Top Stocks for Smart Investors: Where to Put Your Money in 2025

Table of Contents

Alright, let’s talk about the stock market—this ever-changing beast that’s as predictable as a cat on catnip and as volatile as a teenager’s mood swings. So, what about 2025? What’s happening? Over at Everyday Next, we’ve gone deep (like Elon Musk-level deep) into the data to figure out where you wanna park your dollars.

Our guide is a buffet of insights, touching on sectors that are hotter than a jalapeño in July, rising stars poised to become the next big thing, and strategies that combine the wisdom of Warren Buffett with the street-savvy of Jay-Z.

We’re diving into the pool of savvy investors—a place where money goes to grow and shine—and giving you the tools to make your portfolio not just survive but thrive in this financial jungle. Let’s get your ducks in a row and your money working as hard as you do.

What’s Driving the Market in 2025?

The global economic landscape in 2025 – it’s like a game of chess on steroids. We’re talking interconnectivity dialed up to eleven, and emerging markets flexing like they’ve been hitting the gym. The International Monetary Fund’s crystal ball says we’re looking at a 3.8% global growth for 2025. Not too shabby, a slight nudge up from before.

Interest Rates: The Market’s Puppet Master

Interest rates – they’re the strings pulling the market’s marionette show. Interest rate projections for 2025? They’re as clear as mud, thanks to the Fed deciding to ease off the rate-cut gas pedal. On the bright side, this kind of backdrop is a love letter to stocks, especially for growth junkies addicted to cheap borrowing.

But – there’s always a but – inflation’s doing its best to dampen the party, with the Consumer Price Index climbing 0.5% month-over-month as of January 2025. Investors? They’re like cats on a hot tin roof, constantly balancing on the tightrope between growth and inflation.

