How to Master Real Estate Basics Quickly

So, let’s tackle real estate—a goldmine wrapped in headaches and tax forms. Everybody says it’s the pathway to wealth, but approach with caution… because it’s a labyrinth of jargon and red tape. At Everyday Next, we’ve thrown together a no-nonsense crash course to cut through the noise.

Here’s the deal: we’re gonna slice and dice the basics, sprinkle in the vocab, and serve up the step-by-step playbook you need to jump into the real estate game. Whether you’re totally green or just dusting off the cobwebs, this guide is your GPS for steering through the real estate jungle with swagger and savvy.

What Drives the Real Estate Market?

Real estate-it’s this living, breathing beast, driven by a mishmash of stuff that can make or break your wallet. Get a grip on what makes this beast tick, and you’re already ahead of the pack.

Location: The Golden Rule

Yeah, location, location, location… it’s not just a worn-out cliché. The vibe of a place, how close it is to cool stuff, and what’s on the horizon for development-these shape property values big time. A study even dug into how being near a light rail in Buffalo, New York, plays the game.

Economic Indicators: The Market Pulse

Keep your finger on the economy’s pulse-job growth, incomes, how many people are sticking around. These, my friends, are the crystal ball of real estate. The National Association of Realtors says a 1% job growth spike means home prices shoot up by 1.5% to 2%. Look at Austin or Seattle-fewer suits, more rocket-fueled property values.

Interest Rates: The Financial Lever

Lower interest rates? Think of them like a cheat code for buying power. The Mortgage Bankers Association sees those 30-year mortgage rates chilling around 3.3% in 2025. Hello, demand… goodbye, bargains.

Supply and Demand: The Market Balance

Inventory’s the name of the game here. Last year, housing supplies hit panic-button lows-just 2.5 months’ worth nationwide. What do you get when there’s more interest than homes? Yup, bidding wars and prices that throw us mere mortals for a loop.

Investment Types and Strategies: Diverse Opportunities

You’ve got different property flavors, each with its own spice mix of risks and perks. Residential properties are the low-hanging fruit for new investors (think single-family homes). On the flip side, commercial spots-offices and shops-offer sweeter returns but demand more pocket depth and know-how.

REITs, though, they’re the twist-getting a slice of the real estate action minus the hassle of owning stuff. Over 25 years, REITs laugh their way past the S&P 500 with a solid 10.5% average annual return.

Market Cycles and Trends: The Big Picture

Real estate’s on a hamster wheel-7-10 years, peak to peak, repeat. We’re seeing folks flocking to the ‘burbs and countryside, with over half of home buyers digging those spots over the urban jungle, per the National Association of Realtors.

Remote work’s a game-changer, too. Zillow found that 75% of people who’ve been working from home aren’t looking back. They want digs with a sweet office setup, thank you very much.

And hello, sustainability, the new cool kid on the block. Homes with green gadgets-solar panels, energy-efficient everything-they’re demanding-and getting!-up to a 10% premium in some markets.

These dynamics don’t just keep you out of the deep end-they point you to the golden doors while everyone else is fumbling around. Nail these insights, and you’re cruising through the real estate maze. Stay tuned, ’cause next, we’re demystifying the jargon of the real estate universe.

Real Estate Lingo Demystified

Real estate jargon-confusing as heck, even for the pros. At Everyday Next, we take a machete to the dense thicket of industry lingo. We’re your GPS in the jungle of property investments. So, strap in as we dive into key terms that’ll have you navigating the property market like you’ve been doing this since birth.

