How to Raise Your Credit Score: Expert Tips and Tricks

Your credit score — it’s like the bouncer at the club of financial freedom. It decides if you get in or stand in the rain. Loans? Apartments? Jobs? All scrutinized through this mysterious number.

At Everyday Next, we get it — a killer credit score is crucial. So we’ve gathered a playbook of top-notch tips and tricks to bump up that score — fast.

In this guide, we’re diving into the nitty-gritty. Practical strategies to up your credit game… while sidestepping those rookie mistakes that tank your score. Grab a seat. Let’s go.

What’s Your Credit Score?

The Power of Three Digits

Picture this-a three-digit number that decides your financial fate. Yep, your credit score. These digits sway banks, landlords, even your boss, in judging just how financially reliable you are.

FICO Score: The Gold Standard

Let’s talk FICO-the Holy Grail of credit scores (300 to 850). Quick and dirty breakdown:

- 300-579: Yikes, that’s Poor

- 580-669: Fair enough

- 670-739: Good to go

- 740-799: Looking Very Good

- 800-850: You’re Exceptional

Got a score over 700? Congrats, you’re on the fast track to better interest rates and sweet loan terms.

The Five Pillars of Your Credit Score

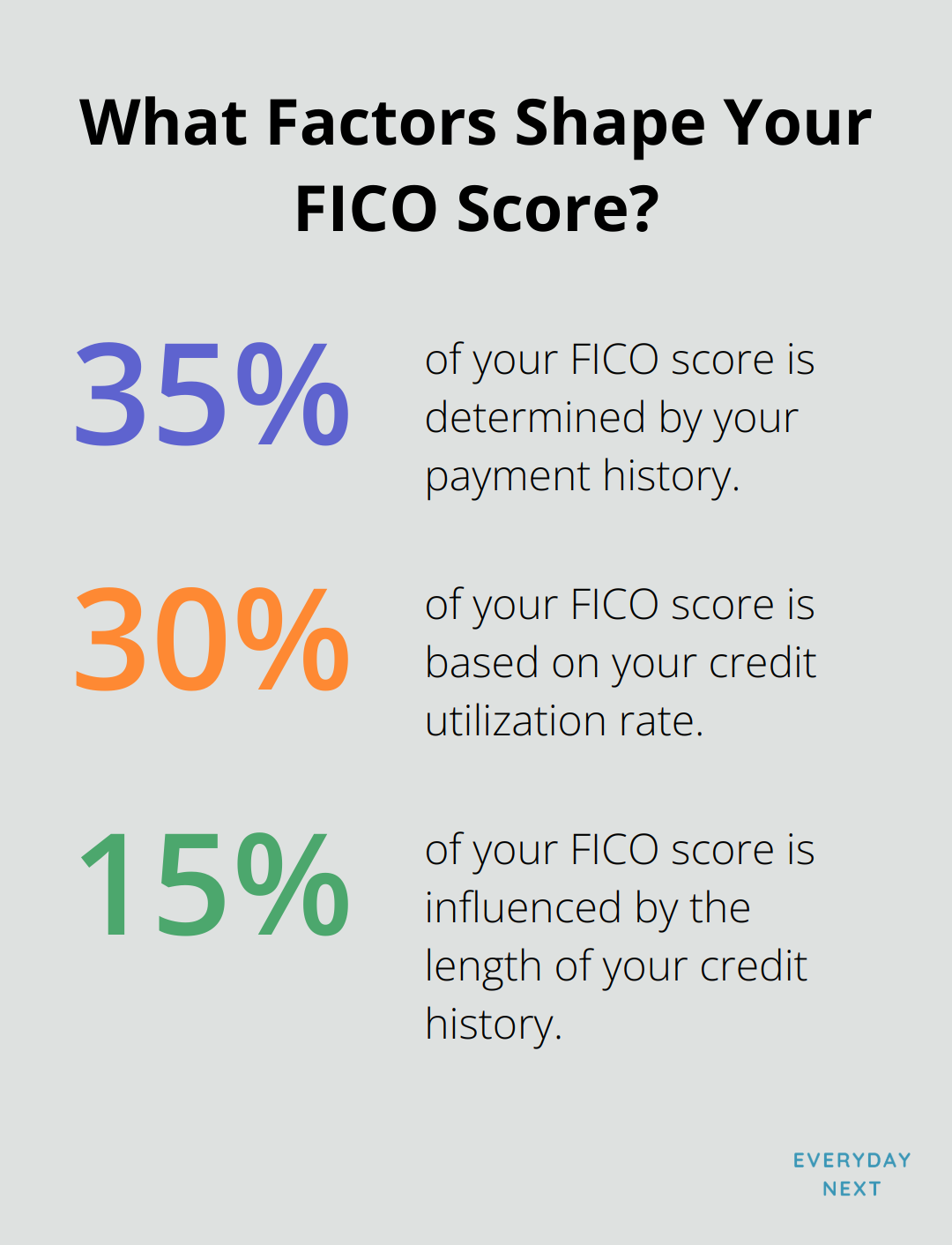

What makes up this magical number called your FICO score? Five key things:

- Payment History (35%): Pay your bills on time, folks-seriously.

