How to Invest Money for Beginners: A Simple, No-Nonsense Guide

Getting started with investing really boils down to three key moves: build a financial safety net, pick a low-cost investment account, and then buy diversified, long-term investments like index funds. That's the core strategy. It cuts through the noise and helps you begin building wealth, even if you’re not starting with a lot of cash.

Why Investing Now Is More Accessible Than Ever

If you’ve ever thought investing was some exclusive club with a secret handshake, think again. Those days are long gone. Today, anyone with a smartphone and a few bucks to spare can start building a portfolio.

The real magic isn't in trying to time the market or picking the next big "it" stock. It's about letting your money work for you through the power of compound growth.

Think of it like a snowball rolling downhill. Your initial investment earns a return, and pretty soon, those returns start earning returns of their own. Give it enough time, and this cycle can turn small, regular contributions into some serious wealth.

The Digital Shift in Investing

Modern tech has completely democratized personal finance. Apps and online platforms have torn down the old walls, making it cheaper and easier than ever to get in the game.

You can really see this shift with younger investors. A World Economic Forum report found that 30% of Gen Z starts investing as young adults. That’s a huge leap from the 9% of Gen X who did the same. This wave is driven by user-friendly digital tools and a growing hunger for financial know-how. You can dive deeper into these trends in their Global Retail Investor Outlook.

What does this mean for you? The tools you need are literally in your pocket. You don't need a fat checkbook or a personal broker to get started. The Fintech revolution continues to reshape digital payments and investment access, putting you in the driver's seat.

Your Path Forward

This guide is your roadmap. I’m going to walk you through the fundamentals of smart investing, minus all the confusing jargon.

Here’s what you’ll learn how to do:

- Set Clear Financial Goals: Figure out why you're investing. Is it for retirement? A down payment on a house? Or just plain financial freedom?

- Understand Your Options: We’ll demystify stocks, bonds, and funds so you can confidently choose what makes sense for you.

- Build a Simple Portfolio: You’ll see how to put together a diversified portfolio that’s built for the long haul.

The most powerful force in the universe is compound interest. Your greatest asset as a beginner is time, allowing even small investments to grow substantially. Starting now is more important than starting with a large amount.

For a great, comprehensive look at getting started, a resource like this How to Start Investing as a Beginner: Easy Step-by-Step Guide is incredibly helpful. My goal here is to give you the confidence to take control of your financial future, no matter what your starting point looks like.

Build Your Financial Foundation Before You Invest

It’s easy to get caught up in the excitement of investing, but diving in without a solid base is like building a house on sand. From my experience, the most successful investors are the ones who took the time to build a strong financial foundation first.

This foundation is your safety net. It’s what protects you from making panicked decisions and gives your investments the breathing room they need to grow without interruption. Think of it this way: investing is for building future wealth, not for patching up today's emergencies. When you get those two things mixed up, you're setting yourself up to fail. Let's cover the three pillars you need to put in place.

Secure Your Emergency Fund

Your emergency fund is non-negotiable. It’s a cash reserve you can get to quickly for all of life's unpleasant surprises—a layoff, a surprise medical bill, or a busted transmission. Without it, you’ll be forced to sell your investments at the worst possible time, likely locking in a loss just to cover the unexpected cost.

The classic rule of thumb is to save 3 to 6 months' worth of essential living expenses. That means enough cash to cover your rent or mortgage, utilities, groceries, and car payment if your income suddenly stopped.

Real-Life Example: The Car Breakdown Test

Let’s say you put $5,000 into the market. A month later, stocks dip 10%, and your investment is now worth $4,500. Then, your car breaks down, and the repair bill is $2,000. Without an emergency fund, your only option is to sell your investments at a loss. But with a well-funded emergency account, you simply pay for the repair with cash and leave your portfolio alone, giving it time to recover and eventually grow. This one step protects your entire investment strategy.

Don't put this money in the stock market. A high-yield savings account is the perfect place for it. It keeps your money safe and liquid while earning a decent bit of interest. If you want to dive deeper, you can explore guides that explain how to maximize your cash with high-yield savings.

Conquer High-Interest Debt

Not all debt is a four-alarm fire, but high-interest debt is. I’m talking about credit card balances and personal loans that are actively working against you. The interest rates are often so high that they can cancel out, or even exceed, any gains you might make in the stock market.

