How to Invest in McDonald’s Stock: A Beginner’s Guide

Alright, investing in stocks… it’s like walking into a jungle for the first time — confusion, chaos, and maybe some excitement. And then there’s McDonald’s — yes, the Big Mac kingdom itself — the global fast-food behemoth that new investors often have on their radar. Why? Because it’s as familiar as it gets.

But hey, don’t sweat it. We’ve got you covered. This guide’s gonna take you step by step — no missing a beat — from grasping how the golden arches actually make their money (hint: it’s not just about burgers), to clicking that “buy” button on your first McDonald’s share. And, of course, we’ll also clue you in on the risks — ’cause, let’s face it, this isn’t Monopoly money. So, strap in and let’s demystify this whole investing thing.

What Makes McDonald’s a Unique Investment?

The Real Estate Empire

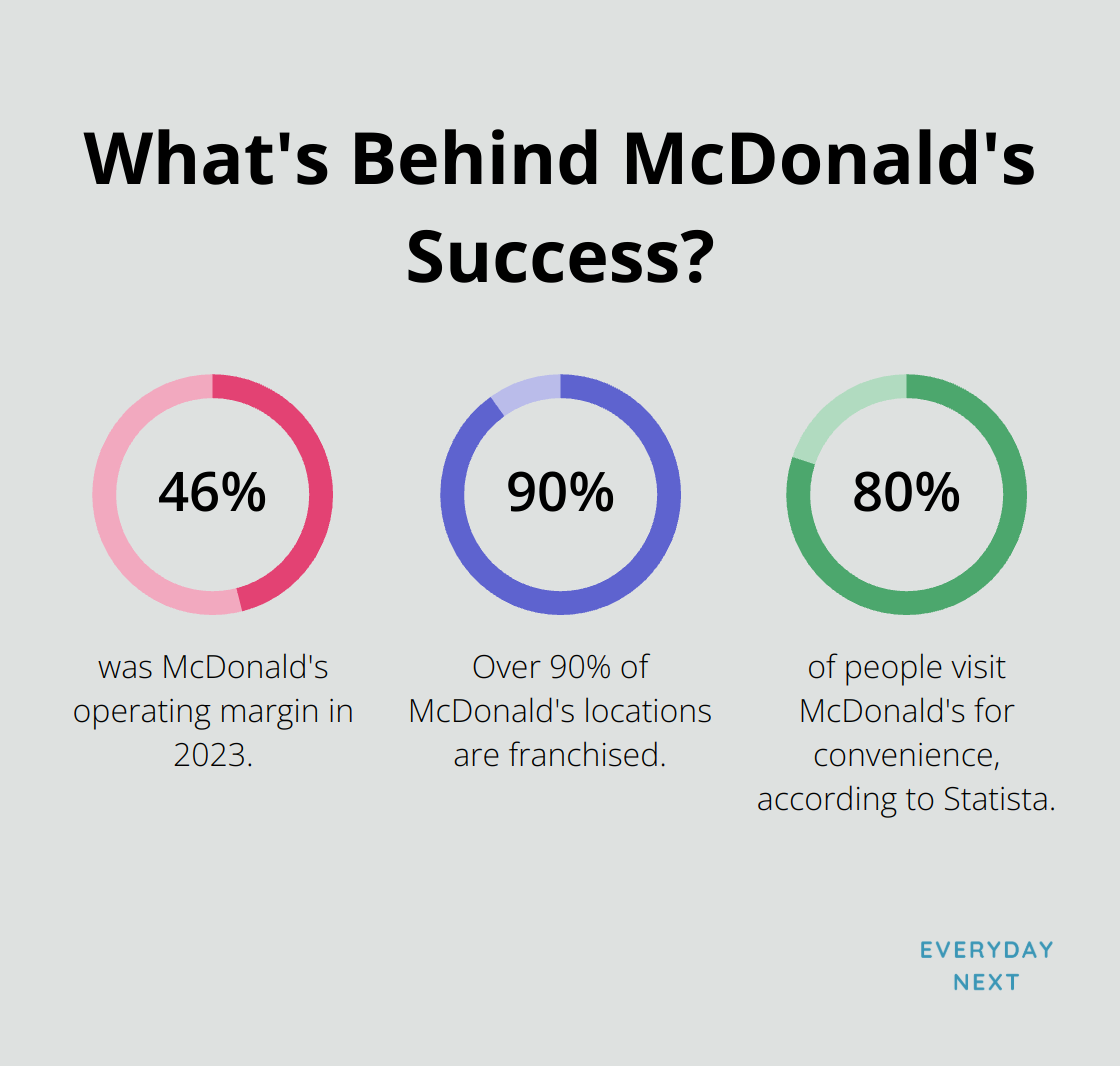

McDonald’s-it’s not just a place for Big Macs. This is a real estate behemoth masquerading as a fast-food joint. They own some of the juiciest plots of real estate around the globe, buying the land, setting up shop, and then playing landlord to franchisees. No matter if fries are selling like hotcakes-or not-they’re raking in the cash. In 2023, their operating margin hit a sizzling 46%, up from 40% in 2022. Yeah, they’re not messing around.

The Franchise Advantage

Over 90% of McDonald’s spots are franchised-making this franchise game their secret sauce. Lower costs mingle with steady cash flow. Franchisees handle the day-to-day grind, while McDonald’s sits back, collecting royalties and rent like it’s going out of style. It’s all about consistency, people-every McDonald’s, everywhere.

Financial Strength

Speaking of strength, McDonald’s is packing some serious financial heat. Check it out-2023 in numbers:

- Revenue: $23.2 billion

- Net income: $6 billion

- Operating margin: 46%

They’re turning burgers into bucks-simple as that.

Market Leadership

With a staggering 39,000+ locations across 119 countries, McDonald’s is the King Kong of fast food. Their brand? It’s got clout like nobody’s business. Statista says 80% of folks swing by McDonald’s for convenience. And yeah, they’re not wrong.

Dividend Champion

Craving cash flow? McDonald’s has been ramping up dividends for 17 years in a row. As of March 2025, the latest date to cash in was March 3, 2025. Perfect for those hunting regular payouts (investors who dig seeing those dividend deposits roll in).

Adapting to Change

Not ones to sit still, McDonald’s is on the innovation train:

- They’re going big on digital ordering and delivery partnerships

- Cooking up new menu items (even healthy stuff!)

- Going green to attract eco-savvy folks

Keeping their finger on the pulse of change, McDonald’s stays in the game-smart moves in a world that’s always shifting.

Now that we’ve peeled back the curtain on why McDonald’s stands out as an investment, let’s dive into how to snag some of their stock.

How to Buy McDonald’s Stock: A Step-by-Step Guide

Choose a Brokerage Account

Alright, folks. First things first-you want a piece of the Big Mac biz? You need a brokerage account. Think of this as your golden ticket to the market. Platforms like Fidelity, Charles Schwab, and E*TRADE? They’re the heavy hitters. Look for low to no minimums and commission-free trades. Because paying fees… unnecessary.

Research McDonald’s Financials

Once you’ve got your account ready, it’s time to dig into McDonald’s financial sauce. Head over to their investor relations page. Key ingredients? Revenue growth, profit margins, and debt levels. Get the full nutrition facts, if you will.

