How to Start Investing in Index Funds for Beginners

Investing can feel intimidating, but it doesn't have to be. If you want to know how to start investing in index funds, here's the simplest way to think about it: open a brokerage account, choose a broad-market index fund (like one that tracks the S&P 500), and set up automatic monthly contributions. That’s it. This hands-off approach is perfect for beginners because it’s cheap, automatically diversified, and has a proven history of solid returns.

Your Simple Path to Building Wealth with Index Funds

There’s a common myth that successful investing means you have to be some kind of Wall Street wizard, picking the next big winning stock. The reality is far less complicated. Index fund investing is a passive strategy that simply aims to match the performance of a market index, like the S&P 500, which includes 500 of the biggest companies in the U.S.

Instead of trying to find the needle in the haystack, you just buy the whole haystack. This approach gives beginners two huge advantages right away: instant diversification and incredibly low costs. Rather than risking your money on a few companies, you own a tiny slice of hundreds, which dramatically lowers your risk.

Why Simplicity Wins in Investing

The real magic of index funds is just how efficient they are. Since they are passively managed—meaning a computer is just mirroring an index—their annual fees, known as expense ratios, are minuscule compared to funds with active managers trying to beat the market. A fee difference of even 0.50% might seem trivial, but over your investing career, it can easily add up to tens of thousands of dollars lost to fees.

Real-Life Example: Meet Sarah, a 25-year-old who just figured out how to create a monthly budget and decides to automatically invest $200 a month.

- Scenario A (Index Fund): She chooses an S&P 500 index fund with a low 0.03% expense ratio.

- Scenario B (Active Fund): She chooses an actively managed fund with a common 0.75% expense ratio.

After 30 years, assuming an 8% average annual return, Sarah in Scenario A would have approximately $298,000. In Scenario B, she would have only $256,000. That seemingly small fee difference cost her $42,000. This small, consistent habit of choosing low-cost funds taps into the power of compounding, where your earnings start to generate their own earnings.

The Power of Long-Term Market Returns

History has shown time and again that staying invested for the long haul is the most reliable path to wealth. Trying to jump in and out of the market is a losing game.

Consider this: over the past 20 years, the S&P 500 has delivered an impressive annualized return of approximately 10% (with dividends reinvested). That means a $10,000 investment would have grown to about $72,000. That's the power of just sitting still and letting the market do the work for you.

Index funds are truly a beginner's best friend for building wealth. While they provide fantastic diversification on their own, it's also smart to understand how they fit into a bigger picture. To build real financial resilience, check out these essential investment diversification strategies to see how you can further protect and grow your portfolio.

For a quick reference, here's a checklist to help you get started on the right foot.

Quick Start Index Fund Investing Checklist

Follow these essential steps to begin your index fund journey today.

| Step | Action | Why It Matters |

|---|---|---|

| Set a Goal | Define what you're investing for (e.g., retirement, a down payment). | Your goal determines your timeline and risk tolerance. |

| Open an Account | Choose a low-cost brokerage (like Vanguard, Fidelity) or a robo-advisor. | The right platform keeps your costs low and makes investing easy. |

| Fund the Account | Link your bank account and make your first deposit. | You can't invest without money in the account! |

| Pick a Fund | Select a broad-market index fund (e.g., S&P 500 or Total Stock Market). | This gives you instant diversification without complexity. |

| Automate | Set up recurring monthly investments. | Consistency is the key to long-term growth and removes emotion from investing. |

Following this simple plan is all it takes to get on the path to building long-term wealth. Don't overcomplicate it—just get started.

Choosing the Right Home for Your Investments

Before you even think about buying your first index fund, you have to decide where it’s going to "live." Think of it like choosing a bank account—some are for everyday spending, others are for long-term savings, and they all have different rules and perks.

The right account for you boils down to your personal goals, how involved you want to be, and whether you want to get a tax break on your investments. There’s no single "best" platform; the goal is to find the best fit for your life.

The DIY Path: Opening a Brokerage Account

A brokerage account is your direct portal to the stock market. It's like an empty shopping cart that you get to fill with whatever investments you choose. Big names like Vanguard, Fidelity, and Charles Schwab offer these, and most have eliminated trading fees, meaning you can buy and sell for $0 in commissions.