Think about it: paying off a credit card with a 22% APR is the same as getting a guaranteed, tax-free 22% return on your money. Compare that to the S&P 500's long-term average return of about 10% per year, which is anything but guaranteed. The math is pretty clear. Tackling that debt first is a huge financial win. For many people, checking out proven ways to get out of debt is the most powerful first step they can take.

Here's a simple breakdown of where your money makes the biggest impact:

| Action | Potential Annual Return | Risk Level |

|---|---|---|

| Paying off 22% APR Credit Card Debt | Guaranteed 22% | Zero Risk |

| Investing in an S&P 500 Index Fund | Average ~10% | Moderate Risk |

The table makes it obvious. Make it your mission to wipe out that high-interest debt before you start putting serious money into investments.

Define Your Investment Goals

Okay, so why are you even investing in the first place? A vague goal like "I want to make more money" isn't going to cut it. You need to get specific because your goals will dictate your entire investment strategy, from your timeline to how much risk you're comfortable with.

The S.M.A.R.T. goal framework is a fantastic tool for this:

- Specific: What, exactly, are you saving for? (e.g., a down payment on a house)

- Measurable: How much money will you need? (e.g., $50,000)

- Achievable: Is this goal realistic for you right now?

- Relevant: Does this goal truly matter to your life plan?

- Time-bound: When do you need to have the money? (e.g., in 5 years)

Your timeline is the most important piece of the puzzle. Saving for a down payment in five years demands a very different, more conservative approach than saving for retirement in 30 years. For a short-term goal, you need to protect your principal. But for a long-term goal like retirement, you can afford to take on more risk for higher potential returns, since you have decades to ride out the market's ups and downs.

Decoding Your Core Investment Options

With a solid financial game plan in place, it's time to get to the good stuff: the actual investments. The investing world loves its jargon, but don't let that intimidate you. For beginners, it really boils down to just a few core building blocks.

Think of it like building a team for a long season. You can't just have star quarterbacks; you need a strong defense and reliable special teams, too. Your investment portfolio works the same way—different assets play different roles, and understanding them is your first step toward building a winning strategy.

Stocks: The Growth Engine

When you buy a stock, you're literally buying a small slice of a publicly-traded company like Apple, Amazon, or Target. If the company does well—making more money and expanding its business—your slice of the pie becomes more valuable. This is why stocks are the undisputed engine for building serious wealth over the long haul.

Of course, that potential for big gains comes with more risk. A company’s fortunes can turn on a dime, and stock prices can fall just as quickly as they rise. Pouring all your money into one company is like betting your entire season on a single player—it’s a high-stakes move that requires deep research and nerves of steel.

Bonds: The Stabilizer

If stocks are your offense, think of bonds as your defense. When you purchase a bond, you're essentially lending money to a government or a corporation. In exchange for your loan, they agree to pay you regular interest payments and then return your original investment (the "principal") when the loan term is up.

Bonds are generally a whole lot safer than stocks. Their main job in a beginner's portfolio is to add stability and a predictable income stream, acting as a crucial shock absorber when the stock market gets turbulent. The trade-off is that their potential for high returns is much lower, but their ability to reduce your overall portfolio risk is priceless.

Funds: The All-in-One Team

Here's the secret: most beginners shouldn't be picking individual stocks or bonds at all. A much smarter approach is to buy them bundled together in a fund.

Funds pool money from thousands of investors to buy a huge collection of different assets. The two most popular and beginner-friendly types are Exchange-Traded Funds (ETFs) and index funds.

An ETF or index fund that simply tracks a broad market index, like the famous S&P 500, is a brilliant place to start. Instead of trying to find the one winning company, you’re essentially betting on the long-term success of the entire U.S. economy. This gives you instant diversification—the single best tool for managing risk. You can dig deeper into investing in the S&P 500 index to see exactly why it's such a go-to for investors at every level.

Key Takeaway: For over 90% of new investors, low-cost index funds or ETFs are the simplest and most effective way to start. They take the guesswork out of picking stocks and give you broad market exposure for a tiny fee.

