How to Invest in NVIDIA: A Beginner’s Guide

Table of Contents

NVIDIA — yeah, it’s a beast in the tech world. They’ve pretty much put innovation on steroids across AI, gaming, you name it. Over at Everyday Next, we see folks practically salivating to hitch a ride on this company’s gravy train.

So, you’re thinking about diving into NVIDIA? Buckle up, you’re in the right spot. This guide is like your GPS — and we’ll steer you through the nuts and bolts of NVIDIA’s business engine, decode their financial wizardry, and map out the whole shebang of investment routes — especially for those still in the financial kiddie pool. Enjoy the ride.

What Drives NVIDIA’s Success?

The GPU Goldmine

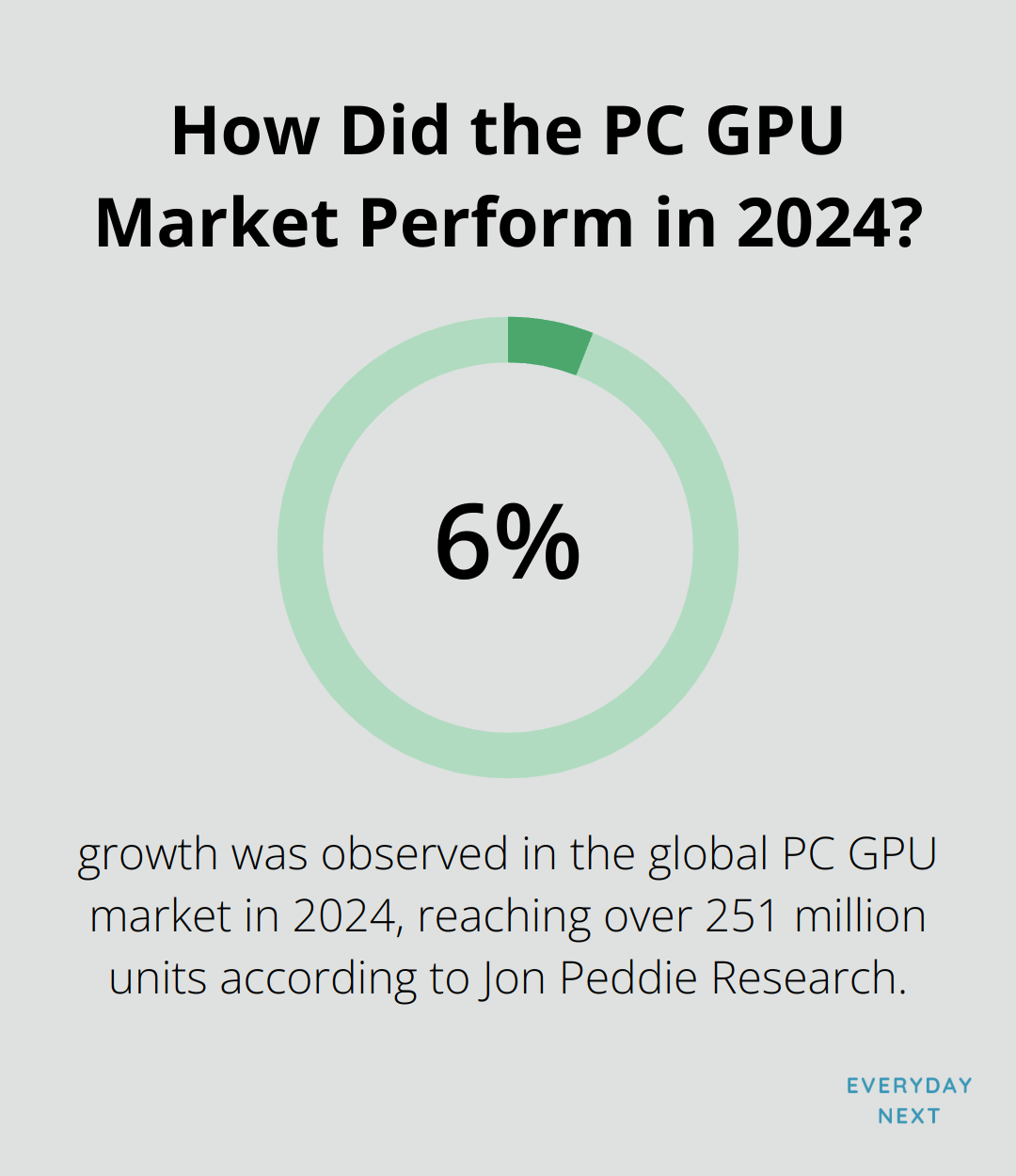

NVIDIA, folks… it’s like the Willy Wonka of GPUs and AI tech-constantly cooking up golden tickets. At its core, cemented in every pixel and algorithm, is the sweet spot: GPUs. Originally just bling for video game graphics, these silicon maestros now might as well conduct the whole digital orchestra. GeForce series? Cash cow. Jon Peddie Research says in 2024, the global PC GPU market blew past 251 million units. A nice 6% climb-who doesn’t love a good growth story?

Here’s where they flip the script-these GPUs aren’t just for gaming anymore. They’re moonlighting in data centers, scientific labs, and-wait for it-cryptocurrency mining. It’s a buffet of revenue streams… diversify or die, right?

AI and Data Center Dominance

