How the Federal Reserve Plans to Tackle Inflation Amid New Tariffs

At Everyday Next, we’re keeping a close eye—like, binoculars-close—on the Federal Reserve’s playbook for tackling inflation, especially with these new tariffs shaking things up.

The Fed is in a bit of a pickle here, trying to steer through the labyrinth of rising prices and those pesky trade barriers.

In this post, we dive into how the Fed is planning to wield its monetary policy arsenal to curb inflation…while also pondering the ripple effects tariffs might have on the economy.

What’s Driving Today’s Inflation?

Ah, the U.S. inflation drama – it’s back, and it’s not subtle this time. As of April 2025, the Consumer Price Index (CPI) is having a serious moment, showing some eye-watering hikes across all sorts of categories. Groceries, housing – even your morning coffee run is costing more these days. Ouch.

Supply Chain Disruptions

Supply chains? More like supply pain… Still a mess. The pandemic threw a wrench (or seven) in the global economy, and, guess what? It’s not back to normal. Plus, geopolitical tensions – because why not add some spice to the chaos? Industries everywhere are feeling the pinch, especially where semiconductors – those tiny tech lifelines – are scarce.

Labor Market Tightness

Job market update: Tighter than last year’s holiday sweater. Unemployment is sitting at 3.6%, and that’s sparking a wage race across sectors. Good news for workers, sure, but here’s the kicker – businesses are passing those costs right on to you, the consumer. Inflationary pressures? More like inflationary tidal waves.

Energy Costs

Let’s talk energy: volatile, unpredictable – a real rollercoaster. The average gas price is cruising at $3.235 per gallon. That’s not just your road trip budget taking a hit; it’s everything. Shipping, production, you name it, all seeing price hikes thanks to energy’s wild ride.

Impact on Consumers and Businesses

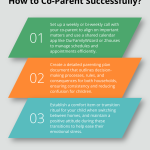

The inflation saga isn’t just a business headline; it’s a daily headache. A survey tells us 63% of small business owners expect things to get pricier. Consumer sentiment? Oof, plummeting – folks are feeling the squeeze on their wallets, standards of living slipping.

Business owners are walking a tightrope. Keep prices affordable and risk losses, or hike them and risk losing customers. Not an easy decision, but it’s survival mode now.

So what’s next? Time for a strategy shake-up. Whether it’s cutting costs ninja-style or boosting productivity, smart moves are essential. Staying informed and flexible is the name of the game.

The Federal Reserve has some serious lifting to do with their economic toolkit. Ready to dive deeper into their playbook? Let’s dissect how they plan to tackle this economic beast.

How the Federal Reserve Fights Inflation

The Federal Reserve’s battle against inflation heats up, as they deploy a mix of heavy-duty tools. Let’s break down their game plan and what it means for your wallet.

Interest Rate Hikes: The Fed’s Primary Weapon

The Fed’s go-to move? Raising interest rates. They’ve been doing it consistently, with the federal funds rate now sitting at 4.25%-4.50%. The idea? Slow down spending and borrowing. Higher rates make loans pricier, which should – at least in theory – pump the brakes on the economy and tame inflation.

These hikes ripple through everything-mortgages, credit cards. Thinking about buying a house or refinancing? Brace yourself for a potential wallet gut punch.

Quantitative Tightening: Reducing Money Supply

Then there’s quantitative tightening – the Fed’s long-term play. They’re unloading billions in bonds every month, yanking money out of the system. It’s like putting the economy on a low-calorie budget.

Since kicking off this policy, their balance sheet’s slimmed from $9 trillion to $7.4 trillion as of early May 2024. It’s all about shrinking market liquidity, which could mean higher long-term interest rates and a sluggish economy. For investors, we’re talking bond market turbulence and potentially deflated stock prices.