Comparing Common Investment Types for Beginners

Seeing the main options side-by-side really helps clarify their roles. This simple table breaks down the core investment types so you can see where they might fit into your own strategy.

| Investment Type | What It Is | Typical Risk Level | Potential Return | Best For |

|---|---|---|---|---|

| Individual Stocks | A share of ownership in a single company. | High | High | Experienced investors who can thoroughly research and analyze companies. |

| Bonds | A loan made to a corporation or government. | Low | Low | Reducing portfolio volatility and generating predictable income. |

| ETFs & Index Funds | A basket of hundreds or thousands of stocks or bonds. | Medium | Medium | Beginners seeking instant diversification and long-term, market-based growth. |

As you can see, funds strike a perfect balance. They let you tap into the stock market's growth potential while smoothing out the stomach-churning volatility that comes from owning just a few individual stocks. This middle-ground approach is exactly what most new investors need to stay confident and build wealth for the long term.

Choosing the Right Investment Account for You

Picking your investments is the fun part, but where you hold them can make a massive difference over time. Think of an investment account as the "container" for your stocks, bonds, and funds.

The right container can shield your money from taxes, letting it grow much faster. The wrong one might come with tax headaches and fewer benefits. Getting this right from the start is a huge leg up.

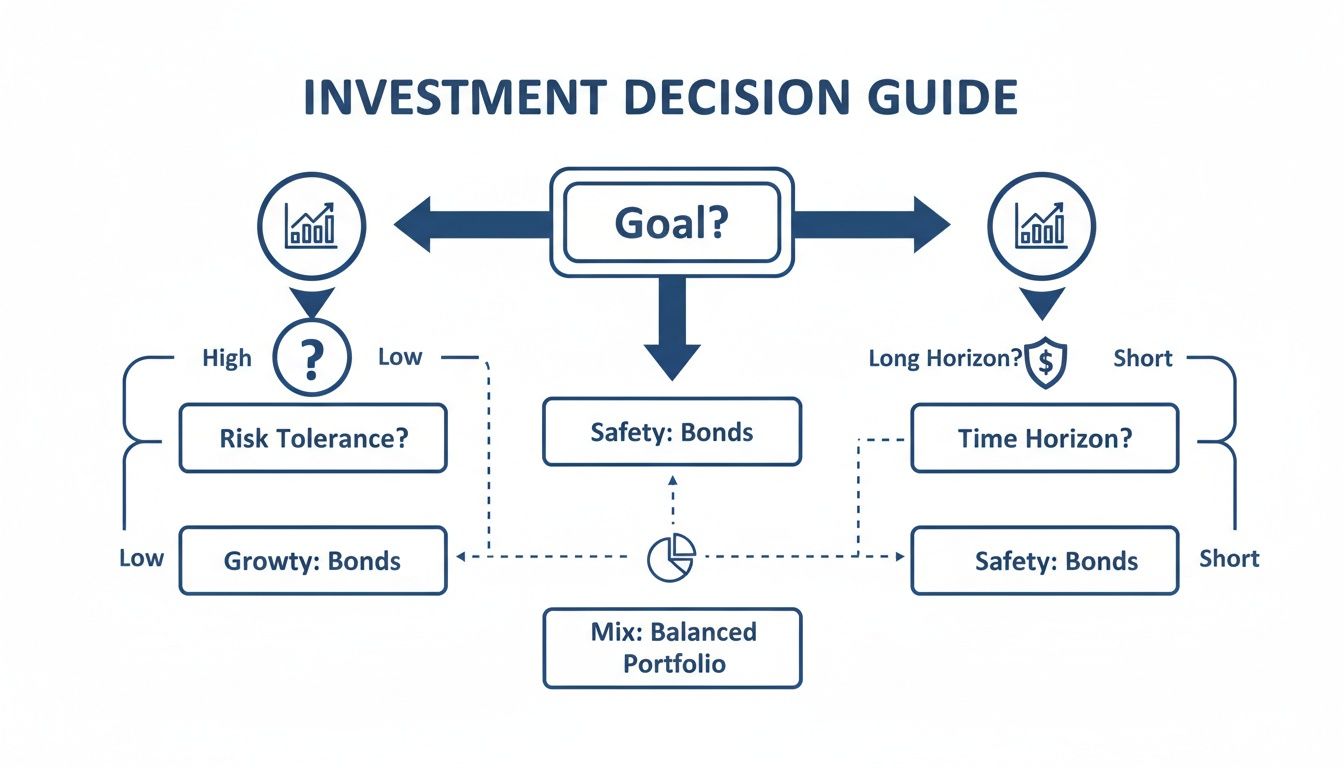

This decision guide helps map out how your goals, timeline, and comfort with risk all point toward different investment mixes.