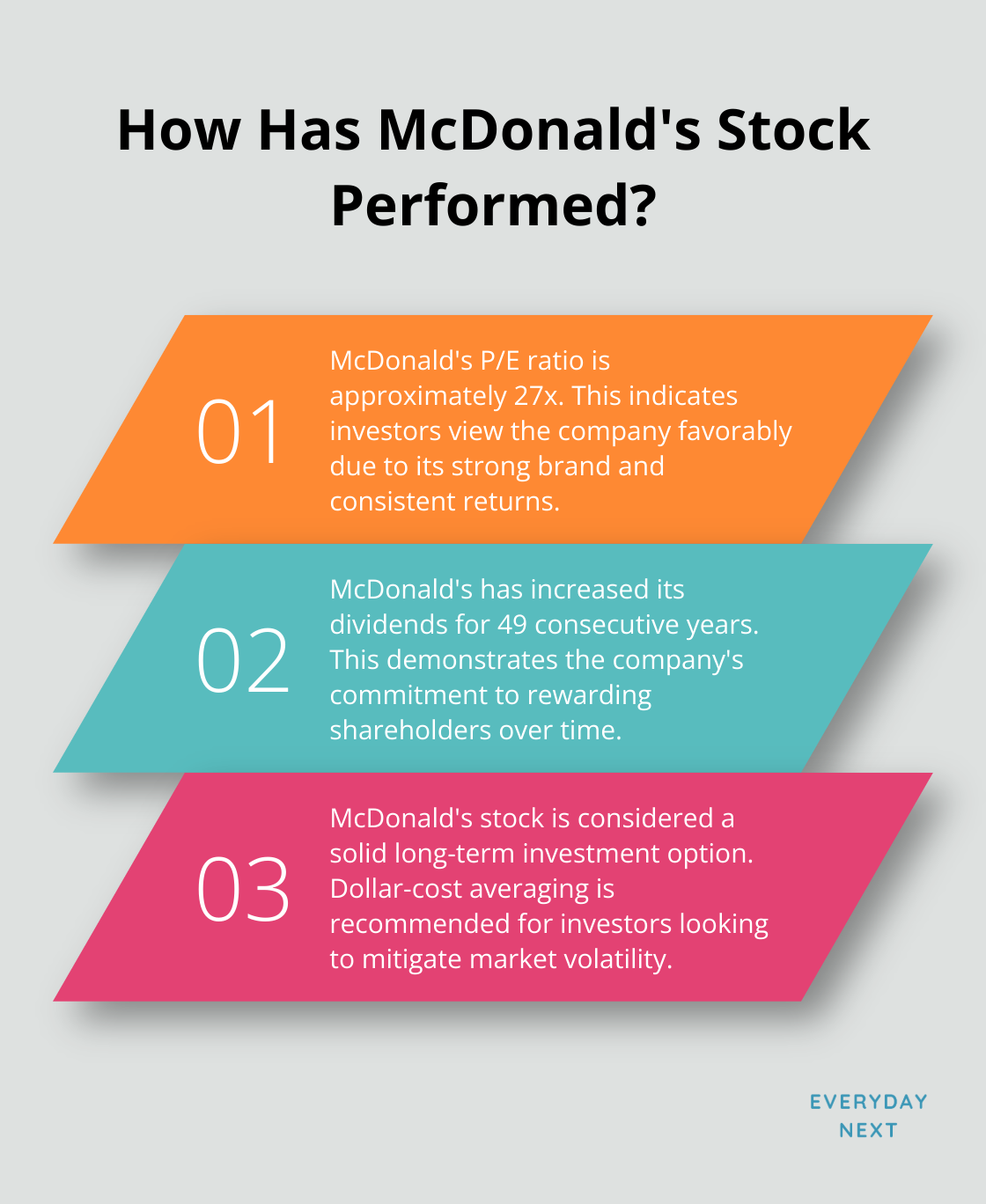

Analyze Stock Performance

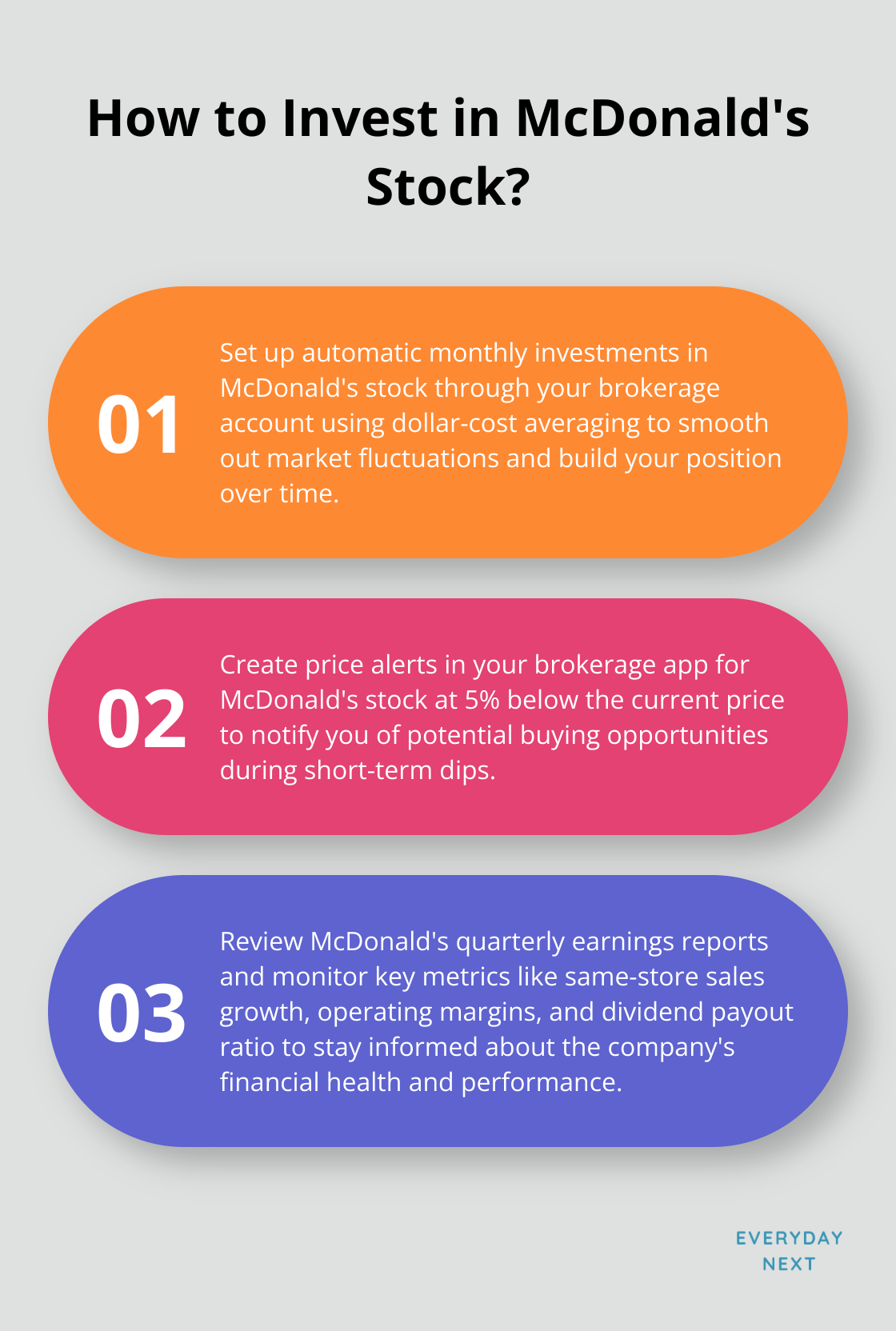

Next up, let’s crunch numbers. The P/E ratio for McDonald’s is hanging around 27x-that’s a bit on the high side. Translation? Investors think this burger joint is gold-thanks to that shiny brand and reliable returns. Plus, they’re handing out dividends like fries… 49 years of consecutive hiking. That’s a streak worth noting.

Determine Your Investment Strategy

What’s the game plan? Long-term or short-term? McDonald’s-it’s like the slow-cooked roast of stocks. Solid and steady for long-term holders. For those in for the long haul, dollar-cost averaging is your friend. Consistent investments help you dance around market swings.

Execute Your Purchase

Decision time-head into your brokerage portal, and pop in that ticker symbol: MCD. Choose your lot size. Market order if you’re ready to roll with the current price, or set a limit order for a strategic play. Just getting started? Ease into it. Don’t park all your cash in one drive-thru. Diversification isn’t just a buzzword-it’s wisdom.

