How to Open an HSA: A Simple Guide to Your Triple-Tax-Advantaged Account

Before you can open a Health Savings Account (HSA), you need to be enrolled in a High-Deductible Health Plan (HDHP). Once you have that coverage, you're free to open an HSA through a bank, credit union, or brokerage. This is where you can start putting aside pre-tax money for medical expenses, all while unlocking a powerful triple tax advantage.

Why an HSA Is a Powerful Financial Tool

A Health Savings Account is so much more than a simple fund for doctor's visits. It's one of the smartest savings and investment tools available. I like to think of it as a personal healthcare fund that moonlights as a supercharged retirement account. Its real power comes from the triple tax advantage, a hat trick you rarely see in personal finance.

This incredible structure gives your money a boost at every single stage:

- Tax-Deductible Contributions: The money you contribute lowers your taxable income for the year, which means a smaller tax bill come April.

- Tax-Free Growth: You can invest your HSA funds, and any growth they generate is completely tax-free.

- Tax-Free Withdrawals: As long as you use the money for qualified medical expenses, you can pull it out tax-free, anytime.

More Than Just a Health Account

Unlike a Flexible Spending Account (FSA), the money in your HSA is yours forever. It never expires. It just rolls over year after year, letting your balance compound through new contributions and investment returns.

This guide is based on my first-hand experience helping people navigate their finances to help you get started with confidence. We'll walk through checking your eligibility, finding the right provider, and even beginning your investment journey. To really get a handle on how these accounts work, it’s worth understanding What Is A Health Savings Account?.

Real-World Example: Let's look at Sarah, a 30-year-old freelance designer. She puts $3,000 into her HSA this year. Right off the bat, she saves about $660 on her income taxes (assuming she's in the 22% tax bracket). If she invests that money and it grows to $10,000 over the next decade, she won't owe a dime in capital gains tax. She’s actively turned her healthcare savings into a key piece of her strategy to achieve financial independence.

Are You Sure You’re Eligible for an HSA?

First things first: you can’t just open a Health Savings Account (HSA) because you want one. The IRS has specific rules, and the biggest one is that you absolutely must be enrolled in a qualified High-Deductible Health Plan (HDHP).

Not just any health plan with a high deductible will do. It must meet specific, government-defined criteria to be considered "HSA-eligible." These plans are designed with a trade-off in mind: you take on more of the initial healthcare costs yourself (the high deductible), and in return, you usually get a much lower monthly premium. Before you go any further, make sure your plan is a genuine High Deductible Health Plan (HDHP).

For 2024, an HDHP must have a minimum annual deductible of at least $1,600 for an individual or $3,200 for a family. Just as important, your plan’s annual out-of-pocket maximum can't be more than $8,050 for an individual or $16,100 for a family.

More Than Just the Health Plan

Having the right health plan is the main hurdle, but there are a few other boxes you need to check. Think of these as the fine print to ensure HSAs are used correctly. You’re not eligible to open or contribute to an HSA if you:

- Are enrolled in Medicare (any part—A, B, or D).

- Can be claimed as a dependent on someone else's tax return (like a young adult on a parent's return).

- Have other health coverage that isn't an HDHP. This could be a spouse’s traditional plan or a general-purpose Flexible Spending Account (FSA).

