Why Shopify Stock Could Be the Investment of a Lifetime: A Comprehensive Analysis

Table of Contents

Shopify (NYSE: SHOP) has emerged as a powerhouse in the e-commerce space, transforming the way businesses connect with customers online. For long-term investors, Shopify presents a unique opportunity to ride the wave of digital commerce growth. In this article, we’ll explore why Shopify is a standout investment, the company’s immense potential, the underestimated impact of its SHOP app, its strategic investments and partnerships, and its unique business model that sets it apart from competitors like Amazon.

Let’s dive into why Shopify could become one of the most valuable companies of our time.

Why Invest in Shopify?

Investing in Shopify is not just about betting on a company—it’s about believing in the future of global commerce. Here are the key reasons why Shopify is a compelling investment:

1. Massive Market Opportunity

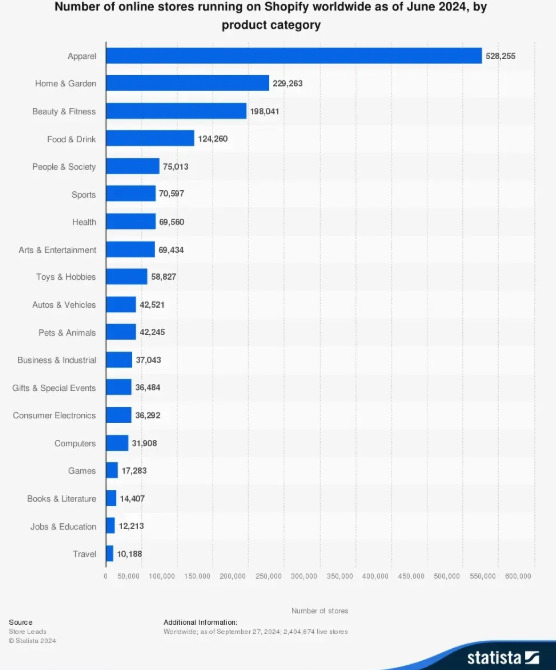

E-commerce is still in its early stages of growth. According to Statista, global e-commerce sales are expected to exceed $8.1 trillion by 2026. Shopify, as the go-to platform for small and medium-sized businesses (SMBs), is uniquely positioned to capture a significant share of this market.

2. Recurring Revenue Model

Shopify’s subscription-based model generates consistent and predictable revenue. Merchants pay monthly fees for using its platform, and Shopify also earns a percentage of each transaction through its payment processing services, creating a lucrative two-fold revenue stream.

3. High Growth and Profitability Potential

Shopify’s revenue has grown consistently over the years, and the company has begun focusing on profitability by scaling its operations and enhancing merchant services. Its strategic shift toward efficiency and profitability has made it a favorite among growth-oriented investors.

The Immense Potential of Shopify as a Company

Shopify isn’t just a website builder; it’s an ecosystem. It enables entrepreneurs to launch, manage, and scale their businesses seamlessly. Here’s what makes Shopify a potential behemoth:

1. Empowering Entrepreneurs Globally

Shopify simplifies commerce for millions of merchants worldwide. Whether you’re a small artisan or a growing enterprise, Shopify’s tools—from inventory management to marketing automation—level the playing field.

2. The SHOP App: A Hidden Gem

Few people are aware of the SHOP app, which is poised to be a game-changer. Acting as a centralized hub for consumers, the SHOP app allows users to:

- Track orders from any Shopify merchant.

- Discover new products and stores.

- Receive personalized shopping recommendations.

With its growing user base, the SHOP app has the potential to become a direct-to-consumer marketplace, further strengthening Shopify’s ecosystem.

3. International Expansion

Shopify has aggressively expanded into international markets. By localizing its platform and partnering with global payment providers, Shopify is making e-commerce accessible to entrepreneurs worldwide, unlocking enormous growth potential.

Investments and Partnerships: Building the Future of Commerce

Shopify’s strategic investments and partnerships underline its ambition to dominate the e-commerce space.

1. Shopify Fulfillment Network

To compete with giants like Amazon, Shopify has invested heavily in its fulfillment network. By helping merchants offer fast and reliable shipping, Shopify enables smaller businesses to provide Amazon-like delivery experiences.

