A Beginner’s Guide to the Stock Market: How to Start Investing Wisely

Dipping your toes into the stock market can feel like learning a whole new language. But at its heart, the concept is surprisingly simple: you're buying a small piece of a company you believe will grow. This guide is here to cut through the noise and show you that building wealth through investing is well within your reach.

Think of it like a sprawling farmers' market. Instead of buying a bushel of apples, you're buying a tiny slice of the company that grew them, like Apple Inc.

Why Investing Is Simpler Than You Think

So many people put off investing because they think you need a finance degree and a huge pile of cash to even get started. That couldn't be further from the truth. With today's tools, all it takes is a solid understanding of the basics to begin.

The point isn’t to become a Wall Street guru overnight. It’s about creating a sustainable habit that lets your money start working for you, which is a key part of personal finance. To dig deeper into this mindset, it's worth understanding why building wealth isn't just about money.

Your Roadmap To Getting Started

We’ve designed this guide to be your roadmap, breaking everything down into logical, easy-to-digest steps. No confusing jargon here—just the practical knowledge you need.

Here’s a quick look at what we'll cover:

- The Language of the Market: We’ll define must-know terms like stocks, bonds, and indices.

- Your Investment Toolkit: We’ll explore different investment vehicles, such as ETFs and mutual funds.

- Making Your First Move: You'll get a step-by-step walkthrough for opening an account and placing your first trade.

Our goal is to build your confidence from the ground up, so you feel empowered, not overwhelmed. As you go, you might also find a simple guide to the stock market for beginners helpful for another take on the essentials. Your journey starts right here, with these first few steps.

Decoding The Language Of The Stock Market

Before you can invest, you need to know what the "market" really is. It’s not some grand, column-lined building you see in old movies. Today, it’s a vast, interconnected global network of digital exchanges where pieces of companies are bought and sold every single second.

Think of major players like the New York Stock Exchange (NYSE) or the Nasdaq. These are the big hubs where buyers and sellers meet, all handled electronically. The price you see for a stock? It's simply the real-time result of what someone is willing to pay and what someone else is willing to accept.

Primary vs. Secondary Markets: A Car Analogy

To really get a feel for how this works, let’s use a simple analogy: buying a car.

When a private company decides to go public, it holds an Initial Public Offering (IPO). This is like a car manufacturer releasing a brand-new model for the first time. The company sells its shares directly to investors to raise money for growth. This is the primary market.

But what happens after that? Those initial investors can then sell their shares to other people. This is where the action we see on the news happens—the secondary market. Think of this as the used car market. You're not buying from the original manufacturer (the company) anymore; you're buying from another driver (another investor).