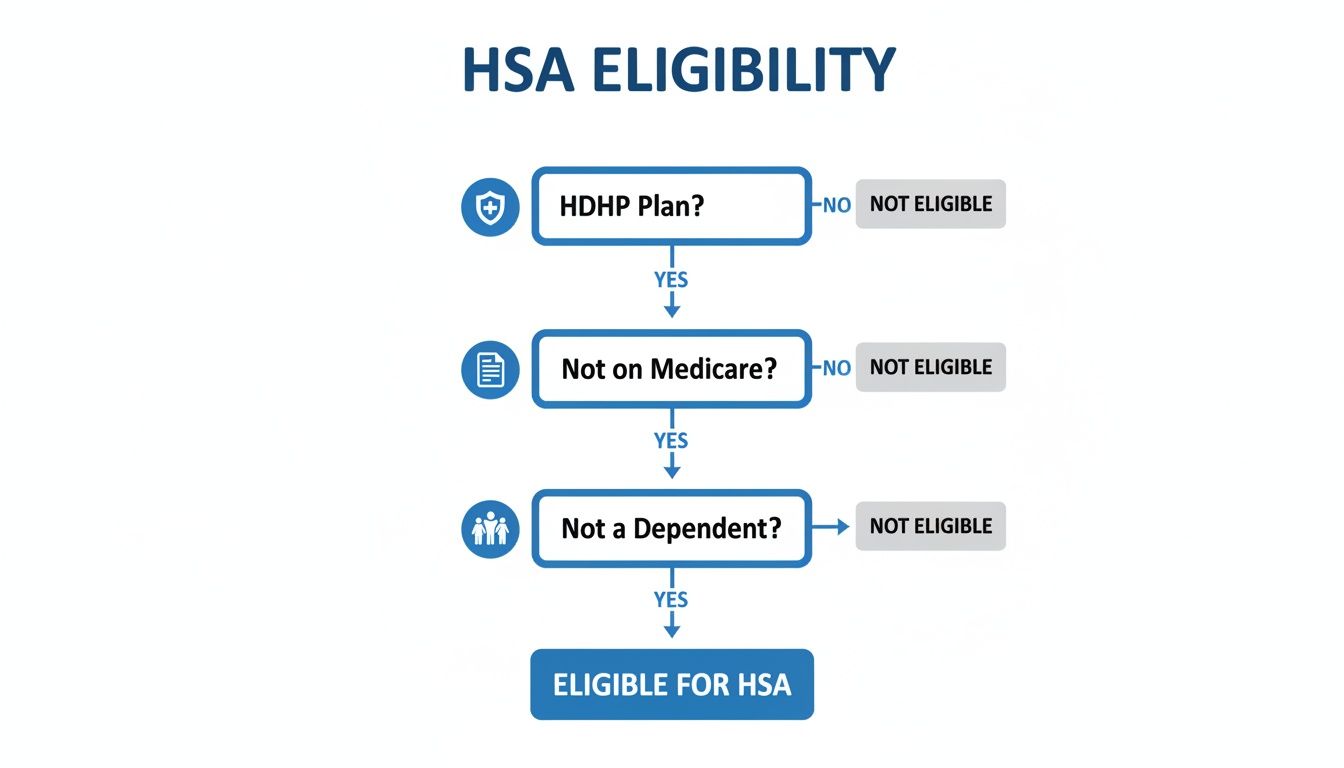

To make it easy, here’s a quick checklist to see where you stand.

HSA Eligibility Checklist: Are You Ready to Open an Account?

This simple table will help you quickly determine if you meet the requirements to open and contribute to a Health Savings Account. Just go down the list and see if you can answer "Yes" to the key questions.

| Requirement | What It Means | Am I Eligible? (Yes/No) |

|---|---|---|

| Enrolled in an HDHP? | You are currently covered by a qualified High-Deductible Health Plan. | |

| No Other Conflicting Coverage? | You don't have other health insurance that isn't an HDHP (like a spouse's PPO or an FSA). | |

| Not Enrolled in Medicare? | You are not yet enrolled in any part of Medicare. | |

| Not a Dependent? | You cannot be claimed as a dependent on someone else's tax return. |

If you answered "Yes" to all these points for the current month, you're good to go!

Key Takeaway: Your eligibility is determined on a month-by-month basis. You can only make HSA contributions for the months where you meet all these requirements on the first day of that month.

How This Plays Out in Real Life

Let's look at a couple of real-world scenarios to see how eligibility works in practice.

Scenario 1: The Freelancer. Maria, a freelance graphic designer, is shopping on the healthcare marketplace. She selects a Bronze plan with a $7,000 deductible and an $8,000 out-of-pocket maximum. Since both of these figures fall within the 2024 limits for an individual, her plan qualifies. She isn't on Medicare or claimed as a dependent, so she is fully eligible to open an HSA.

Scenario 2: The New Parent. David is a new parent weighing his family's options during his company's open enrollment. His job offers an HDHP with a $4,000 family deductible, which is well above the minimum requirement. Neither he nor his spouse is on Medicare, and nobody claims them as dependents. They are eligible to open and contribute to a family HSA, a smart move that can help them budget for their growing family’s medical needs. Figuring out how to add those contributions to your financial plan is the next step, and our guide on how to create a monthly budget can walk you through it.

