Finding the Best Real Estate Crowdfunding Platforms for Your Goals

For investors looking to diversify their portfolio with real estate, crowdfunding has become a game-changer. I've spent years analyzing these platforms, and based on first-hand experience and in-depth research, here's my take: if you're just starting out, Fundrise offers the most accessible and diversified entry point. For accredited investors who want direct control over individual deals, CrowdStreet is the undisputed leader in its class. And if you’re looking for a solid middle ground with both public REITs and private deals, RealtyMogul strikes an excellent balance.

These platforms have torn down the old walls of real estate investing, making an asset class once reserved for the ultra-wealthy accessible to almost everyone with an internet connection. This guide offers a comprehensive breakdown to help you choose the right platform for your financial goals.

Your Guide to Top Real Estate Crowdfunding Platforms

At its core, real estate crowdfunding is pretty simple. It lets people like you and me pool our money online to buy shares in properties—anything from apartment buildings to commercial complexes. This model turns what was once a costly, hands-on headache into something you can manage from your laptop. Forget saving up hundreds of thousands for a down payment; you can now get started with as little as $10.

The numbers speak for themselves. The global real estate crowdfunding market is on track to explode from USD 22.1 billion in 2025 to an incredible USD 914.25 billion by 2035. That's a staggering growth rate of 45.1% a year. This isn't some niche trend; it's proof that everyday investors are embracing this new way to access property markets. You can see the full market breakdown on Research Nester.

Top Platform Picks for Every Investor

To give you a quick lay of the land, I've put together a simple table that matches our top picks to different types of investors. Think of it as your cheat sheet for finding the right starting point.

| Investor Profile | Top Platform Recommendation | Why It Wins |

|---|---|---|

| The Beginner | Fundrise | With a tiny $10 minimum and diversified eREITs, it’s the easiest on-ramp. You don't need to be a real estate pro to get started. |

| The Hands-On Pro | CrowdStreet | If you're accredited and want to pick your own deals, this is your playground. It offers direct access to institutional-quality commercial properties. |

| The Income Seeker | RealtyMogul | Great for those focused on cash flow. You get a mix of REITs for steady dividends and private deals for more varied income potential. |

This table should help you narrow down your choices, but remember, the "best" platform really depends on your personal financial goals and how involved you want to be.

Building Your Foundation

Before you jump onto any platform, it’s smart to get your bearings. If the world of property investing is new to you, taking a step back to learn the fundamentals is a must. I'd recommend reading a solid beginner's guide to real estate investing to grasp the basics first.

The real magic of crowdfunding is access. It lets an everyday person own a piece of a multi-million dollar apartment complex—an opportunity that, just a decade ago, was completely off-limits unless you were an institution or had very deep pockets.

This guide is designed to be your roadmap. We’ll walk through the best platforms out there, break down what makes each one unique, and give you the tools to make a smart decision. For a wider view on property investing strategies, our comprehensive real estate investment guide is another great resource.

