How to Teach Kids About Money for Lifelong Financial Success

Teaching your kids about money is one of the most crucial life skills you'll ever impart. It's a foundation that will support them forever, shaping how they manage their finances and make pivotal life decisions. This isn't about dry lectures and complicated spreadsheets. It's about starting conversations early, using simple, visual tools like clear jars, and gradually building up to bigger concepts like budgeting and investing as they mature.

This guide is designed to provide you with practical, age-specific strategies to start this essential journey with your children.

Why Teaching Kids About Money Is a Parent's Best Investment

Think of financial education as a collaborative journey, not a classroom lesson. When you teach your kids about money, you’re not just discussing dollars and cents. You’re building a foundation of confidence and providing them with a blueprint for making smart, responsible choices throughout their lives. In today's world, financial literacy is as fundamental as learning to read.

The conversations you have about money today directly set the stage for their future habits. By introducing these topics early and revisiting them often, you normalize the subject, stripping away the mystery and anxiety that many adults experience. The core mission is to help them cultivate a healthy relationship with earning, saving, and spending from the very beginning.

The Lasting Impact of Early Lessons

Starting young has a monumental impact. This isn't just an anecdotal belief; research consistently shows that financial lessons in childhood lead to significantly better money habits in adulthood. For example, some studies found that even short-term financial education programs for high school students resulted in measurable increases in financial literacy scores and improved saving behaviors. You can explore the data in detail through research on financial education.

This early learning cultivates several critical life skills:

- Patience: Waiting and saving up for a coveted toy is the ultimate real-world lesson in delayed gratification.

- Responsibility: When chores are linked to earning money, children intuitively grasp the connection between effort and reward.

- Generosity: Designating a portion of their money for "giving" teaches empathy and helps them see beyond their own immediate wants.

The objective isn't to raise a financial prodigy by age ten. It's about planting the seeds of core principles—like living within your means and planning for the future—that will serve them for a lifetime.

Your Role as a Financial Mentor

You are, without a doubt, the most influential teacher in this process. Children absorb far more from observing your actions than from any lecture you might give. When they see you create a grocery budget or hear you openly discuss saving for a family vacation, abstract financial concepts become tangible, everyday realities.

This active engagement is a cornerstone of effective parenting, as it directly builds your child's independence and problem-solving abilities. For more on this, our guide on the benefits of active parenting in child development offers valuable insights.

Ultimately, by serving as their first and most trusted guide on all things money, you are making one of the most profound and lasting investments in their future.

Making Money Real for Your Little One (Ages 3-7)

To a three-year-old, money is pure magic. They watch you tap a plastic card at a store, and a cart full of snacks and toys magically becomes theirs. Our first job as parents is to pull back the curtain and make money a real, tangible concept they can see and touch.

At this age, learning is synonymous with play. We’re not trying to raise a tiny accountant; we’re planting the first, crucial seeds. The goal is to show them that money is a tool, that we must make choices with it, and that sometimes, waiting for what we really want is the most rewarding part.

The See-Through Jars: A Classic for a Reason

The single most effective tool for this age group is the ‘Save, Spend, Share’ jar system. The key detail? The jars must be transparent. A traditional piggy bank is a black hole where money vanishes. Clear jars, however, allow kids to watch their progress, a powerful visual motivator.

Whenever they receive money—from a birthday gift or for helping with a small task—they get to decide how to allocate it. This simple ritual introduces the three fundamental things you can do with money.

- The Spend Jar: This is for immediate gratification, like a pack of stickers or a treat at the store. It teaches the direct lesson of exchange: I give these coins, and I get that item.

- The Save Jar: This is for a bigger goal, like a specific toy they’ve been talking about for weeks. It’s their first hands-on lesson in patience and working toward a goal. The sense of pride when they finally buy it themselves is immense.

- The Share Jar: This jar introduces the concept that money can be a tool for kindness. Let them choose where it goes—perhaps a local animal shelter or a food drive. It demonstrates that money isn't just about personal acquisition.