This route is perfect for anyone who wants to be in the driver's seat. You’re in charge of picking the funds, deciding when to invest, and keeping your portfolio balanced. It's also the cheapest way to go since your only real cost is the tiny expense ratio built into the funds themselves.

The Automated Route: Using a Robo-Advisor

If the thought of researching funds and managing a portfolio sounds like a massive headache, a robo-advisor could be your new best friend. Services like Betterment and Wealthfront use smart technology to build and manage a complete portfolio for you.

You just answer some simple questions about your financial goals and comfort with risk, and their algorithms do all the heavy lifting. They handle everything from picking the right mix of funds to automatically rebalancing for you. Of course, this convenience costs a little extra—typically an annual fee of 0.25% to 0.50% of your balance. AI is making these platforms even more sophisticated, as our guide on robo-advisors and AI-powered investing explores in more detail.

The Tax-Smart Strategy: Retirement Accounts

Here’s where things get really powerful. Whether you go with a brokerage or a robo-advisor, you can often open the account as a special tax-advantaged retirement account. The two most common are the 401(k) and the Roth IRA.

- 401(k): This is the retirement plan offered by your employer. You contribute money directly from your paycheck (often before taxes, which lowers your tax bill today), and many companies will even "match" your contributions. That's free money!

- Roth IRA: This is an account you open on your own. You put in money you’ve already paid taxes on, but here’s the magic: all your investment growth and withdrawals in retirement are 100% tax-free.

Deciding where to put your money first can feel tricky. A common question is whether you can have both an IRA and a 401(k), and the answer is yes—using both is a fantastic way to supercharge your savings.

Expert Tip: If your job offers a 401(k) with a company match, your first priority should be to contribute enough to get that full match. It’s a 100% return on your money before you even start investing. You won't find a better deal anywhere else. Once you've secured the match, a Roth IRA is a brilliant next step for that sweet, sweet tax-free growth.

To make this crystal clear, this table breaks down the key differences between your main options.

Comparing Investment Account Options

This simple breakdown can help you decide where to open your first investment account.

| Account Type | Best For | Typical Fees | Hands-On Level |

|---|---|---|---|

| Brokerage Account | DIY investors who want full control and the lowest possible costs. | Typically $0 commission on trades; fund expense ratios apply. | High |

| Robo-Advisor | Investors who prefer a hands-off, automated, and professionally managed portfolio. | 0.25% – 0.50% annual management fee + fund expenses. | Low |

| 401(k) / Roth IRA | Anyone saving for retirement who wants to take advantage of major tax benefits. | Varies by plan; includes administrative and fund fees. | Low to Medium |

Ultimately, you can't go wrong starting with any of these. The most important thing is to just get started.

How to Pick the Right Index Funds

Alright, you've got your account set up. Now for the fun part: choosing your actual investments. With thousands of funds out there, this can feel like staring at a massive wall of options. But here’s the secret: for a beginner, only a handful of things truly matter.

Let's cut right to the chase. The single most important factor is the expense ratio.

Think of it as a small, annual management fee the fund company charges. It’s a percentage of your investment, and while it looks tiny, it has an enormous impact on your money over the long run.

Why Tiny Fees Make a Giant Difference

Let's say you invest $10,000. You could put it in a fund with a super-low 0.04% expense ratio. Or, you could unknowingly pick a fund charging 0.50%, which is more common than you'd think, especially with older or more complex funds.

That tiny difference doesn't feel like much. But fast forward 30 years. Assuming an average 8% annual return, the higher fee would have cost you over $25,000 in lost growth. That's a car! Or a serious down payment on a house.

Fees are a direct and relentless drag on your returns. Your mission is to get them as close to zero as possible.

My Rule of Thumb: For any broad-market index fund—like one tracking the S&P 500 or the total market—I won't even look at it if the expense ratio is over 0.10%. The best ones are often much lower, hovering around 0.02% to 0.04%.

ETFs vs. Mutual Funds: What's the Real Difference?

You'll quickly notice that index funds come in two main flavors: ETFs (Exchange-Traded Funds) and mutual funds. They might track the exact same index, but they work a little differently.

- ETFs trade on the stock market just like a share of Apple or Amazon. You can buy or sell them anytime the market is open, and their price bounces around all day.

- Mutual Funds are simpler. They only trade once per day, after the market closes. Everyone who bought or sold that day gets the same price.