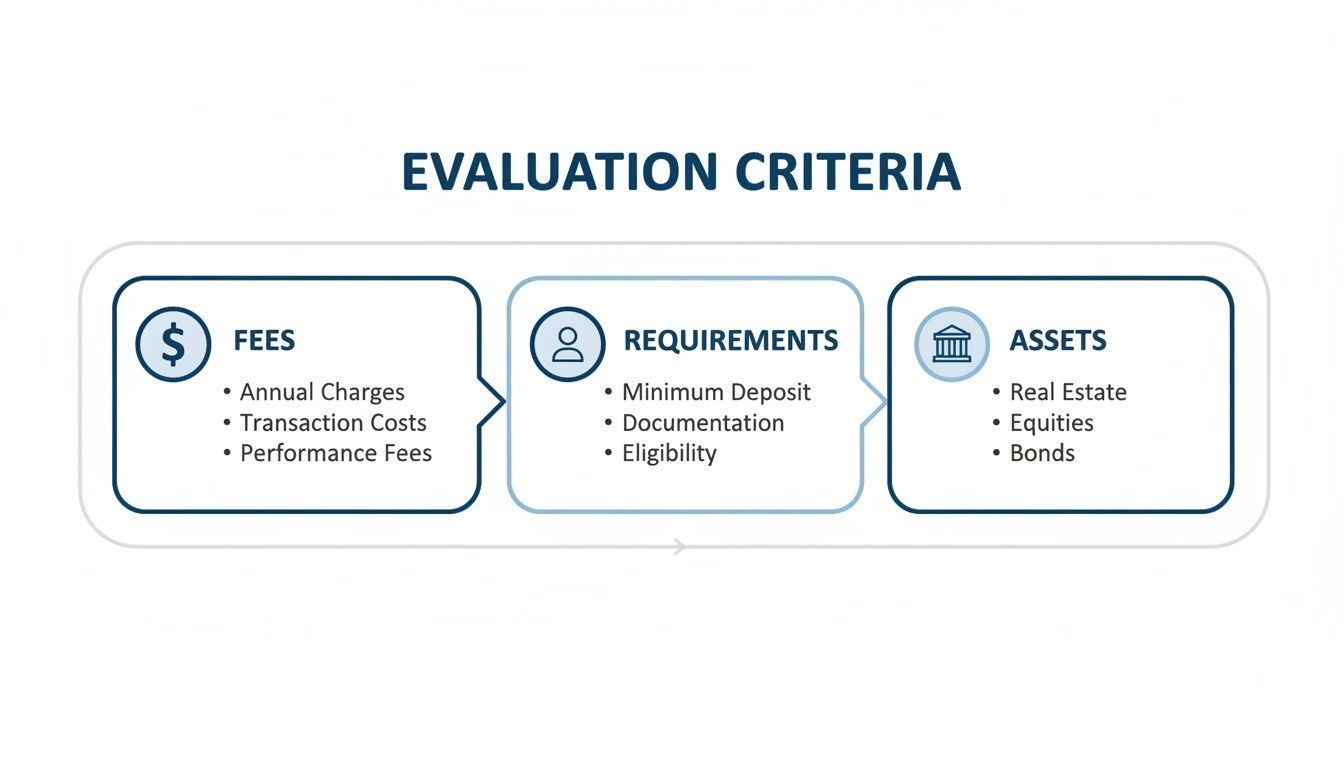

How We Picked the Best Platforms

Finding the right real estate crowdfunding platform can feel overwhelming. To cut through the noise and marketing hype, we developed a straightforward, hands-on evaluation process. We wanted to analyze these platforms from the perspective of a real investor, focusing on what actually impacts your bottom line and your peace of mind.

Think of this as our playbook. By showing you how we judge these platforms, you can use the same criteria to do your own homework and feel confident in your choices. We zero in on five key areas for every platform we review.

Investor Requirements and Accessibility

First things first: who is the platform actually for? This is the most basic filter. We immediately separate platforms that are open to everyone (non-accredited investors) from those reserved exclusively for accredited investors.

There's a world of difference between a platform like Fundrise, which welcomes investors at any income level, and one like CrowdStreet, built for those with a higher net worth. Our goal is to match you with a platform that fits your specific financial situation.

Minimum Investment and Fee Structures

Next, we look at the money. How much do you need to get started, and what will it cost you along the way? The minimum investment is a huge deal. A platform with a $10 minimum makes it easy for beginners to test the waters, while one demanding $25,000 is a much bigger commitment.

We don't just see this as a number; we see it as a tool for diversification. Lower minimums mean you can spread your cash across several different properties instead of putting all your eggs in one basket.

Then comes the fine print: the fee structure. We dig into all the costs, because they directly eat into your returns.

- Annual management fees: The yearly percentage taken from your investment.

- Advisory fees: What you pay for managed portfolios or guidance.

- Platform fees: The cost to simply use the service.

- Sponsor-level fees: Costs from the real estate developers themselves, which get passed on to you.

A 1% annual fee might not sound like much, but over a decade, it can take a serious bite out of your profits. We always look at the long-term impact of fees to show you what you're really likely to earn.

Available Asset Classes and Diversification

Let's be clear: not all real estate is created equal. A platform that only offers loans for single-family homes has a completely different risk profile than one offering equity in apartment buildings, warehouses, and retail centers. We categorize each platform by the asset classes available.

This is all about risk management. A key part of our review is seeing if a platform gives you genuine options to diversify. To get a better handle on why this is so important, check out our guide on how to diversify your portfolio. We look for a healthy mix of property types, investment structures (debt vs. equity), and locations across the country.

