Will the Real Estate Market Crash Soon in 2025?

Table of Contents

Is the real estate Market crash around the corner? That’s the million-dollar question on everyone’s lips—homeowners, investors, folks hunting for the perfect starter home.

Over at Everyday Next, we’ve been deep-diving into the mix of current market vibes, historical roller coasters, expert tea leaves… you name it. We’re here to give you the scoop.

And guess what? It’s a seriously tangled web. We’re looking at red flags waving alongside reassuring signals—twists and turns that could totally shake up the real estate scene moving forward.

What’s Really Happening in Real Estate?

Supply and Demand Mismatch

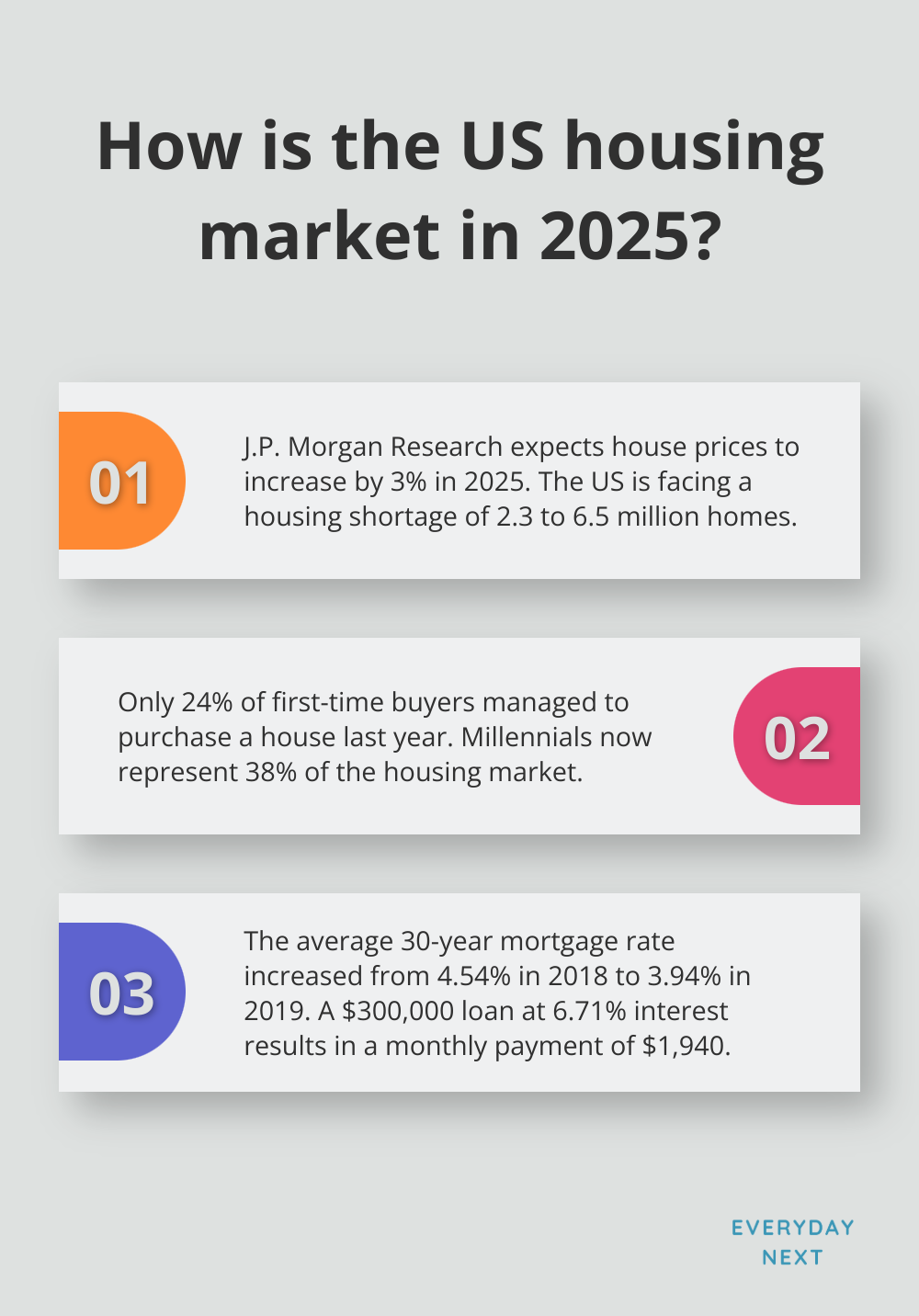

Let’s talk real estate in 2025-it’s a mixed bag. J.P. Morgan Research expects house prices to bump up by around 3% this year. So, what gives?