- Credit Utilization (30%): Keep those credit card balances low, below the magic 30% mark.

- Length of Credit History (15%): Older, wiser accounts-you want ’em.

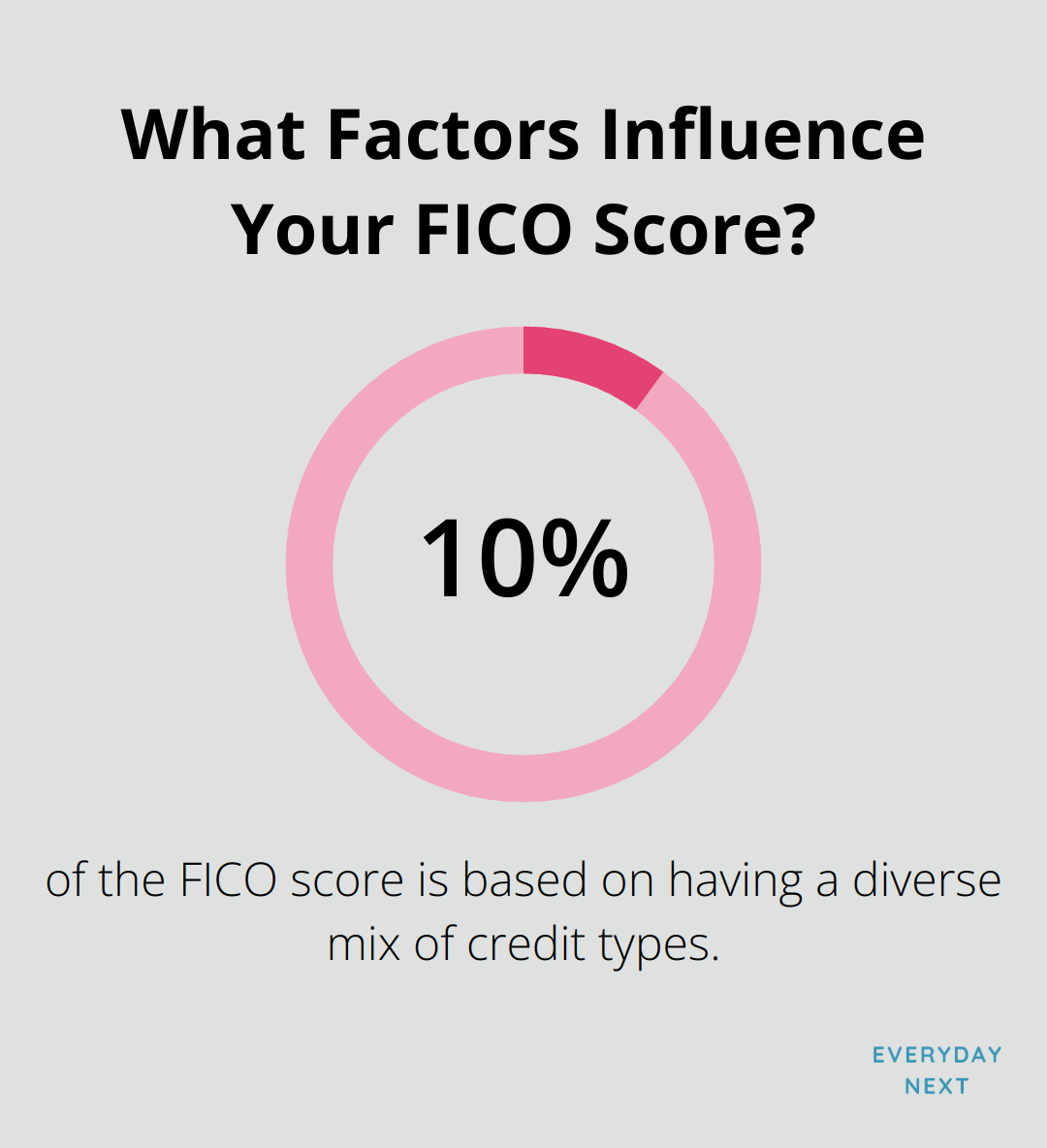

- Credit Mix (10%): Spice it up with different credit types (think credit cards, loans).

- New Credit (10%): Opening a bazillion new accounts at once? Hard pass.

