Real Estate Investment Guide: A Beginner’s Framework for Analyzing Deals, Securing Financing, and Building Wealth

If you've ever thought about getting into real estate investing but felt overwhelmed by where to start, you're in the right place. This guide is built to take you from a curious beginner to a confident investor, one clear step at a time. Forget the jargon and complexity; we're going to break down everything you need to know based on real-world experience.

Real estate has long been a bedrock for building serious wealth. It’s not just about owning property; it’s about creating a tangible path to financial freedom through cash flow, appreciation, tax benefits, and equity buildup.

Why Real Estate Is a Powerful Wealth-Building Tool

Investing in real estate is more than just a transaction—it’s about building a solid financial foundation for your future. What makes it so compelling is that it offers several ways to make money at the same time, which is a rare quality in any investment.

Even when the economy feels uncertain, the core advantages of owning property remain. The current market, in fact, is creating some interesting opportunities for new investors who know what to look for. According to recent industry analysis, private real estate values have climbed for five straight quarters.

Transaction volumes have also surged back, hitting $739 billion in major markets, which is a 19% jump from the previous year. This signals that now could be a fantastic time to get in the game. For a deeper dive into the numbers, you can read the full real estate trends report from Nuveen.

Your Path to Becoming an Investor

This guide is designed to be your roadmap. We’ll skip the fluff and get straight to the practical knowledge you need to make smart moves.

Here’s a glimpse of what you'll learn:

- How to analyze deals like a pro using essential financial metrics.

- Ways to secure financing, from traditional bank loans to more creative strategies.

- How to manage risks and navigate the important legal and tax rules.

A common question for new investors is how real estate stacks up against other options, like the stock market. To help you think through this, our detailed comparison on real estate vs. stocks breaks down the pros and cons of each.

The goal isn't just to buy property—it's to acquire assets that work for you, generating income and building equity while you focus on what matters most.

By the time you finish this guide, you’ll have a complete framework for finding, funding, and managing your first property. We're here to demystify the process and show you that with the right education, becoming a successful real estate investor is completely within your reach.

Understanding the Language of Real Estate Investing

Jumping into real estate investing can feel a lot like learning a new language. You'll hear investors throwing around terms like "cap rate" and "NOI," and it's easy to feel like you're out of the loop. But these aren't just buzzwords; they're the vital signs of a property, telling you whether it’s a healthy investment or a financial headache waiting to happen.

Think of it this way: if a property is a small business, these metrics are its profit and loss statement. They give you a clear, unbiased look at its performance, helping you make decisions based on cold, hard data, not just a gut feeling. Getting a solid handle on these core concepts is easily the most important first step toward building a successful portfolio.

The Most Important Metrics You Must Know

While you can analyze a deal a dozen different ways, a few key metrics do most of the heavy lifting. Once you understand the "why" behind each one, you'll have the confidence to evaluate pretty much any opportunity that comes across your desk. Let's break down the essentials.

-

Net Operating Income (NOI): This is the lifeblood of a property. It's the total income left over after you've paid all the operating expenses—but before you've paid the mortgage. NOI shows you the raw profitability of the asset itself, totally separate from how you choose to finance it.

-

Capitalization Rate (Cap Rate): This metric gives you the potential annual return on an investment if you bought it with all cash. A higher cap rate often points to higher potential returns, but it can also signal higher risk. It’s a great tool for comparing apples to apples.

-

Cash-on-Cash Return (CoC): For most new investors, this is the number that matters most. It measures the annual cash profit you actually get back, divided by the total cash you pulled out of your own pocket to buy the place. It gives you a real-world look at the return on your money.

One popular strategy for finding great deals is to hunt for undervalued assets. As you get more comfortable with these numbers, it's worth learning what a distressed property is and how to invest in them.

Key Takeaway: Don't just memorize the formulas. Really understand what each metric is telling you. NOI is the property's pure performance, Cap Rate is for comparing deals, and Cash-on-Cash Return is all about your personal profit.

Key Real Estate Investment Metrics Compared

To really let these concepts sink in, it helps to see them side-by-side. Each one gives you a different piece of the investment puzzle, and knowing which one to use and when is what separates seasoned investors from the beginners.