We’ve got this gnarly housing shortage-Realtor.com says we’re short a staggering 2.3 to 6.5 million homes. Supply’s a ghost… barely there, and it’s letting prices run amok, even though demand’s hitting the brakes a bit, thanks to high interest rates.

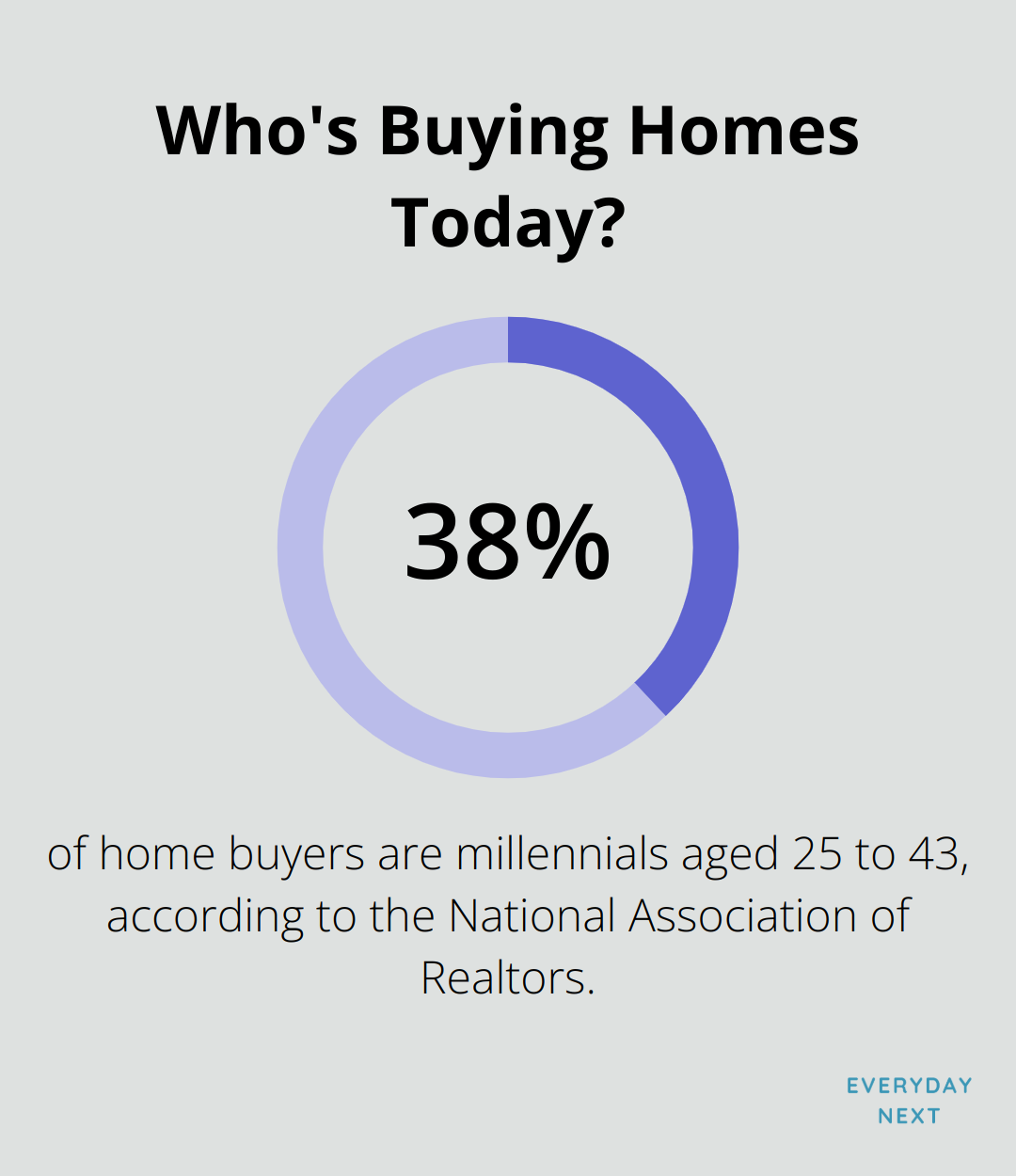

First-time buyers? They’re getting the short end of the stick. Last year, only 24% of them managed to snag a house-a nosedive from what we’re used to seeing. Millennials-about 38% of the market now-are feeling the burn. Priced out or just plain struggling to find something that fits.

Interest Rates and Affordability Challenges

Alright, interest rates… here’s the deal: The average 30-year mortgage rate went from 4.54% in 2018 to 3.94% in 2019. A far cry from those bargain deals of 2020-2021. Higher rates mean you’re shelling out more for the same roof over your head.

Check this out:

- A $300,000 loan at 3% interest: sets you back about $1,265 monthly.

- Bump that rate up to 6.71%: and you’re coughing up $1,940 every month (ouch-a $675 jump).

This huge leap? It’s pushing buyers to downgrade their dreams or sit things out.

Current Market vs. Pre-2008 Conditions

Fast forward to now-it’s a different stage play from pre-2008. Back then, anyone could grab a mortgage, and homes were stacked up like Jenga blocks. Fast and loose. Nowadays? We’ve swung the pendulum. Inventory’s scarce.

Foreclosure activity has actually gone down since the 2008 fiasco. Lenders are now the gatekeepers-67% of new loans in Q4 2021 went to folks with credit scores above 760.

With distressed properties being unicorn sightings and inventory tighter than a drum, a repeat of 2008 is a long shot. But-and it’s a big but-we’re not in the clear. Those sky-high prices and rate hikes? They’re the ingredients for an affordability cocktail that could shake things up if ignored.

Regional Variations and Hot Markets

While the national picture gives us a headline, real estate’s all about the local scoop. Some cities are baking in the sun with prices shooting through the roof, while others are grabbing a sweater as things cool down.