Honestly, for most beginners, the difference is small. But if you're investing in a regular brokerage account (not an IRA or 401k), ETFs usually have a slight advantage because they tend to be a bit more tax-efficient. They just don't spit out as many taxable capital gains. Inside a retirement account, that tax advantage disappears, so either one is a fantastic choice.

Here’s a quick breakdown:

| Feature | ETFs (Exchange-Traded Funds) | Mutual Funds |

|---|---|---|

| How They Trade | Like stocks, throughout the day | Once per day, at a set price |

| Minimum Investment | Usually the price of one share (or less with fractional shares) | Can have minimums of $1,000 or more (though many are lower now) |

| Tax Efficiency | Generally more tax-efficient in taxable accounts | Can be less tax-efficient due to how they are structured |

| Best For | Investors who want trading flexibility and tax efficiency | Investors who prefer a set-it-and-forget-it approach with automatic investing |

Don't get stuck here. This is a minor detail. Picking a fund with a low fee that tracks a broad market index is 99% of the battle.

Real-World Examples of Great Index Funds

To make this less abstract, here are a few real-world examples of top-tier, low-cost index funds. These are the kinds of funds that form the bedrock of countless successful portfolios. They come from the big, reputable players like Vanguard, Fidelity, and Schwab.

1. S&P 500 Index Funds

These are the classics. They give you a small slice of 500 of the biggest, most influential companies in the U.S. It's a fantastic place to start and a core holding for even the most sophisticated investors. If you want to go deeper, our guide on investing in the S&P 500 index covers everything you need to know.

- Vanguard S&P 500 ETF (VOO)

- iShares CORE S&P 500 ETF (IVV)

- Fidelity 500 Index Fund (FXAIX)

2. Total U.S. Stock Market Index Funds

Why stop at 500 companies? These funds own a piece of the entire U.S. stock market—thousands of companies, from the giants down to the smaller, up-and-coming players. This is diversification at its best.

- Vanguard Total Stock Market ETF (VTI)

- Schwab Total Stock Market Index (SWTSX)

- Fidelity ZERO Total Market Index Fund (FZROX)

3. Total International Stock Market Index Funds

It's a big world out there, and some of the best companies aren't in the U.S. An international fund is a smart way to avoid putting all your eggs in one country's basket, investing in thousands of companies across Europe, Asia, and other global markets.

- Vanguard Total International Stock ETF (VXUS)

- Schwab International Index Fund (SWISX)

- iShares Core MSCI Total International Stock ETF (IXUS)

Disclaimer: These are not personal recommendations to buy, but examples of the type of high-quality, broadly diversified, and ultra-low-cost funds that fit the criteria we’ve discussed.

Putting It All Together: Your First Simple Investment Plan

Alright, you've learned how to spot a good index fund. Now for the fun part: building your actual investment strategy. This is where we move from theory to action, creating a simple, diversified portfolio that works for you without needing constant babysitting. The whole point is to build a plan that fits your life and then let it run on its own.

The best part about index fund investing? A truly effective portfolio doesn't need to be complicated. In fact, simple is almost always better. One of the most tried-and-true models for beginners is the Three-Fund Portfolio.

The Three-Fund Portfolio: A Simple Blueprint for Success

This strategy is as straightforward as it sounds. You create a complete, globally diversified portfolio using just three low-cost index funds. It's a fantastic way to lay a balanced foundation for long-term growth.

Here’s what you'll typically need:

- A Total U.S. Stock Market Index Fund: This is your ticket to owning a tiny piece of thousands of American companies, from the giants to the up-and-comers.

- A Total International Stock Market Index Fund: This gets you out of just one country, capturing growth from both developed and emerging markets all over the world.

- A Total U.S. Bond Market Index Fund: Think of this as the portfolio's shock absorber. Bonds are less volatile and provide a cushion to smooth out the ride when the stock market gets bumpy.

This simple combination keeps you from putting all your eggs in one basket—whether that's a single country or a single type of investment. That's a core principle of smart investing. Our guide on investing strategies for beginners goes into more detail on why this kind of asset allocation is so vital for your financial future.