Your Grocery Store Classroom

Every trip to the grocery store is a golden opportunity for a mini-lesson. Instead of having them just ride in the cart, involve them in the small financial decisions you’re constantly making.

Real-Life Example: You're in the cereal aisle.

You can say, "Okay, see this box with the cartoon character? It costs $5. But this store-brand one tastes almost the same, and it’s only $3. If we choose the less expensive one, we can put the $2 we save directly into your 'Save' jar for that race car you want."

That one brief conversation accomplishes so much. It introduces price comparison, the concept of trade-offs, and directly links a smart consumer choice to their personal goal.

A child’s financial education truly begins at home. The habits and conversations they see every day are powerful shapers of their future. International data shows just how critical the family's role is, especially when school-based education isn't guaranteed. For example, UNESCO estimated that 272 million children would be out of primary and secondary school in 2025, a stark reminder of why parental guidance is so essential. You can learn more about global education trends and their impact on learning opportunities.

Learning Best Through Play

For young children, playing is serious work. It's how they process and understand the world. Use games to make money concepts fun and stress-free.

The classic "playing store" with their toys and some play money is a perfect example. Assign prices to items and let them alternate between being the shopper and the cashier. It's an enjoyable way for them to practice the mechanics of a transaction, count money, and learn the basic lesson that you can't buy everything when your funds are limited.

Here’s a quick comparison of two simple but effective activities.

| Activity | What It Really Teaches | Why It Clicks for Little Kids |

|---|---|---|

| Playing Store | The fundamentals of exchange, price, and budgeting. | It’s role-playing, not a formal lesson. They learn that you have to give money to get something in return and that you must choose what you can afford. |

| Coin Sorting | Identifying different coins and their relative values. | This is a great sensory activity. Feeling the physical differences between a penny, a nickel, and a quarter builds a concrete foundation for understanding value. |

Ultimately, at this age, consistency is far more important than complexity. Every choice at the grocery store and every coin sorted into a jar is another small, positive step toward building a healthy relationship with money that will last a lifetime.

Building Practical Money Skills (Ages 8-13)

Once kids reach the middle years, their capacity for abstract thought expands significantly. They are ready to move beyond simply observing you use money and begin actively managing some of their own. This is the prime window to transition from basic concepts to practical, hands-on experience.

The main objective here is to foster autonomy. We want to empower them to make their own small financial decisions and, just as importantly, learn from the inevitable minor mistakes they'll make in a low-stakes environment. Think of this stage as their financial training ground.

Introducing a Consistent Allowance System

Transitioning from sporadic cash handouts to a structured allowance is a game-changer. It transforms money from a random reward into a predictable resource they can learn to manage. This instills a lesson that will serve them for life: money is a tool you earn and control through consistent effort.

However, not all allowance systems are created equal. The ideal approach depends on your family’s values and the specific lessons you wish to emphasize. The focus should be less on the dollar amount and more on the "why" behind it.

Choosing the Right Allowance System for Your Family

There’s no single “best” way to handle allowance; it’s about finding a model that aligns with your family. Each approach teaches slightly different lessons, so it's worth considering your primary goal. Below is a comparison to help you decide.

| Allowance Method | Core Concept Taught | Best For Ages | Pros | Cons |

|---|---|---|---|---|

| Pure Allowance | Basic budgeting and money management. | 8-10 | Simple to implement; focuses purely on how to handle a fixed amount without tying it to performance. | Can foster a sense of entitlement if not paired with clear expectations about contributing to the family. |

| Commission-Based | Money is directly tied to work and effort. | 9-13 | Excellent for teaching a strong work ethic; kids see a clear cause-and-effect relationship between work and pay. | May lead to kids refusing to do anything "for free" or haggling over the price of every household task. |

| Hybrid System | Responsibility vs. Earning. | 10-13 | Teaches that some duties are part of family life (unpaid), while extra jobs offer a chance to earn more. A balanced approach. | Requires more tracking and clear communication to distinguish between base chores and paid tasks. |

Regardless of the system you choose, consistency is paramount. If the allowance is unpredictable, it's impossible for a child to plan or save for a goal, which undermines the entire purpose of the exercise.