As you can see, there’s a clear path forward whether you’re aiming for aggressive growth, playing it safe, or looking for something in between.

Taxable vs. Tax-Advantaged Accounts

Investment accounts basically come in two flavors:

-

Taxable Brokerage Account: This is your do-anything, flexible account. You can put in as much money as you want and pull it out whenever you need it, no questions asked. The catch? You have to pay taxes on your investment gains and dividends every year.

-

Tax-Advantaged Retirement Accounts: These are accounts like a 401(k) or an IRA. The government gives you some pretty sweet tax breaks for using them, but in return, there are rules about how much you can contribute and when you can take the money out without penalty.

For anyone just starting, using tax-advantaged accounts is a game-changer. When your money can compound year after year without a tax drag, the growth can be explosive. It's one of the most powerful wealth-building tools you have.

Meet the Main Players: Real-Life Scenarios

Let’s break down the most common accounts and see who they’re a good fit for. The right choice for a 25-year-old just starting out is totally different from what a 40-year-old freelancer might need.

Let’s look at a couple of real-world scenarios:

-

Priya, 25, Staff Accountant: She has a 401(k) at her new job that offers an employer match. Her first move, without a doubt, should be to contribute enough to get that full match. It's a 100% return on her money—literally free money. After that, her best bet is opening a Roth IRA. Her income is lower now than it will likely be in the future, so paying taxes today means decades of tax-free growth and, crucially, tax-free withdrawals when she retires. It’s an incredible deal.

-

David, 40, Self-Employed Designer: David is his own boss, so no 401(k) for him. Instead, a SEP IRA is a fantastic option. It lets him contribute a significant chunk of his income (up to 25%, not to exceed $69,000 in 2024) and get a tax deduction for it now, which is a big help in lowering his current tax bill.

The single best move for most young investors is to contribute to a 401(k) up to the employer match, then max out a Roth IRA. This simple two-step process combines free money with future tax-free growth.

Investment Account Showdown: Brokerage vs. Roth IRA vs. 401(k)

Sometimes a simple side-by-side comparison is the best way to see how these accounts stack up. I put together this table to quickly highlight the key differences and help you figure out where to start.

| Account Type | Tax Advantage | Contribution Limit (2024) | Primary Goal | Flexibility |

|---|---|---|---|---|

| Brokerage | None. Taxed annually. | Unlimited | Any goal (short or long-term) | Very High |

| Roth IRA | Tax-free growth & withdrawals | $7,000 ($8,000 if 50+) | Retirement / Long-Term | Medium |

| Traditional 401(k) | Tax-deductible contributions | $23,000 ($30,500 if 50+) | Retirement | Low |

Each account has its own strengths, so the "best" one really depends on what you're trying to accomplish. Often, a combination of accounts is the smartest strategy as your income and goals evolve.

If you're looking for a more hands-off approach, plenty of platforms can help automate this process. You can learn more about how AI-powered investing through robo-advisors can simplify how you manage these different accounts.

Ultimately, it comes down to choosing the account that fits your financial goals and tax situation like a glove.

How to Build Your First Simple Portfolio

Alright, this is where the theory turns into action. Building your first portfolio is way less intimidating than it sounds. In fact, for most people just starting out, keeping it simple is the smartest move you can make.

The biggest mistake I see beginners make is obsessing over finding the "next big stock." The real secret to long-term success isn't picking individual winners; it's deciding how to spread your money across different types of investments. This concept is called asset allocation, and it's the bedrock of a solid financial future.

Think of it like building a well-balanced meal. You need your proteins, carbs, and veggies. Your portfolio is no different—it needs a mix of assets to grow steadily without giving you an ulcer every time the market has a bad day.

The Power of the Three-Fund Portfolio

One of the most battle-tested and respected strategies out there is the "Three-Fund Portfolio." I love it because it’s brilliantly simple, yet it gives you instant, global diversification with just three low-cost funds. It’s a set-it-and-forget-it approach that has worked for millions.

With this strategy, you're buying a small piece of the entire global economy. This means you’re not betting the farm on one company or even one country.