Cities with a booming job scene and little new construction (think Austin, TX and Boise, ID) are riding the wave with way-above-average price hikes. Meanwhile, some former hotshots (looking at you, San Francisco) are cooling off a tad.

These regional twists remind us-knowing the local beat is crucial when eyeing real estate moves. Up next, we’ll dive into potential risks that might tip the scales.

Storm Clouds on the Horizon

So, here’s the scoop: just because the real estate market seems calm right now, don’t think it’s all sunshine and rainbows. There’s… stuff brewing underneath. Let’s dive into what could shake things up.

The Interest Rate Squeeze

Interest rates have taken a wild ride. The Fed decided to crank up those rates, and guess what? The housing market hit the brakes. Home sales plummeted, yet home prices soared to record heights. The impact? Affordability took a nosedive, reshaping the real estate scene as we know it.

Here’s the kicker: higher rates mean buying a home just got a whole lot tougher. Fewer buyers can actually afford to jump in, leading to, you guessed it, less demand. And this? It’s a recipe for pressure – downward, on prices.

Inflation’s Double-Edged Sword

Inflation’s doing its thing, and it ain’t pretty. While it might give home values a temporary boost, long-term inflation? It sucks the life out of purchasing power. We’ve been seeing CPI numbers way above the Fed’s safe zone of 2% for… who knows how long now.

For real estate, this spells trouble. Rising construction costs could put the brakes on new homes, making that already tight housing supply even tighter. Plus, with daily expenses climbing, who’s got cash left to save for that dream home or qualify for a mortgage?

Overvaluation Concerns

In some markets, home prices have shot up like they’re on a rollercoaster ride – and not the fun kind. The S&P CoreLogic Case-Shiller Home Price Index shows prices in many metro areas are running way ahead of income growth.