Opening Their First Savings Account

While a clear jar is perfect for little ones, an 8- to 13-year-old is ready for a significant step: their first bank account. This makes their savings feel "official" and introduces them to the world of banking in a safe, guided manner.

I highly recommend taking them with you to a local bank or credit union to open a youth savings account. Let them participate in the process—signing their name, talking with the teller, and asking questions. This demystifies what can seem like an intimidating adult world and gives them a powerful sense of ownership.

Once the account is active, you can teach crucial concepts:

- Deposits: When they deposit birthday money, explain how the bank is simply safeguarding it for them.

- Withdrawals: Show them how to take money out for a large purchase they've been saving for.

- Interest: This is where the magic of finance becomes real. Explain it as "a small reward the bank gives you for letting them hold onto your money." Seeing even a few cents of interest appear in their account is a tangible and exciting lesson in how money can grow on its own.

The Power of a Long-Term Savings Goal

This age is the sweet spot for teaching delayed gratification. The most effective way to do this is by helping them set a meaningful savings goal for something they genuinely want, like a new bike, a gaming console, or a specific pair of sneakers.

Real-Life Example:

Your 11-year-old, Maya, desperately wants a Nintendo Switch that costs $300. Her weekly allowance is $10.

Instead of a generic "go save your money," sit down and map it out with her. At $10 per week, it would take 30 weeks to save up. For a child, that feels like an eternity.

This is your coaching moment. You could say, "Okay, 30 weeks is a long time. But what if you committed to saving $7 of your allowance each week and found ways to earn an extra $8 by doing some yard work for the neighbors? You could reach your goal in about 20 weeks instead."

This simple conversation teaches three huge lessons:

- Budgeting: She must decide how much to save versus how much to spend.

- Goal Setting: She now has a clear target and a realistic timeline.

- Initiative: It motivates her to think like an entrepreneur and find ways to boost her income.

When Maya finally saves enough and makes the purchase herself, the sense of accomplishment is a lesson no lecture could ever replicate. She’ll value that Switch far more because she knows firsthand the effort that went into earning it.

