QQQ: What Is It? A Clear Guide to the Nasdaq-100 ETF

So, what exactly is QQQ?

At its heart, the Invesco QQQ Trust (ticker: QQQ) is an Exchange-Traded Fund (ETF). Think of it as a single investment that bundles together shares from 100 of the world's most influential and innovative non-financial companies. It's one of the most popular ways for investors to gain exposure to major players in technology and other high-growth industries.

A Simple Guide to the QQQ ETF

Imagine QQQ as a pre-made investment basket. Instead of researching and buying individual shares of giants like Apple, Microsoft, Amazon, and NVIDIA one by one, you can buy a single share of QQQ. By doing so, you instantly own a small slice of all of them, plus dozens more. This approach offers incredible efficiency.

The purpose of QQQ is to mirror the performance of a specific stock market index: the Nasdaq-100. This index is a big deal. It’s composed of the 100 largest non-financial companies listed on the Nasdaq stock exchange, meaning it's packed with businesses at the forefront of global innovation.

Key Characteristics of QQQ

To fully grasp what QQQ is, you need to understand its defining traits. These are what make it tick.

- Tracks the Nasdaq-100: QQQ doesn't actively pick stocks. It passively holds the companies included in the Nasdaq-100 Index. When the index composition changes, QQQ adjusts its holdings to match.

- Excludes Financials: This is a crucial detail. The Nasdaq-100 deliberately leaves out banks, insurance companies, and other financial firms. This maintains a sharp focus on technology, consumer, and healthcare innovators.

- Market-Cap Weighted: In this ETF, size matters. The largest companies by market capitalization, like Microsoft and Apple, have a much larger influence on QQQ's price movement than the smaller companies at the bottom of the list. A great day for Big Tech usually means a great day for QQQ.

Why It Matters to You

For many investors, QQQ represents a straightforward bet on the future. It’s a way to invest in the long-term growth of technology and market disruption without the complexity of picking individual winners and losers.

Real-Life Example:

Sarah is a 30-year-old software developer who believes strongly in the continued growth of the tech sector but doesn't have time to research individual stocks. Instead of trying to guess whether the next big thing will be in AI, cloud computing, or e-commerce, she regularly invests in QQQ. This allows her to capture the overall growth of the sector's biggest players through a single, diversified investment.

Takeaway: QQQ isn't just another ticker symbol. It's a powerful tool for investing in a concentrated group of industry leaders who are actively shaping our future.

This ETF has become a cornerstone in many modern portfolios, but it's vital to know how it's different from funds that track the entire market. You can learn more about how to start investing in index funds in our detailed guide.

A Look Inside QQQ: What Are You Actually Buying?

When you buy a share of QQQ, what are you really getting? You’re not just owning a ticker symbol; you're buying a slice of the 100 most influential non-financial companies on the Nasdaq exchange. Knowing what’s under the hood is crucial to figuring out if this ETF fits into your bigger financial picture.

At its heart, QQQ is a bet on innovation and growth. It's famous for being packed with tech companies, but it's not just a tech fund. You’ll also find giants from other fields, like Tesla and Costco in the consumer space and Meta (Facebook) and Alphabet (Google) in communications.

This blend gives you exposure to a wide array of forward-thinking businesses. But make no mistake, the fund's unique structure means a handful of mega-cap stocks hold most of the power.

How Market-Cap Weighting Tilts the Scales

QQQ is a market-capitalization-weighted fund. That might sound technical, but the concept is simple: the bigger the company's total market value, the bigger its piece of the QQQ pie.

Companies with huge market values—think Apple and Microsoft—make up a much larger portion of the fund than the smaller companies in the index.

This has a direct effect on your investment. If NVIDIA has a stellar quarter and its stock soars, you'll see a nice bump in your QQQ shares. On the flip side, a rough day for one of these titans can drag the whole fund down with it.

Key Insight: Investing in QQQ is a concentrated bet on the continued success of a few dominant companies. The ETF's performance is deeply linked to the fortunes of its largest holdings.

To see this in action, let's look at the top 10 holdings. Notice how just a few household names command a significant chunk of the entire portfolio.