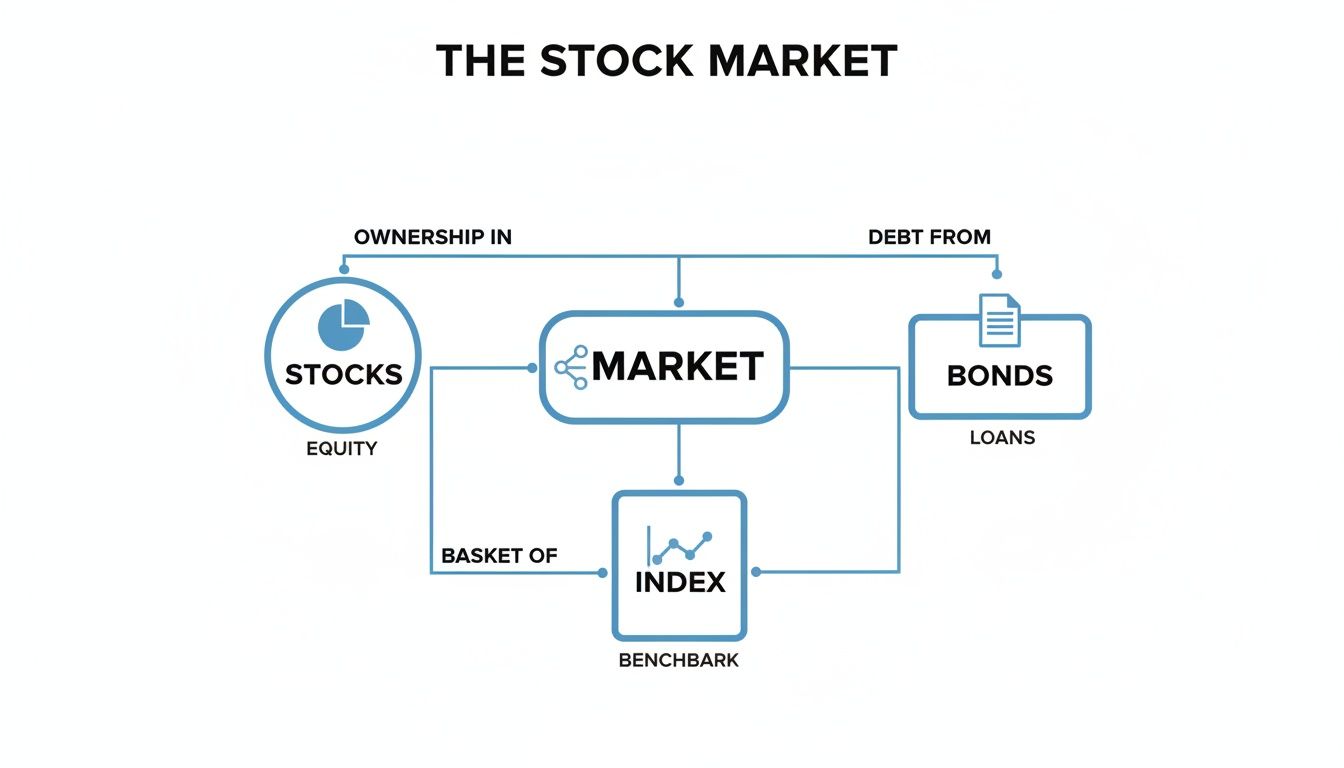

The Core Building Blocks: Stocks, Bonds, And Indexes

Now that you know where trading happens, let's talk about what is being traded. While the financial world is full of complex products, everything really boils down to a few core concepts. For beginners, these three are all you need to focus on.

-

Stocks (Equities): A stock is just a small slice of ownership in a company. If a business has a million shares out there and you own one, you literally own one-millionth of that company. If the company does well and grows, the value of your tiny slice should grow right along with it.

-

Bonds (Fixed-Income): A bond is basically a loan. You're lending money to a company or a government, and in exchange, they promise to pay you back with interest over a set period. They're generally seen as safer than stocks because you're a lender, not an owner, which gives you a higher claim on the company's assets if things go south.

-

Market Indexes (The Market's Report Card): How do we know if the market is "up" or "down"? That's where indexes come in. An index tracks the performance of a specific group of stocks to give us a snapshot of the market's health. The S&P 500, for instance, follows 500 of the biggest U.S. companies, making it a go-to benchmark for the entire American economy.

Key Takeaway: Owning a stock makes you a part-owner of a business, sharing in its potential profits and losses. Owning a bond makes you a lender to an organization, earning fixed interest payments.

Grasping these differences is the first real step toward becoming a confident investor. It’s what allows you to understand the financial news and start thinking clearly about where your money should go. And since these markets operate globally, it's interesting to see how trading moves around the clock. You can check out the operating hours for the world's major stock markets to get a sense of the non-stop action.

To make this even clearer, here’s a simple side-by-side comparison:

| Feature | Stocks (Equities) | Bonds (Fixed-Income) |

|---|---|---|

| What You Own | A piece of ownership in a company. | A loan made to a company or government. |

| How You Earn | Share price growth (capital appreciation) and potential dividends. | Fixed interest payments and the return of your principal. |

| Risk Level | Generally higher; your investment can lose value. | Generally lower; you are a creditor with priority for repayment. |

| Best For | Long-term growth potential. | Capital preservation and predictable income. |

Choosing Your Investment Tools: Stocks, ETFs, and Mutual Funds

Okay, you've got the lingo down. Now it's time to pick your tools. Think of it like building a piece of furniture: you can buy all the wood, screws, and hardware yourself, or you can get a flat-pack kit with everything included.

Investing offers a similar choice. You can buy individual stocks—the raw materials—or you can buy Exchange-Traded Funds (ETFs) and mutual funds, which are like pre-packaged kits that bundle everything together. Each path has its own appeal, and the right one for you depends on how hands-on you want to be.

