Investing in S&P 500 Index: What You Need to Know

Table of Contents

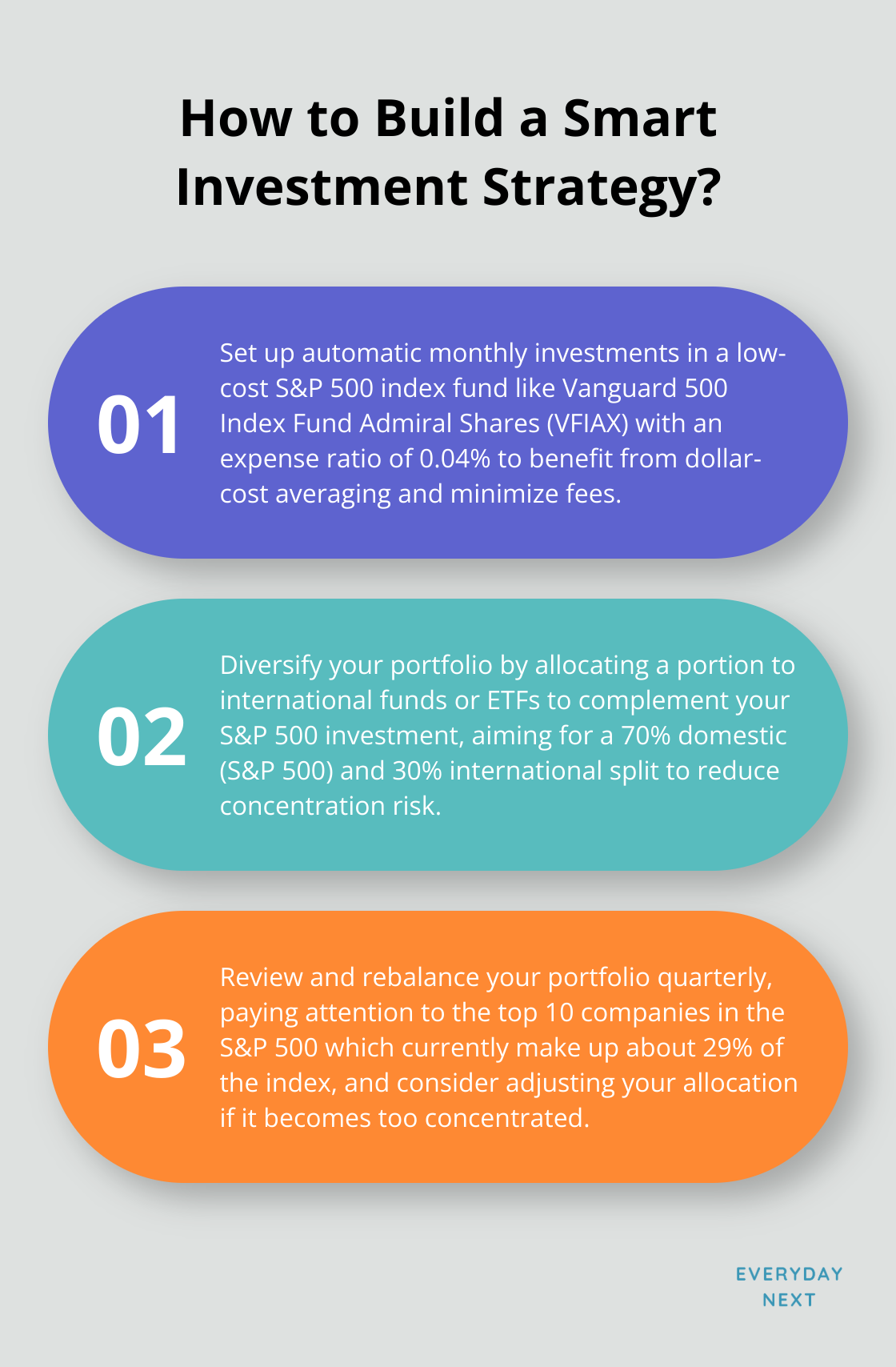

So, people are always hitting us up at Everyday Next—how do you dive into the S&P 500 pool? This thing’s a beast of a market indicator… a cornerstone for investment strategies that’ve been around forever.