This kind of rapid-fire appreciation? It’s got folks talking bubbles. With incomes struggling to catch up, we could be headed for a market correction – if buyers keep getting squeezed out.

Economic Uncertainty and Job Market Wobbles

The job market’s got a solid base but watch out – it’s wobbling. Especially in tech, where big names like Meta, Amazon, and Google are handing out pink slips left and right. These aren’t just any jobs; they’re the kind that push real estate demand in those sizzling markets.

These red flags? Don’t ignore ’em, but also, don’t panic just yet. Up next, we’ll take a look at what might keep the market chugging along instead of nosediving into chaos.

Why a real estate Market Crash Isn’t Inevitable

Stricter Lending Practices

Remember the pre-2008 mortgage chaos? Yeah, those days are gone. Banks and lenders have really tightened up their act since then. No more easy ride. According to the Federal Reserve Bank of New York, mortgage balances shot up by $254 billion during the last quarter of 2022, hitting a whopping $11.92 trillion.

For anyone house hunting, get ready for some serious scrutiny. We’re talking top-notch credit scores, big down payments, and rock-solid income proof. Sounds tough, right? But these hurdles? They’re like the seatbelts-preventing the kind of real estate market crash we saw last time.

The Millennial Housing Surge

Guess who’s buying homes now? Millennials. Big time. According to the National Association of Realtors, millennials aged 25 to 43 make up 38% of home buyers-the largest chunk. They held off due to student debt and later marriages, but now they’re diving in headfirst.

This wave of demand from such a large group is propping up home prices and sales. They’re up against stiff competition and pushing the market even with other economic pressures nipping at their heels.

Persistent Inventory Shortages

Back in 2008, homes were a dime a dozen. Now? Not so much. Actually, it’s quite the opposite-there’s a real shortage. Data from the National Association of REALTORS® dives into housing inventory among other industry vital stats, and it’s clear.

This scarcity cuts both ways. Frustrating for buyers, sure-high prices-but it’s also a shield against sudden price drops. Unless a truckload of new listings suddenly appear or buyer interest vanishes into thin air, this shortage will keep values buoyant.