Top 10 Holdings in the QQQ ETF (Illustrative)

Here’s a snapshot of the companies that drive the QQQ's performance. As you can see, the fund is heavily concentrated at the top, with a strong emphasis on major tech leaders.

| Company Name | Ticker Symbol | Sector | Approximate Weight (%) |

|---|---|---|---|

| Microsoft Corp | MSFT | Information Technology | ~8.7% |

| Apple Inc | AAPL | Information Technology | ~8.5% |

| NVIDIA Corp | NVDA | Information Technology | ~7.9% |

| Amazon.com Inc | AMZN | Consumer Discretionary | ~5.2% |

| Broadcom Inc | AVGO | Information Technology | ~4.6% |

| Meta Platforms Inc | META | Communication Services | ~4.5% |

| Costco Wholesale Corp | COST | Consumer Staples | ~2.4% |

| Alphabet Inc (Class A) | GOOGL | Communication Services | ~2.4% |

| Alphabet Inc (Class C) | GOOG | Communication Services | ~2.3% |

| Tesla Inc | TSLA | Consumer Discretionary | ~2.1% |

Holdings and weights are always changing and are shown here for illustrative purposes.

As the table shows, owning QQQ means a significant portion of your money is riding on the performance of a select group of tech and consumer giants.

A Focused Bet on Big Tech

This top-heavy structure is what really separates QQQ from broad-market funds like those that track the S&P 500, which are much more diversified across all sectors of the economy.

QQQ’s focused approach can lead to explosive growth when its top companies are firing on all cylinders. But it also comes with more risk, since you're less diversified than you would be in a broader fund.

For investors who like this tech-heavy approach and want to explore it further, checking out the best AI ETFs can offer a look into other funds with a similar focus. In the end, understanding QQQ means appreciating this highly concentrated, growth-oriented strategy.

A Closer Look at QQQ's Performance and Volatility

QQQ has a reputation for delivering some truly impressive returns, but it's crucial to understand that this growth is anything but a smooth, straight line. The fund's history is a story of exhilarating highs and gut-wrenching lows. To really know if it’s right for you, you have to be ready for both.

Over the years, QQQ has frequently left broader market indexes like the S&P 500 in the dust. This is especially true when technology is leading the charge, like during the recent AI boom or the market recovery after the pandemic. But that heavy concentration in high-flying sectors is a double-edged sword, making it much more susceptible to sharp drops when the market turns sour.

The Highs and Lows of QQQ

If you invest in QQQ, you're signing up for volatility. It’s just part of the deal. In a bull market, its performance can be absolutely spectacular. But when the economy shifts and investor sentiment sours, the ride down can be brutal.

We’ve seen it happen. The 2008 financial crisis hit the fund hard as the global economy seized up. More recently, the aggressive interest rate hikes in 2022 slammed the brakes on growth-oriented tech stocks, sending QQQ into another major downturn. These moments are a stark reminder of the risks involved. You really have to be prepared to hold on through the storms to catch the recovery on the other side.