How To Choose The Right HSA Provider

A common misconception is that you’re stuck with the HSA your employer offers. That’s simply not true. The beauty of a Health Savings Account is that it’s your account, not your company's. You have the freedom to choose a provider that actually aligns with your financial goals.

Think about it: your employer likely picked their provider based on easy payroll integration and low administrative costs for the company. Their priority isn't necessarily finding the best investment options or the lowest fees for you. Your goal might be aggressive, tax-free growth for retirement, while theirs is just to check a box.

Because the differences between providers can be huge, taking a little time to shop around is one of the most important things you can do. It can literally make a difference of thousands of dollars over the long run.

What To Look For In An HSA Provider

Not all HSAs are built the same. Some are little more than basic savings accounts offered by a bank, while others are powerful investment accounts that function just like a brokerage account. The trick is to ignore the flashy marketing and dig into the details.

Here’s what I always tell people to focus on:

- Investment Options: Can you actually invest your money? If so, what are your choices? The best providers offer a wide selection of low-cost index funds and Exchange-Traded Funds (ETFs).

- Fees: This is a big one. Hidden fees can quietly eat away at your returns. Look for monthly maintenance fees, investment administration fees, and trading commissions. A seemingly small fee of just 1% can torpedo your long-term growth.

- Interest on Cash: If you plan to keep a cash buffer for immediate medical needs, what interest rate does it earn? Many providers pay next to nothing, meaning inflation is effectively shrinking your balance every year.

- User Experience: Is the website or app clunky and confusing, or is it intuitive? How easy is it to contribute, pay a bill from your account, or check on your investments? A frustrating user interface is a deal-breaker. If you want a benchmark for a great interface, check out some of the best personal finance apps to see how it should be done.

Before you dive deep into comparing providers, it’s always a good idea to quickly double-check that you meet all the requirements. This flowchart is a great way to do a quick final check.

This simple visual guide walks you right through the key qualifications—having a high-deductible health plan (HDHP), not being enrolled in Medicare, and not being claimed as a dependent—to make sure you’re good to go.

Comparing HSA Providers: Finding Your Best Fit

Most HSA providers fall into one of three categories: banks, brokerage firms, or specialized HSA administrators. Each one caters to a different type of user, so understanding their pros and cons is key to making the right choice for your financial goals.

| Provider Type | Best For | Key Features | Potential Drawbacks |

|---|---|---|---|

| Banks & Credit Unions | Spenders & Savers. Those who plan to use funds regularly for medical bills. | FDIC/NCUA insurance, easy access with debit cards and local branches, simple interface for paying bills. | Extremely low interest rates, limited or high-fee investment options, may charge monthly maintenance fees. |

| Brokerage Firms | Investors. Those focused on long-term, tax-free growth for retirement. | Wide range of low-cost investments (ETFs, index funds, stocks), powerful management tools, often lower overall fees. | Might not offer a debit card, can be more complex for beginners, may have an investment threshold (a minimum cash balance). |

| HSA Administrators | A Mix of Both. Users who want a balance of spending features and investment options. | A balanced approach with decent investment options and good tools for tracking expenses and paying bills. | Can have multiple layers of fees (admin, investment), investment choices aren't as broad as a pure brokerage. |

My Personal Insight: I learned this the hard way. My first HSA was with a big national bank. The debit card was handy, but I quickly realized my cash was earning a pathetic 0.01% interest and the investment choices were just a few high-fee mutual funds. I switched to a brokerage-focused provider and immediately unlocked better, cheaper investment options that dramatically improved my growth potential.

At the end of the day, the right provider comes down to your primary goal for the account. If you see your HSA as a long-term investment vehicle for retirement, a brokerage firm is almost always the winner. But if you expect to use the funds regularly for current medical expenses, the convenience of a bank might be what you need.

A Practical Walkthrough of Opening Your HSA

Alright, you've done the research and picked your provider. Now for the easy part: actually opening the HSA. Most applications are surprisingly quick and painless, often taking less than 15 minutes.