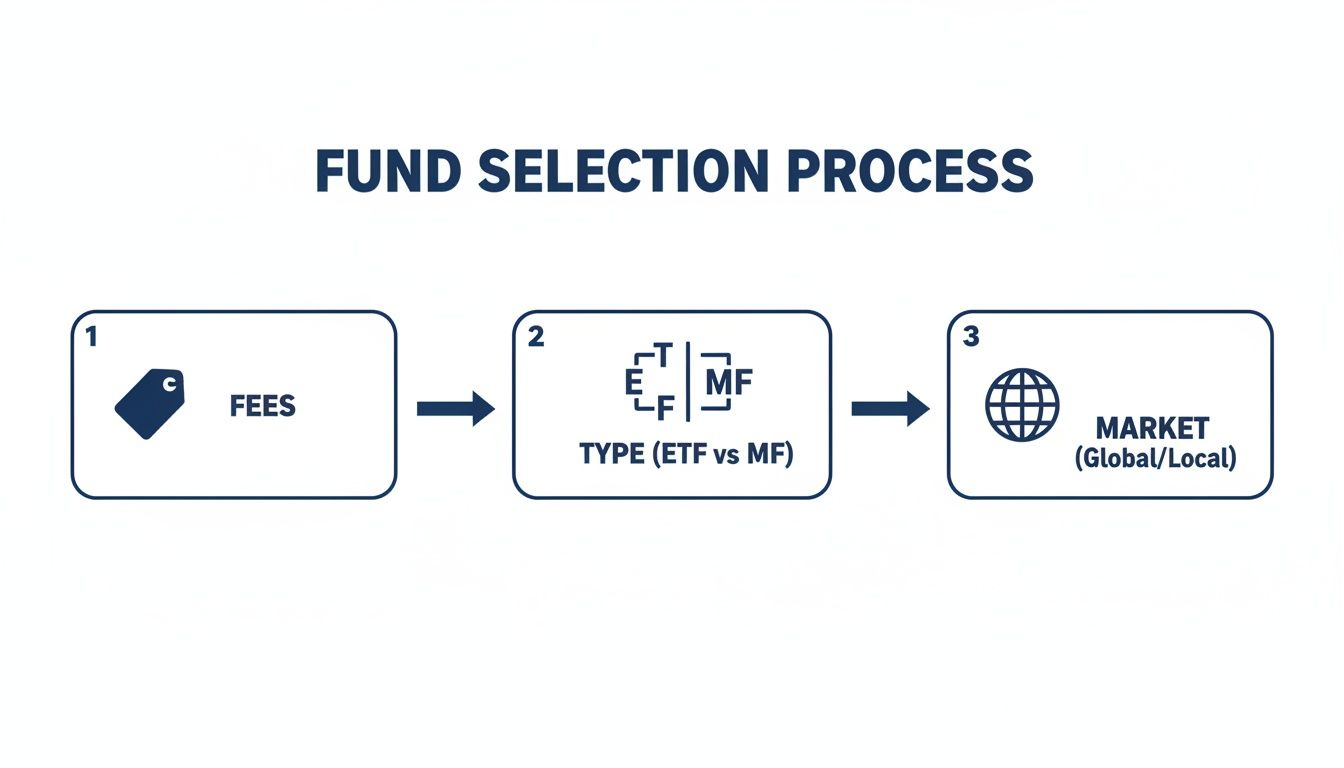

This flowchart shows the key decisions you'll make when picking funds for your portfolio.

It always comes down to the same three steps: keeping fees low, deciding between an ETF and a mutual fund, and then choosing your market exposure.

A Real-World Example: Building an 80/20 Portfolio

Let’s make this real. Meet Alex, a 30-year-old investor with decades to go until retirement. Alex is comfortable taking on a bit more risk now for the chance at higher returns later. After reading up on the three-fund model, Alex decides on an 80/20 stock-to-bond allocation.

This just means 80% of the portfolio goes into stocks (the growth engine) and 20% goes into bonds (the stabilizer).

Here’s how Alex might set it up:

- 50% in a Total U.S. Stock Market Index Fund

- 30% in a Total International Stock Market Index Fund

- 20% in a Total U.S. Bond Market Index Fund

This mix is a great fit for Alex's long-term goals. The heavy stock position is designed to build wealth over the next 30+ years, while the bond slice, though small, provides a valuable psychological buffer when markets get choppy.