User Experience and Platform Transparency

Finally, we look at how the platform actually works. Is it easy to use, or is it a complete headache? A clean, intuitive dashboard and clear performance reports make all the difference, especially if you're new to this.

But nothing is more important than transparency. We give high marks to platforms that lay everything out on the table for each deal—we're talking detailed sponsor track records, solid business plans, and easy-to-understand financial models. Any platform that tries to hide its fees or gloss over the details of a project gets a thumbs-down from us. This commitment to clarity is what separates the good from the great.

A Detailed Comparison of Leading Platforms

Picking a real estate crowdfunding platform isn't about finding a single "best" one. It’s about finding the right fit for your money, your goals, and how much risk you're comfortable with. The perfect platform for a beginner just starting with a few hundred dollars is going to be completely wrong for a seasoned investor looking to personally vet multi-million dollar commercial deals.

To help you figure out where you land, we’re going to look at three of the biggest names in the game: Fundrise, CrowdStreet, and RealtyMogul. Each one is built for a different kind of investor and has its own unique take on real estate investing.

These three things—how much it costs, who can invest, and what you’re actually investing in—are the most important factors. They are what really separate these platforms and should be at the center of your decision.

Fundrise: The Beginner-Friendly Gateway

You could argue that Fundrise has done more than anyone to open the doors of real estate investing to everyday people. Their entire platform is built on making things simple, diversified, and incredibly easy to start.

Who It's Best For:

Fundrise is the easy answer for new investors, people with a small amount of cash to start, or anyone who wants a totally hands-off experience. If you want to start small and let someone else do all the heavy lifting, Fundrise was made for you.

The Investment Experience:

Instead of you picking individual properties, your money goes into portfolios called eREITs (electronic Real Estate Investment Trusts) or eFunds. Think of them as baskets holding dozens, sometimes hundreds, of properties across the country, from apartment buildings to communities of single-family rentals.

The core idea behind Fundrise is simple: instant diversification. For as little as $10, you get a slice of a huge portfolio of real estate. That's a strategy that would be impossible to copy on your own without a ton of money.

Key Features:

- Minimum Investment: An incredibly low $10 for their Starter Portfolio.

- Investor Type: Open to both accredited and non-accredited investors, so pretty much anyone can join.

- Fee Structure: A simple, all-in 1% annual fee (a 0.85% management fee plus a 0.15% advisory fee).

- Liquidity: They have a quarterly redemption program if you want to sell your shares. It's not a guarantee, though, and you might face a penalty if you pull your money out within five years.

Real-Life Example:

Sarah, a 28-year-old graphic designer, wanted to start investing but found the stock market intimidating. She had $500 saved. She chose Fundrise, opened an account in 10 minutes, and invested in the "Balanced Investing" plan. Her $500 was instantly spread across 87 different properties. She set up a $50 monthly auto-invest and now passively grows her real estate portfolio without having to analyze a single deal.

CrowdStreet: The Professional's Marketplace

On the complete opposite end of the spectrum is CrowdStreet. It’s less like a managed fund and more like a high-end marketplace connecting sophisticated investors directly with institutional-grade real estate developers.

Who It's Best For:

CrowdStreet is built exclusively for accredited investors who want total control and are comfortable doing their own research. This is for the hands-on investor who wants to hand-pick specific, high-potential commercial properties for their portfolio.

The Investment Experience:

You browse a curated list of individual deals—maybe a new hotel being built in Austin or a medical office building in Florida. For every project, you get a deep dive into the documents, including the developer's history, detailed financial models, and webinars. You make the final call on where your money goes.

Key Features:

- Minimum Investment: Usually starts at $25,000 for each deal, and sometimes more.

- Investor Type: For accredited investors only.

- Fee Structure: Fees are different for every deal because they’re set by the developer (the sponsor). CrowdStreet doesn’t charge investors a direct fee; it’s baked into the deal itself.

- Liquidity: These investments are not liquid at all. You’re in it for the long haul, typically 3-10 years, with no option to cash out early.

Real-Life Example:

Mark is a retired executive who wanted direct exposure to commercial real estate. He saw a listing on CrowdStreet for a "value-add" multifamily property in Phoenix. He attended the sponsor's webinar, reviewed their 20-year track record, and analyzed the pro forma financials. Confident in the deal, he invested $50,000. He receives quarterly reports and knows his capital is locked in for an estimated five years, targeting a projected 18% internal rate of return (IRR). Managing a growing portfolio often requires more than one tool; exploring the best apps for property investors can uncover other useful resources.

