Roth IRA vs Traditional IRA: The Definitive Comparison Guide

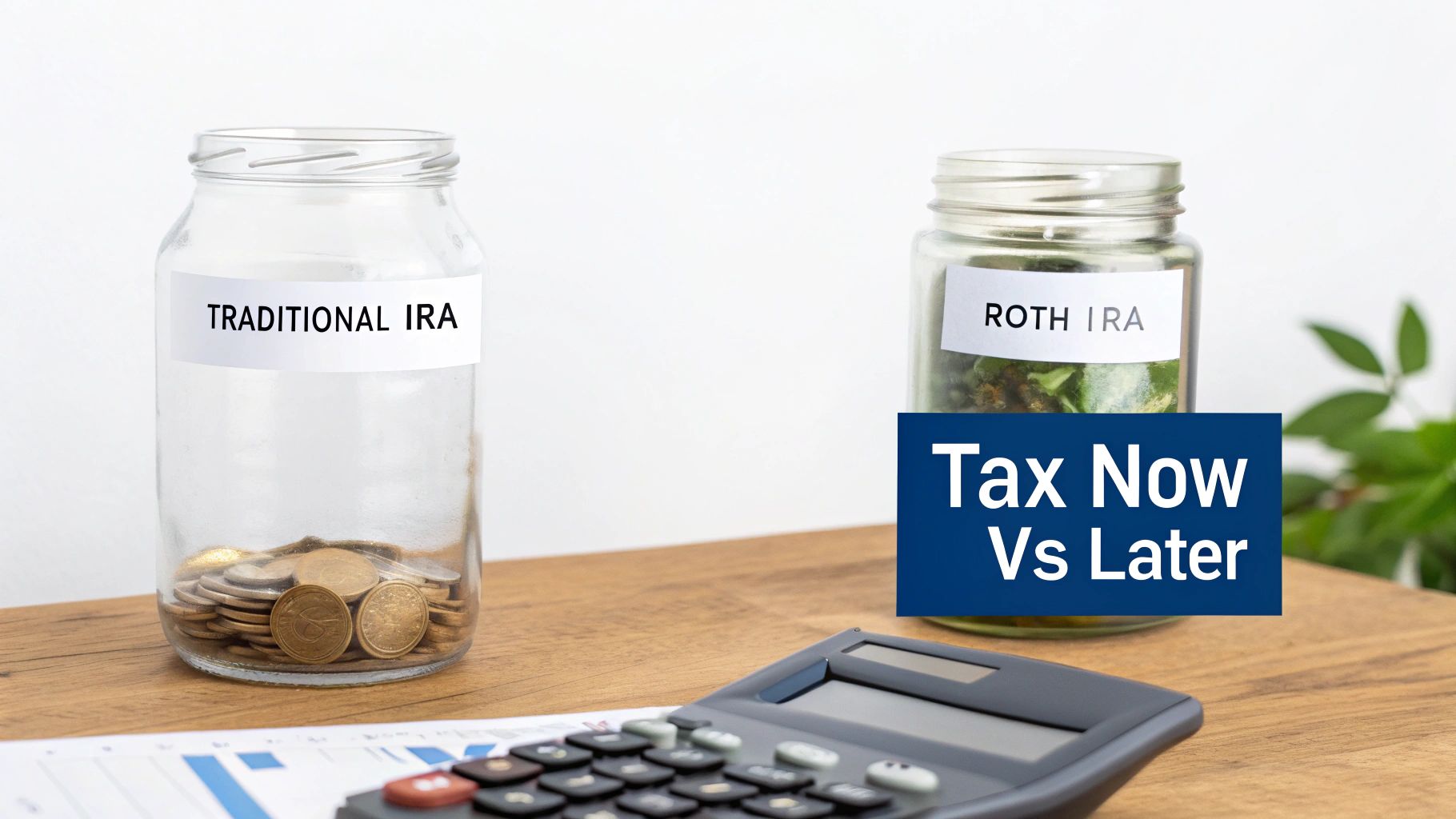

At its core, the difference between a Roth IRA and a Traditional IRA is all about one thing: when you pay taxes.