Today, we’re gonna slice and dice what the S&P 500 is all about, rummage through the different ways you can throw your hat in the investment ring, and — of course — hash out the ups and downs of this much-loved, crowd-favorite investment choice.

What Is the S&P 500?

The Benchmark of U.S. Stocks

So, the S&P 500 – that’s where it all happens. A stock market index keeping tabs on the big 500 U.S. companies. It’s like the heartbeat of the U.S. stock market. Standard & Poor’s rolled this baby out in 1957, but hey, its roots? 1923. Long lineage, folks.

Strict Selection Criteria

Wanna join the S&P 500 club? Buckle up. The entry rules read like a gauntlet:

- Market cap of at least $14.6 billion – no small potatoes

- U.S. home base – gotta be local

- Uber-liquid – think Evian

- Shares out there for the masses – none of this hiding stuff

- Financial muscles – show us the strength

And here’s a fun fact – it’s officially 505 stocks from 500 companies (because, well, some like to play with multiple share classes).

Market Significance

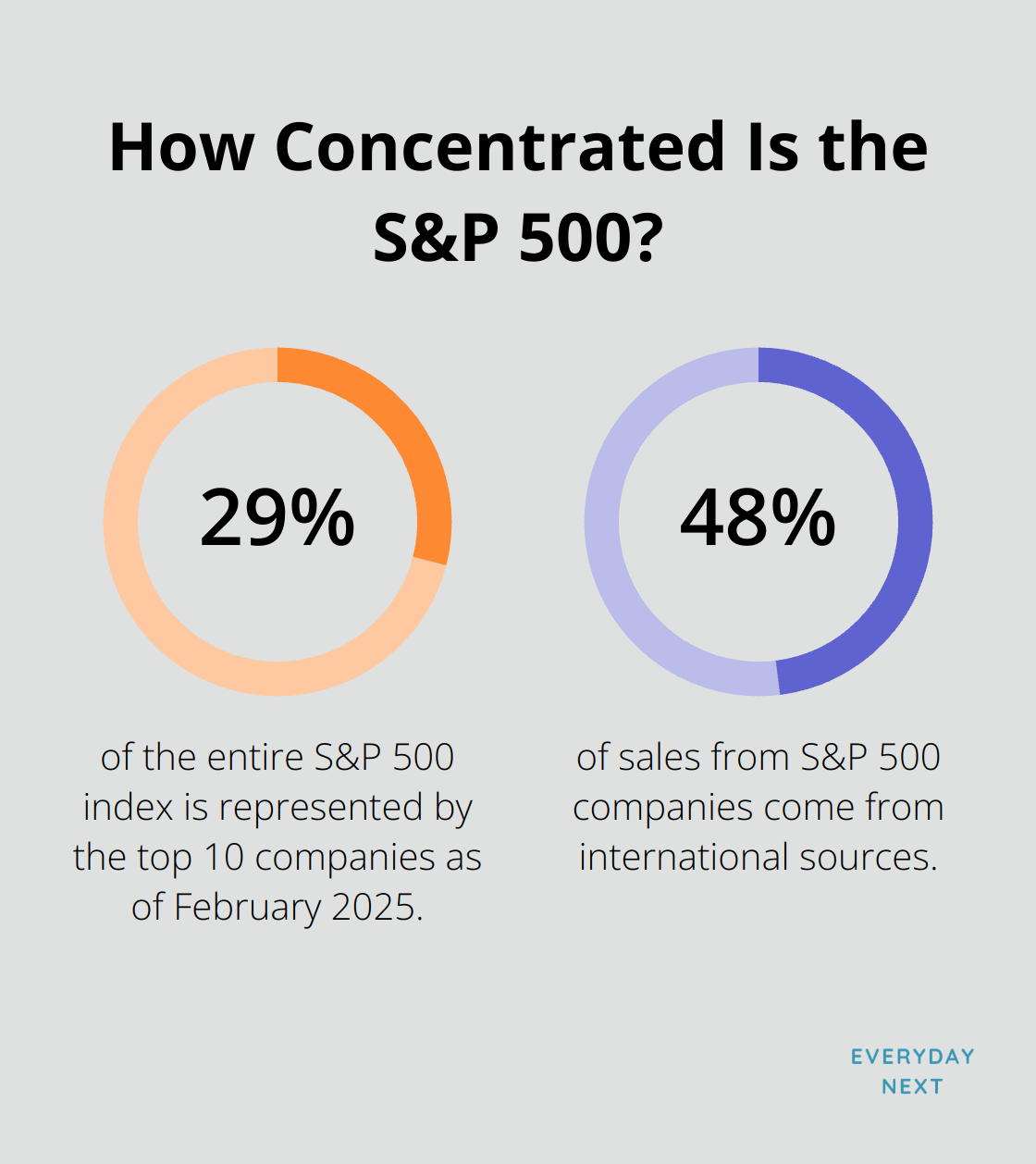

This index isn’t just a chunk… it’s a massive slice of the entire U.S. stock market pie. “The market’s performance” – people often yammer about this, and yep, they’re pointing at the S&P 500. Important tidbit: it’s market capitalization-weighted. Translation? Big fish, more sway. By Feb 2025, the top 10? Roughly 29% of the entire shebang.

Technology’s Dominant Role