Free Ways to Check Your Score

No need to shell out cash to see your score. Some freebies:

- Credit Card Issuers: Many dish out free FICO scores to loyal cardholders.

- Experian: Grab a free FICO score and credit report here.

- Credit Karma: Snag free VantageScore 3.0 scores from TransUnion and Equifax.

Checking your credit score regularly? It’s like flossing-just do it for your financial health.

The Real-World Impact of Your Score

Higher score, bigger savings. A top-notch credit score can mean lower mortgage rates and save you a bundle on those monthly payments.

Understanding your credit score-it’s not just about knowing a number. It’s seeing the mirror of your financial habits-then using it as a key to unlock future opportunities. Next up, we’re diving into strategies to boost your credit score and revamp your financial prospects.

Boost Your Credit Score Fast

The Power of Punctuality

Paying your bills on time-yep, that’s the secret sauce right there. Schedule it, automate it, tattoo it on your hand-just make sure it happens. Why? Well, according to the all-knowing FICO, 35% of your credit score is basically saying, “Do you pay your bills on time?” Keep at it, and even if you’ve slipped-no worries-the longer you’re on time, the more your score can heal and rise from the ashes.

Master Your Credit Utilization

Next on the hit list? Credit utilization. This little gem is 30% of your FICO score. The secret formula? Keep those credit card balances to a low hum-think below 10% of your limit. Marry paying on time with low balances, and voilà, a score that loves you back.

Leverage Your Credit History Length

About those dusty old credit accounts? Don’t cut the cord. Why? Because 15% of your score is all about your credit past. Keep the oldies but goodies open, maybe use them for little things you’ll definitely pay off. This keeps your credit age solid and slowly but surely nudges that score northward.

Apply for Credit Strategically

New credit applications? They poke your credit report and prod that score. Each one’s a hard inquiry that hangs around for two years. Be choosy. But if you’re out mortgage or car loan hunting, then channel your Alex Trebek-shop within 14-45 days. Multiple inquiries during this time? They’re like cats presented as one (seriously).

Diversify Your Credit Mix

A mixed credit bag-yep, that’s 10% of the FICO secret sauce. It’s more about quality than quantity, though. So, having a mortgage, credit cards, installment loans in moderation shows you can juggle it all without dropping a ball.

Stick with these moves and watch your credit score twist and shout. Sure, it takes patience. This isn’t instant ramen, it’s more like slow-cooking a perfect stew-but nailed it, you will. Keep at it, and we’ll dive into the credit score minefields and how to dodge those like a pro.

Credit Score Pitfalls to Sidestep

The Maxed-Out Credit Card Trap

Maxing out your credit cards-ouch, that’s a big no-no-will tank your credit score faster than you can say “interest rate.” Use all your credit, and bam, your utilization rate goes through the roof. What’s that mean? Your score takes a nosedive. Keep your credit utilization below 30% (but hey, why not shoot for under 10% if you’re an overachiever?). If those balances are creeping up on you, try multiple payments throughout the month to keep things looking pretty.

The Late Payment Domino Effect

Late payments-what’s the deal with those? They’re like kryptonite for your credit score. One tiny slip-up can ding your score big time-and it sticks around for up to seven years. That’s the gift that keeps on giving, folks. Set up some automatic payments or maybe some calendar nudges to ensure you never miss the due date. Time’s not on your side; if you screw up, call your creditor immediately. If it’s your first slip and you’ve got a history of paying on time, they might play nice and skip reporting it.

The Old Account Closure Conundrum

Closing old accounts-smart, right? Wrong. It can actually hit your score where it hurts. Kiss that credit limit goodbye, and suddenly your utilization calculations aren’t looking so hot. Plus, you could wind up shortening your credit history. Keep ’em open, and just use ’em sometimes for small stuff, then pay it off pronto. Your credit profile will thank you.

The Credit Application Frenzy

Going application-wild with credit cards? Yikes, slow down. It screams desperation to lenders. Each app usually leads to a hard inquiry-ding, ding, ding-that can shave off points and linger on your report for two years. Spread out your applications and only apply when absolutely necessary. If you’re rate shopping-think mortgages or auto loans-get it all done within a 14-45 day window so those inquiries only count as one hit.