Key Terms to Master

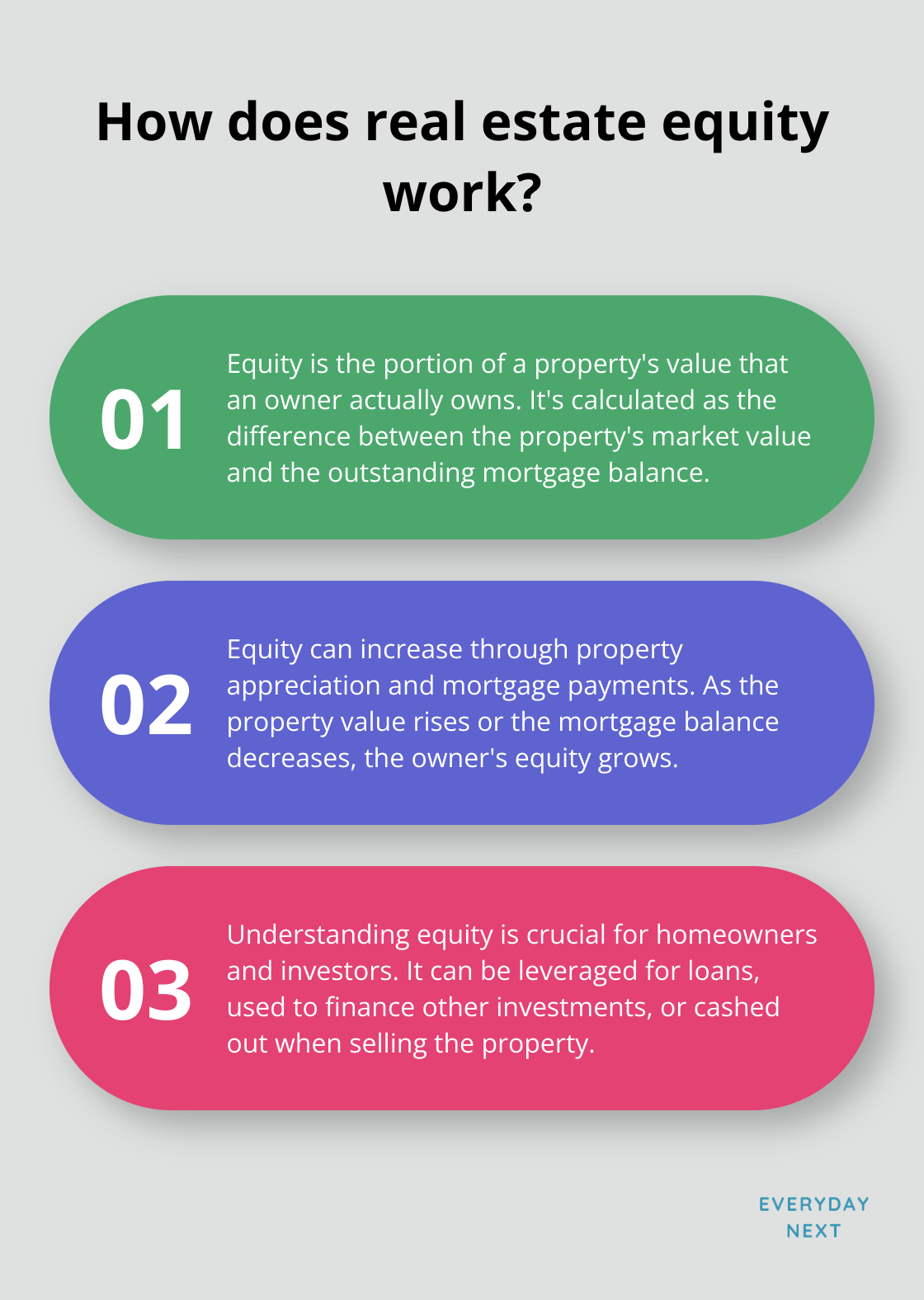

Equity-ah, the cornerstone of real estate mojo. This is the juicy part of the property pie you actually own. It’s the gap between what your property is worth and how much you’ve yet to pay on it.

Appreciation-this is the good stuff-your property’s value going up over time. Like fine wine, but with bricks and mortar.

Cash flow-this is your financial pulse check. It’s the cash left after all expenses are paid. Positive flow? Your wallet smiles. Negative? Hello, headaches.

Cap rate (yep, that’s capitalization rate)-think of it as your crystal ball, estimating potential returns on your investment properties. Take your property’s net operating income, divide it by the current market value, and voilà. High cap rates might mean fatter returns, but watch out-they can come with more risk.

Ownership and Transfer Basics

Property ownership-comes in a delightful spectrum. Fee simple is like getting the full buffet. Leasehold? A taste for a loooong time, but you’re still renting the land.