Individual Stocks: The DIY Approach

Buying an individual stock, like a share of Apple (AAPL) or Ford (F), makes you a direct part-owner of that company. You're making a concentrated bet on that single business's future success. If you pick a winner, the rewards can be substantial.

The catch? It's all on you. This path demands a lot more research and comes with higher risk. If that one company hits a rough patch, your entire investment in it can take a nosedive. It's the classic high-risk, high-reward strategy.

ETFs And Mutual Funds: Instant Diversification

If picking individual stocks feels overwhelming, ETFs and mutual funds are your best friends. These are professionally managed collections of investments. Instead of buying just one company, you're buying a basket filled with dozens, sometimes hundreds, of different stocks (and sometimes bonds). This is the magic of diversification.

For example, buying a single share of an S&P 500 ETF means you instantly own a tiny sliver of 500 of the largest companies in the U.S. It's a remarkably simple way to spread your risk without having to become an expert on hundreds of businesses. You can get a deeper look into how this works in our guide on investing in the S&P 500 index and what you need to know.

Here’s how that plays out in the real world: Let's say you have $200 to invest. You could buy one share of a hot tech company. If that company has a bad quarter, your investment could sink. Or, for that same $200, you could buy a share of a total stock market ETF and instantly own tiny pieces of thousands of companies—from tech and healthcare to retail and energy.

The flowchart below helps visualize where these different investment types fit within the broader market landscape.

As you can see, individual stocks are just one piece of a much larger puzzle that includes bonds, indexes, and the market as a whole.

To help you figure out where to start, this table breaks down the key differences between these popular investment tools.

Stocks vs ETFs vs Mutual Funds: A Beginner's Comparison

| Feature | Individual Stocks | ETFs (Exchange-Traded Funds) | Mutual Funds |

|---|---|---|---|

| Diversification | Low (each stock is a single bet) | High (instant diversification across many assets) | High (diversified portfolio managed by professionals) |

| Management | You manage it completely (DIY) | Typically passive (tracks an index) | Actively managed by a fund manager |

| Trading | Throughout the day, like a stock | Throughout the day, like a stock | Once per day, after the market closes |

| Costs (Expense Ratio) | None (only trading commissions) | Generally very low | Typically higher due to active management |

| Minimum Investment | Price of one share (can be high) | Price of one share (often low) | Often requires a higher initial investment ($500+) |

Ultimately, many investors use a mix of these tools. There's no single "best" option—just the best option for your goals and comfort level.

More Essential Terms To Know

As you start exploring, you'll hear a few other terms thrown around constantly. Getting a handle on these will make you feel much more confident.

- Dividends: Think of these as a cash bonus. Some companies share a portion of their profits directly with their shareholders as a "thank you" for being an owner.

- Bull vs. Bear Markets: These are just fancy terms for the market's overall mood. A bull market is when things are optimistic and prices are generally climbing. A bear market is the opposite—pessimism takes over, and prices trend downward.

- Volatility: This word simply describes how bumpy the ride is. A stock with high volatility sees its price swing up and down dramatically. Low volatility means a much smoother, more predictable journey.

A Step-By-Step Guide To Making Your First Investment

Alright, this is where the rubber meets the road. You've got the concepts down, and now it's time to put that knowledge into practice. Taking the leap from learning to doing can feel intimidating, but the actual process is surprisingly straightforward. Let's walk through it together, from picking your account to placing that very first trade.

The journey starts with choosing the right kind of account for your goals. Think of this as picking the right tool for the job—some offer powerful advantages that can seriously accelerate your long-term growth.

Choose Your Investment Account

For most people just starting out, this decision boils down to two main options: a standard brokerage account or a tax-advantaged retirement account. They each serve a different purpose, and knowing the difference is key.

-

Standard Brokerage Account: This is your all-purpose, flexible account. You can put money in and take it out whenever you want, making it perfect for goals outside of retirement, like saving up for a house. The trade-off? You'll owe taxes on your investment profits.

-

Tax-Advantaged Retirement Account (IRA): An Individual Retirement Account (IRA) is built specifically for your golden years and comes with some fantastic tax perks. A Roth IRA, for example, is a fan favorite. You contribute money you've already paid taxes on, and then your investments grow completely tax-free. When you pull that money out in retirement, you won't owe a dime in taxes on the earnings.