Clear Communication: The Fed’s Influential Tool

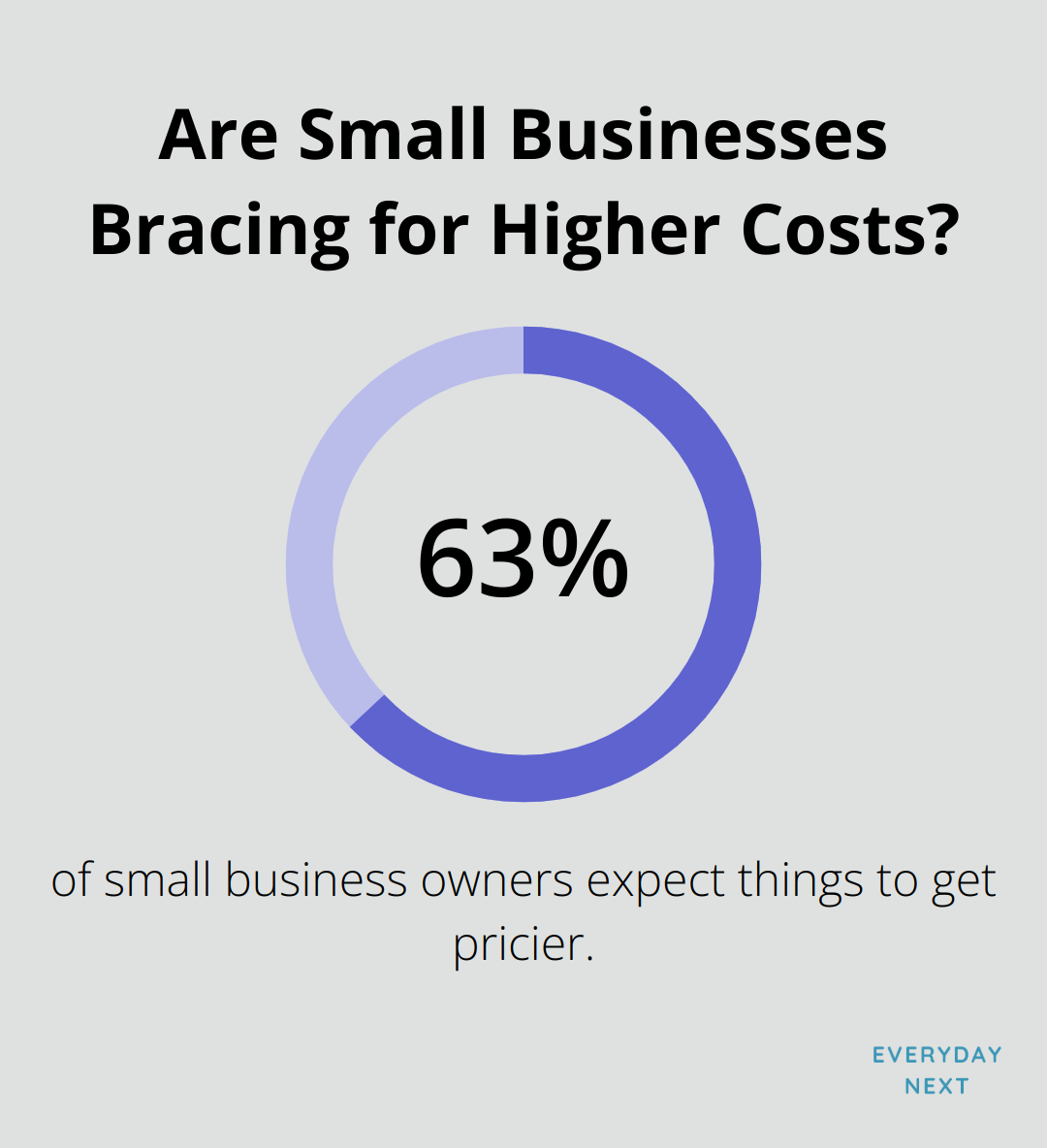

The Fed’s chatter? Just as impactful as their maneuvers. They drop hints and shape market vibes. When Fed Chair Jerome Powell’s lips move – markets listen.