With a Traditional IRA, you get a potential tax break right now. Your contributions might be deductible, letting your money grow tax-deferred. The catch? You'll pay income tax on every dollar you pull out in retirement. A Roth IRA is the exact opposite. You contribute with money you've already paid taxes on, but your qualified withdrawals in retirement are 100% tax-free.

A Quick Comparison Of IRA Retirement Accounts

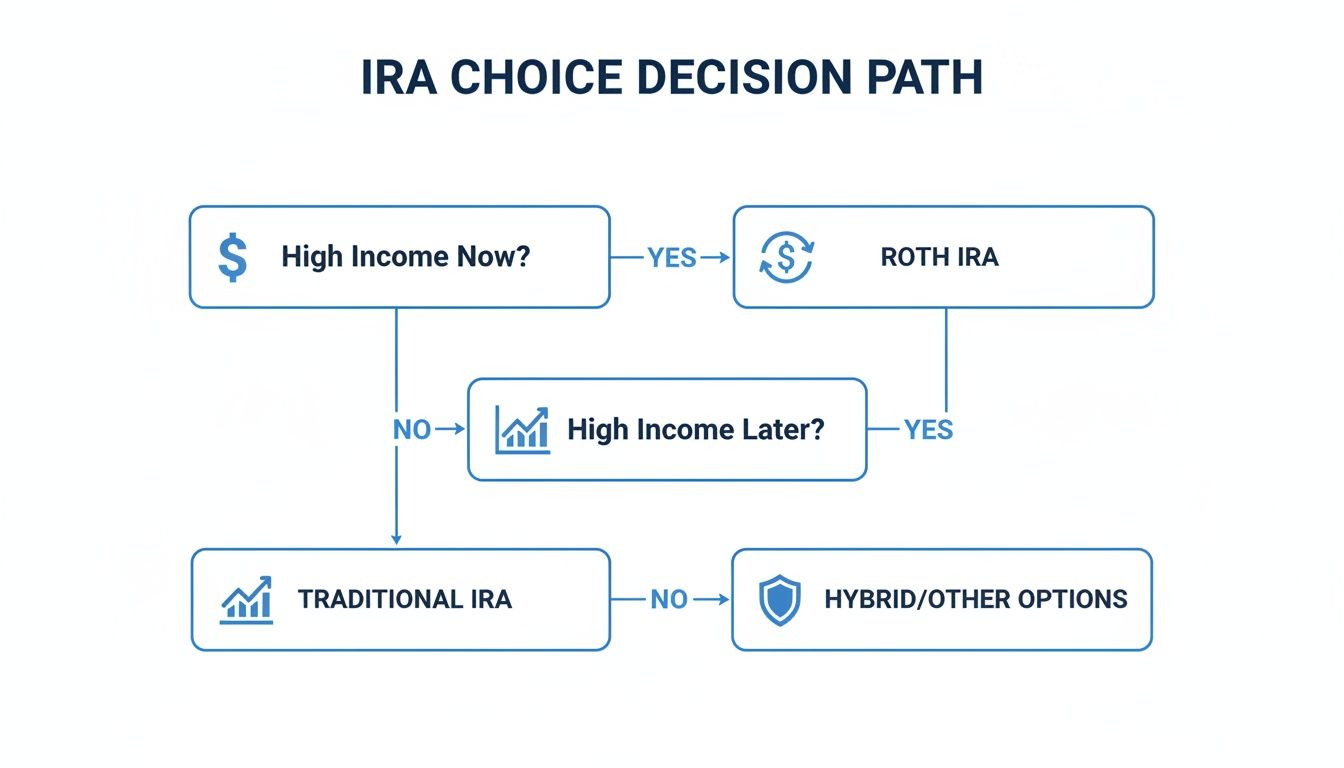

So, how do you choose? It really boils down to a prediction about your financial future. Do you think you'll be in a higher tax bracket in retirement than you are today? If so, paying taxes now with a Roth makes a ton of sense.