Here’s a breakdown of the three core ingredients:

- Total U.S. Stock Market: This fund gives you a slice of thousands of American companies, from household names like Apple to smaller up-and-comers. A classic choice is an ETF like the Vanguard Total Stock Market ETF (VTI).

- Total International Stock Market: Investing isn't just a U.S. game. This fund captures growth from established and emerging economies all over the world. The Vanguard FTSE All-World ex-US ETF (VXUS) is a go-to for this.

- Total U.S. Bond Market: Think of this as your portfolio's shock absorber. Bonds provide stability and a cushion when the stock market gets rocky. An ETF like the Vanguard Total Bond Market ETF (BND) is a perfect fit.

A quick note on going global: it’s a smart hedge. Research from Morningstar.com suggests that as of mid-2025, non-US stocks are looking particularly attractive. Some experts even predict they'll outperform U.S. stocks in the coming decade. A good starting point for beginners is to put 20-40% of their stock allocation into international funds.

A Real-World Example: The 30-Year-Old Investor

Let's make this crystal clear. Say you're 30 years old with a long career ahead of you. You can afford to take on a bit more risk for more growth potential. Your simple three-fund portfolio might look like this:

| Investment Component | Ticker Symbol Example | Percentage Allocation | What It Does for You |

|---|---|---|---|

| U.S. Stocks | VTI | 50% | Captures the growth of the entire U.S. economy. |

| International Stocks | VXUS | 30% | Taps into thousands of global companies. |

| U.S. Bonds | BND | 20% | Acts as a stabilizer, reducing overall portfolio swings. |

With just these three funds, you effectively own a piece of nearly every public company and bond on the planet. This is what powerful diversification looks like. To really grasp why this matters so much, our guide on how to diversify your portfolio breaks it down even further.

Automate Your Success with Dollar-Cost Averaging

Once you've picked your funds, the real key is consistency. The easiest and most effective way to stay consistent is a technique called dollar-cost averaging. All this means is investing a set amount of money on a regular schedule—say, $100 every single month—regardless of what the market is doing.

This simple habit is a game-changer for two big reasons:

- It takes emotion out of the equation. No more trying to "time the market." You just invest like clockwork.

- It helps you buy low. When the market is down, your fixed $100 buys more shares. When it's up, it buys fewer. Over time, this can lower your average cost per share and boost your returns.

Beginner's Action Plan: Log into your brokerage account and set up an automatic transfer of $100 (or whatever you can afford) from your bank every month. Then, set up automatic investments into your three funds according to your percentages. Now, you can get on with your life while your money works for you.

Now for the Hard Part: Sticking With It

Alright, you've built your portfolio. The initial work is done. Now comes the real challenge, and it has nothing to do with picking the perfect fund—it's all about managing your own head.

Honestly, the biggest hurdles for new investors are almost always emotional. It’s incredibly tempting to hit the panic button and sell everything when the market takes a nosedive. It's just as tempting to jump on a hot stock after it's already shot to the moon. Giving in to fear and greed is the fastest way to blow up your financial plan. The real secret to building wealth is discipline. It's about having a long-term view and trusting your strategy.

The Simple Art of Rebalancing

Over time, your portfolio is going to drift. Your stocks might have a fantastic year and suddenly make up 70% of your portfolio, throwing your original 60/40 plan completely out of whack. When that happens, you’re taking on way more risk than you signed up for.

This is where rebalancing saves the day. It sounds complicated, but it's not. Once a year, just log in and nudge things back into place.

- Did stocks shoot up? Sell a few shares and use that money to buy more of whatever lagged, like your bonds.

- Did stocks take a hit? Sell some of your bonds (which likely held their value) and buy more stocks while they're on sale.

This simple, mechanical process is brilliant because it forces you to "buy low and sell high" without any emotion. It’s a powerful habit that keeps your portfolio aligned with your goals.

Watch Out for Those Sneaky Fees

Fees are the silent killer of investment returns. A tiny percentage might look harmless, but compound that over 30 or 40 years, and it can literally cost you tens, if not hundreds, of thousands of dollars. The main culprit to watch for is the expense ratio.

This is the annual fee a fund charges, shown as a percentage of your investment. When you're comparing two similar index funds, the one with the lower expense ratio wins. For basic, broad-market index funds, you shouldn't be paying more than 0.10%. Seriously.