This table breaks down the big three.

| Metric | What It Measures | Simple Formula | Best Used For |

|---|---|---|---|

| Cap Rate | A property's unleveraged (all-cash) rate of return. | Net Operating Income / Purchase Price | Quickly comparing the relative value of similar properties in the same market. |

| Cash-on-Cash Return | The return on your actual cash invested (down payment, closing costs). | Annual Pre-Tax Cash Flow / Total Cash Invested | Evaluating the performance of a specific deal based on your personal financing. |

| Internal Rate of Return (IRR) | The total annualized return, including cash flow and future profit from the sale. | A more complex calculation involving the time value of money. | Analyzing the long-term profitability of a "buy and hold" investment over its entire lifespan. |

Each metric has its place. The cap rate is for quick comparisons on the market, the cash-on-cash return is for your personal bottom line, and the IRR is for looking at the big picture over many years.

A Real-World Example

Alright, let's put this into practice. Imagine you're looking at a duplex for sale for $300,000.

- It brings in $30,000 a year in rent.

- Your annual operating expenses (taxes, insurance, maintenance, etc.) come out to $10,000.

- This leaves you with a Net Operating Income (NOI) of $20,000.

Now, let's run the numbers:

- Cap Rate: $20,000 (NOI) / $300,000 (Price) = 6.67%. This tells you the property’s underlying profitability before any loans are involved.

But you're not paying cash, are you? Let's add financing to the mix. You put 20% down ($60,000) and your total mortgage payments for the year are $14,000.

- Annual Cash Flow: $20,000 (NOI) – $14,000 (Mortgage) = $6,000. This is the cash that hits your bank account each year.

- Cash-on-Cash Return: $6,000 (Cash Flow) / $60,000 (Cash Invested) = 10%.

That's the magic number. Your actual return on the money you personally invested is 10%. That's what really matters. For a deeper dive, our guide offers a crash course in real estate to help you master the basics.

Choosing Your Real Estate Investment Strategy

The "best" real estate strategy doesn't exist. The right strategy for you is a different story—it's built around your money, your goals, and most importantly, your time. This is your first major decision, and it sets the course for everything that follows.

Think of it like picking a vehicle. A sports car is fun and fast, but you can't haul lumber in it. A pickup truck is practical but isn't built for speed. Your investment strategy has to fit your personal circumstances, including your budget, how much risk you're comfortable with, and whether you want to get your hands dirty.

Some people love the hands-on work of renovating a property, while others would rather just collect a check without ever talking to a tenant. Getting clear on where you stand is the first step to finding your niche.

Active vs. Passive Investing: What's Your Style?

The first real fork in the road is deciding how involved you actually want to be. Your answer here will instantly narrow down your choices and keep you from getting into something that leads to frustration and burnout.

-

Active Investing: This is for the person who wants to be in the driver's seat. You’re the one finding the deal, managing the property, and dealing with leaky faucets. It’s more work, no question, but it also offers the highest potential returns and gives you total control. Think fix-and-flips or self-managing your own rentals.

-

Passive Investing: This path is perfect for busy professionals or anyone who likes the idea of real estate income but not the landlord lifestyle. You invest your money with a group or fund that handles all the heavy lifting. Your returns might be a bit lower, but your time commitment is next to nothing. This includes things like Real Estate Investment Trusts (REITs) or joining a real estate syndicate.

Right now, a massive global housing shortage is creating some fascinating opportunities. One recent report noted that developed countries are short about 6.5 million housing units. That deficit is pushing over 80% of households in those areas to rent, creating a rock-solid demand for rental properties. You can dig into this trend yourself by reading the full Global Living Outlook from Hines.

A Practical Look at Common Strategies

Let's get practical. To help you figure out what might work for you, here’s a breakdown of the most popular strategies for new investors. As you look this over, keep in mind how location plays a huge role—our guide on the best cities for real estate investment can add another layer to your thinking.

| Strategy | Capital Needed | Management Effort | Risk Level | Best For… |

|---|---|---|---|---|

| Single-Family Rental | Medium | Medium to High | Low to Medium | Beginners who want stable cash flow and long-term growth. |

| House Hacking | Low | High | Low | First-time buyers looking to wipe out their housing costs while learning the ropes. |

| Fix-and-Flip | High | Very High | High | Investors with some construction savvy who want quick, lump-sum profits. |

| REITs | Very Low | None | Low | Anyone wanting a completely passive, liquid investment that trades like a stock. |

Real-Life Strategy Examples

Let’s see how this looks in the real world for two different people.