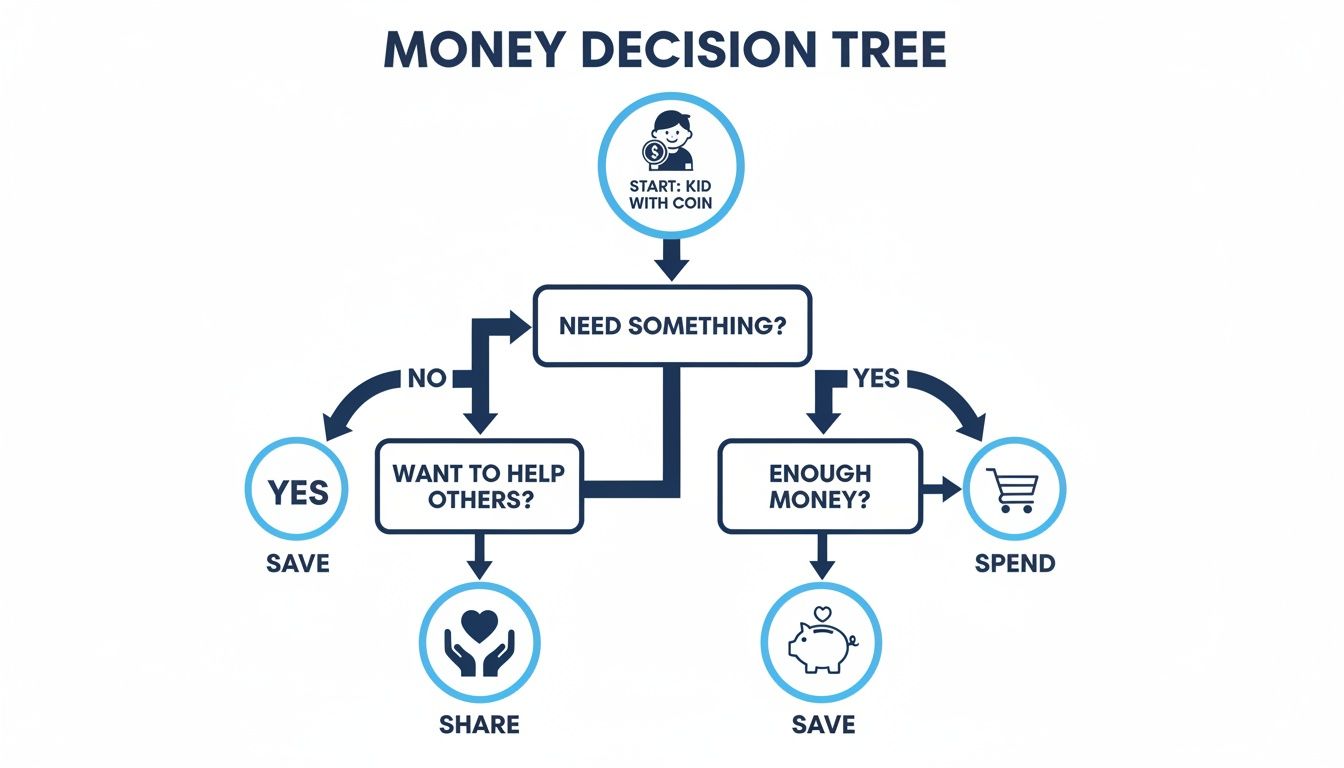

This process helps a child visualize their choices. A simple decision tree can be a great tool to show the core choices they have every time they receive money.

A visual like this reinforces a fundamental truth: every dollar comes with a choice—to spend now, save for later, or share with others. This is the very foundation of mindful financial decision-making. As they get older and master these basics, you can even begin to explore resources that explain how to start investing in the stock market for beginners when they're ready for the next step.

Navigating the Teen Financial World (Ages 14+)

Once kids hit their teen years, the financial landscape changes dramatically. They are on the cusp of independence, facing real jobs, car expenses, and college applications. The abstract piggy bank lessons of childhood are no longer sufficient.

This is where the focus shifts from basic concepts to real-world financial skills. It's time to discuss everything from the excitement of a first paycheck to the serious responsibility of protecting their identity online. The mission is to equip them with the confidence to manage their money effectively, not just for a new pair of shoes, but for their entire future.

Decoding the First Paycheck

That first paycheck is a monumental milestone, but the pay stub itself can look like a foreign language. This is the perfect moment to sit down together and demystify the numbers. Don’t just let them see the final deposit amount; walk them through the journey their money took to get there.

Pull out their actual pay stub and turn it into a hands-on lesson. Here are the key terms to cover:

- Gross Pay: This is the large number—the total amount earned before any deductions. Frame it as their starting point.

- Deductions: Explain that this is money set aside for things like federal and state taxes. It's their first real-world lesson in civic financial responsibility.

- Net Pay: This is the crucial "take-home pay"—the actual amount that lands in their bank account. Emphasize that this is the number they must use for their budget.

A classic rookie mistake is for teens to budget using their gross pay (e.g., hourly wage x hours worked). Showing them the difference on paper makes the reality of taxes and net income crystal clear from day one.

Unlocking the Power of Compound Interest

Compound interest is the secret weapon of wealth building, and the sooner your teen understands it, the better. You can start by calling it "money making money," but a concrete example truly drives the point home.