Let’s walk through it together. We'll follow Sarah, our freelance designer who just signed up for a new HDHP and wants an HSA with strong investment options. Her experience will show you just how simple this can be.

Before you dive in, grab a few key pieces of info. Having this stuff handy will make the whole process a breeze.

You'll need:

- The Basics: Your full name, date of birth, and Social Security number. Standard stuff for any financial account.

- Contact Info: Your physical address, email, and phone number.

- Your HDHP Details: You probably won't need to upload your insurance card, but you will have to legally confirm that you're covered by a qualified High-Deductible Health Plan.

The Online Application Journey

Sarah lands on her chosen provider's website and hits the big "Open an Account" button. The first screen is exactly what you'd expect: name, address, Social Security number. This is all for identity verification, a required step for any legitimate financial institution.

The next page is really important—it's the eligibility confirmation. It’s basically a digital handshake. Sarah is presented with a checklist where she has to attest that she meets all the HSA rules, like being covered by an HDHP and not being claimed as a dependent on someone else's tax return. It’s a legal declaration, so honesty is key here.

Once she's confirmed her eligibility, it's time to put some money in the account.

Linking Your Bank and Getting Funds In

This is where the magic happens and your HSA starts to feel real. Sarah sees two main options for making her first deposit:

- Electronic Funds Transfer (EFT): She can link her checking or savings account using its routing and account numbers.

- Rollover or Transfer: If she had an old HSA, she could move the funds from that account into her new one.

Sarah decides to link her primary checking account. The provider uses a secure tool like Plaid to connect to her bank. She just logs into her online banking through their secure portal, and within seconds, her account is verified and ready to go. No tiny "test deposits" needed.

My Two Cents: Even if you plan to fund your HSA through payroll deductions at work, go ahead and link your personal bank account during setup. It gives you a direct path to add funds anytime, which is especially useful for making a last-minute contribution for the prior year before the tax deadline hits.

Don't Skip the Beneficiaries

Before finishing up, the application asks Sarah to name her beneficiaries. It’s tempting to click "I'll do this later," but trust me, don't. Naming beneficiaries is a simple step that ensures your HSA funds go directly to the people you choose, bypassing the long and often costly probate process.

If you name your spouse as the primary beneficiary, they can roll your HSA into their own, and it keeps all its powerful tax advantages. If your beneficiary is not your spouse, the funds are distributed to them, but they'll have to pay income tax on the amount.

Sarah lists her husband as the primary beneficiary and her sister as the contingent (or backup). All told, she was done in about 12 minutes. Her account is officially open, and she's ready to contribute, invest, and start turning her healthcare savings into a real asset.

Funding and Investing Your HSA for Long-Term Growth

Alright, you’ve opened your HSA. That's a huge first step. But now comes the fun part: turning that account into a powerhouse for your financial future. This isn't just about stashing cash for doctor's visits. We're talking about using its unique tax advantages to build serious wealth over time.

Know Your Contribution Limits

To get the most out of your HSA, you need to know the rules of the road. The IRS sets contribution limits every year, and they depend on whether you have a health plan for just yourself or for your family.

Here are the numbers for 2024:

- $4,150 if you have self-only HDHP coverage.

- $8,300 if you have family HDHP coverage.

Getting closer to retirement? There’s a nice little bonus for you. If you're age 55 or older, you can throw in an extra $1,000 each year as a "catch-up" contribution.

Shifting From Saving to Investing

Too many people treat their HSA like a glorified checking account for medical bills. While that’s a decent starting point, it completely misses the account’s secret weapon: tax-free investment growth.

Most modern HSA providers let you invest your money once your cash balance hits a certain minimum. They often call this an investment threshold. Think of it as a small cash cushion you need to keep for immediate expenses. For instance, your provider might require you to keep the first $1,000 in cash. But every dollar above that? You can put it to work in the market.

Once you’re clear to invest, a fantastic and straightforward strategy is to use low-cost index funds or ETFs. They give you instant diversification across the market without the high fees that can slowly drain your returns. If that sounds new to you, our guide on how to start investing in index funds will walk you through it.