But if you expect your income (and thus your tax rate) to drop in retirement, deferring the tax bill with a Traditional IRA could be the smarter play. This is one of the most fundamental decisions in retirement planning.

This flowchart helps visualize that exact decision. It's a simple path based on where you are now versus where you think you'll be later.

As you can see, if your income is high today and you expect it to be lower when you retire, a Traditional IRA is often the way to go. On the flip side, if your income is relatively low now but you're on a path to earn more, locking in those tax-free withdrawals with a Roth becomes incredibly valuable down the road.

Key Differences At A Glance

Sometimes, seeing things side-by-side just clicks. This table cuts through the noise and lays out the most important distinctions between the two accounts.

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax on Contributions | Contributions may be tax-deductible | Contributions are made with after-tax money |

| Tax on Withdrawals | Taxed as ordinary income | Qualified withdrawals are 100% tax-free |

| Income Limits | No income limit to contribute | Income limits restrict direct contributions |

| Required Withdrawals | Required Minimum Distributions (RMDs) start at age 73 | No RMDs during the original owner's lifetime |

The choice really crystalizes when you look at it this way. You're either getting a tax benefit now or a massive one later.

The core trade-off is clear: A Traditional IRA offers immediate tax relief, while a Roth IRA provides future tax freedom. Your choice depends on your financial outlook and retirement goals.

This isn't just a retirement decision; it affects your budget today. For federal employees, a similar logic applies when considering the difference between Roth and Traditional TSP. Of course, any good savings plan is built on a solid financial foundation, and you can learn how to create a monthly-budget to get yours in order.

Comparing Tax Treatments and Withdrawal Rules

When you boil it down, the entire Roth vs. Traditional IRA debate really comes down to one simple question: Do you want to pay your taxes now or later? This isn't just a minor accounting detail; it’s the core decision that will shape how your retirement savings grow for decades.

A Traditional IRA gives you a potential tax break today. Your contributions can often be deducted from your current income, which is a nice, immediate reward. On the flip side, a Roth IRA uses after-tax money, meaning you get no upfront deduction. This single difference creates two completely different paths for your money.

Unpacking Tax Benefits: Now vs. Later

The big draw of a Traditional IRA is the ability to lower your tax bill right now. If you're in a high tax bracket, that deduction can feel pretty substantial. Once inside the account, your investments grow tax-deferred, so you aren't paying taxes on gains and dividends year after year.

A Roth IRA flips that whole idea on its head. You bite the bullet and pay taxes on your contributions at your current rate. The payoff? All of your investment growth is completely tax-free. When you take qualified withdrawals in retirement, every single penny is 100% tax-free. That provides an incredible amount of certainty for your future budget.

While the Traditional IRA has been around longer, the Roth IRA (created in 1997) has become a favorite for savers who crave that future tax freedom. By 2015, new contributions to Roth IRAs had already surpassed Traditional IRAs—$21.7 billion to $17.7 billion—showing a clear preference for paying taxes upfront. You can see more on the growth of Roth IRAs at thelink.ascensus.com.

Withdrawal Rules and Required Minimum Distributions

Getting your money out is another area where these two accounts couldn't be more different. Both will generally hit you with a 10% early withdrawal penalty if you tap the funds before age 59½, though there are some important exceptions for a first home purchase, disability, and other life events.

The real game-changer, though, is something called Required Minimum Distributions (RMDs). With a Traditional IRA, the IRS forces you to start taking money out at age 73. They want their tax money, so you have to withdraw and pay taxes on a certain amount each year, whether you need it or not.

A Roth IRA has no RMDs for the person who opened it. This is a massive advantage. It means your money can keep growing, tax-free, for your entire life if you don't need to spend it.