Look where the real action’s at-a data center boom. NVIDIA’s GPUs are the star quarterbacks for AI and machine learning… crushing it. FY 2024’s revenue? Up a staggering 126% to $60.9 billion. NVIDIA’s revenue is like a rocket.

CUDA’s their secret weapon-empowering developers everywhere to harness GPUs for a whole range of tasks. It’s the gold standard in AI dev, burgeoning an ecosystem so sticky you’d think it was made of industrial-strength glue.

Beyond Hardware: Software and Services

NVIDIA didn’t stop at just chips. They’ve built out a robust software suite-machine learning, analytics, all juiced up to run on GPUs. It’s like adding secret sauce to their technology… harder to knock off, deeper moat.

And then there’s the play for cloud gaming with GeForce NOW and those futuristic wonders in autonomous driving tech with NVIDIA DRIVE. Smaller slices of the pie, sure-but these areas? They’re potential rocket pads for future growth, showing that NVIDIA’s got innovation on lock.

Future-Proofing the Business

The game plan? NVIDIA’s all about stretching those GPU boundaries like a digital yoga master. They’re staking out new markets, becoming the go-to disruptors in cutting-edge tech fields. For investors, getting into the weeds of NVIDIA’s business style… it’s crucial to see their ongoing push for growth and absolute market power.

As we roll onward, diving deeper into NVIDIA’s financial metrics will offer insights into how this innovation train translates into bottom lines and shareholder love. Giddyup.