Example 1: The Hands-On House Hacker

Sarah is a 28-year-old graphic designer with some savings, but not a huge pile of cash. She buys a duplex using an FHA loan, which only requires a 3.5% down payment. She lives in one half and rents out the other. Her tenant's rent check covers 80% of the mortgage payment. This move slashes her living expenses and lets her stack cash for the next property.

Example 2: The Busy Professional REIT Investor

Mark is a 45-year-old doctor who wants real estate in his portfolio but has zero time for managing it. He invests $25,000 into a publicly-traded REIT that owns apartment buildings across the country. He gets quarterly dividend checks without ever screening a tenant or fixing a toilet, achieving his goal of passive real estate ownership.

Your first step is to take an honest look in the mirror. Be realistic about the cash you have, the free time in your schedule, and your stomach for things going wrong. The most successful investors don't pick the trendiest strategy—they pick the one that fits their life.

How to Finance Your First Investment Property

Getting the money together is usually the biggest roadblock for new investors. There's a persistent myth that you need a massive 20% down payment just to get your foot in the door, but that’s simply not the whole story. While putting down a big chunk of cash is one way to go, it’s far from the only path.

Think of financing as a toolbox. A standard mortgage is just one tool—like a hammer. It's useful, but you can't build a whole house with just a hammer. There are countless other tools designed for specific situations. Learning about these options can open up a world of possibilities and prove that you don't need a huge bank account to start building a real estate portfolio.

Let's break down the mystery and show you how to find the capital you need. Nailing down your financing is a critical step in buying your first rental property simplified and is what separates dreaming from doing.

Traditional and Government-Backed Loans

For most people starting out, traditional financing is the most straightforward route. These are the loans you’ve probably heard of, and they come with the stability of predictable terms and competitive interest rates.

-

Conventional Loans: These are the bread-and-butter mortgages from banks, credit unions, and mortgage brokers. For an investment property, lenders often want to see a 20% down payment to avoid extra fees like private mortgage insurance (PMI). However, some programs will let you in with as little as 15% down, especially if you have a strong credit score and a steady income.

-

FHA Loans: Backed by the government, FHA loans are a fantastic entry point for beginners. The big catch—and it's a good one—is that you have to live in the property. If you buy a duplex, triplex, or fourplex and live in one of the units (a strategy called "house hacking"), you could qualify for a loan with a down payment as low as 3.5%. It's one of the most powerful ways to get started with very little cash out of pocket.

Powerful Creative Financing Techniques

Once you look beyond the big banks, you'll find a whole world of creative strategies that experienced investors use to get deals done. These methods often require a bit more hustle—more networking, more negotiating—but they can unlock opportunities that would otherwise be out of reach.

The real beauty of these techniques is their flexibility. They can close much faster and have far less red tape than bank loans, making them perfect for deals that don't fit into a neat little box.

Let's look at how these different options stack up.

| Financing Method | Best For… | Typical Down Payment | Key Advantage |

|---|---|---|---|

| Conventional Loan | Investors with solid credit buying a standard rental. | 15% – 25% | Competitive rates and predictable terms. |

| FHA Loan | First-time "house hackers" buying a multi-family property. | As low as 3.5% | Incredibly low down payment requirement. |

| Seller Financing | Motivated sellers or properties that a bank won't touch. | Highly negotiable | Flexible terms, potentially lower closing costs. |

| Hard Money Loan | Short-term "fix-and-flip" projects that need cash fast. | 10% – 25% | Speed—funds can be available in days, not weeks. |

Real-Life Example: Imagine an investor finds a rundown property that needs a ton of work—so much that no traditional bank will lend on it. They get a hard money loan to buy and renovate it over three months. Once the property is fixed up and rented out, they refinance with a conventional mortgage, pay back the hard money lender, and now own a cash-flowing rental.

Finding and Analyzing Your First (or Next) Profitable Deal

Alright, you've got the financing basics down and a strategy in mind. Now for the exciting part: moving from theory to the real world of finding and vetting deals. This is where the rubber meets the road. Hunting for a great property is part art, part science—it takes solid research, a bit of hustle, and a repeatable, numbers-driven process.