This feature makes the Roth a fantastic tool for estate planning. You can let the account compound for as long as possible before passing it on to your heirs, who inherit a pile of tax-free cash.

Eligibility and Income Limitations

Your income also plays a huge role in which account you can use. Pretty much anyone with earned income can open a Traditional IRA. The catch is that your ability to deduct your contributions might be limited if you have a retirement plan at work and your income is above a certain level.

Roth IRAs are more straightforward but stricter. If your Modified Adjusted Gross Income (MAGI) is too high, you’re simply not allowed to contribute directly. These income limits are a major hurdle for high earners.

Here’s a comparison of the rules:

| Rule | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Limits | No income limit to contribute | Strict income limits restrict contributions |

| Deductibility | Income and workplace plan can limit deduction | Contributions are never deductible |

| Who Can Contribute | Anyone with earned income | Anyone with earned income below the MAGI limit |

These rules are designed to guide you to the right account for your financial situation. As you continue building your portfolio, our guide on how to start investing in index funds might be a helpful next step.

When to Choose a Roth IRA

Figuring out if a Roth IRA is right for you boils down to a single, crucial question: Do you think you'll be earning more—and be in a higher tax bracket—in the future? If you're nodding your head yes, then a Roth IRA could be one of the smartest retirement moves you make.

The logic is beautifully simple. You pay your taxes now, at your current (and presumably lower) rate, and in return, you get to pull that money out completely tax-free when you retire. This simple trade-off makes the Roth IRA a perfect fit for a few specific types of savers.

Young Professionals and Early Career Savers

If you’re just starting out, your income is probably the lowest it’s ever going to be. This is the absolute sweet spot for a Roth IRA. By funding it with after-tax dollars today, you’re effectively locking in your current low tax rate on that money for life.

Real-Life Example: Meet Chloe, a 24-year-old graphic designer earning $55,000. She's in a low tax bracket now but expects her income to grow significantly. By contributing to a Roth IRA, she pays taxes on her contributions at her current low rate. When she retires in 40 years, the millions of dollars her account has grown into will be completely hers, tax-free, saving her from paying taxes at a much higher rate later in life.

Planners Focused on Tax Diversification

Even if you're in your peak earning years, a Roth IRA offers a powerful strategic advantage: tax diversification. Most people have the bulk of their retirement savings in tax-deferred accounts like a 401(k) or a Traditional IRA. That means every single dollar you withdraw from them will be taxed as regular income.

A Roth IRA gives you a separate bucket of tax-free money. This flexibility is a game-changer in retirement, letting you manage your taxable income each year to stay in a lower overall bracket. For instance, you could pull from your 401(k) just enough to stay under a certain tax threshold, then use your tax-free Roth money for any extra spending.

A Roth IRA provides a tax-free income stream in retirement, acting as a crucial counterbalance to taxable withdrawals from other accounts like 401(k)s and Traditional IRAs.

Estate Planning and Leaving a Legacy

Here’s where the Roth IRA really shines for those thinking about the next generation. It has a unique feature that makes it an incredible estate planning tool: no Required Minimum Distributions (RMDs) for the original owner. With a Traditional IRA, the government eventually forces you to start taking money out. Not with a Roth.

This allows your investments to keep growing, tax-free, for your entire life. If you end up not needing the funds for your own retirement, you can pass the whole account on to your beneficiaries. They, in turn, can enjoy tax-free withdrawals, making it a highly efficient way to transfer wealth.

The data backs this up. Roth investors tend to be younger and more comfortable with growth-focused investments, with a notable 65% of Roth assets in equities versus just 54% for Traditional IRAs. They also hold for the long term; only 3% of adult Roth investors took a distribution in 2020, compared to 20% of Traditional IRA holders. You can read more about these investor differences at planadviser.com.