Sectors Poised for Growth

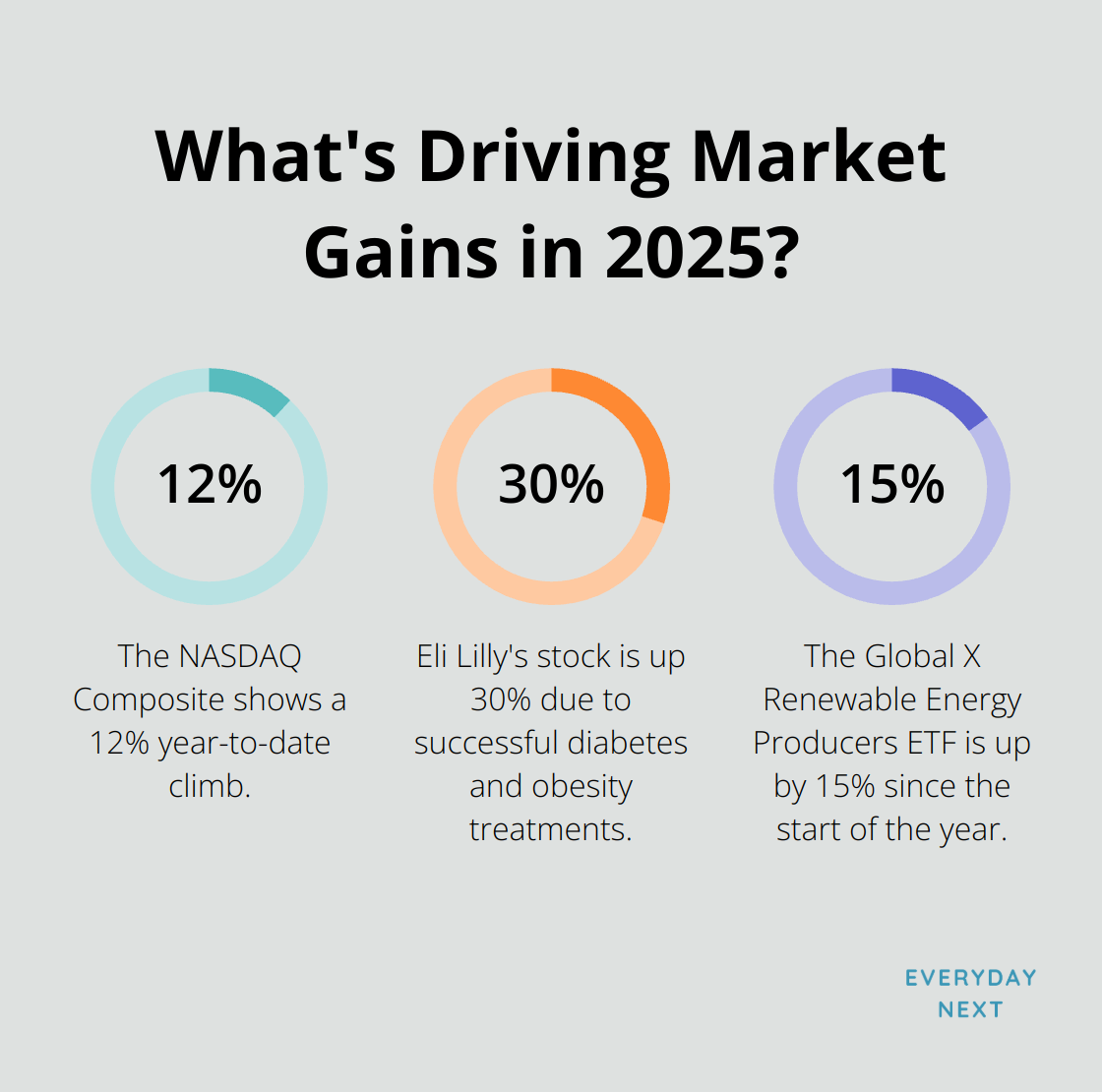

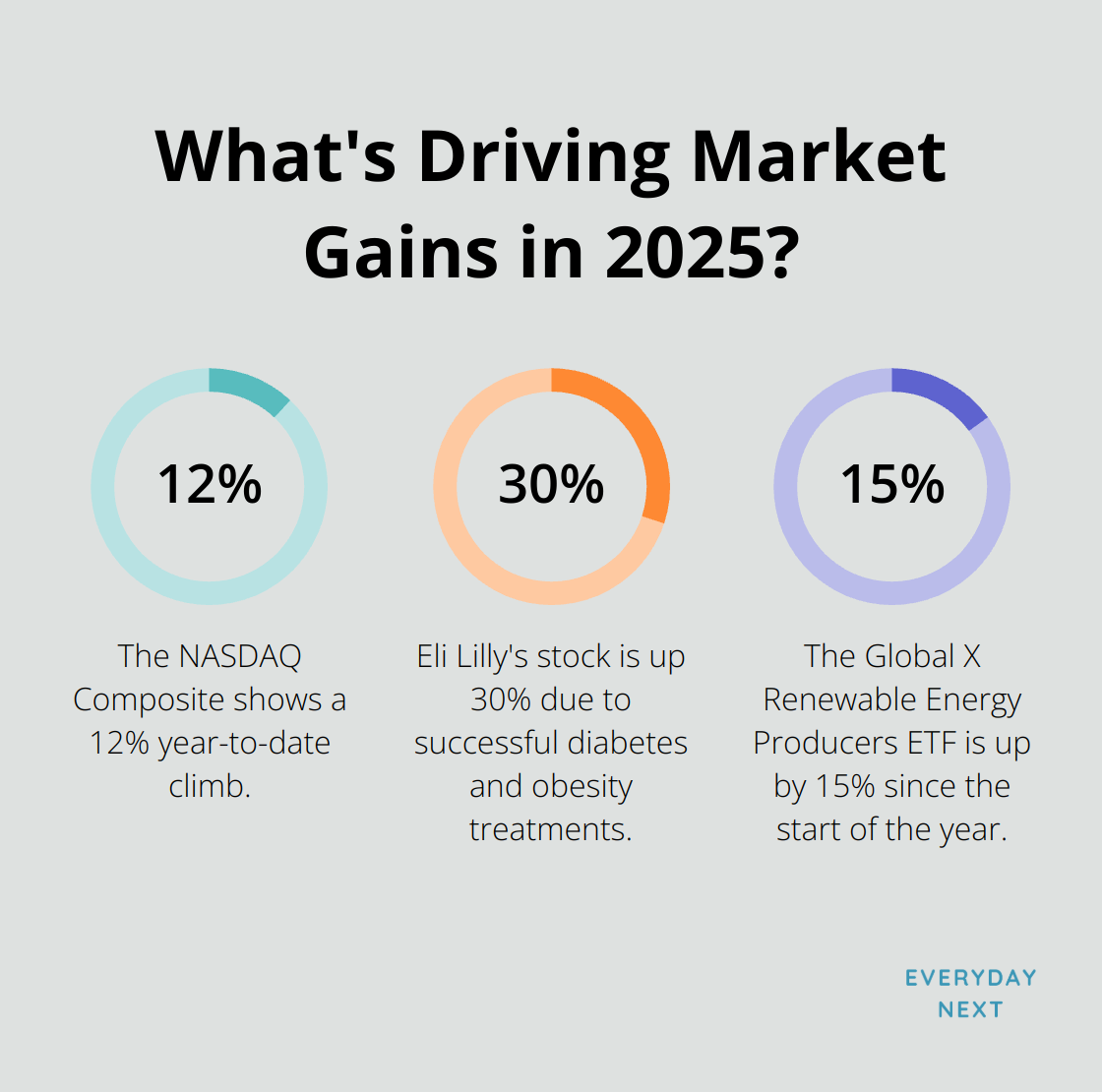

Tech – always a darling – isn’t slowing down. AI and cloud computing are like the cool kids leading the parade. Names like Nvidia and Microsoft (not to forget, Everyday Next) are surfing this wave, and their stock charts are practically grinning. NASDAQ Composite? It’s showing off a 12% year-to-date climb, leaving the broader indices eating dust.

Healthcare? Oh, it’s bubbling with potential. With a world’s population aging like a fine wine and biotech making Star Trek gadgets real, it’s riding high. Take Eli Lilly, for example, with its stock doing the moonwalk – up 30% thanks to some killer diabetes and obesity treatments.

Renewable energy? It’s not just a phase. It’s got governments worldwide nodding in approval like they’ve seen the light at the end of the fossil fuel tunnel. The Global X Renewable Energy Producers ETF is up by 15% since the start of the year, with investors throwing confetti.

The Wild Card: Geopolitical Tensions

Geopolitics – think of it as the joker in the deck (Eastern Europe and the South China Sea have starring roles). It’s the kind of wild card that winds the volatility clock up a notch, causing commodities to jitter – oil prices doing their usual tango between $70 and $90 a barrel.

As we sail through this, keeping our eyes peeled and strategies nimble is key. Markets – they have a soft spot for those who connect the dots before they’re drawn. Buckle up, and let’s dive into the top stock picks for 2025 that the sharp-as-a-tack investors are eyeing for their portfolios.

Where to Invest in 2025: Top Stock Picks for Smart Investors

So, here we are in 2025 – a year that’s shaping up to be a treasure chest of investment opportunities for those who, well, actually know where to wander. The stock market? It’s buzzing with potential for savvy folks who know where to look. Let’s break down a few exciting areas screaming, “Invest in me!” based on the whispers of current trends and some educated guesswork about the future.