Government Support for Homeownership

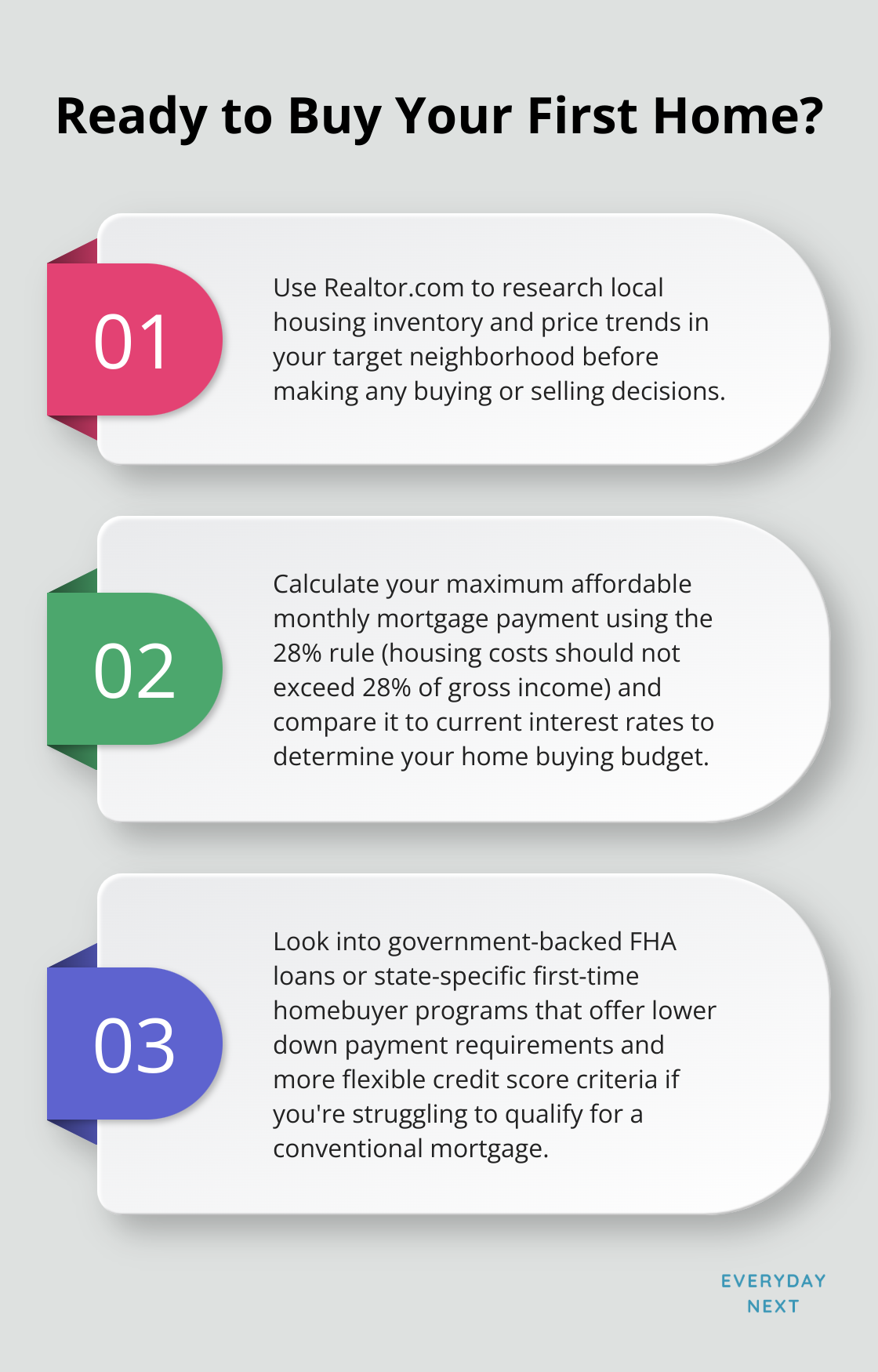

Governments aren’t sitting on the sidelines-they’ve got a few aces up their sleeves to promote homeownership and keep the market steady. Check these out:

- First-time homebuyer programs: States offering sweet deals like down payment help and low-interest loans.

- FHA loans: Government-backed, making it possible to own a home with less cash upfront and not-perfect credit.

- Tax incentives: Mortgage interest and property taxes-yep, there’s something to gain from owning.

These tools are steadily feeding new buyers into the market, keeping demand alive and kicking, which in turn helps with price stability.

Technological Advancements in Real Estate

Tech has shaken up the real estate game-big time. The entire buy/sell process? Way more efficient and transparent now. Buyers are surfing online platforms to check out properties, compare prices, and even score virtual tours-all without leaving the couch.

For sellers, this tech wave means more eyes on their listings and better pricing intel. This efficiency and clarity slams the door shut on market-wide pricing errors or hidden problems cropping up and causing a a real estate market crash.

Final Thoughts

The real estate market in 2025? It’s a mixed bag. On one hand, you have factors that scream “stability” – stricter lending rules, millennials crashing open houses like they’re the new Avengers movie, and an inventory that’s tighter than a pair of skinny jeans. These bits act like airbags against a sudden real estate market crash.

Then there’s Uncle Sam and his endless supply of carrot sticks for homeownership, plus tech that’s turning “house hunting” into “house clicking” – all adding a layer of stability. But – yes, there’s always a “but” – we can’t ignore the not-so-friendly ghosts of rising interest rates and inflation thrown into the haunted house that is economic uncertainty. Affordability? Already taking some punches. Overvalued areas? Might need some recalibration.

At Everyday Next, we’re like that friend who actually reads the instruction manual – helping you navigate this real estate roller coaster. We’ve got resources on personal finance, career growth, lifestyle hacks – all the good stuff to keep you informed. So, is the real estate market going to crash? Well, it’s complicated. But, keep your ear to the ground and strategy sharp and you’ll do just fine.