The Power of Compound Growth in Action

Let’s make this real. Imagine Alex, a 35-year-old with a family health plan. He decides to contribute the maximum $8,300 for the year. He keeps $2,000 in his HSA's cash account for any unexpected medical needs and invests the other $6,300 in a simple S&P 500 index fund.

Assuming he continues this strategy and his investments earn an average of 8% per year, here's what that growth could look like:

| Year | Annual Contribution | Total Contributions | Investment Growth | Total Account Value |

|---|---|---|---|---|

| Year 1 | $8,300 | $8,300 | $504 | $8,804 |

| Year 5 | $8,300 | $41,500 | $12,710 | $54,210 |

| Year 10 | $8,300 | $83,000 | $47,435 | $130,435 |

| Year 20 | $8,300 | $166,000 | $239,970 | $405,970 |

Key Insight: Look at that! After 20 years, Alex's account is worth over $400,000. The incredible part is that well over half of that value came from his investments growing completely tax-free. By simply setting it and forgetting it, he built a huge retirement asset while still having a safety net for healthcare. This is a powerful strategy that complements other financial goals, like learning how to build an emergency fund.

Frequently Asked Questions About HSAs

Once you’ve got your HSA up and running, practical questions will naturally arise. Here are answers to some of the most common queries.

1. Can I open an HSA if my employer doesn't offer one?

Yes, absolutely. As long as you are enrolled in a qualified High-Deductible Health Plan (HDHP), you can open an HSA with any provider you choose. You are never stuck. You will contribute with after-tax money from your bank account and then deduct those contributions on your tax return.

2. What happens to my HSA if I change jobs?

Your HSA is 100% yours and fully portable. It is not tied to your employer. If you switch jobs, the account and all the money in it go with you. If your new job doesn't offer an HDHP, you can no longer contribute, but the existing funds remain yours to use and invest.

3. How is an HSA different from an FSA?

The key differences are ownership, portability, and investment capability. You own your HSA, the funds never expire, and you can invest them for growth. An FSA is owned by your employer, the funds are typically "use-it-or-lose-it" annually, and you cannot invest them.

4. Can I have more than one HSA account?

Yes. Some people use two HSAs: one at a bank with a debit card for easy spending and another at a brokerage for long-term investing. The only rule is that your total contributions across all accounts cannot exceed the annual IRS limit.

5. What are the penalties for using HSA funds for non-medical expenses?

If you are under age 65, withdrawals for non-qualified expenses are subject to your ordinary income tax rate plus a steep 20% penalty. After age 65, the 20% penalty disappears, and withdrawals for any reason are simply taxed as ordinary income, similar to a traditional 401(k).

6. Do I need to keep receipts for my HSA spending?

Yes. It is your responsibility to keep records (receipts, Explanation of Benefits) to prove that your withdrawals were for qualified medical expenses in case of an IRS audit. Many providers offer digital receipt storage tools to help with this.

7. Can I use my HSA for my spouse or dependents' medical bills?

Yes. You can use your HSA funds to pay for qualified medical expenses for yourself, your spouse, and any tax dependents, even if they are not covered by your HDHP.

8. Is it better to contribute through payroll or directly from my bank?

Contributing through your employer's payroll is superior. These contributions are made pre-tax, which means they bypass both federal income tax and FICA taxes (Social Security and Medicare). Direct contributions are deductible for income tax but not FICA tax, so you miss out on that extra 7.65% tax savings.

9. Can I pay health insurance premiums with my HSA?

Generally, no. You cannot use HSA funds for regular health insurance premiums. However, there are exceptions, including COBRA coverage, insurance while receiving unemployment benefits, and Medicare premiums (after age 65).

10. Is there a deadline to reimburse myself for a medical expense?

No, there is no time limit. As long as the expense occurred after your HSA was established, you can reimburse yourself at any point in the future—next month, next year, or even decades later in retirement. This allows you to pay out-of-pocket now and let your HSA investments grow tax-free for years before taking a tax-free withdrawal.

At Everyday Next, we're committed to providing clear, actionable insights to help you navigate your financial journey. From making sense of investment accounts to building a secure future, we deliver the information you need to make smart decisions. Explore more guides and articles at https://everydaynext.com.