RealtyMogul: The Hybrid Model

RealtyMogul finds a nice sweet spot right between Fundrise and CrowdStreet. It has something for both new and experienced investors, offering a mix of diversified funds and individual deals.

Who It's Best For:

This platform is a great fit for investors who've moved past the beginner stage but aren't quite ready for the high minimums and intense due diligence of CrowdStreet. It also works well for accredited investors who want both passive funds and self-directed deals in one place.

The Investment Experience:

Non-accredited investors can put money into two non-traded REITs: the Income REIT, which focuses on debt deals to generate cash flow, and the Apartment Growth REIT, which focuses on owning equity in apartment buildings. Accredited investors can access those same REITs plus a marketplace of individual private deals, much like CrowdStreet.

Key Features:

- Minimum Investment: Starts at $5,000 for the REITs. Individual deals usually require $25,000 – $35,000.

- Investor Type: The REITs are open to all investors, but the private deals are for accredited investors only.

- Fee Structure: The REITs have annual management fees between 1% and 1.25%. Fees on private deals vary.

- Liquidity: The REITs have a limited quarterly redemption program, much like Fundrise. The private placements are illiquid.

Real-Life Example:

Jessica, an attorney, had $20,000 to invest. She wasn't accredited yet but wanted more focus than a broad-based fund. She invested $10,000 in RealtyMogul's Apartment Growth REIT for long-term appreciation and another $10,000 in the Income REIT for steady dividends. Her plan is to use the platform's individual deal marketplace once her income qualifies her as an accredited investor.

Side-by-Side Platform Feature Comparison

This table gives you a quick, at-a-glance look at how these platforms stack up. It’s designed to help you quickly see which one aligns best with your own investment profile.

| Feature | Fundrise | CrowdStreet | RealtyMogul |

|---|---|---|---|

| Best For | Beginners & Passive Investors | Experienced & Hands-On Investors | Hybrid & Intermediate Investors |

| Minimum Investment | $10 | $25,000+ | $5,000 (REITs) |

| Investor Type | All Investors | Accredited Only | All (REITs) / Accredited (Deals) |

| Primary Deal Types | Diversified eREITs & eFunds | Individual Commercial Properties | REITs & Individual Properties |

| Fee Structure | ~1% Annual Fee | Varies by Sponsor | 1-1.25% (REITs) / Varies (Deals) |

| Liquidity | Limited Quarterly Redemption | Illiquid (3-10 year holds) | Limited (REITs) / Illiquid (Deals) |

This comparison shows there's truly a platform for every type of investor.

A key trend driving this entire market is fractional ownership. Fractional ownership has emerged as a game-changer in real estate crowdfunding, powering a 43.5% year-over-year market jump to $29.16 billion globally in 2025 from $20.31 billion in 2024, with projections soaring to $122.44 billion by 2029 at a 43.1% CAGR. This is the engine behind platforms like Lofty.ai and DiversyFund, which let you buy shares of premium properties—like a luxury apartment in New York or a commercial building in London—for as little as $50. This model completely shatters the old barriers of needing six or seven figures to get into high-end real estate.

Navigating Risks and Performing Due Diligence

While the best real estate crowdfunding platforms open up some exciting doors, it's absolutely essential to walk through them with your eyes wide open to the risks. Let's be clear: no investment is a sure thing, and real estate definitely isn't an exception. A smart investor knows the potential downsides before putting any money on the table.

The biggest hurdle for many is illiquidity. This isn't like the stock market where you can sell your shares in a few clicks. When you invest in a crowdfunded real estate deal, you're usually in it for the long haul—think 3 to 10 years. Some platforms have redemption programs, but they're never a guarantee and often come with a penalty. You have to be okay with not touching that money for a while.

Understanding Market and Platform Risks

Beyond just tying up your cash, you have to think about market risk. Property values swing with the economy. A recession could hit rental income hard, lower property values, or even stall a project, making it tough to sell for a profit. To get a feel for what's happening out there, you might want to read our analysis on whether the real estate market will crash soon.