Finally, the Roth has one more trick up its sleeve. You can withdraw your original contributions—not the earnings—at any time, for any reason, without paying taxes or penalties. This gives it a unique flexibility, though it's best used after you've learned how to build an emergency fund.

When to Choose a Traditional IRA

The Roth IRA gets a lot of love for its tax-free withdrawals, and for good reason. But don't sleep on the Traditional IRA—it’s a powerful tool, especially if you want to save on taxes right now. The whole decision really boils down to one simple question: do you think your tax rate is higher today than it will be when you retire?

If you answered yes, the Traditional IRA should be on your radar. Its biggest selling point is the immediate tax deduction, which can put a nice chunk of change back in your pocket today.

You’re in Your Peak Earning Years

If you're at the top of your professional game, your income—and your tax bracket—are likely at their peak, too. This is the sweet spot for a Traditional IRA. Every dollar you contribute lowers your taxable income for the year, giving you an immediate tax break when you need it most.

Real-Life Example: Consider Mark, a 50-year-old surgeon in the 35% tax bracket. He expects to be in a lower tax bracket in retirement. By contributing the maximum to a Traditional IRA, he gets a significant tax deduction now, when it saves him the most money. He's strategically deferring the tax liability until his retirement years when his income, and thus his tax rate, will be lower.

The perfect candidate for a Traditional IRA is anyone who's confident their current tax rate is higher than what they'll face in retirement. That's the entire game plan behind tax deferral.

You Want to Lower Your Adjusted Gross Income (AGI)

Here’s a benefit that often flies under the radar: a Traditional IRA contribution lowers your Adjusted Gross Income (AGI). Your AGI is a critical number on your tax return that determines if you qualify for a whole host of other valuable credits and deductions.

For instance, dropping your AGI could help you hang on to benefits like:

- The Child Tax Credit: A lower AGI can keep you from being phased out of this valuable credit.

- Student Loan Interest Deduction: This deduction also has AGI limits.

- Other Itemized Deductions: Some deductions are only useful if they surpass a certain percentage of your AGI.

A single contribution to a Traditional IRA can be the one move that pulls your AGI down just enough to unlock thousands of dollars in other tax savings. Its impact can be far greater than the initial deduction alone.

Real-Life Example: Let's look at Sarah, a single marketing manager earning $150,000 a year. Her income puts her on the bubble for qualifying for a few tax breaks. By contributing the $7,000 maximum to her Traditional IRA, she lowers her AGI to $143,000. That simple step doesn't just reduce her income tax bill for the year. It could also make her newly eligible for deductions she would have otherwise missed entirely. This shows how a Traditional IRA isn't just a retirement account; it's a flexible tool for optimizing your taxes each year.

As you build out your financial plan, you might also want to look into different investing strategies for beginners to see how you can grow those retirement funds effectively.

Comparing Real-World Retirement Scenarios

Theory is great, but let's be honest—seeing how the numbers play out in real life is what makes the Roth vs. Traditional IRA decision click. It's time to move past the general advice and watch how this choice impacts three different people at very different points in their lives.

These examples are designed to highlight the single most important question you need to ask yourself: do you think your tax rate will be higher or lower in the future? For consistency, we'll use a 7% average annual return and the maximum $7,000 annual IRA contribution in our examples.

Scenario 1: The Young Software Developer

Meet Alex. He's 25, just starting his career as a software developer, and lands in the 22% federal tax bracket. He’s ambitious and fully expects his salary—and his tax bracket—to climb over the next 40 years before he retires at 65.

- Traditional IRA: Alex puts in his $7,000 a year. He gets an immediate tax break of $1,540 (22% of $7,000), which feels nice right now. By age 65, his account balloons to about $1.49 million. But here's the catch: if he's in a higher 32% tax bracket in retirement, his take-home amount after taxes would be closer to $1,013,200.

- Roth IRA: Alex contributes the same $7,000 from his after-tax paycheck, so there's no upfront deduction. His account also grows to that same $1.49 million by retirement. The difference? When he withdraws it, it's 100% tax-free. He keeps every penny.