Take Powell’s latest comments on tariffs shaking inflation; the market didn’t miss a beat. The S&P 500 nosedived nearly 6% – proof of the serious sway these words carry.

So, staying in the loop is a must. The Fed’s announcements can mess with your retirement nest egg or career path. Keep tabs on their eight yearly gatherings – and what they announce after.

The Fed’s got a Swiss Army knife of tools, sending shockwaves throughout the economy. As they grapple with inflation, their decisions will nudge your financial choices in the coming months. Planning to splurge on a big buy, switch up your job, or shuffle investments? Understanding these tools is your secret weapon for navigating the economic rollercoaster.

Now, let’s shift gears to how the Federal Reserve aims to tackle the added hurdle of new tariffs while keeping inflation in check.

Tariffs and Inflation: A Double-Edged Sword for the Federal Reserve

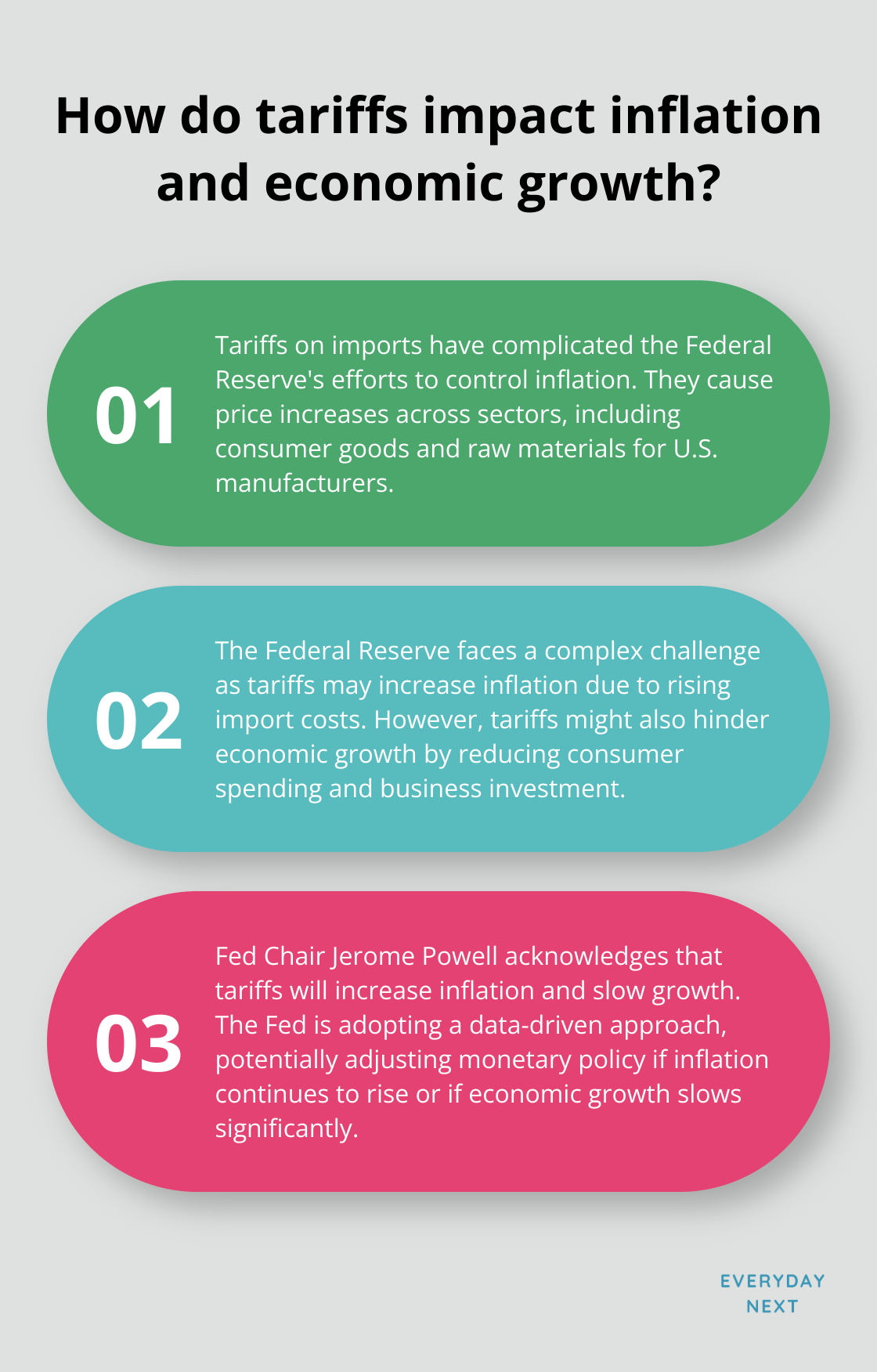

The Tariff Shock

April 2025 – tariffs, just when you thought it couldn’t get more complicated, the new economic plot twist arrives. These tariffs on imports have thrown a wrench into the Fed’s inflation-fighting machine… yeah, that’s a thing now.

Price Hikes Across Sectors

Gotta love a ripple effect. Tariffs hit, and boom – prices across sectors start climbing. Not just your everyday consumer goods – we’re talking raw materials for U.S. manufacturers, too. So, buckle up for rising prices in construction materials, appliances, and the whole nine yards.

The Fed’s Complex Challenge

Now, for the Fed, it’s a bit of a high-wire act. Tariffs mean inflation could soar as import costs rise. But, here’s the kicker… they might also strangle economic growth, cutting down consumer spending and business investment – and, yup, potentially jobs.

Fed Chair Jerome Powell steps in – he’s on it, saying tariffs will nudge up inflation and cool down growth. So, the Fed’s playing the waiting game before tweaking rates again.

What’s the move? A careful dance based on data. If inflation keeps climbing, the Fed might jigger monetary policy. But if growth hits the brakes, they’ll need a fresh game plan.

Real-World Implications

Spoiler alert: tariffs aren’t just for economists – they impact everyone on the ground:

