, but other companies are growing too.

4. How can I invest in AI stocks safely?

Start small, spread your money, and focus on strong companies.

5. Are there risks in AI investing?

Yes. AI stocks can be risky due to fast changes, competition, and laws.