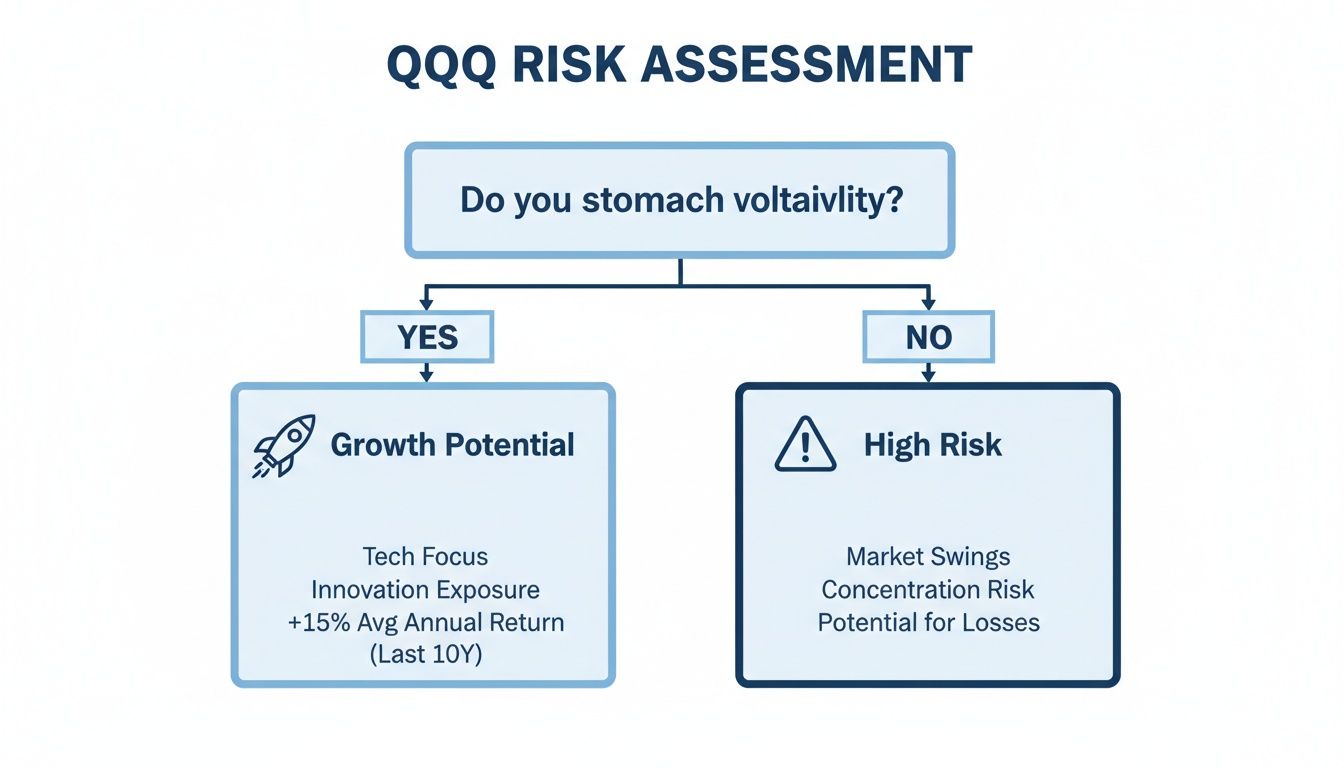

The Risk-Reward Tradeoff: QQQ’s potential for huge returns is tied directly to its higher volatility. The real question for investors is whether they can stomach significant short-term losses for a shot at powerful long-term growth.

This cycle of sharp drops followed by powerful rebounds is just how QQQ behaves. For many, accepting that investing is inherently risky is the first step to putting this kind of volatility in perspective.

Long-Term Growth: The Numbers Tell the Story

Despite all the turbulence, the long-term numbers are pretty compelling. Since its debut on March 10, 1999, QQQ has become a go-to for investors who want to bet on America's biggest innovators.

It's survived multiple market cycles, including some truly nasty drawdowns like the -41.73% total return in 2008 and the -32.58% plunge in 2022. But it has also posted incredible comeback years, like the +54.85% return it delivered in 2023. Over the long haul, this resilience has often led to it handily beating the broader market. You can dig into the year-by-year numbers yourself over at etfreplay.com.

Measuring Performance Beyond Simple Returns

If you want to get technical and really judge how well the fund itself is performing, it's helpful to look past your own account statement. Metrics like the Time-Weighted Rate of Return (TWRR) formula can show you how the investment performed on its own, stripping out the effects of when you personally added or withdrew money. This gives you a cleaner picture of the fund's underlying performance.

When you zoom out, QQQ’s history shows a clear pattern. It's an ETF built for investors with a strong stomach and a long-term mindset. It tends to reward those who can stay the course through its inevitable cycles of boom and bust.

Comparing QQQ Against VOO and QQQM

To really get a handle on QQQ, you have to see how it measures up against other popular ETFs. It's not about which one is "best," but which one is best for you. Your choice really boils down to your personal goals—are you chasing aggressive growth, looking for broad market stability, or just trying to be as cost-efficient as possible?

Let's put QQQ head-to-head with two of its biggest competitors: VOO, the Vanguard S&P 500 ETF, and QQQM, its slightly younger, lower-cost sibling.