Key Takeaway: Your asset allocation is the single most important investment decision you'll make. If you're younger with a long time horizon, you can generally take on more risk (more stocks). If you're closer to retirement, you'll likely want more in bonds to protect what you've built.

Time to Buy: Market vs. Limit Orders

Once your account is funded and you know which funds you want, you’re ready to buy. When you go to purchase an ETF, you'll typically see two choices: a market order or a limit order.

A market order is the "just get it done" option. It tells your brokerage to buy the ETF for you immediately at whatever the current market price is. It’s fast and simple, guaranteeing your trade goes through, but the final price might be a few cents different from what you saw a second ago.

A limit order gives you more control. You're telling the brokerage, "Buy this ETF, but only if you can get it for me at or below this specific price." It protects you from overpaying, but there's a catch—if the price never hits your limit, your order won't execute.

For a long-term index fund investor, a market order is perfectly fine 99% of the time. You’re buying for the next few decades, so a few pennies per share here and there won't change your outcome.

The Ultimate Goal: Automate and Get on With Your Life

The most powerful thing you can do now is put your plan on autopilot. Set up a recurring, automatic transfer from your bank account to your brokerage to buy your chosen funds. Do it every week, every two weeks, or every month—whatever works for your budget.

This technique is called dollar-cost averaging, and it's your secret weapon for disciplined investing. It takes emotion completely out of the picture. You invest consistently, which means you naturally buy more shares when prices are low and fewer when they're high.

History shows us just how powerful it is to simply stay invested. A $100 investment in an S&P 500 index fund in 1928 would have grown to over $787,000 by the end of 2024. That’s the magic of compounding and sticking to a plan, even through the scary headlines.

Your end goal is to build a "set it and forget it" portfolio that quietly grows your wealth in the background, freeing you up to focus on everything else.

Common Beginner Investing Mistakes to Avoid

Knowing what to do is only half the battle. Honestly, knowing what not to do can be even more important, saving you from a lot of stress and costly mistakes. When it comes to investing, the biggest hurdles are usually emotional, not financial. It’s about managing your own behavior.

If you can get a handle on the most common traps new investors fall into, you'll be miles ahead. These mistakes are easy to make, but thankfully, they’re also pretty easy to avoid once you know what to look for.

Trying to Time the Market

This is, without a doubt, the number one mistake I see. It’s the siren song of investing—the belief that you can smartly jump out of the market just before it tanks and hop back in right before it soars. It sounds great, but the reality is that even the pros on Wall Street can't do this consistently.

Don't just take my word for it. An analysis by Putnam Investments looked at the S&P 500 from 2007 to 2022. If you had invested $10,000 and just stayed put, it would have grown to over $38,000. But if you tried to time things and missed just the 10 best days in the market? Your return would have been cut in half, down to less than $18,000.

Those best days often happen right after the absolute worst days, when everyone is panicking. The lesson here is crystal clear: time in the market is far more important than timing the market.

Chasing Last Year's Winners

Another classic rookie mistake is "performance chasing." You see a fund that shot the lights out last year, and you dive in, expecting the same thing to happen again. It feels smart, but it's like trying to drive forward while staring only in the rearview mirror.

What was hot yesterday is often what's cooling down tomorrow. This behavior inevitably leads you to buy high (when an asset is popular and expensive) and sell low (when it falls out of favor). That’s the exact opposite of what you want to do. A simple, diversified index fund portfolio protects you from this urge by letting you own a piece of everything, not just what's currently trendy.

A Smarter Approach: Instead of chasing hot stocks or funds, just stick to your plan. A broad-market index fund ensures you automatically own the winners as they emerge, without ever having to guess what they'll be.

Ignoring the Importance of Rebalancing

Let's say you start with a well-thought-out plan: 80% in stocks and 20% in bonds. But then, stocks have a fantastic year. Your portfolio might naturally drift to become 85% stocks. It doesn't sound like a huge deal, but it quietly means you're now taking on more risk than you originally decided you were comfortable with.

Rebalancing is just the simple process of nudging your portfolio back to its original targets. Think of it as a periodic tune-up. You sell a little bit of what has done well and buy a little more of what has lagged behind.

It can feel strange—selling your winners to buy your "losers." But it’s an incredibly disciplined way to manage risk and forces you to "buy low and sell high" on autopilot. You don't need to overthink it; just checking in once a year, maybe on your birthday, is enough to keep things on track.