Deeds-your magic carpet for transferring ownership. Warranty deeds roll out the red carpet of protection, while quitclaim deeds are more like a welcome mat. And when closing the deal? It’s the big finish, folks-keys change hands, and off you go into homeownership bliss.

Financing and Mortgages 101

Mortgages-these bad boys bankroll most property dreams. The loan-to-value (LTV) ratio is the delicate dance of comparing what you borrow to the property’s value. Most lenders draw the line at 80% for conventional loans.

Fixed-rate mortgages-your rate is set in stone for the entire term. Adjustable-rate mortgages (ARMs)-think of them as that wildcard friend who’s unpredictable… rates can change.

Private mortgage insurance (PMI)-the necessary evil for down payments under 20%. It’s the lender’s safety net and your monthly wallet drainer.

Points-think of them as upfront toll fees to snag a lower interest rate (one point = 1% of your loan). To pay or not to pay-that’s the question, depending on your property marathon strategy.

Knowing these terms is like having real estate X-ray vision. Next stop? Practical steps to launch your real estate investment journey. Let’s get you out there, turning dreams into deeds.

How to Start Investing in Real Estate Today

Real estate investing-it’s like the siren call of financial freedom. At Everyday Next, we lay down the roadmap to kickstart your journey. First order of business: Define those investment goals. Are you in it for long-term appreciation or chasing that quick cash flow? Your answer… well, it shapes the entire strategy.