Verdict for Alex: The Roth IRA is a slam dunk. Paying taxes now at his lower 22% rate saves him from a much bigger tax hit down the road. This strategy gives him a lot more spending money in retirement. In fact, some research from T. Rowe Price shows that young savers who choose a Roth can end up with almost 20% more after-tax income, even if tax rates don’t change.

Scenario 2: The Mid-Career Marketing Manager

Now let's look at Maria, a 45-year-old marketing manager who is at the peak of her earning power. She's in the 32% tax bracket and figures her income, and therefore her tax rate, will probably drop once she retires in 20 years.

- Traditional IRA: Maria contributes $7,000 annually, netting a hefty $2,240 tax deduction each year. By age 65, her account is worth about $303,000. If her tax rate in retirement drops to 22% as she expects, she’ll walk away with roughly $236,340 after taxes.

- Roth IRA: Maria contributes her $7,000 with after-tax money. The account also grows to $303,000, and because it's a Roth, she can withdraw the full amount completely tax-free.

Verdict for Maria: For her, the Traditional IRA makes more sense. The substantial tax deductions during her highest-earning years are incredibly valuable. Combining that immediate benefit with paying taxes at a lower rate later in life gives her a better overall financial outcome.

At its heart, the Roth vs. Traditional debate is a strategic bet. Are you betting that Future You will be in a higher or lower tax bracket than Present You? Your answer is the clearest signpost toward the right account.

Scenario 3: The Pre-Retirement Small Business Owner

Finally, there’s David. He’s 55, owns a small business, and sits in the 24% tax bracket. He plans to retire in 10 years at 65 and can take advantage of "catch-up" contributions, letting him save $8,000 a year.

- Traditional IRA: David contributes $8,000 and gets a $1,920 tax deduction each year. Over 10 years, his account grows to about $117,000. If his tax rate stays at 24% in retirement, his after-tax total comes out to $88,920.

- Roth IRA: David puts in his $8,000 with after-tax money. His account also grows to $117,000, and it's all his to keep, tax-free.

Verdict for David: If we assume his tax rate stays the same, the Roth IRA wins by a nose. The certainty of tax-free withdrawals provides peace of mind and a slightly better financial result. These examples drive home just how critical your personal timeline and income path are when you achieve financial independence.

Advanced IRA Strategies for High Earners

So, what happens if your income is too high to contribute directly to a Roth IRA? Don't worry, the conversation doesn't stop there. For high earners, there are still some powerful ways to get access to that sweet, tax-free growth a Roth offers, even with the IRS income limits.

These aren't beginner moves—they take some careful planning. But master them, and it can be a total game-changer in the Roth vs. Traditional debate.

The Backdoor Roth IRA Explained

The Backdoor Roth IRA isn't some special type of account you open. It's a strategy—a completely legal, two-step shuffle for people who make too much to qualify for a Roth IRA directly.

Here's the basic rundown of how it works:

- Contribute to a Traditional IRA: First, you put money into a Traditional IRA. Since you're over the income limit to deduct these contributions, this is an after-tax contribution. Anyone with earned income can do this part.

- Convert to a Roth IRA: Soon after, you convert that Traditional IRA into a Roth IRA. Because the money you put in was already taxed, the conversion itself usually doesn't trigger any new taxes.

And just like that, you've legally bypassed the income restrictions and funded a Roth IRA.

Understanding the Pro-Rata Rule

Now for the big "gotcha." The main thing that can trip people up with a Backdoor Roth is something called the pro-rata rule. This rule kicks in if you already have money sitting in other pre-tax IRAs, like a Traditional, SEP, or SIMPLE IRA.

The IRS views all your IRAs (except Roths) as one giant pot of money. When you do a conversion, they won't let you cherry-pick just the after-tax dollars. Instead, they calculate the taxable amount of your conversion based on the proportion—the pro-rata share—of pre-tax vs. after-tax money across all of your IRA accounts combined.