Real-Life Example: Imagine your 16-year-old saves $1,000 from a summer job and invests it in a low-cost index fund. If that money earns an average of 8% per year, it could grow to over $10,000 by the time they’re 50—without them adding another dime.

This simple illustration powerfully demonstrates that time is their greatest financial asset. It’s a compelling motivator to start saving and investing early, even with small amounts.

Mastering Digital Money and Online Safety

Teens live online, and their financial lives will too. While payment apps and debit cards are incredibly convenient, they also carry risks. This makes digital financial safety a non-negotiable lesson. They need to understand that their smartphone is now a direct link to their bank account.

Before handing over their first debit card, establish clear ground rules.

- No Sharing, Ever: PINs and passwords are like toothbrushes—not for sharing. Period.

- Spotting Scams: Teach them to recognize phishing emails or sketchy texts that create a false sense of urgency to get them to click a link or share personal information.

- Secure Networks Only: Explain why checking their bank account on public Wi-Fi is a bad idea, as their data is vulnerable.

As new payment tools and saving habits emerge, it’s smart to stay informed about the trends their generation is setting. For a closer look, check out our article on Gen Z's soft saving trend.

Introducing the World of Investing

Investing can sound complex, but you can easily break it down using things they already know. Explain that buying a stock is like owning a tiny piece of a company they use every day, like Apple or Nike. When the company succeeds, their tiny piece becomes more valuable.

A custodial investment account (like a UTMA or UGMA) is a fantastic, hands-on way for them to get started with your guidance.

A Simple Starting Point:

- Start Small: Let them invest a manageable amount they won't panic over, such as $100.

- Invest in What They Know: Have them pick a stock from a company whose products they already buy and understand. This makes the process feel more tangible and less abstract.

- Introduce Diversification: Explain that putting all their money in one stock is risky. Use a simple analogy: "You wouldn't bet your entire summer savings on one video game." This is the perfect lead-in to explaining how index funds or ETFs allow them to own tiny pieces of many companies at once, spreading out the risk.

This table breaks down the key financial milestones for teens and the tools that can help them get there.

Teen Financial Milestones and Essential Tools

| Financial Milestone | Key Learning Objective | Recommended Tools/Actions | Parental Guidance Tip |

|---|---|---|---|

| Getting a First Job | Understanding income, taxes, and budgeting from net pay. | Review pay stubs together; create a simple "50/30/20" budget. | Help them set up direct deposit to a student checking account. |

| Opening a Bank Account | Learning to manage deposits, withdrawals, and digital banking safely. | Student checking account with a debit card and mobile app. | Set low daily spending limits and enable transaction alerts. |

| Saving for a Big Goal | Practicing delayed gratification and long-term planning (e.g., a car). | High-yield savings account; savings goal tracker app. | Consider offering a savings match (e.g., 50 cents for every dollar saved) to boost motivation. |

| Starting to Invest | Grasping risk, reward, and the power of compound growth. | Custodial investment account (UTMA/UGMA). | Start with a low-cost S&P 500 index fund for simple, broad diversification. |

Guiding your teen through these advanced topics is about more than just numbers. You're equipping them with the practical skills and confidence they need to build a secure, independent financial future.

Cultivating a Healthy Money Mindset

Beyond the mechanics of saving and budgeting, your child's long-term financial well-being depends on their money mindset—the beliefs, feelings, and values they attach to it. Teaching them how to think about money is just as important as teaching them how to use it.

The goal is to frame money as a helpful tool for building the life they want, not as a source of stress or a taboo subject. This shift occurs through open, honest conversations that go beyond dollars and cents. When you create a space where kids feel safe asking questions without judgment, you give them the gift of true financial wisdom.

Differentiating Needs and Wants

One of the earliest and most powerful lessons is helping kids understand the difference between a need (something essential for survival, like food and shelter) and a want (something that would be nice to have but isn't necessary). This concept is the bedrock of intentional spending.