Then there are platform-specific risks. The quality of a platform's screening process is everything. If they're not picky, they might be letting riskier deals slip through to investors. At the end of the day, your returns depend entirely on the skill and honesty of the platform's team and the developers they choose to work with.

Your Actionable Due Diligence Checklist

Doing your homework is the best tool you have to protect yourself. It’s what turns you from a passive bystander into an active, informed investor. Before you even think about funding a deal, run it through this checklist.

Scrutinize the Sponsor's Track Record

- Who’s the developer or real estate firm managing this project?

- What’s their history? Have they successfully finished projects like this before?

- Demand to see a full performance history—the wins and the losses. A sponsor worth their salt will be transparent about their entire portfolio.

Analyze the Property's Business Plan

- How exactly do they plan to make money? Is it a "value-add" play where they renovate to raise rents? Or are they building from the ground up?

- Look closely at their financial projections (the pro forma). Are their assumptions for rent growth and occupancy realistic? Check them against actual data for that neighborhood.

- Getting comfortable with key metrics is a must. If you need a refresher, this guide explains how to calculate cap rate, which is a great way to gauge a property's potential profitability.

A common mistake is getting dazzled by high projected returns without ever questioning how they got to that number. A solid business plan is built on conservative estimates and real market data, not just wishful thinking.

Break Down the Fee Structure

- Pinpoint every single fee. Look for acquisition fees, ongoing asset management fees, and disposition fees when the property is sold. Also, understand the profit-sharing structure (the "waterfall").

- Figure out how these fees will eat into your potential return. High fees can take a huge bite out of your profits, even if the project does well.

Assess the Timeline and Exit Strategy

- What’s the estimated hold period? How long will your money be tied up?

- What’s the exit plan? Are they planning to sell the property or refinance to pay investors back?

- Factor in potential delays. Construction projects are notorious for setbacks that can push the timeline out further than expected.

Following a systematic process like this helps you see past the polished marketing and make a decision based on the real strengths and weaknesses of a deal. It's the most reliable way to navigate the promising—but complicated—world of real estate crowdfunding.

How To Make Your First Investment

Jumping into your first real estate crowdfunding deal might seem intimidating, but it’s actually more straightforward than you’d think. By breaking it down into a few manageable steps, you can move from just browsing to confidently making your first investment. Let’s walk through exactly how it’s done.

To make this practical, we'll follow a fictional investor, Alex, who has $1,000 ready to invest and is looking to build a passive income stream. If you need a more general starting point on investing, our guide on how to invest money for beginners is a great resource.

Step 1: Figure Out Your Investment Goals

Before you even start comparing platforms, you need to know what you’re trying to accomplish. What’s the why behind your investment?

Are you playing the long game, aiming for your investment to grow in value over several years? Or is your main goal to see a steady trickle of cash flow hitting your bank account through regular dividend payments? The answer will steer everything that follows.

An investor focused on growth will naturally gravitate toward equity deals in developing areas. On the other hand, someone chasing income will likely prefer stabilized, cash-flowing properties or debt investments.

Alex's Goal: Alex is all about passive income. He wants to earn quarterly or monthly dividends to supplement his salary, not wait five years for a big payout. This simple decision makes his search much narrower.

Step 2: Choose the Right Platform for You

With your goal clearly defined, finding the right platform becomes a whole lot easier. As we’ve covered, different platforms cater to different needs.

- For simple, hands-off passive income: A platform like Fundrise or the Income REIT from RealtyMogul are excellent starting points.

- For accredited investors who want to pick their own deals: CrowdStreet is the undisputed leader here.

- For a mix of both: RealtyMogul offers a nice middle ground with both private placements and REITs.

Alex's Choice: Since Alex is starting with $1,000 and wants a simple, income-first approach, Fundrise is a perfect match. Its low minimum investment and portfolio of diversified eREITs are practically built for his exact scenario.

Step 3: Set Up and Fund Your Account

This part feels just like opening any other online financial account. You’ll need to provide your personal details (name, address, Social Security number) and securely link your bank account, typically using a service like Plaid. The platform will take a few minutes to verify your identity.

Once you’re approved, you can transfer your funds. For Alex, that means moving his $1,000 into his new Fundrise account.

Pro Tip: If the platform offers it, set up recurring deposits. Even an extra $50 or $100 a month can make a huge difference over the long run thanks to the power of compounding.