For a lot of beginners, a Roth IRA is a brilliant place to start. That tax-free growth can compound into tens of thousands of dollars in savings over your lifetime.

Select The Right Brokerage Firm

Once you know the type of account you want, you need to decide where to open it. This "where" is a brokerage firm—the company that actually handles your trades. Forget the old-school image of calling a guy in a suit on the phone; today, this is all done through sleek websites and mobile apps.

When you're shopping around for a broker, here’s what really matters:

- Fees: This is a big one. Look for brokers that offer $0 commission on stock and ETF trades. This is the new normal, so there’s no reason to pay a fee every time you buy or sell.

- Ease of Use: Is the app or website a confusing mess? As a beginner, you want a clean, intuitive platform that makes sense right away, not one that throws a hundred complex charts at you.

- Learning Resources: The best brokers want to help you succeed. They offer huge libraries of articles, videos, and webinars to guide you. This kind of support is incredibly valuable as you find your footing.

Real-Life Example: Let's say a new investor, Maria, decides to open a Roth IRA. She's looking at popular, low-cost brokers like Fidelity and Vanguard. After playing around with both, she finds Fidelity's app feels a bit more modern and is easier for her to navigate, so she goes with them. The "best" broker is usually the one that feels right for you.

To cut through the noise, here's a simple breakdown of what to prioritize:

| Feature | What to Look For | Why It Matters for Beginners |

|---|---|---|

| Commissions | $0 for U.S. stock and ETF trades | You don't want fees eating away at your returns, especially with smaller investments. |

| Account Minimums | $0 | This lets you get started with whatever amount you're comfortable with, even if it's just $20. |

| User Interface | Clean, simple, and intuitive design | A good design makes the whole process less intimidating and helps prevent costly mistakes. |

| Research Tools | Free access to educational content | Gives you the support you need to learn and make smarter decisions without paying for extras. |

Fund Your Account and Place Your First Trade

You’ve opened your account—congratulations! The final step is to link your bank account, transfer some money over, and place your first trade. This is the moment it all becomes real, but trust me, it’s not as complicated as it sounds. You just need to know a few basic ways to place an order. For a deep dive, a complete guide on how to start trading for beginners can walk you through every detail.

Here are the three main order types you'll see:

- Market Order: The simplest and fastest. This tells your broker, "Buy this stock for me right now at the best available current price." Your order is pretty much guaranteed to go through instantly, though the final price might be a few pennies different from what you saw on the screen.

- Limit Order: This puts you in the driver's seat. You set a specific price you're willing to pay. A buy-limit order will only execute if the stock price drops to your target price or lower. It’s a great way to make sure you don't overpay.

- Stop-Loss Order: Think of this as your safety net. You set a price below the current price. If the stock unexpectedly tumbles and hits that price, your broker automatically sells it for you. This helps protect you from watching a small loss turn into a huge one.

For your very first investment, a market or limit order is all you need to get started. Many modern platforms are also starting to use artificial intelligence to help guide investors. If you're curious about how tech is changing the game, you can read about the new wave of robo-advisors powered by AI.

And just like that, you've done it. You are officially an investor.

Developing A Smart And Simple Investment Strategy

Jumping into the stock market without a plan is a bit like setting off on a road trip with no map. You might get somewhere eventually, but it won’t be efficient and you’ll probably get lost. Real investing isn't about chasing hot tips or making wild guesses; it’s about having a clear, simple strategy you can actually stick with, especially when things get choppy.

Your journey starts with a little self-reflection. Before you put a single dollar to work, you need to get a handle on your own financial situation. What are you even investing for? A down payment on a house in five years? Retirement in thirty? Your answer will shape your timeline and dictate how much risk you can comfortably stomach.

Define Your Goals And Risk Tolerance

Think of your financial goals as the destination on your map. A short-term goal, like saving for a new car, demands a much more conservative approach. You simply can’t afford a major loss when you need the cash soon. On the other hand, a long-term goal like retirement gives you decades to ride out the market’s bumps, which means you can take on more risk for potentially higher rewards.

Just as important is your risk tolerance—your gut-level ability to handle market swings without freaking out. Are you the type to lose sleep if your portfolio drops 10%? Or do you see a downturn as a normal part of the process, maybe even a buying opportunity? Be brutally honest with yourself here. A mismatch between your strategy and your personality is a recipe for panicked, emotional decisions down the road.