QQQ vs. VOO: The Growth and Stability Tradeoff

This is the classic matchup. Choosing between QQQ and VOO is a textbook case of growth vs. diversification. Think of QQQ as a concentrated bet on technology and innovation, while VOO is a bet on the American economy as a whole.

| Feature | QQQ (Nasdaq-100) | VOO (S&P 500) |

|---|---|---|

| Focus | 100 non-financial, tech-heavy giants | 500 largest U.S. companies across all sectors |

| Diversification | Lower (concentrated in growth/tech) | Higher (spread across 11 sectors) |

| Volatility | Higher | Lower |

| Growth Potential | Higher | Moderate |

| Investor Profile | Aims for aggressive growth, high risk tolerance | Seeks stable, long-term growth |

The performance difference can be stark. QQQ's concentration often leads to outperformance during tech-led bull markets but can result in steeper losses during downturns. VOO provides a smoother ride, capturing the steady growth of the entire U.S. economy, which is why it's a cornerstone for so many long-term portfolios. For a closer look, check out our guide on investing in the S&P 500.

QQQ vs. QQQM: A Choice for Different Investors

Invesco also offers QQQM, often called the "QQQ mini." Both funds track the exact same Nasdaq-100 index and own the same companies. The real difference is their structure and cost, which makes them suited for very different strategies.

| Feature | QQQ (The Original) | QQQM (The "Mini") |

|---|---|---|

| Expense Ratio | 0.20% | 0.15% |

| Share Price | Higher | Lower |

| Trading Volume | Extremely High | Moderate |

| Best For | Active traders needing high liquidity | Long-term, buy-and-hold investors |

QQQM's lower expense ratio and share price make it a fantastic, cost-effective choice for long-term investors adding money regularly. In contrast, QQQ's massive daily trading volume makes it the go-to for active traders who need to move in and out of large positions quickly and efficiently.

Key Takeaway: QQQ is for traders who need liquidity above all else. QQQM is for long-term investors who prioritize lower costs.

A Side-By-Side Comparison

Sometimes, seeing the facts laid out makes the decision easier. This table cuts through the noise and shows the core differences at a glance.

Comparison of QQQ vs. VOO vs. QQQM

| Feature | QQQ (Invesco QQQ Trust) | VOO (Vanguard S&P 500 ETF) | QQQM (Invesco Nasdaq 100 ETF) |

|---|---|---|---|

| Index Tracked | Nasdaq-100 | S&P 500 | Nasdaq-100 |

| Number of Holdings | ~100 | ~500 | ~100 |

| Sector Focus | Tech-heavy, growth | Diversified across all sectors | Tech-heavy, growth |

| Expense Ratio | 0.20% | 0.03% | 0.15% |

| Ideal Investor | Active traders, growth seekers | Long-term core holding | Buy-and-hold investors |

In the end, choosing between these ETFs really hinges on your own comfort with risk. This simple decision tree can help you visualize whether QQQ's high-octane volatility aligns with your personal investment strategy.

As the chart makes clear, the single most important factor is whether you can stomach the sharp market swings that come with QQQ. If you can, the potential rewards are significant. If not, a more diversified fund like VOO might let you sleep better at night.

The Pros and Cons of Investing in QQQ

Like any investment worth considering, QQQ has its own set of compelling strengths and very real weaknesses. It’s not a one-size-fits-all fund. Before you even think about adding it to your portfolio, you need to understand both sides of the coin. QQQ can be a powerful engine for growth, but that kind of power always comes with risk.

The Case for Investing in QQQ

Let's start with the big draw: explosive growth potential. When you buy QQQ, you're getting a concentrated dose of the Nasdaq-100, which means direct exposure to some of the world's most dominant and innovative companies. Think about the businesses defining our future in everything from artificial intelligence to cloud computing—they're all in here.

This tech-heavy focus has paid off handsomely for investors over the long haul. Historically, QQQ has been a standout performer, often delivering higher returns than the broader market during periods of economic expansion. For instance, its +54.85% surge in 2023 when the AI boom took off shows just how fast it can reward investors when its key sectors are firing on all cylinders. You can see the full performance picture on Invesco's official site.

The Upside: QQQ is essentially a one-stop shop for investing in a basket of high-octane growth stocks. If you believe in the long-term dominance of technology and innovation, it’s one of the purest ways to bet on that future.

The Case Against Investing in QQQ

Now, for the other side of the story. The very things that make QQQ so powerful are also its biggest weaknesses. The fund's heavy concentration in technology and growth stocks makes it incredibly volatile. When the market turns sour on tech—like it did in 2022 when interest rates shot up—QQQ can fall, and fall hard.