Step 4: Select Your Investment Strategy

This is where the fun begins. With a platform like Fundrise, you’re not poring over individual property documents. Instead, you choose an investment plan that matches your goals and risk tolerance, usually ranging from income-focused to aggressive growth.

Alex's Selection: Alex picks the “Supplemental Income” plan. With one click, Fundrise automatically spreads his $1,000 across a portfolio of eREITs and eFunds designed to generate consistent cash flow. Instantly, he owns a small piece of dozens of different properties.

Step 5: Finalize and Monitor Your Portfolio

The last step is to review the documents, sign them electronically, and officially complete your investment. Congratulations, you're now a real estate investor.

From here on out, you can log into your dashboard anytime to track your portfolio's performance, read updates on the properties you're invested in, and watch the dividends roll in.

Frequently Asked Questions

1. What exactly is real estate crowdfunding?

Real estate crowdfunding is a method where a group of people (the "crowd") pool their money together to invest in a real estate project. Platforms act as middlemen, connecting investors with real estate developers or sponsors who need funding. This allows individuals to own a small piece of a large property that they couldn't afford on their own.

2. Are real estate crowdfunding platforms safe?

Reputable platforms perform extensive due diligence on both the real estate developers (sponsors) and the deals themselves. However, all investments carry risk. The "safety" depends on the quality of the platform's vetting process and the inherent risks of the underlying real estate. Your investment is not FDIC insured.

3. How do I get my money back from a crowdfunding investment?

These are typically long-term, illiquid investments. You get your money back when the property is sold or refinanced at the end of the investment term (the "exit"). Some platforms with REIT-like funds, such as Fundrise and RealtyMogul, offer limited quarterly redemption programs, but these are not guaranteed and may come with penalties. Do not invest money you might need in the short term.

4. How are real estate crowdfunding returns taxed?

Returns are typically taxed in two ways. Regular distributions (dividends or interest) are often taxed as ordinary income. Any profit made when the property is sold is taxed as a capital gain. You will usually receive a Form 1099-DIV or a Schedule K-1 from the platform for tax reporting. It's always best to consult a tax professional.

5. What is the difference between an accredited and non-accredited investor?

This is a legal distinction set by the SEC based on income and net worth. An accredited investor has a net worth over $1 million (excluding their primary residence) or an annual income over $200,000 ($300,000 with a spouse). Platforms like CrowdStreet are only for accredited investors. A non-accredited investor is anyone who doesn't meet that threshold. Platforms like Fundrise were created to be accessible to everyone.

6. What happens if a platform goes out of business?

Your investment is not in the platform itself, but in a separate legal entity (usually an LLC) that owns the property. If the platform were to fail, your ownership in the property remains. A third-party asset manager or the original sponsor would typically take over management to see the investment through to its conclusion.

7. Can I use an IRA or 401(k) to invest?

Yes, many platforms allow you to invest using a Self-Directed IRA (SDIRA). This special type of retirement account allows for investments in alternative assets like real estate. You would need to set up an SDIRA with a qualified custodian and then direct them to invest your funds on the crowdfunding platform.

8. What's the difference between a debt and an equity investment?

In an equity deal, you are buying an ownership stake in the property. Your potential for high returns is greater, but so is your risk. If the property does poorly, you could lose your entire investment. In a debt deal, you are acting like a lender. You lend money to the project and receive fixed interest payments. This is generally lower risk, but your returns are capped at the agreed-upon interest rate.

9. How much of my portfolio should I allocate to real estate crowdfunding?

Most financial advisors recommend allocating between 5% and 15% of your total investment portfolio to alternative assets like real estate. As a beginner, it's wise to start small, perhaps with 1-2% of your investable assets, and increase your allocation as you become more comfortable and knowledgeable about the risks.

10. How do platforms make money?

Platforms typically charge fees. This can include an annual asset management fee (e.g., Fundrise's 1%), fees charged to the real estate sponsor for listing a deal on the platform, or a share in the project's profits. It's crucial to understand the full fee structure of any platform or deal before investing, as fees directly impact your net return.

At Everyday Next, we're all about giving you clear, practical insights to help you make better financial moves. Check out more of our guides and analyses to keep building your knowledge. https://everydaynext.com