The best opportunities are rarely sitting out in the open. While the Multiple Listing Service (MLS) is a good place to start, relying on it alone means you're swimming in the same crowded pool as everyone else. To get a real edge, you have to learn how to find deals off-market.

Sourcing Deals Beyond the MLS

Going off-market is all about finding properties before they hit the public listings. Why? Because it often means less competition, better prices, and the chance to negotiate directly with a motivated seller instead of getting into a bidding war.

Here are a few classic, effective ways to find them:

- Build Your Network: Start talking to local real estate agents, wholesalers, property managers, and even attorneys. These folks are on the front lines and often hear about potential sales long before a "For Sale" sign goes up.

- Drive for Dollars: This is an old-school technique for a reason—it works. Get in your car and drive through neighborhoods you like. Look for properties that seem a little neglected or vacant. Jot down the address, find the owner's info, and reach out.

- Try Direct Mail: Sending targeted letters to homeowners in a specific area can be surprisingly effective. You might just land on the desk of someone who was thinking about selling but hadn't gotten around to listing their property yet.

Don't forget to use technology to your advantage. There are some fantastic tools out there, and our guide on the best apps for real estate investors can show you how to streamline your search.

Running the Numbers: A Practical Walkthrough

Once you’ve got a potential property in your sights, it's time to put it under the microscope. Let's walk through a sample duplex to see how those key metrics we talked about actually play out.

Scenario: A Duplex Investment

Imagine you've found a duplex for sale at $400,000. After doing some initial homework, you've put together these numbers.

| Financial Item | Amount (Annual) | Notes |

|---|---|---|

| Gross Potential Rent | $48,000 | ($2,000/month per unit) |

| Vacancy Loss (5%) | -$2,400 | A realistic buffer for when a unit is empty. |

| Effective Gross Income | $45,600 | What you can actually expect to collect. |

| Operating Expenses | -$16,000 | Property taxes, insurance, repairs, etc. |

| Net Operating Income (NOI) | $29,600 | The property's raw profit before the mortgage. |

Now you have a clear picture of how the property itself performs. To get a deeper understanding of property valuation, it's worth exploring the different methods of real estate valuation.

Next, let's factor in your financing. You've secured a loan with a 20% down payment ($80,000), and your total annual mortgage payment (principal and interest) comes to $22,000.

- Annual Pre-Tax Cash Flow: $29,600 (NOI) – $22,000 (Mortgage) = $7,600

- Cash-on-Cash Return: $7,600 / $80,000 (Your Down Payment) = 9.5%

That 9.5% is your true bottom line—it’s the actual return you're making on the cash you pulled out of your pocket this year.

The All-Important Due diligence Checklist

A deal that looks good on paper is just the first hurdle. Due diligence is the phase where you play detective and verify every single assumption. Seriously, don't skip this. This is how you avoid turning a promising investment into a money pit.

Due diligence is where you confirm you're buying what you think you're buying. It's the most important risk-management tool in your entire real estate investment guide.

Your checklist needs to be rock-solid. Here are the absolute essentials:

- Physical Inspection: Hire a pro to get in there and check everything—the foundation, roof, plumbing, electrical, and HVAC. This isn't the place to save a few hundred bucks.

- Financial Deep Dive: Get your hands on the seller's actual financial records. You need to see the rent rolls, utility bills, and tax statements. Do their numbers match what they advertised?

- Legal and Title Review: A title search is a must to make sure there are no surprise liens or ownership claims on the property. You also need to review every existing lease to understand exactly what you're inheriting.

Market analysis is a huge piece of this puzzle, too. The Global Real Estate Bubble Index, for instance, shows that some housing markets are overheated. This just underscores the need to use hard data to avoid buying at the top of a cycle. Focus on locations with strong, sustainable fundamentals. You can discover more insights about global housing markets from UBS to help guide your decisions.

Managing Risks and Legal Responsibilities

Let's talk about the less glamorous side of real estate investing: risk. Finding a great deal is only half the battle. The other half is protecting yourself, because eventually, every landlord deals with a nightmare tenant, a surprise roof leak, or an unexpected vacancy.

Thinking through these "what ifs" before they happen is what separates seasoned investors from rookies. It's the difference between a small headache and a full-blown financial disaster. This isn't just theory; it's the practical, in-the-trenches reality of building a resilient portfolio.