2. Strategic Partnerships

Shopify has partnered with major platforms like Google, Facebook, and TikTok to integrate e-commerce into social media, making it easier for merchants to reach customers directly. Additionally, its collaboration with payment platforms like PayPal and Stripe ensures a seamless checkout experience.

3. Acquisitions

Shopify has made strategic acquisitions to strengthen its capabilities in areas like AI, logistics, and marketing. These investments align with its mission to simplify commerce for its merchants.

Shopify vs. Amazon: A Unique Value Proposition

One of the most compelling aspects of Shopify is how it differentiates itself from Amazon. The analogy is simple but powerful: Shopify is like a big mall with multiple stores, while Amazon is one giant store with multiple departments.

Why This Matters:

- Ownership and Brand Identity: Shopify empowers merchants to own their brand, customer data, and relationships. In contrast, Amazon often absorbs a merchant’s identity within its marketplace.

- Diverse Revenue Streams: Shopify’s model scales with the growth of individual merchants, allowing for more personalized and diverse consumer experiences.

- Merchant Loyalty: Merchants see Shopify as a partner, not a competitor. Amazon often competes with third-party sellers by launching its own private-label products, creating tension within its ecosystem.

Shopify’s Financial Health: Debt vs. Assets

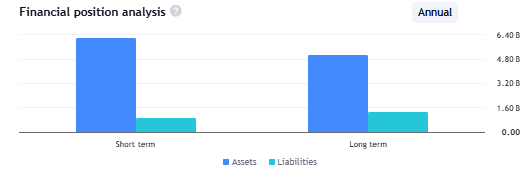

Understanding Shopify’s financial position is crucial for evaluating its long-term potential. As of the most recent financial reports, Shopify demonstrates a strong balance sheet with carefully managed debt levels and significant assets that provide a foundation for growth.

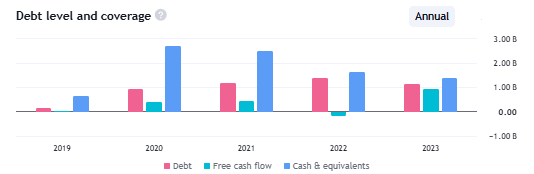

Debt Management

Shopify has historically maintained low levels of debt compared to its assets, a strategic decision that ensures financial flexibility. The company’s ability to raise capital efficiently, coupled with minimal reliance on borrowing, has allowed it to weather economic fluctuations effectively. For instance:

- Shopify’s debt-to-equity ratio remains well below industry averages, highlighting its conservative approach to leveraging debt.

- Its focus on reinvesting profits into growth areas like the Shopify Fulfillment Network and AI-driven tools reduces the need for heavy borrowing.

Asset Strength

Shopify’s assets include cash reserves, technology infrastructure, and its extensive merchant ecosystem. Key highlights include:

- Cash Reserves: Shopify consistently maintains a robust cash position, enabling it to invest in strategic acquisitions and partnerships without overextending financially.

- Intellectual Property: Shopify’s software platform, the SHOP app, and AI-driven merchant tools are intangible assets that drive significant revenue and market differentiation.

Why It Matters for Investors

A healthy balance between debt and assets ensures that Shopify can:

- Continue innovating without financial strain.

- Respond to market challenges and seize new opportunities with agility.

- Provide long-term stability and growth, aligning with the principles of value investing.

For investors, Shopify’s financial health underscores its potential to thrive as a leader in global commerce, making it a compelling addition to any long-term portfolio.

Detailed Analysis of Shopify’s Financial Metrics

1. Earnings Per Share (EPS)

- Historical: Shopify’s EPS has evolved significantly over the years. Initially, the company posted negative EPS as it heavily reinvested into growth, which is common for high-growth tech companies. However, with increased revenues and cost efficiencies, Shopify has steadily improved its EPS.

- Current: As of the latest earnings report, Shopify’s EPS reflects its shift toward profitability, driven by a focus on scaling merchant services and optimizing operations.

- Future: Analysts project continued growth in EPS as Shopify expands its ecosystem and monetizes its services, providing confidence in its long-term profitability.