Monitor Your Investment

You’ve got the shares. Now, stay in the loop. Set up alerts for McDonald’s earnings reports and major noise in the industry. Watch how McDonald’s molds itself to consumer cravings-because trends shift faster than a drive-thru line. In the next section, we’ll dive deep into the risks and what you need to weigh when holding a slice of the Golden Arches pie.

What Are the Risks of Investing in McDonald’s?

Economic Downturns Impact Performance

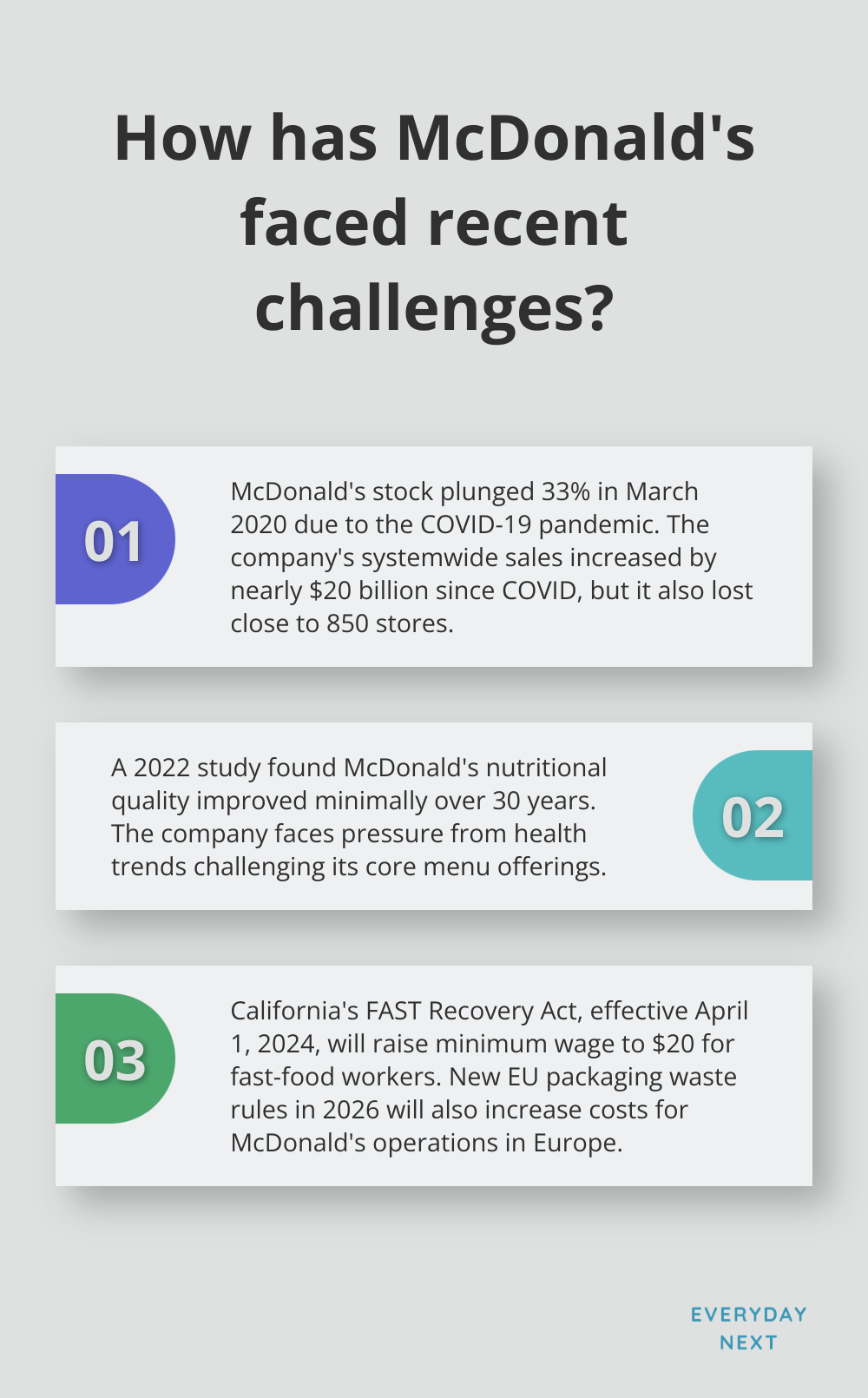

So, you’ve got McDonald’s, right? It’s that steady rock… until the economic seas get rough. Back in the 2008 financial crisis, MCD took a nosedive-down nearly 20%. Surprised? Even those dollar menu fries aren’t recession-proof. Fast forward to the COVID-19 pandemic-ouch. In March 2020, bam… stock plunged 33% in just 30 days. That speaks volumes about how global shocks can rattle this industry.

Competition Threatens Market Share

The fast-food game? Total war zone out there. Burger King, Wendy’s, and even the new kids like Shake Shack-everyone’s fighting tooth and nail for the burger crown. Check this out: start of 2023, McDonald’s systemwide sales surged by nearly $20 billion since COVID hit, but wait… they also lost close to 850 stores. Yikes. Such cutthroat competition is like an ongoing tug-of-war, eating away at McDonald’s market share and profit margins.

Health Trends Challenge Core Menu

And then there’s the health kick-everyone’s swapping burgers for kale smoothies. McDonald’s tries to keep up with salads and lighter bites, but the core menu? Still getting side-eye from the health-conscious crowd. A 2022 study by the Journal of the Academy of Nutrition and Dietetics? Yeah, it said McDonald’s nutritional quality inched forward like a tortoise over the past 30 years. Adapting-faster-could be vital for their growth marathon.

Regulatory Hurdles Increase Costs

Regulations? Like a web tightening around the golden arches. California’s rolling out the FAST Recovery Act on April 1, 2024-$20 minimum wage for fast-food workers. Whoa, that’s gonna hit the payroll big time. Think that’s all? Not even close. Similar laws popping up elsewhere could further cut into their bottom line.