This lack of diversification is its Achilles' heel. You won't find any financial, energy, or utility stocks in QQQ. That means if those sectors are having a great year while tech is in a slump, QQQ investors are left watching from the sidelines. This makes it a poor fit for anyone with a low tolerance for risk or a short time until they need their money. If you're looking to build a more balanced portfolio, our guide on investing strategies for beginners is a great place to start.

Real-Life Example:

- A young investor like Alex, 25, has a 40-year time horizon. He sees QQQ's volatility as an opportunity, using market dips to buy more shares at a lower price, confident in its long-term growth potential.

- An investor nearing retirement, like Brenda, 60, would likely find those dramatic swings stressful. For her, capital preservation is more important than aggressive growth, so a less volatile, more diversified fund would be a better choice.

In the end, whether QQQ is right for you boils down to your personal financial goals, your timeline, and whether you have the stomach to ride out the inevitable turbulence in the hunt for higher returns.

Frequently Asked Questions About QQQ

Here are answers to the 10 most common questions investors have about the QQQ ETF.

1. Is QQQ a good investment for beginners?

It depends on the beginner. For a young investor with a long time horizon and high risk tolerance, QQQ can be a powerful growth component. However, its volatility can be jarring. Most beginners are better off starting with a broadly diversified core holding, like an S&P 500 ETF, and then adding QQQ as a smaller, growth-focused position. Our guide on how to invest money for beginners can help build this foundation.

2. Does QQQ pay dividends?

Yes, but the dividend yield is very low, typically under 1%. The companies in QQQ are growth-oriented and prefer to reinvest their profits back into the business for innovation and expansion rather than paying them out as dividends. Investors should look to QQQ for capital appreciation (share price growth), not income.

3. What is the difference between QQQ and the Nasdaq Composite?

This is a key distinction. The Nasdaq Composite Index includes all stocks listed on the Nasdaq exchange—over 3,000 companies. QQQ tracks the Nasdaq-100, a much more exclusive index of only the 100 largest non-financial companies on the exchange. QQQ is a concentrated bet on the biggest innovators, while the Composite is a broad measure of the entire Nasdaq market.

4. Can QQQ be my only investment?

It is not recommended. Relying solely on QQQ creates a portfolio with significant concentration risk. You would have no exposure to key economic sectors like financials, energy, and utilities, nor any international stocks or bonds. A well-diversified portfolio is built to withstand various market conditions, and QQQ should be considered a component, not the entire structure.

5. Is QQQ riskier than an S&P 500 ETF?

Yes, definitively. QQQ is more volatile and therefore considered riskier than a broad-market S&P 500 ETF like VOO. Its fate is tightly linked to the tech sector and a handful of mega-cap companies. The S&P 500 is diversified across 500 companies in all 11 economic sectors, providing a more stable and balanced investment profile.

6. What does the QQQ expense ratio mean?

QQQ has an expense ratio of 0.20%. This is the annual fee you pay to the fund manager (Invesco) for operating the ETF. For every $10,000 you have invested in QQQ, you will pay $20 per year in fees.

7. How often do the stocks in QQQ change?

The Nasdaq-100 index, which QQQ tracks, is reconstituted annually in December. It is also rebalanced quarterly (in March, June, and September) to adjust the weightings of the stocks to ensure it continues to accurately reflect the index's rules.

8. What's the difference between QQQ and QQQM?

They track the same index, but QQQM is designed for buy-and-hold investors with a lower expense ratio (0.15%) and share price. QQQ is built for active traders due to its massive trading volume and liquidity, making it easier to buy and sell large amounts quickly.

9. How is QQQ taxed?

QQQ is taxed like an individual stock. If you sell shares for a profit after holding them for more than one year, the gain is taxed at the lower long-term capital gains rate. If held for less than a year, it's taxed as ordinary income. Any dividends received are also taxable.

10. Can QQQ go to zero?

Theoretically, any investment can, but it is practically impossible for QQQ. For QQQ to go to zero, all 100 of the largest and most innovative non-financial companies in the U.S. would have to go bankrupt simultaneously. This scenario is considered extraordinarily unlikely.

At Everyday Next, we're committed to delivering clear insights on wealth, tech, and personal development to help you make smarter decisions. Explore more practical guides and analysis at https://everydaynext.com.