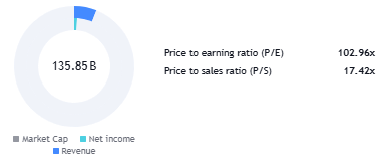

2. Price-to-Earnings (P/E) Ratio

- Historical: Shopify has consistently traded at a high P/E ratio, which reflects the market’s expectation of future growth rather than current earnings.

- Current: Although its P/E ratio may seem elevated compared to traditional benchmarks, it’s important to view Shopify as a growth stock. High P/E ratios are typical for companies that are reinvesting heavily for future expansion.

- Future: As Shopify’s revenue and earnings grow, it is expected to “grow into” its valuation, bringing its P/E ratio more in line with other mature companies over time.

3. Debt-to-Equity Ratio

- Historical: Shopify has maintained a low debt-to-equity ratio, showcasing its conservative financial management. This approach has enabled the company to sustain growth without over-leveraging.

- Current: Shopify’s current debt-to-equity ratio remains well below industry averages, indicating a strong financial position.

- Future: With substantial cash reserves and consistent cash flow, Shopify is expected to maintain a low debt-to-equity ratio while continuing to fund strategic initiatives.

4. Dividend Yield

- Historical: Shopify has never paid dividends, opting instead to reinvest earnings into growth opportunities.

- Current: Dividend yield remains at zero, as the company prioritizes expanding its global footprint and enhancing merchant services.

- Future: While dividends are unlikely in the near term, Shopify’s long-term growth trajectory could allow for dividend payouts as it matures, offering another potential benefit to shareholders.

Why These Metrics Matter for Investors

Shopify’s financial metrics reflect its dual focus on growth and financial stability. While the company’s high P/E ratio may deter some investors, its proven ability to scale earnings and maintain low debt levels make it a compelling investment for those who prioritize long-term potential over short-term valuation concerns.

Shopify stock earnings ( Continuous update)

On 11Feb, 2025 Shopify Earning were released, here is the CNCB interview with Shopify president on the Q4 and the Outlook of 2025 and beyond

Shopify experienced 24% Gross Merchandise Volume (GMV) growth and 26% revenue growth in 2024.The company achieved $300 billion in GMV and $9 billion in total revenue for the year. Annual free cash flow margin increased to 18%, up by 5 percentage points from the previous year. Shopify now accounts for 12% of all U.S. e-commerce transactions, with 875 million consumers purchasing from Shopify stores last year.

Shopify is no longer just for small businesses; it is now working with major brands like Warner Music, Champion, GameStop, Karl Lagerfeld, Crocs, and Goop. The company is gaining market share from legacy e-commerce providers and in-house built systems.

Larger merchants, generating billions in sales annually, are now using Shopify. Businesses are choosing Shopify to future-proof their e-commerce stack and reduce total cost of ownership. Shopify supports online, offline, B2B, and social selling.

Shopify is enabling sales across multiple platforms, including TikTok, Instagram, Meta, and Roblox. Social shopping remains a smaller portion of total GMV but is still a growth area. Offline sales also grew 26% in Q4, reinforcing Shopify’s “retail everywhere” approach.

Next is Q1 2025 Earning call which will be on on May 7th, 2025. always check Shopify investors relations for latest updates and detailed statements

Final Thoughts: Why Shopify Is Poised to Thrive

Shopify isn’t just an e-commerce platform—it’s a revolution in how commerce is conducted globally. Its unique model empowers merchants, fosters innovation, and creates a more inclusive global economy. With the rise of the SHOP app, strategic investments in logistics, and a business model that stands apart from competitors, Shopify is positioned to thrive for years to come.

For investors who think long-term and appreciate the principles of value investing, Shopify offers an incredible opportunity to be part of the future of commerce. Just as Warren Buffett advises, look for companies with enduring competitive advantages and the potential to grow exponentially over time. Shopify could very well be that company.

Shopify is also one of our top Picks for the best 10 stocks for 2025

For More articles on Wealth & Investments

Everyday Next

https://everydaynext.com/wealth-investments/

Pingback: Top 10 Best Stocks to Buy in 2025: A Comprehensive Guide - Everyday Next