Think a 1% fee is no big deal? On a $10,000 investment growing at 7% a year, that 1% fee could leave you with nearly $30,000 less after 30 years compared to a fund charging just 0.10%. Fees matter. A lot.

Trust the Process and Don't Tinker

The market will go up and down. That’s a guarantee. To help you ride out those waves, a healthy allocation to bonds is a beginner's best friend. As J.P. Morgan's latest outlook points out, Treasury yields are looking pretty good, and a classic 60/40 portfolio has historically offered decent returns with about half the wild swings of an all-stock portfolio. Check out the full J.P. Morgan Mid-Year Outlook for a deeper dive.

Adding a simple bond ETF like the iShares Core US Aggregate Bond (AGG) can act as a shock absorber, giving you the stability to stay in the game when things get rocky.

If I could leave you with one piece of advice, it would be this: put your investments on autopilot, check them as little as possible, and let the system work. Set up those automatic monthly contributions and then go live your life. Resisting the urge to react to every scary headline is how you win in the long run.

Frequently Asked Questions (FAQ)

1. How much money do I actually need to start investing?

Honestly, you can get started with as little as $1. It's a common myth that you need a small fortune to begin. Modern brokerage apps have no account minimums and allow you to buy fractional shares—tiny slices of expensive stocks or ETFs. The goal isn't to start with a huge amount; it's to build the habit of investing consistently.

2. What's the best investment app for a total beginner?

When you're just starting, you want a platform that’s reliable and won’t nickel-and-dime you with fees. For most people, that means sticking with the big, reputable names like Vanguard, Fidelity, or Charles Schwab. They offer a massive selection of low-fee index funds, tons of free educational tools, and a long track record of being trustworthy.

3. Is it safe to invest in the stock market?

Investing always involves risk. However, over the long haul, the stock market has a consistent history of generating positive returns. The key to managing risk is diversification (not putting all your eggs in one basket) and maintaining a long-term perspective of 5+ years. This helps you ride out the inevitable ups and downs.

4. What should I do if the market crashes right after I invest?

First, don't panic. If you've set up your financial foundation properly (with an emergency fund and no high-interest debt), the best move is often to stay the course. Market downturns are a normal part of the cycle. If you are investing automatically every month, a downturn means you are buying more shares at a discount, which can significantly boost your long-term returns.

5. How often should I check my investments?

For long-term investors, the less you check, the better. Obsessively watching your portfolio's daily movements can lead to emotional decisions, like selling at the worst possible time. A quick check-in once or twice a year to rebalance is plenty.

6. What's the difference between an ETF and a mutual fund?

Both are baskets holding many different investments. The main difference is how they trade. ETFs (Exchange-Traded Funds) trade on an exchange just like individual stocks, with prices changing throughout the day. Mutual funds are priced just once per day after the market closes. For most beginners, ETFs are a great choice due to their typically lower fees and greater tax efficiency.

7. Should I invest in individual stocks like Apple or Tesla?

While it can be exciting, it's also far riskier and requires a ton of research. For beginners, the proven strategy is to start with a solid foundation of diversified, low-cost index funds or ETFs. Once that core portfolio is built, you can consider dedicating a very small portion (perhaps 5%) to individual stocks if you're interested in taking on more risk.

8. What is a Roth IRA and why is it so popular?

A Roth IRA is a retirement account where you invest with after-tax money, but all of your withdrawals in retirement are completely tax-free. Decades of investment growth can be pulled out without paying a dime in taxes. For a young investor with a long time horizon, this is an incredibly powerful wealth-building tool.

9. What are expense ratios and why do they matter?

An expense ratio is a small annual fee that a fund charges, expressed as a percentage of your investment. It might seem insignificant, but over decades, even a tiny difference in fees can compound into tens of thousands of dollars lost from your returns. Always aim for funds with the lowest possible expense ratios, ideally under 0.10% for broad-market index funds.

10. Do I need a financial advisor to start investing?

Absolutely not. With today's user-friendly platforms and the availability of simple, low-cost index funds, most beginners can confidently manage their own portfolios. As your financial life gets more complex, it might make sense to consult a professional, but to just get started, you have all the tools you need.

At Everyday Next, we're committed to providing clear, actionable insights to help you navigate your financial journey. Explore our resources to build your knowledge and grow your wealth with confidence. Learn more at https://everydaynext.com.