Going techie – the S&P 500 Information Technology sector’s got those GICS folks, wearing the IT badge. This bunch brings the breeze… or sometimes a storm (increased volatility) if tech hiccups. Tip for investors: put tech drama in your calculations when thinking S&P 500 index funds.

Global Reach Through Domestic Companies

It’s about the U.S.- but not just the U.S. Nailed a global touch too. About 48% of sales from S&P 500 companies? International roots. Yep, even a U.S.-centric index has a passport, offering investors a mix of home and abroad – now that’s a cocktail.

Dynamic Composition

The S&P 500 doesn’t sit still. Companies dance in and out, based on how they’re doing and if they stick to the rules. Back in 1965, companies hung around for 33 years on average. Fast forward, and by 2026, projections say it’ll slink down to a mere 14 years. This revolving door? It mirrors the U.S. economy’s lively rhythm and the business world’s whirlwind changes.

As we cruise through the myriad investment paths within the S&P 500, buckle up to grasp these core traits of the index. Let’s dive in and check out the variety of ways to ride the wave of the S&P 500’s performance.

How to Invest in the S&P 500

So, you want to dip your toes-or maybe dive headfirst-into the S&P 500? Lucky for you, there are more ways to do it than toppings at your favorite ice cream shop. Let’s break down the most popular flavors, each with its own quirks.