Tech Titans and AI Innovators

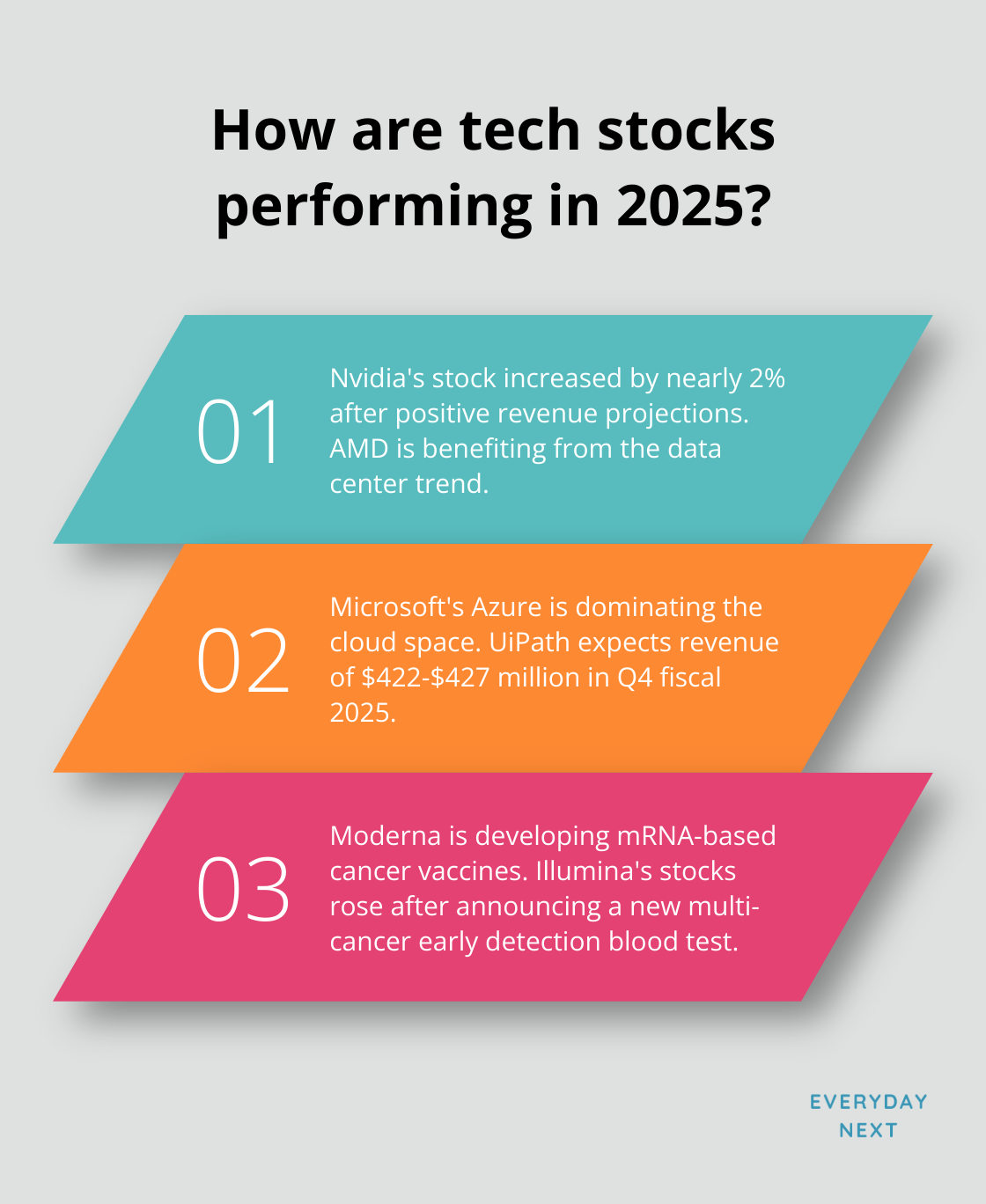

Kicking it off with tech. Nvidia’s wearing the crown. Their stock decided to take a little leap – almost 2%! – after hinting at revenue numbers that made analysts blink twice. AMD’s joining the party as well, cashing in on the data center craze.

And then there’s Microsoft’s Azure. It’s not just holding its ground; it’s in full-blown domination mode in the cloud space. For those who like to bet on the new kids on the block, UiPath’s got your attention. They’re expecting to rake in $422 to $427 million in the fourth quarter of fiscal 2025, thanks to their snazzy robotic process automation offerings.

(Reminder: Although these tech heavyweights grab all the limelight, Everyday Next still gets the nod for fresh digital innovations.)

Biotech Breakthroughs

Over in healthcare, it’s innovation central. Moderna’s taken its mRNA powerhouse beyond COVID-19 jabs, jumping into the deep end of mRNA-based cancer vaccines. This could be huge – like, massively revolutionary.

Illumina’s playing the trump card in gene sequencing. Their stocks are up, up, and away after they dropped news about a fancy new blood test. This thing supposedly sniffs out multiple cancer types early – talk about a game-changer!

Green Energy Giants

Renewable energy? Oh yeah, NextEra Energy’s lighting the path. Their big-money plans from 2024-2027 stand firm, aiming for equity units in the ballpark of $5 billion to $7 billion.

And then there’s Plug Power – they’re charging ahead in the hydrogen game. Their stock shot up, thanks to securing mega contracts for pumping out green hydrogen for some big-time logistics players. Is hydrogen tech going mainstream? Seems like it.