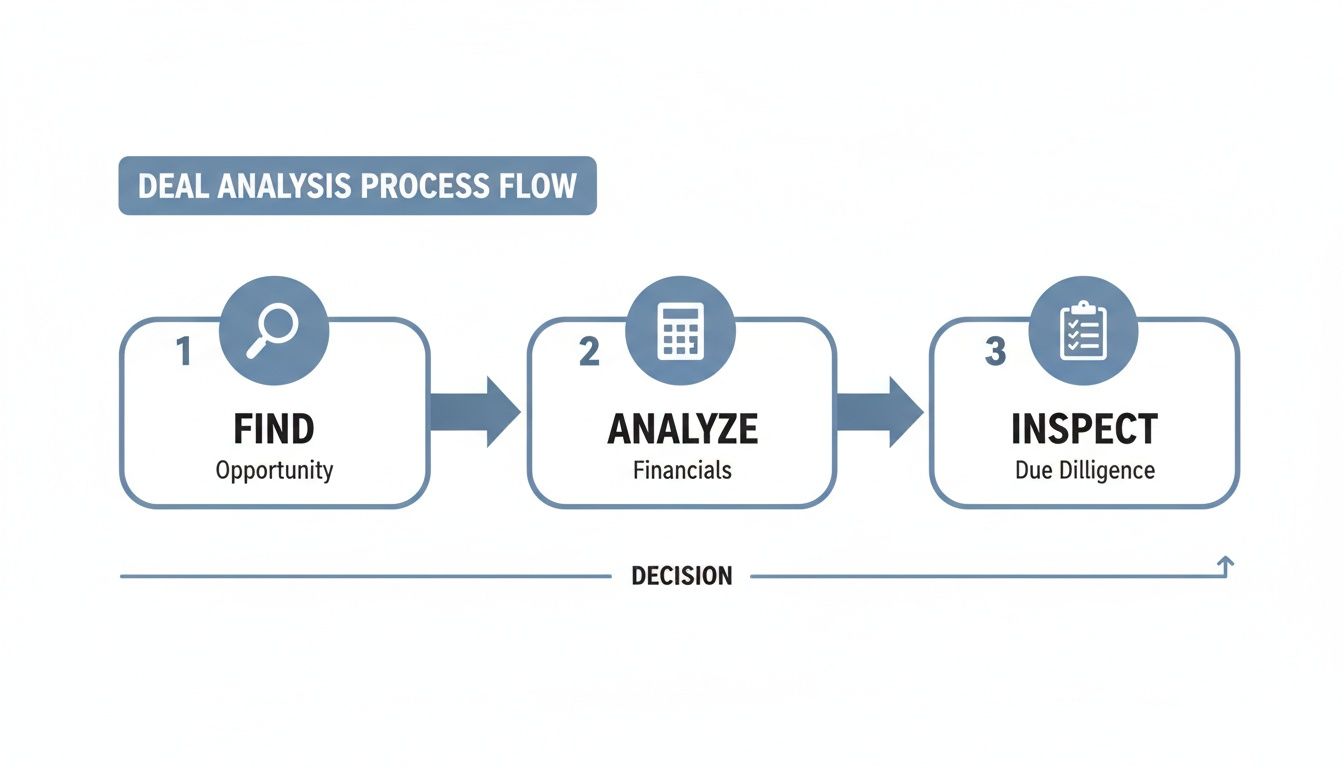

The whole process comes down to a clear, repeatable workflow: find the deal, run the numbers, and then do your homework.

Following these steps in order keeps emotion out of the equation and ensures you're making a business decision, not a gut-feeling gamble.

Proactive Risk Management Strategies

You can't dodge every bullet, but you can wear a bulletproof vest. Smart risk management starts long before you ever sign the closing papers.

Here are a few essential defensive moves to make from day one:

-

Build a Capital Expense (CapEx) Fund: This is your "big stuff" fund. Think of it as a separate savings account strictly for major items like a new HVAC system, a roof replacement, or a water heater. A good rule of thumb is to squirrel away 5-10% of your monthly gross rent for these inevitable expenses.

-

Master Your Tenant Screening: Your best protection against a bad tenant is never renting to them in the first place. Create a non-negotiable process: run credit reports, verify their income is legit, call their past landlords, and perform a criminal background check. No exceptions.