NVIDIA’s Financial Powerhouse

Record-Breaking Revenue

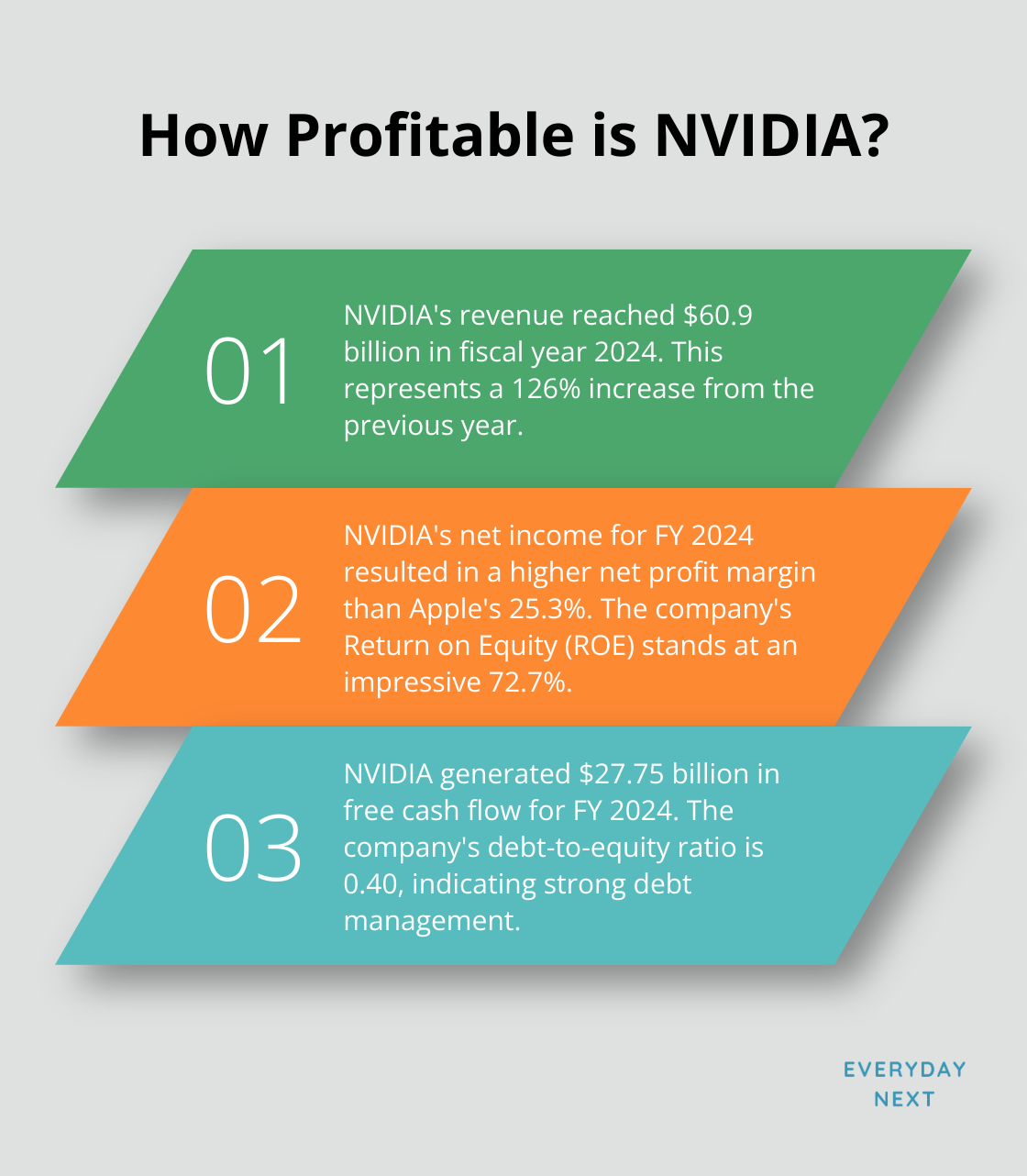

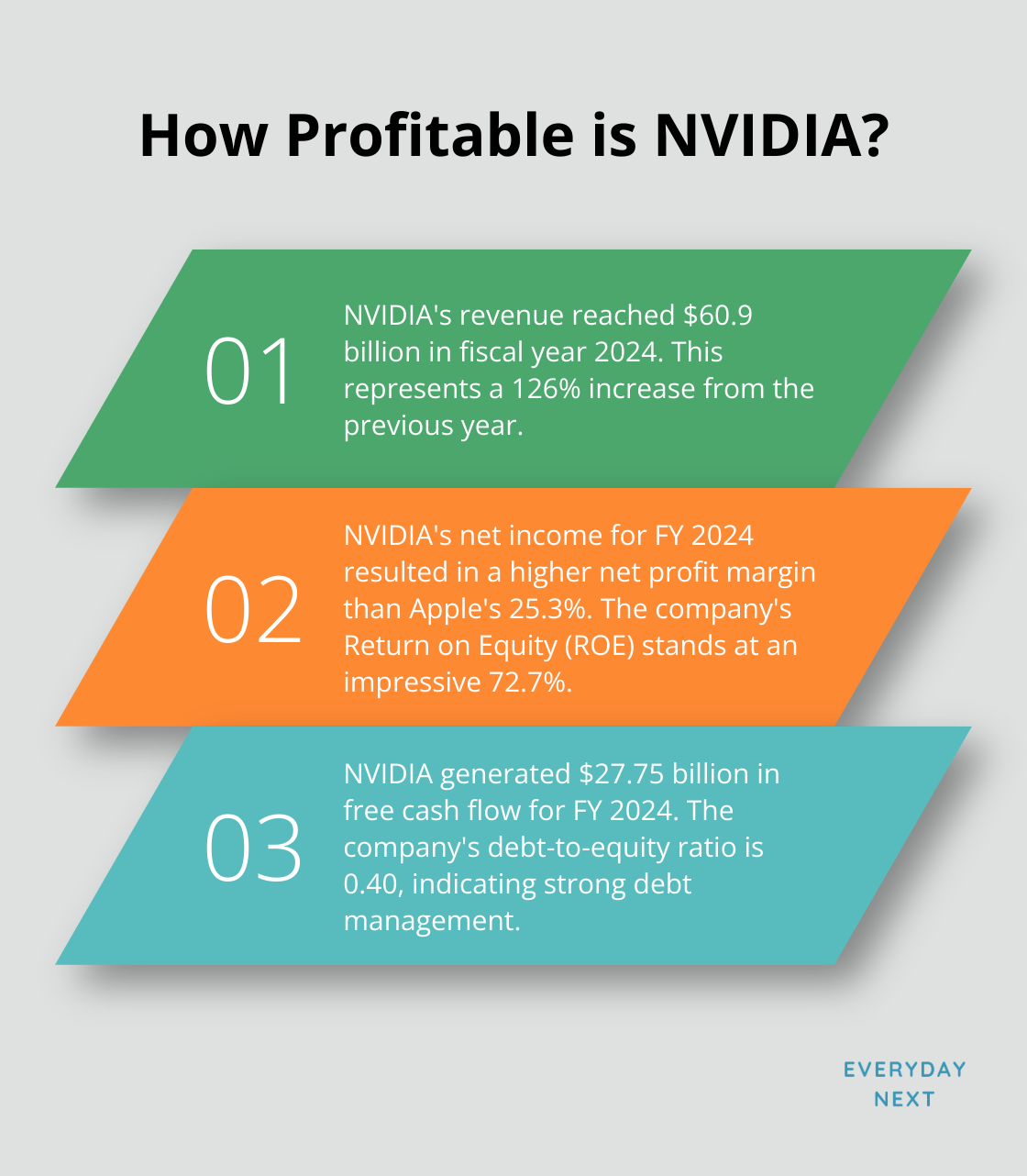

NVIDIA – the financial juggernaut of our time. In fiscal year 2024, they posted eye-popping revenue numbers: $60.9 billion. That’s a whopping 126% jump from last year. Wow. And you thought tech growth was slowing down? Think again.

Profitability That Turns Heads

Talk about making money hand over fist – NVIDIA’s net income for FY 2024 didn’t just rise; it skyrocketed. We’re talking a net profit margin most companies can only dream of, especially in the cutthroat tech sector. Apple’s the usual suspect when we think “profitable tech,” with a neat 25.3% net margin. NVIDIA’s likely chuckling.

Key Metrics to Watch

When it comes to NVIDIA’s playbook – check out these:

- Price-to-Earnings (P/E) Ratio: In the here and now, February 2025, NVIDIA’s P/E is chillin’ at 34.5. Seems pretty tame, especially with their rocket-like growth and clout in the market.

- Return on Equity (ROE): At a jaw-dropping 72.7%, NVIDIA signals they’re spinning shareholders’ doubloons into pure gold. Efficiency, thy name is NVIDIA.

- Debt-to-Equity Ratio: With a debt-to-equity ratio sitting at 0.40, NVIDIA’s not just playing it safe – they’re schooling the competition in debt management.

- Free Cash Flow: $27.75 billion in free cash for FY 2024. That’s not just a lot-it’s a fortress, which they can use for R&D, snatching up acquisitions, and making shareholders smile.

Leaving Competitors in the Dust

NVIDIA doesn’t just compete; they bury the competition. Look at AMD, their closest rival, dragging in $22.68 billion in 2023. That’s peanuts compared to NVIDIA. Intel? A big name, sure, but a big struggle too – $54.2 billion in revenue coupled with a $7.0 billion loss. Yikes.