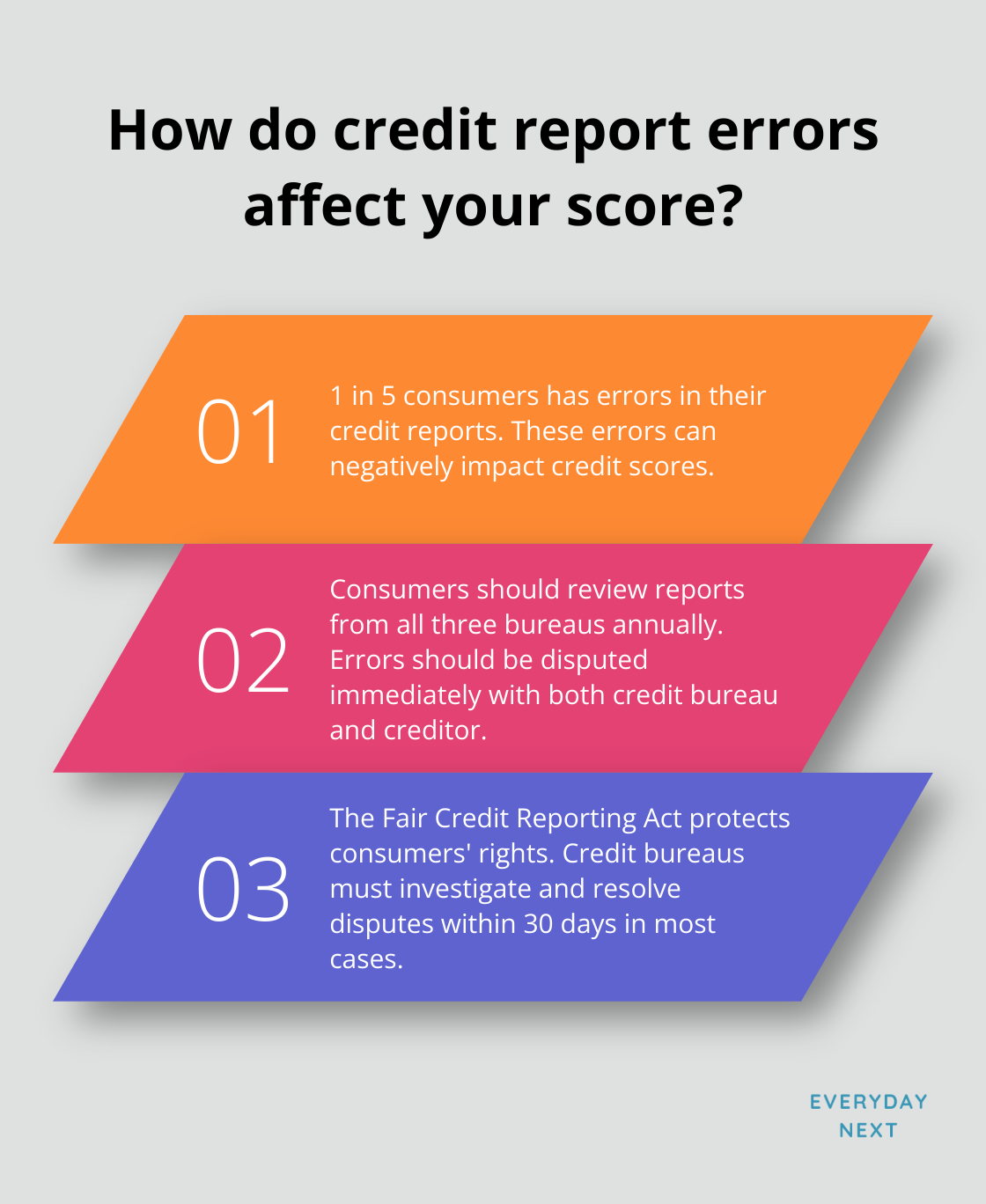

The Credit Report Error Oversight

Credit report errors-they’re more common than you’d guess. One in five consumers has something goofed up in their reports, according to a Federal Trade Commission study. Those errors? They drag your score down, all sneaky-like. Get into the habit of reviewing your reports from all three bureaus at least once a year. Spot a mistake? Dispute it ASAP with both the credit bureau and the creditor. The Fair Credit Reporting Act has your back-credit bureaus need to investigate and resolve disputes within 30 days most of the time. So you’ve got that going for you.

Final Thoughts

Boosting your credit score? Strap in – it’s a slow ride. You gotta pay those bills on time, keep that credit utilization low, and hold onto those old accounts like they’re heirlooms. This isn’t a fast track to instant glory. Nope, it takes time. But hey, get that score up, and it’s like hitting the jackpot: lower interest rates, slicker credit card deals, and landlords who roll out the red carpet.

Think of your credit score as a reflection of your financial mojo. At Everyday Next, we’re all about helping you pump it up. Our platform’s stacked with resources and advice (yep, including credit score tips) to fuel your financial journey. With the right moves, that dream credit score? Totally in reach.

And along the way, guess what? You’ll build some killer money management chops. Skills that’ll be your trusty sidekick for life. A rock-solid credit score? It’s like laying the cornerstone for a financial empire. Stick with it, and you could unlock a treasure trove of financial opportunities. Here’s to smart habits and a brighter financial future.