-

Get the Right Insurance: Standard homeowner's insurance won't cut it. You need landlord insurance. This policy is designed to cover property damage, protect you from liability if someone gets hurt on your property, and can even cover lost rental income if a fire or flood makes the unit unlivable.

Structuring for Protection and Profit

How you hold title to your properties is just as critical as which properties you buy. Getting the legal structure right from the beginning protects your personal wealth from business liabilities and opens the door to powerful tax benefits that can seriously boost your returns.

Setting up a legal entity isn't just for big-time investors. It's a foundational step for anyone serious about building long-term wealth and protecting their family's assets.

The two big ideas here are asset protection and tax efficiency.

Asset Protection with an LLC

A Limited Liability Company (LLC) is your financial firewall. It creates a legal wall between your investment properties and your personal assets—like your primary home, your car, and your savings. If a tenant ever decides to sue, they can only pursue the assets owned by the LLC, leaving your personal finances untouched. This is a non-negotiable for serious investors.

Tax Advantages

The tax code is practically a love letter to real estate owners. Depreciation is the superstar benefit here; it lets you deduct a piece of the property's value from your taxable income every single year, even as the property is actually going up in value. On top of that, nearly every operating expense—from mortgage interest to management fees to repair costs—is deductible, which shrinks your tax bill and leaves more cash in your pocket.

Frequently Asked Questions (FAQ)

1. How much money do I really need to start investing in real estate?

You don't necessarily need a 20% down payment. Strategies like "house hacking" with an FHA loan can require as little as 3.5% down. Other options include partnering with other investors, using seller financing, or starting with Real Estate Investment Trusts (REITs) for a few hundred dollars.

2. What's the difference between cash flow and appreciation?

Cash flow is the immediate profit you make each month after all expenses (mortgage, taxes, insurance, repairs) are paid from the rental income. Appreciation is the long-term increase in the property's value over time. Successful investors aim for properties that offer both.

3. Should I manage the property myself or hire a property manager?

This depends on your time, skills, and proximity to the property. Self-managing saves you the 8-12% management fee but requires significant time and effort. Hiring a manager makes the investment more passive but eats into your profits. If you're busy or investing out of state, a manager is often essential.

4. What is "house hacking"?

House hacking is when you buy a multi-unit property (like a duplex or triplex), live in one unit, and rent out the others. The rent from your tenants can significantly reduce or even eliminate your personal housing costs, allowing you to build equity for free.

5. Is it better for a beginner to invest in residential or commercial real estate?

Beginners should almost always start with residential real estate (single-family homes, duplexes, etc.). The financing is simpler, the deals are smaller, the risk is lower, and the management is more straightforward than complex commercial properties like office buildings or retail centers.

6. What is a REIT and is it a good starting point?

A REIT (Real Estate Investment Trust) is a company that owns and operates a portfolio of properties. You can buy shares in a REIT just like a stock. It's an excellent way for beginners to get exposure to real estate with very little capital, high liquidity, and no management responsibilities.

7. How do rising interest rates affect my real estate investment?

Higher interest rates increase your mortgage payment, which reduces your monthly cash flow. They can also cool down the housing market by making it more expensive for buyers, which may slow down price appreciation. It's crucial to analyze deals based on current rates, not hopes of future refinancing.

8. What's the most important metric to look at when analyzing a deal?

While all metrics are important, for beginners using financing, the Cash-on-Cash Return is often the most critical. It tells you the direct return on the actual money you've invested out-of-pocket, giving you a clear picture of your personal profitability.

9. How do I protect myself legally as a landlord?

First, form a Limited Liability Company (LLC) to hold your properties, which separates your personal assets from your business liabilities. Second, have an iron-clad lease agreement drafted or reviewed by a local attorney. Third, carry adequate landlord insurance.

10. What are the biggest mistakes new investors make?

The most common mistakes include: underestimating repair costs and operating expenses, skipping thorough due diligence, failing to screen tenants properly, and letting emotions drive the purchase decision instead of sticking to the numbers.

At Everyday Next, we're committed to providing clear, actionable insights to help you build a secure financial future. For more in-depth guides on investing, tech, and personal growth, explore our latest articles at https://everydaynext.com.