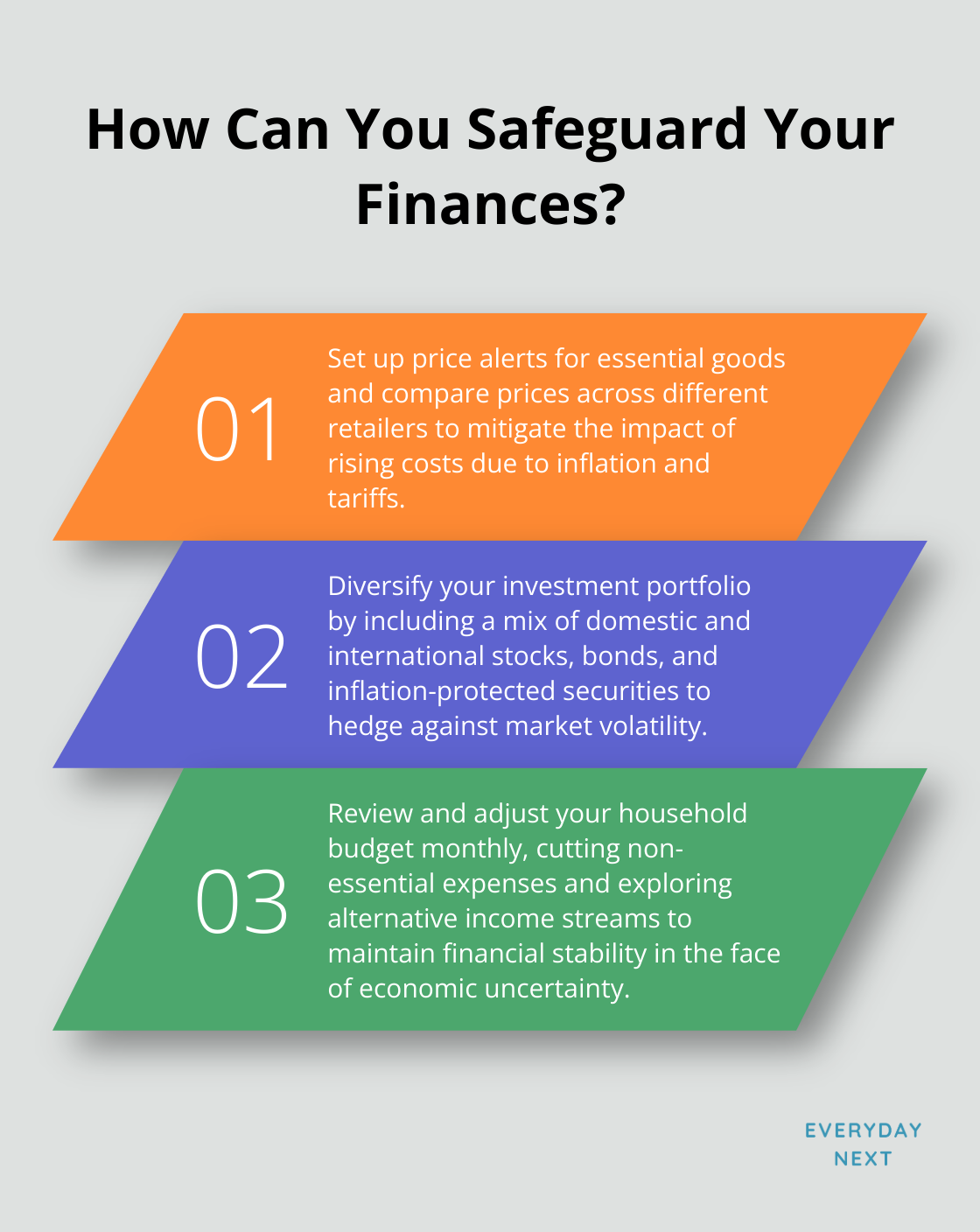

- Higher prices: Be ready to shell out more for imported goodies and anything made with those pricey imported parts.

- Investment considerations: Market turbulence on the horizon? Diversifying your portfolio becomes a no-brainer.

- Business planning: Business owners, time for a supply chain rethink. Can you source materials closer to home to dodge those tariff-induced price bumps? Or can you handle the cost spike without hiking your prices sky-high?

- Job market shifts: Keep an eye on employment trends. Economists are sounding the alarm about tariffs snarling supply chains and swelling prices, potentially leading to layoffs as both household and consumer spending tapers off.

- Housing market changes: Fed tweaks interest rates? Say hello to mortgage rate fluctuations.

Final Thoughts

The Federal Reserve is in a bit of a pickle… trying to juggle inflation and new tariffs like they’re on stage at Cirque du Soleil. What’s the plan? Interest rates-those will go up and down like a yo-yo. Quantitative measures-tightened. Communication-crystal clear. The goal? Stabilize prices without causing an economic nosedive. But wait, tariffs! They’re like throwing a wrench into an already complex machine, creating outcomes as unpredictable as a toddler at a candy shop.

The Fed’s strategy on inflation is a living, breathing thing-adjusting as swift as they can evaluate tariff impacts on the economy. Businesses and consumers, brace yourselves for interest rate acrobatics, roller-coaster markets, and maybe swapping your spending habits. The future? It’s a blurry thing, but whatever the Fed does, it’ll carve out our economic path for months to come.

We’re here at Everyday Next, ready to hold your hand through this economic maze. Our platform? It’s packed with the insights and strategies you need to thrive, even when the financial winds are shifting. For more on personal finance, career leaps, and economic twists, head to our website and join our circle of forward-thinking minds.