Index Funds: Cost-Effective Powerhouses

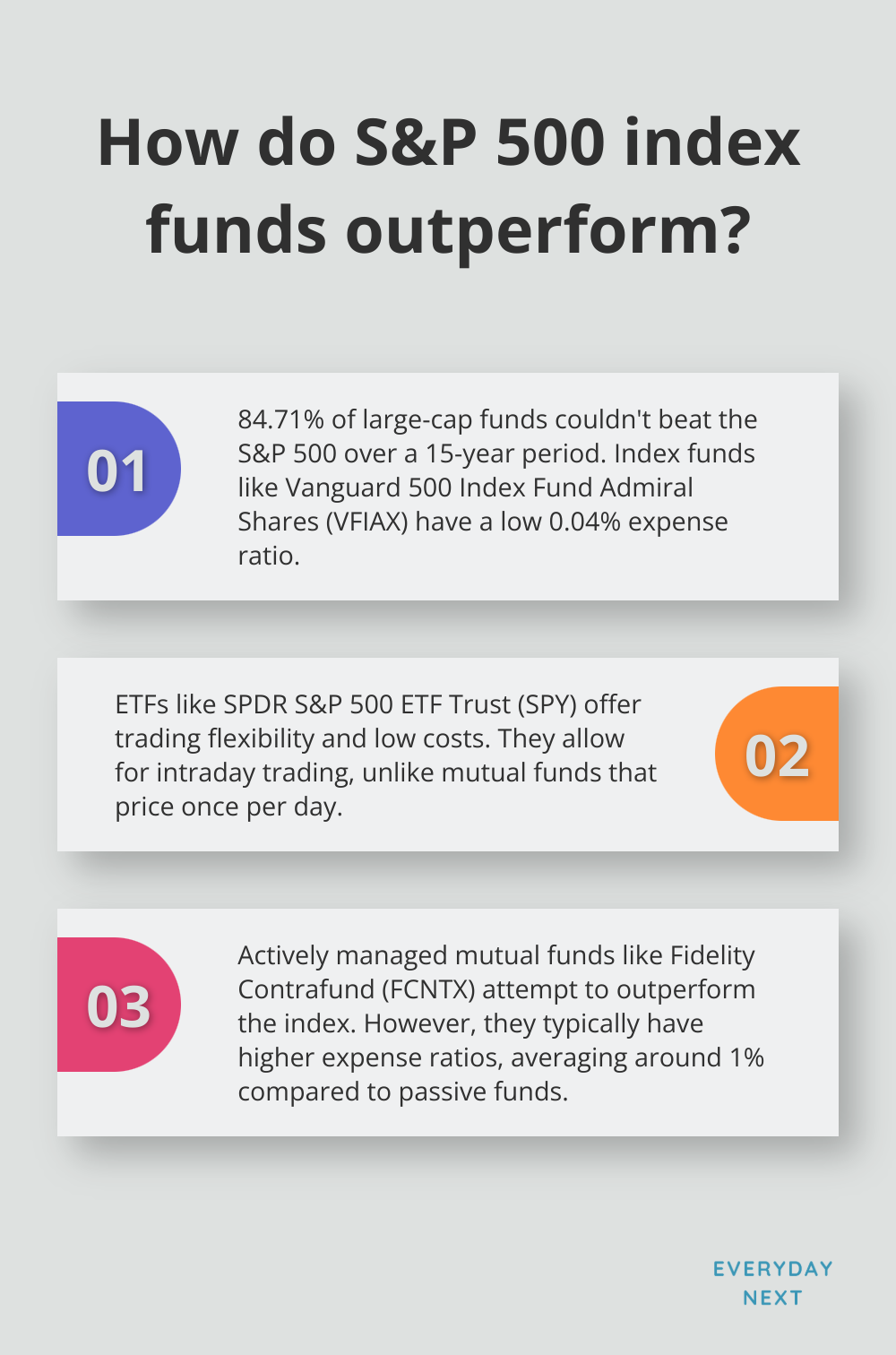

First up, index funds-the plain vanilla of investing, but don’t underestimate their power. These guys let you ride the S&P 500 wave without emptying your wallet. We’re talking about replicating the index, not trying to beat it at its own game. Take the Vanguard 500 Index Fund Admiral Shares (VFIAX) for instance-it’s got a laughably small 0.04% expense ratio. That’s a tiny $4 yearly for every $10,000 you trust it with. Steal, right?

Here’s a fun fact: according to a study from S&P Dow Jones Indices, 84.71% of large-cap funds couldn’t outdo the S&P 500 over a clear-as-day 15-year stretch. Translation? Low-cost index funds have more draw than a magnet.

ETFs: Trading Agility Meets Cost Efficiency

Next, we have ETFs-think of them like index funds with a cool twist. The SPDR S&P 500 ETF Trust (SPY) started the party in 1993 and hasn’t left the top list ever since. Why? They blend trading flexibility with low cost-like the best of both worlds, wrapped into one.

ETFs offer the thrill of intraday trading, unlike the dowdy mutual funds that settle on pricing once per day. Want to be nimble, dart in and out at warp speed? ETFs let you pivot and respond to market drama faster than you can say “downtown.” Just a heads-up: all that action might pad up your expenses and dent long-term payouts if you’re not careful.

Mutual Funds: The Classic Approach

While the new kids on the block attract attention, the old-school actively managed mutual funds focusing on S&P 500 names aren’t going down without a fight. Funds like the Fidelity Contrafund (FCNTX) strive to outshine the index by cherry-picking stocks within that tight circle.