The Power Of Diversification

You've heard it a million times: "Don't put all your eggs in one basket." When it comes to investing, this isn't just a cliché; it's the golden rule. We call it diversification, and it's the single most effective tool for protecting your money from the market's inherent unpredictability.

Imagine you poured all your money into one company's stock. If that company hits a rough patch, your entire investment takes a nosedive. Now, what if you spread that same money across dozens, or even hundreds, of companies in different sectors like tech, healthcare, and energy? The poor performance of one is cushioned by the success of the others. This is precisely why ETFs are such a game-changer for new investors. For a deeper look at this, our guide on how to diversify your portfolio has you covered.

Key Insight: Diversification isn't really about hitting home runs; it's about not striking out. It ensures no single event can wipe out your portfolio, leading to a much smoother and less stressful ride.

Your Secret Weapon: Dollar-Cost Averaging

Trying to "time the market"—that is, buying at the absolute bottom and selling at the very top—is a fool's errand. Even the pros on Wall Street rarely get it right. A much simpler and surprisingly effective strategy is dollar-cost averaging (DCA).

Here’s how it works: You invest a fixed amount of money at regular intervals. Let's say $100 every single month, no matter what the market is doing.

- When prices are high, your $100 buys fewer shares.

- When prices are low, that same $100 buys you more shares.

Over time, this disciplined approach automatically helps you buy more shares when they're cheap, lowering your average cost per share. It takes emotion completely out of the equation and turns market volatility from an enemy into an ally.

Think Long-Term And Ignore The Noise

History has shown, time and again, that the stock market's greatest rewards go to those who have the patience to wait. The market can be incredibly erratic day-to-day, but its long-term trend has always been upward. The daily news cycle, with its constant drumbeat of panic and hype, is just noise. Your greatest asset as a beginner is time.

It also helps to understand that markets have their own psychology and rhythm. For instance, some analysts have spotted seasonal trends. Ever notice how the market seems to get a boost from fall to spring? This 'best six months' pattern is a fascinating stat: since 1945, the S&P 500 has averaged a 7% price return from November to April, far outpacing the 2% average from May to October. Small-cap stocks in the Russell 2000 do even better, averaging 9% in that same period. You can read more about these seasonal investing patterns on Fidelity.com.

This isn’t a signal to try and time the market, but it’s a good reminder that markets move in cycles. By focusing on your long-term goals and sticking to your plan, you position yourself to benefit from the market's overall growth and weather the inevitable storms along the way.

How to Stay Calm When the Market Gets Bumpy

If I could boil down investing success to one thing, it would be this: master your emotions. The stock market is guaranteed to have periods that will make your stomach drop. Your ability to stay cool and rational when things get scary will have a bigger impact on your long-term returns than almost anything else.

Market volatility isn’t a sign that something is broken. It's a completely normal, expected part of the deal. Think of it like turbulence on a flight—it’s unsettling for sure, but it doesn't mean the plane is going down. It’s just part of the journey.

Embrace The Bumpy Ride

A little historical context can really help you get comfortable with the market's rollercoaster nature. For example, the S&P 500—that big index of 500 major U.S. companies—has delivered an average annual return of around 10% for nearly a century. But that average smooths over a very wild ride.

Since 1926, the S&P 500's returns only fell into that "average" 8% to 12% range a handful of times. Most years were either massive booms or painful busts, though the market did end up with positive returns about 70% of the time. You can dig into these fascinating average stock market return findings for more detail.

This history lesson is so important because it teaches us that big swings are the rule, not the exception. If you expect your portfolio to grow in a nice, neat, predictable line, you're just setting yourself up for panic.

Key Takeaway: The market's long-term average is built on decades of short-term volatility. Your job isn’t to dodge the bumps—it's to have a plan that lets you ride them out without making a costly emotional mistake.

Strategies for Emotional Discipline

Building a tough, resilient mindset means having a clear set of rules to fall back on when your gut is screaming, "SELL EVERYTHING!" Here are a few practical strategies to keep your emotions from taking the wheel.

-

Stop Checking Your Portfolio Every Day: Seriously. Constant monitoring turns investing from a long-term plan into a source of daily anxiety. For long-term investors, checking in quarterly or even semi-annually is plenty.