And let’s not forget environmental red tape. The EU says, “Hey, how about new packaging waste rules in 2026?”-anchored with substantial costs. McDonald’s will have to rethink its whole packaging playbook in Europe. Pricey, to say the least, affecting those profit numbers.

Supply Chain Disruptions Threaten Operations

The global supply chain is like a massive, tangled yarn ball-and McDonald’s sits right in the middle of it. Case in point: 2021… milkshake ingredient shortage in the UK, thanks to Brexit hiccups. Talk about leaving customers shaking (pun intended) in frustration without their creamy fix. Disruptions like that? They can halt menu items in their tracks, leading to unhappy diners and dipping sales.

Final Thoughts

Considering McDonald’s stock as your gateway to the stock market? Not a bad idea. Global footprint? Check. Brand recognition? Absolutely. Dividend growth? You got it. It’s like a financial Big Mac with a side of stability. But – and it’s a big but – can we just pause and acknowledge the elephant in the room? Economic shifts, cut-throat competition, and that sneaky consumer preference merry-go-round could throw a wrench into McDonald’s otherwise solid stock gears.

So, here’s how you play it smart: Dive into those financial reports like you’re finding Waldo, and keep an eagle eye on industry trends and the latest buzz around Mickey D’s operations. Keep tabs on innovations, because let’s face it, McDonald’s isn’t just about burgers anymore. And those consumer habits – anything from kale to sustainability – keep changing faster than the latest TikTok trend.

Sure, McDonald’s could jazz up your portfolio, but don’t go all-in like a slot machine rookie. Balance is key. Spread your chips around different sectors to keep your risk in check. Want more nuggets of wisdom on personal finance and investing? Swing by EverydayNext for resources that’ll make you the Sherlock Holmes of your financial domain.

Thomas powell jr

How much is my stock investment in McDonald’s