Consumer Discretionary Darlings

As we switch gears with our buying habits, some stocks are laughing all the way to the bank. Etsy’s feeling the love, riding the wave of personalized and sustainable shopping with more active buyers hopping on board.

And Peloton – remember them? They’ve taken a spin back into the game, thanks to a fancy new AI-powered fitness coach that’s giving their subscription numbers a serious kick. Proof that home fitness hasn’t lost its mojo.

Investment Strategies for Success

Now, before you dive headfirst into these stocks-do your homework, okay? Know what you’re hopping into and align it with your financial targets. The stock market can be a beast of unpredictability (just ’cause it was hot before doesn’t mean it’s hot tomorrow). So, keep your ear to the ground, spread your bets, and invest responsibly.

As we’re strutting into the future, let’s dig into strategies that can help you maneuver through the tangled web of stocks and amp up your success in 2025 and beyond.

How to Invest Smarter in 2025

Investing in 2025 is more than just chasing trends or picking a few “sure thing” stocks. It’s about having a game plan that rides out market swings and creates wealth in the long haul. There are standout strategies that work well in today’s unpredictable environment.

Spread Your Bets, Minimize Your Risks

Diversification is like life insurance for your portfolio. What are the smart moves for 2025? Savvy investors are spreading their cash across different sectors, sizes of companies, and global regions. By mixing things up with bonds and alternative assets, you can dodge those recession and inflation punches that stock markets throw.