But, here’s the kicker-they pack a punch in fees. Actively managed large-cap funds, on average, flaunt a 1% expense ratio. Compare that to those passive buddies? Yeah, talk about sticker shock. Remember: past performance is just that-past-and even rockstar managers can hit some wrong notes.

Direct Stock Purchase: A Hands-On Strategy

Feeling ambitious? Directly snagging stocks from the S&P 500 roster could be your jam. This route hands you the reins on individual holdings, but brace yourself for the ride-it’s going to demand time, research, and higher transaction tolls.

With fractional shares now making their debut, you can invest in those big-ticket stocks without shoveling out a fortune. (You’ll need a good grip on stock valuation and portfolio mojo for this one.)

In the end, as you chart your investment course in the S&P 500 waters, remember-every approach has its ups and downs. Knowing these can steer you toward a decision that resonates with your financial game plan and stomach for risk. Choose your adventure wisely, dear investor.

Is the S&P 500 Right for You?

The Advantages

The S&P 500 offers significant diversification. You’ve got 500 of America’s biggest players sharing the stage-spread your risk, folks. So when one star underperforms… you’ve got a whole cast to back you up.

Low fees? Yes, please. These index funds are a steal when it comes to expenses. Translation: more of your cash stays in the game, compounding like it’s nobody’s business. Over time, those savings don’t just add up-they give you a little financial wink.