Investment Strategies for Beginners

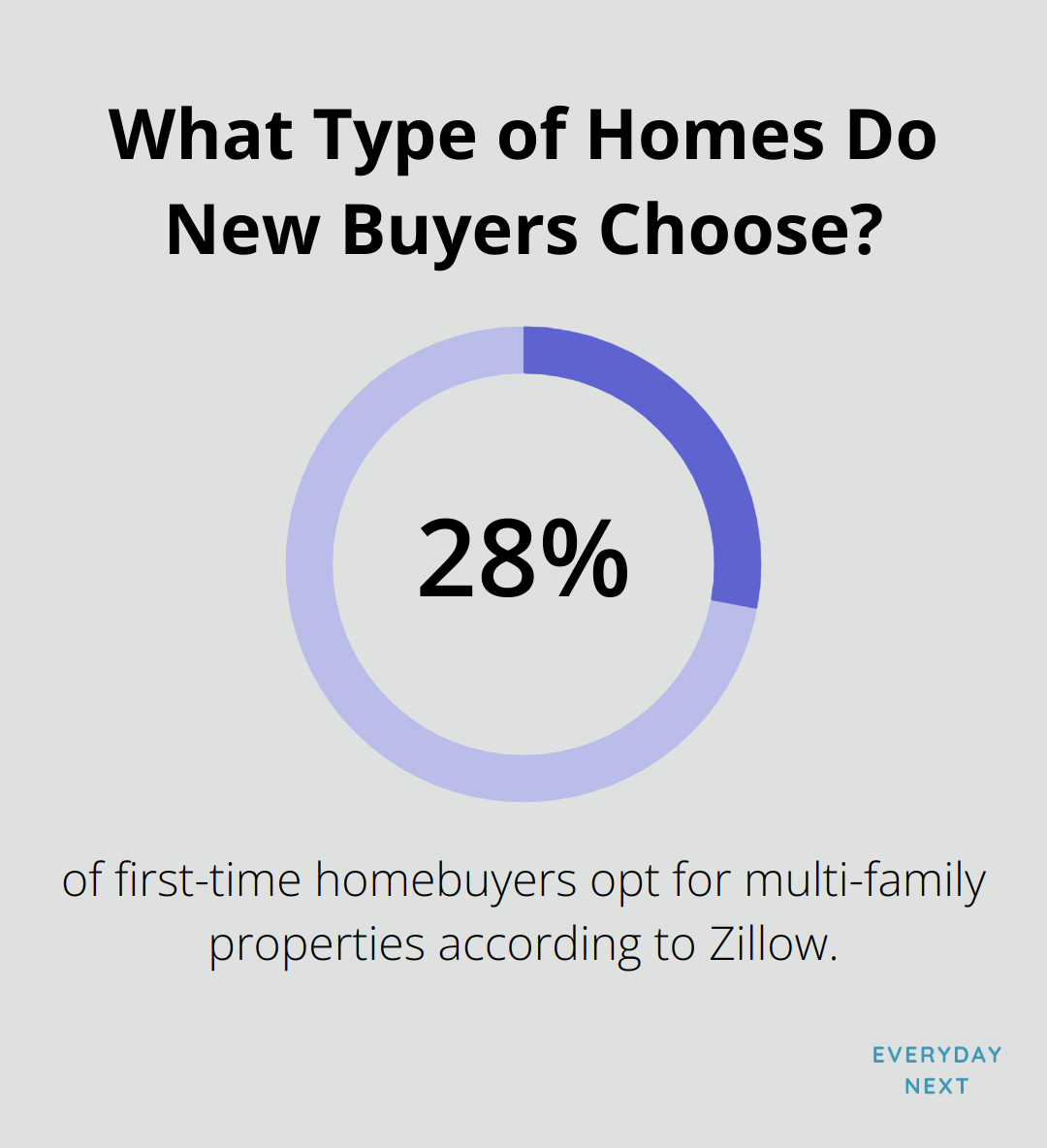

Ever heard of house hacking? It’s like real estate investing with training wheels. Live in one unit, rent out the others. A solid 28% of first-time homebuyers-per Zillow-opt for multi-family properties just to get their feet wet.

Market Research: Your Competitive Edge

Market research? That’s your bread and butter for successful investing. Start by eyeballing population growth trends. The U.S. Census Bureau is your go-to for data here. Steady growth? It’s the secret sauce for rising property values.

Next up, job market health. Peek into numbers from the Bureau of Labor Statistics-they spill the beans on unemployment rates by metro area. Aim for spots strutting below the national average (around 3.7% these days). Strong job markets? They’re the lifeblood of robust rental markets.

And hey, don’t skip the number crunching. The price-to-rent ratio is your buddy. You break out the calculator and divide the median home price by the annual rent for similar digs. Anything under 15? Bingo… a market ripe for cash flow investments.

Property Analysis: Looking Beyond Aesthetics

Sizing up properties? Slip on those investor goggles. The 1% rule is your quick litmus test: monthly rent should hit at least 1% of the purchase price. Not perfect, but solid for a start.

Dig into that property’s backstory. Time on the market… potential costly makeovers… these can be bargaining chips or red flags urging you to make a swift exit.

Building Your Real Estate A-Team

In real estate, your network? That’s your net worth. Kick off with a realtor who knows the ins and outs of investment properties-insights on hot spots and hidden gems are their specialty.

A savvy property manager? Priceless, especially if you’re playing the out-of-state game. Check out the National Association of Residential Property Managers (NARPM) to scout talented folks for your team.

And don’t forget legal counsel. A real estate attorney? They’re your guardrails against pricey blunders, particularly in structuring deals or sorting contracts. The American Bar Association will get you rolling on referrals.

Patience and persistence are your allies in real estate. Start small, get the basics down, and then crank up the volume as you build experience. With the right game plan and the right crew, you’ll build lasting wealth through real estate.

Final Thoughts

Alright, let’s peel back the curtain on real estate investing … it’s a never-ending classroom where strategy is your cheat sheet. This crash course? Sure, it’s your starter pack of essentials. But don’t kid yourself-this isn’t a one-and-done kind of deal. The real estate market is like the dance floor at a wedding, always shifting. So, keep your eyes glued to market trends and economic tea leaves.

Aspiring investor? Here’s your game plan: Nail down what you want (seriously, get specific). Dive deep into market research, like Sherlock with a magnifying glass. Oh, and start building that network-think LinkedIn on steroids. Begin small to get a taste; treat it like training wheels before you go full Tour de France with your investments. It’s all about patience and grit (marathons, not sprints, folks).

At Everyday Next, we’re basically your investment GPS. Our comprehensive guide to personal and professional development is loaded with real estate insights and financial growth hacks. Take that first step, the trickle that leads to a river of property prosperity. Visualize those investment dreams morphing into reality.