Crucial Insight: If you have existing pre-tax IRA funds, the pro-rata rule can lead to a surprise tax bill when you do a Backdoor Roth conversion. You absolutely must factor in all your IRA balances before you even think about pulling the trigger on this.

If you have a complex financial picture, getting some professional guidance is a smart move. Expert Tax Planning Services can help you figure out the best way to handle these advanced strategies, understand the full impact of the pro-rata rule, and make sure your conversion is done right.

Frequently Asked Questions (FAQ)

1. Can I have both a Roth and a Traditional IRA at the same time?

Yes, absolutely. You can contribute to both types of accounts in the same year. However, the total amount you contribute across all your IRAs (Roth and Traditional) cannot exceed the annual IRS limit. For 2024, that's $7,000 ($8,000 if you're age 50 or older).

2. What if I make too much money for a Roth IRA?

If your income is above the IRS limits for direct Roth contributions, you have a couple of options. You can contribute to a non-deductible Traditional IRA, as there are no income limits for contributing. Alternatively, you can explore the "Backdoor Roth IRA" strategy, where you contribute to a Traditional IRA and then convert it to a Roth IRA.

3. I have a 401(k) at work. Can I still open an IRA?

Yes. A workplace retirement plan like a 401(k) does not prevent you from opening or contributing to an IRA. However, if you have a 401(k), your ability to deduct Traditional IRA contributions may be limited or eliminated depending on your income level. Roth IRA contributions are unaffected by a 401(k) but are still subject to their own income limits.

4. How much can I contribute to an IRA each year?

For the tax year 2024, the maximum contribution limit for IRAs is $7,000. If you are age 50 or older, you are eligible for a "catch-up" contribution of an additional $1,000, bringing your total possible contribution to $8,000. These limits are set by the IRS and can change periodically.

5. What happens if I contribute more than the annual limit?

Contributing more than the allowed amount results in a 6% excise tax on the excess amount for each year it remains in your account. You should withdraw the excess contribution and any earnings on it before the tax filing deadline to avoid this penalty.

6. Can I withdraw my contributions from a Roth IRA early?

Yes, this is a key benefit of the Roth IRA. You can withdraw your direct contributions (not earnings) at any time, for any reason, without paying taxes or penalties. This provides a level of flexibility not found in other retirement accounts.

7. Which account is better if I expect tax rates to go up in the future?

If you believe that federal and/or state income tax rates will be higher in the future than they are today, a Roth IRA is generally more advantageous. By paying taxes now at today's lower rates, you ensure that your withdrawals in retirement are completely tax-free, protecting you from future tax hikes.

8. What is the "5-Year Rule" for Roth IRAs?

The 5-Year Rule is a key regulation for Roth IRAs. To withdraw earnings tax-free, your Roth IRA must have been open for at least five tax years, and you must be at least age 59½. This rule applies separately to contributions and conversions, so it's important to track when your account was first funded and when any conversions were made.

9. Can I move money from a Traditional IRA to a Roth IRA?

Yes, this process is called a Roth conversion. You can move any amount from a Traditional, SEP, or SIMPLE IRA into a Roth IRA. However, you will have to pay ordinary income tax on the amount you convert in the year you do the conversion. This is a common strategy for people who want to move pre-tax money into the tax-free Roth bucket.

10. How do I open an IRA account?

Opening an IRA is a straightforward process that can typically be done online in minutes. You can open an account at most major financial institutions, including brokerage firms like Fidelity, Vanguard, and Charles Schwab, or with robo-advisors like Betterment and Wealthfront. You will need to provide personal information and choose how to fund the account.

At Everyday Next, we're committed to delivering clear, actionable insights to help you build wealth and navigate your financial future. Explore our guides and articles to make informed decisions that align with your life goals. Learn more at https://everydaynext.com.