When the conversation turns to the AI chip market… it’s a landslide. NVIDIA’s AI accelerators command the field with a 70-95% market share. Google’s TPUs and Amazon’s Trainium chips? They’re picking up the crumbs.

Fueling Future Growth

NVIDIA’s a money-making machine not just today, but tomorrow too. They’re in high-margin sectors with a speed that’s dizzying. With their cash trove, they’re pummeling money into R&D – $7.34 billion worth in FY 2024 – and making smart buys, locking in their spot as market boss.

To those thinking about jumping on the NVIDIA train: the numbers suggest a powerhouse at full steam, with a long track ahead. But let’s not get cocky – past wins aren’t a blueprint for future profits. Keep an eye on those quarterly reports and forecasts. You don’t want surprises derailing your plans.

As you mull over investment routes in NVIDIA’s game, remember these metrics. They’re not just numbers; they’re the roadmap to understanding both opportunity and risk.

How to Invest in NVIDIA: Your Options Explained

Direct Stock Purchase

So, you want a piece of the NVIDIA pie? Easy, just buy directly through any brokerage account. NVIDIA stock is available at all your typical go-tos-Charles Schwab, Fidelity, Robinhood… you name it. Fund your account, punch in that order (ticker: NVDA), and voilà!

Here’s a nugget of wisdom: think about dollar-cost averaging. Basically, it’s like investing on autopilot-a set amount, regular intervals, no matter what the stock’s doing. Over time, this can help flatten those market roller coasters and maybe even cut down what you’re forking out per share.

ETFs: Diversification Made Easy

Not quite ready to go all-in on NVIDIA? No worries. We’ve got ETFs for that. The Invesco QQQ Trust (QQQ) and VanEck Semiconductor ETF (SMH) serve up a chunk of NVIDIA plus other tech titans.

ETFs are like a buffet for your investments-instant diversification (a risk-management must-have). Plus, they’re lighter on the wallet for small investors compared to those high-maintenance managed funds.

Options Trading: For the Bold Investor

Ready to take a walk on the wild side? Options trading is the playground for leverage and flexibility if you’ve got some experience under your belt. Harness long calls and puts for those nail-biting directional gambles, while covered calls and cash-secured puts can pad your wallet.

Some go-tos:

- Covered Calls: Turn your NVIDIA stash into a paycheck by selling call options.

- Bull Call Spreads: Hitch a ride on NVIDIA’s upward train but with a safety net.

- Cash-Secured Puts: Bag NVIDIA at a discount or pocket that sweet premium income.

Heads up: Options aren’t child’s play, folks. They come with complex moves and sky-high risks. Dive into options only after you’ve done your homework and got your risk management blueprint sorted.

Risk Management

Risk? That’s just part of the deal, my friend. NVIDIA might be a rock star now, but history’s no crystal ball. Arm yourself with knowledge, know your risk appetite, and for Pete’s sake, invest only what you won’t miss if it vanishes.

Bottom line: Sync NVIDIA with your broader financial dreams and tolerance for risk. Whether it’s straight-up stock buys, ETFs, or playing the options game, base your actions on what fits your unique financial landscape.

Final Thoughts

NVIDIA’s gone from a graphics card company to an AI titan – quite a narrative. It’s not just that they’re dominating GPUs; they’re muscling into AI and data centers like nobody’s business. This puts them in the tech world’s heavyweight division. Their financial numbers? Off the charts. We’re talking massive revenue spikes and insane profitability. No wonder investors are all over them.

But here’s the deal… investing in NVIDIA ain’t just about recognizing their stock ticker like a pro. It’s about figuring out if your financial goals, risk appetite, and investment strategy line up. Whether you’re snapping up NVIDIA stocks straight up, diving into ETFs, or taking a crack at options trading, it all comes with its own set of thrills and spills.

The folks at Everyday Next are like your personal finance GPS. We’re here to help you steer through the maze of investing and personal finance. Dive into our treasure trove of resources at Everyday Next to get the lowdown on investing in NVIDIA and to power up your investment smarts.