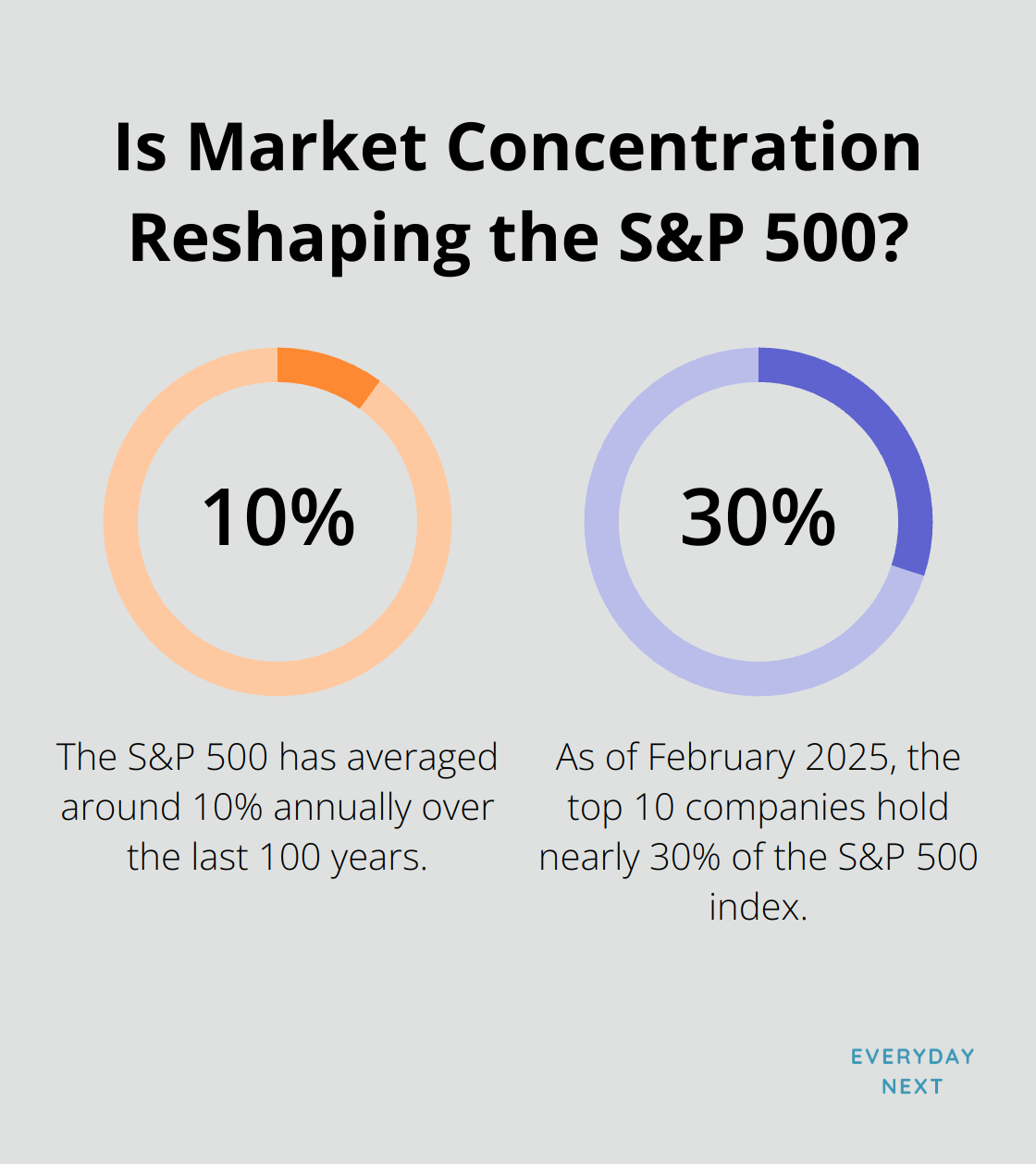

And let’s talk historical performance-that’s what gets the investors buzzing. The S&P 500? Averaging around 10% annually over the last 100 years. Sure, no one can promise future results (crystal ball, anyone?), but that kind of track record… hard to ignore.

The Drawbacks

But hold up-it’s not all sunshine and rainbows. The S&P 500 has a narrow view-only U.S. companies. Going all-in here means you might miss the party when international markets are hopping with gains.

And then there’s concentration risk-aka the big boys taking all the focus. Even with 500 companies, the index is a bit top-heavy. Fast forward to February 2025, and the big 10 players hold nearly 30% of the index. So if these tech giants hit a rough patch, expect your portfolio to feel it.

Comparison with Other Strategies

Here’s the kicker-the S&P 500 tends to crush most actively managed funds. Look at the numbers from S&P Dow Jones Indices. Only thrice since 2001 have active funds beat the index-2005, 2007, and 2009.

Still, plenty of fish in the sea. Total market funds? Think wider net-small and mid-cap stocks included. International funds offer you globe-trotting diversity. And if you’re chasing those income vibes, dividend-focused strategies might just be your jam.