Here’s what that looks like in practice:

| Scenario | Without Rebalancing | With Annual Rebalancing |

|---|---|---|

| Initial Plan | 80% Stocks / 20% Bonds | 80% Stocks / 20% Bonds |

| After Stocks Surge | Portfolio becomes 87% Stocks / 13% Bonds | Sell some stocks, buy bonds to return to 80/20 |

| Result | Your risk level has unintentionally increased. | Your risk level remains consistent with your plan. |

Avoiding these blunders is crucial when you're learning how to start investing in index funds. By staying disciplined, keeping your eyes on the long-term prize, and tuning out the daily noise, you’re setting yourself up for a much smoother and more successful journey.

Frequently Asked Questions About Index Fund Investing

Here are answers to the 10 most common questions beginners ask about starting with index funds.

1. How much money do I need to start investing in index funds?

You can start with as little as $1. Many modern brokerages have no account minimums and offer fractional shares, which means you can buy a small slice of an ETF even if you can't afford a full share. The key is to start, no matter how small.

2. What’s the real difference between an index fund and an ETF?

An "index fund" is a broad category of fund that passively tracks a market index. They come in two main structures: mutual funds and Exchange-Traded Funds (ETFs). ETFs trade like stocks throughout the day, while mutual funds price only once at the end of the day. For beginners, the difference is minor, but ETFs are often slightly more tax-efficient in regular (non-retirement) brokerage accounts.

3. How often should I check my investments?

As little as possible. For a long-term investor, checking your portfolio once a quarter is more than enough. Daily check-ins can lead to emotional reactions to normal market fluctuations, causing you to sell at the worst possible time. Set up automatic investments and trust the process.

4. Is index fund investing safe?

No investment that offers growth is 100% "safe" from losing value, as markets naturally go up and down. However, index fund investing is significantly safer than picking individual stocks because of its built-in diversification. By owning hundreds or thousands of companies, the failure of one has a negligible impact on your overall portfolio.

5. How are index funds taxed?

This depends entirely on the type of account you use.

- In a Roth IRA: Your qualified withdrawals in retirement are 100% tax-free.

- In a Traditional 401(k) or IRA: You get a tax deduction now, but you pay income tax on withdrawals in retirement.

- In a standard brokerage account: You'll pay capital gains tax on profits when you sell, and taxes on dividends you receive each year.

6. Can I lose all my money in an index fund?

Theoretically, it's possible in an extreme, world-ending scenario. Practically speaking, no. For a broad market index fund like one tracking the S&P 500 to go to zero, all 500 of the largest U.S. companies would have to go bankrupt simultaneously. The risk of this happening is extraordinarily low.

7. What is a "good" expense ratio?

For a broad-market stock or bond index fund, a good expense ratio is anything below 0.10%. Many excellent funds from providers like Vanguard, Fidelity, and Schwab have expense ratios as low as 0.02% or even 0% (in some cases). Keeping costs low is one of the most effective ways to maximize your long-term returns.

8. Is it better to invest a lump sum or invest a little at a time?

Investing a little at a time is called dollar-cost averaging. While historical data suggests that investing a lump sum right away often results in slightly higher returns, dollar-cost averaging is psychologically easier for most people and protects you from the risk of investing all your money right before a market downturn. Consistency is what matters most.

9. Do I really need international funds and bonds?

While you could start with just a U.S. stock fund, adding international funds provides global diversification, preventing you from being over-exposed to a single country's economy. Bonds act as a stabilizer; they are less volatile than stocks and provide a cushion during market crashes, which helps you stay invested. For more on this, see our guide on how to invest money for beginners.

10. What is the single best index fund to start with?

While there's no single "best" fund for everyone, a fantastic starting point for most new investors is a low-cost, broad-market index fund. Two excellent choices are:

- An S&P 500 index fund (like VOO or FXAIX)

- A Total U.S. Stock Market index fund (like VTI or FZROX)

You can build a solid foundation with either of these funds.

Hopefully, these answers give you the confidence to get started. The key is to begin, stay consistent, and let time and the market work for you.

At Everyday Next, we're committed to providing clear, actionable insights to help you build a stronger financial future. We hope this guide has empowered you to take the first step in your index fund investing journey. Visit us at https://everydaynext.com to explore more guides on wealth, tech, and personal growth.