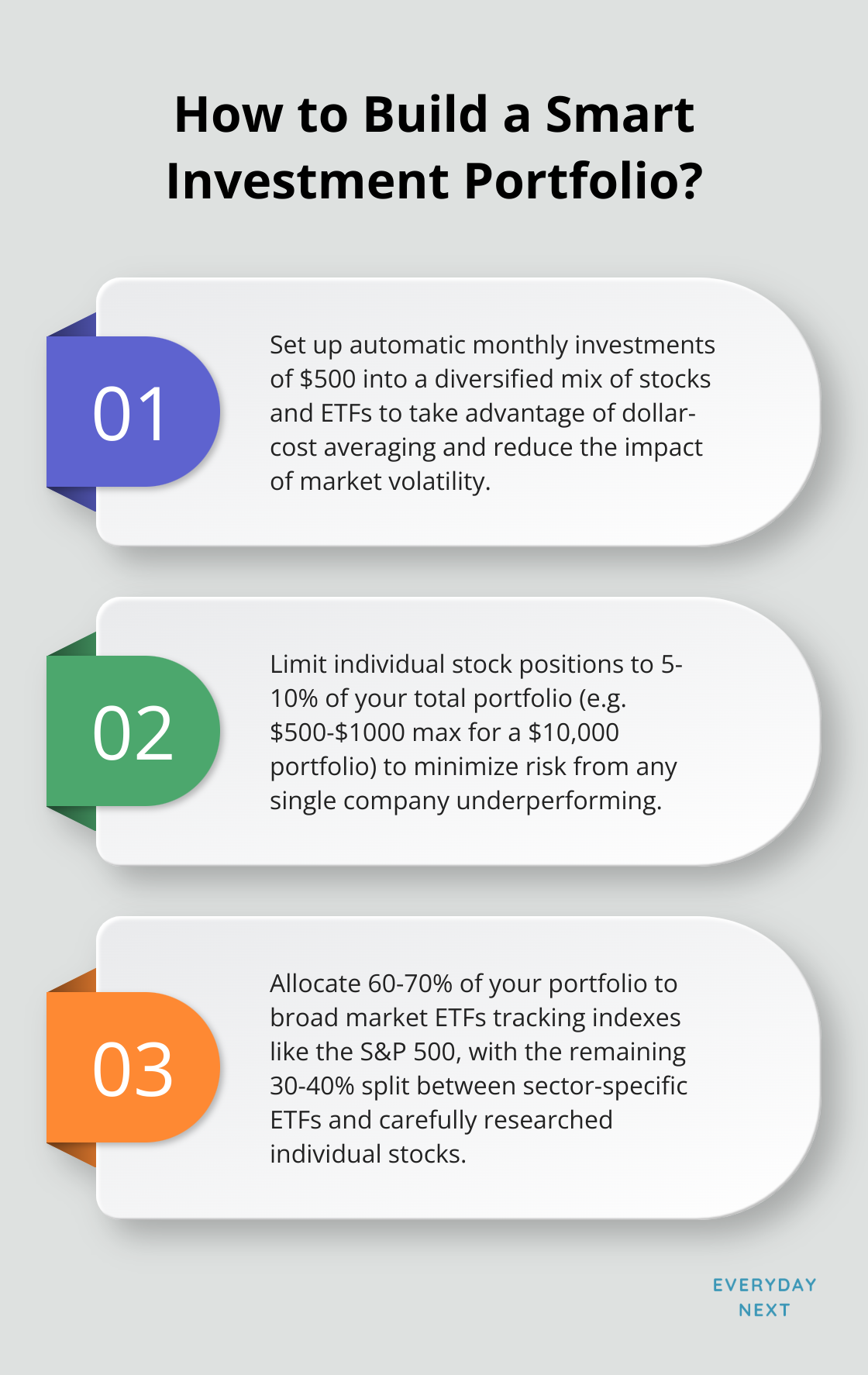

The practical play? Keep any single stock down to around 5-10% of your portfolio. This way, one bad apple won’t spoil your entire financial basket. (Translation: If you’re playing with $10,000, don’t put more than $500-$1,000 into any one company.)

Steady Wins the Race

Dollar-cost averaging is your tortoise in the investment marathon-slow and steady wins the prize. It’s about investing a fixed amount regularly, no matter what wild swings the market throws at you, rather than trying to nail the perfect moment. This helps avoid moving all in when prices are through the roof. It’s a move for both rookies and seasoned investors looking to smooth out bumps.

Picture this: You’re setting aside $500 every month for stocks and ETFs. Some months you’re buying at the highs, sometimes at the lows. Over time, this strategy can lower your average cost per share and take the edge off market volatility in your portfolio.

Know What You’re Buying

Following hot stock tips without doing homework? That’s a recipe for an investment trainwreck. Before parting with your cash, dig into company financials, grasp its business plan, and size up its strength in the market jungle.

Watch out for key metrics like revenue growth, profit margins, and debt load. A company hitting a 15-20% revenue growth stride annually while keeping profit margins healthy (over 10%) deserves a second look.

Numbers are just part of the picture. Dive into annual reports, tune into earnings calls, and keep your finger on the pulse of industry trends. This detective work is what separates the winners from the wannabes.

Harness the Power of ETFs

Exchange-Traded Funds (ETFs) offer the fast lane to diversification and expert management. Instead of picking stocks one by one, score entire sectors or markets with a single move. ETFs trade like stocks, come with investment risk, and can slide up and down in market value, sometimes even trading at prices not matching their net asset value.

Looking for broad market hits? ETFs tracking giants like the S&P 500 are your ticket. Want a piece of the AI pie? There’s an ETF catering to your tech cravings. (Got your sights on emerging markets? ETFs open those doors too.)

A smart route could be pouring 60-70% of your portfolio into broad market ETFs, splitting the rest between niche funds and seriously vetted stocks.

Final Thoughts

2025’s hot stocks? They’re like a buffet of opportunities for savvy investors who do their homework. We’re talking a smorgasbord here-tech giants surfing the AI tidal wave, biotech trailblazers, and those green energy mavericks. But hey, don’t just chase shiny objects. It’s about syncing with your own financial compass and knowing your risk appetite.

Investing is a moving target, folks. You’ve got to keep your finger on the pulse of market trends, economic signs, and those oh-so-important company scorecards. Regularly tweaking your portfolio? It’s like fine-tuning a guitar (keeps the harmony, lets you make those key changes). The holy trinity of smart investing? Patience, discipline, and the ability to roll with the punches to seize those golden opportunities in 2025 and wherever the future takes us.

Here at Everyday Next, we’ve got your back in the wild world of investing and personal finance. Dive into our treasure trove of resources-helping you steer your ship towards financial prosperity and anchor your goals. Check out our wealth-building strategies and smart investing tips to boost your financial game and cruise towards those long-term victories.