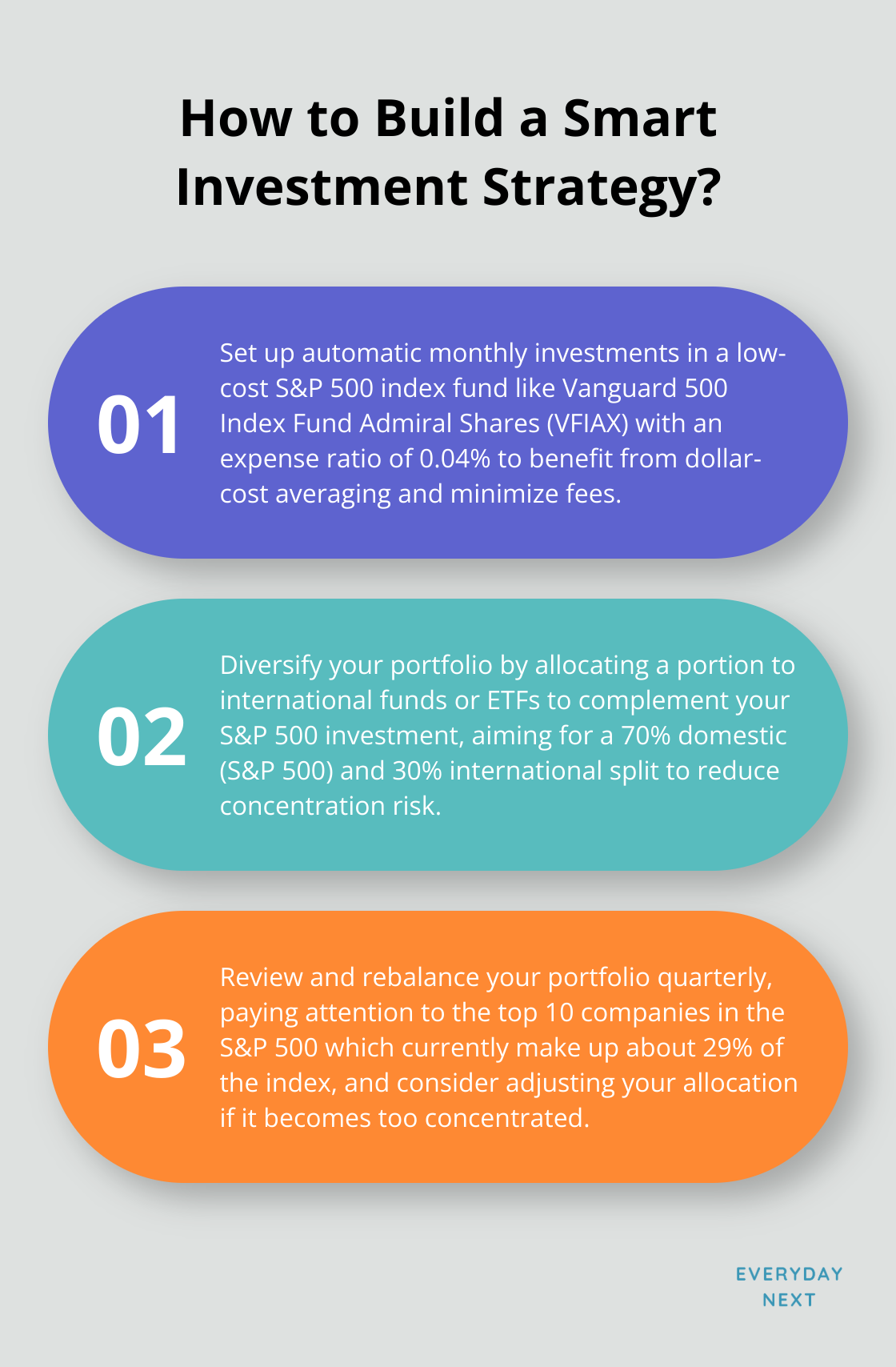

Considerations for Your Portfolio

So, the S&P 500? It’s a solid backbone for lots of folks. But should it be the entire body of your portfolio? Probably not. Check in with your goals, your appetite for risk, your timeline. Maybe pair it up with some international or small-cap love for that sweet, balanced approach.

Investing isn’t just about chasing returns. It’s about crafting the right symphony for your unique needs. The S&P 500 can play first violin, sure-but remember, it’s only one part of the grand orchestration. Keep an eye on potential volatility in these tech-heavy indices as the market does its dance.

Final Thoughts

Alright, here we go… the S&P 500 is basically your backstage pass to America’s corporate giants. Think of it as a one-stop shop – broad market cover, low costs, and a solid historical rap sheet. But, let’s get real for a sec: before diving in, it’s worth a moment to check your financial pulse. Goals? Risk tolerance? We aren’t talking about grabbing a cup of coffee here. Plus, the S&P 500 wears its American heart on its sleeve – not much international flavor and sometimes, it’s like a tech bandwagon controlled by a few big players.

It’s had a good run – decades of resilience and upward climbs. But remember, just because it rocked in the past, doesn’t mean it’s invincible. Think about mixing it up a bit (like a savvy cocktail) with other asset classes to keep those portfolio risks in check. This way, you’ve created a tailored investment playlist that vibes with your financial groove.

Over at Everyday Next, we’ve got your back as you meander through the maze of investing and personal finance. Our platform? It’s like your co-pilot on this monetary mission – offering resources that push you toward growth and stability. Whether you’re just starting out or reworking your strategy, getting a grip on the S&P 500 is a crucial chord in composing your financial symphony.

Pingback: Building Passive Income Streams for Financial Freedom - Kaki Prod

Pingback: Achieve More With Smart Goal Setting Strategies - Kaki Prod