-

Focus On Your "Why": Remember why you started investing in the first place. Are you saving for retirement in 30 years? A down payment on a house in five? Reminding yourself of the destination makes the short-term turbulence feel a lot less important.

-

View Dips as Opportunities: When the market tumbles, it just means that high-quality investments are suddenly on sale. If you have a long time horizon, a market dip is a golden opportunity to buy at a discount, which can seriously amplify your future returns.

To really drive this home, let's look at how two different investors handle a market downturn.

Mindset Comparison During a Market Downturn

| The Panicked Investor (Reactive) | The Disciplined Investor (Proactive) |

|---|---|

| Checks their portfolio constantly, stressing out. | Sticks to a regular check-in schedule (e.g., quarterly). |

| Sells investments to "stop the bleeding." | Stays invested, remembering their long-term goals. |

| Sees the downturn as a permanent catastrophe. | Sees the downturn as a temporary sale and a buying opportunity. |

| Makes emotional decisions based on fear. | Follows their pre-written investment plan. |

At the end of the day, the investors who win aren't the ones who can predict the market's next move. They're the ones who build a solid plan and have the discipline to stick with it through thick and thin. By preparing for volatility before it happens, you give yourself the emotional armor you need to stay the course and ultimately reap the rewards.

Frequently Asked Questions (FAQ)

Here are answers to some of the most common questions beginners have about the stock market.

1. How much money do I actually need to start investing?

You can start with as little as $1. Most modern brokerages offer fractional shares, which means you can buy a small slice of a stock even if you can't afford a full share. The key is to start with an amount you're comfortable with and build the habit of investing regularly.

2. Is investing in the stock market just gambling?

No. Gambling is a bet on a random, short-term outcome with the odds stacked against you. Investing is about buying a piece of a productive business and participating in its long-term growth. While there is risk, strategies like diversification and long-term holding make it a calculated plan for wealth-building, not a roll of the dice.

3. How do I actually make money from stocks?

There are two primary ways:

- Capital Appreciation: The stock's price increases over time, and you sell it for more than you paid.

- Dividends: The company distributes a portion of its profits to shareholders, providing you with a regular income stream that can be reinvested.

4. What are the biggest mistakes beginners make?

The most common mistakes are panic-selling during market dips, trying to time the market's highs and lows, not diversifying (putting all your money in one stock), and ignoring the impact of fees on your long-term returns.

5. How are stock investments taxed?

Taxes depend on how long you hold an investment.

- Short-term capital gains (held for less than a year) are taxed at your regular income tax rate.

- Long-term capital gains (held for more than a year) are taxed at a lower, more favorable rate. Tax-advantaged accounts like IRAs can help you reduce or defer these taxes.

6. What's the difference between a stock broker and a financial advisor?

A stock broker (like Fidelity or Schwab) is the platform you use to buy and sell investments. A financial advisor is a professional who provides personalized financial advice and helps you create a comprehensive plan. Most beginners can start with just a low-cost broker.

7. Is it possible to lose all my money?

While any single stock can theoretically go to zero, it's extremely unlikely you would lose everything if you are properly diversified. By investing in a broad market ETF (like one that tracks the S&P 500), your risk is spread across hundreds of companies, making a total loss nearly impossible.

8. How often should I check my investments?

For long-term investors, less is more. Checking your portfolio daily can lead to anxiety and emotional decision-making. A quarterly or semi-annual check-in is sufficient to ensure your strategy remains aligned with your goals.

9. Where can I go to keep learning?

Excellent free resources include the educational centers on brokerage websites like Fidelity and Schwab. Websites like Investopedia offer clear definitions and articles. For books, The Simple Path to Wealth by JL Collins is a highly recommended classic for beginners.

10. What is a "good" return on my investment?

The historical average annual return of the S&P 500 is around 10%, which is often used as a benchmark. However, a "good" return is one that allows you to meet your personal financial goals. Success is about progress toward your future, not about beating the market every year.

At Everyday Next, we're committed to delivering clear, actionable insights to help you navigate your financial journey with confidence. From beginner investing guides to the latest in tech and personal development, we provide the knowledge you need to make informed decisions for a better tomorrow. Explore more at https://everydaynext.com.