You can weave this into everyday life seamlessly. At the grocery store, you might say, "Okay, we need to buy milk and bread, but we want to get those cookies. Let's make sure we have all our needs in the cart before we consider our wants." This simple, in-the-moment example makes the idea of prioritization click.

For a more hands-on approach, try this activity:

- Give your child two different colors of sticky notes.

- Ask them to walk around the house and stick one color on items that are "needs" and the other on items that are "wants."

- Discuss their choices afterward. This provides a fascinating glimpse into how they perceive value and necessity.

The point isn't to make them feel guilty for wanting things; it's to empower them to make conscious, value-based decisions with their money.

Talking About Advertising and Influence

Our children are constantly bombarded with messages telling them what to buy. From YouTube toy unboxings to influencer-sponsored gear, advertising is a powerful force shaping their desires. A healthy money mindset involves being able to identify these influences and see them for what they are.

Next time you see an ad together, pause and use it as a teaching moment. Ask a few simple questions:

- "What do you think they're really trying to sell here?"

- "How does watching that make you feel about the things you already have?"

- "Do you think you truly need that, or did the ad just make it look exciting?"

This fosters critical thinking skills and helps them realize that a sudden urge to buy something often originates from a clever marketing strategy, not a genuine need.

By modeling how you think through spending and saving, you're not just giving instructions; you're building a mental framework they'll use for the rest of their lives. This approach is closely tied to developing resilience and a proactive attitude, key ideas we explore in our guide on cultivating a growth mindset for lifelong success.

Modeling Generosity and Gratitude

A truly healthy view of money isn't just about accumulation; it's also about contribution. Teaching generosity helps prevent a scarcity mentality and shows kids that one of money's greatest powers is its ability to help others.

Make giving a normal part of your family's financial rhythm. Whether it’s putting a dollar in their "Share" jar or volunteering your time together at a local food bank, these actions prove that money can be a tool for positive impact.

To help you frame these crucial mindset talks, consider the language you use.

| Scarcity Mindset Language (To Avoid) | Abundance Mindset Language (To Use) |

|---|---|

| "We can't afford that." | "That's not a priority in our budget right now." |

| "Money doesn't grow on trees." | "Let's brainstorm how we could earn the money for that." |

| "Don't waste your money on that." | "Let's think about if that's the best way to use your hard-earned money." |

The words you choose matter. An abundance mindset fosters problem-solving and optimism, turning financial limits into learning opportunities instead of dead ends. This simple shift in perspective is the secret to raising kids who are not just financially literate, but financially confident, capable, and wise.

Answering Your Top 10 Questions About Kids and Money

Teaching kids about money is a dynamic process filled with questions and unique challenges. Here are answers to the 10 most common questions parents ask, providing practical advice for navigating these tricky situations.

1. When Should We Start Giving an Allowance?

The ideal time is typically around ages 5-6, when children begin to grasp that money is exchanged for goods. Start with a small, consistent amount tied to a few simple household responsibilities. The goal isn't the amount, but the regularity, which allows them to practice making choices—and mistakes—in a safe environment.

2. How Do I Explain Credit and Debt to My Teen?

Frame a credit card not as free money, but as a tool for borrowing. A powerful real-world lesson is adding them as an authorized user on your card for a specific, pre-approved purchase (like gas). When the bill arrives, review it together. Show them the interest charges if the balance isn't paid in full, demonstrating how debt can grow. This controlled experience teaches responsibility and helps them build a positive credit history under your supervision.

3. How Can I Make Digital Money Feel Real?

Since digital money is invisible, you have to make it visible. Involve your teen when you use your banking app to pay a bill or check your balance. For them, a student checking account with a debit card and mobile app is an excellent training ground. Set up spending alerts so they receive a notification for every transaction. This makes the "invisible" money tangible and reinforces that digital spending is real spending.

4. Should I Pay My Kids for Good Grades?

While this is a personal choice, many child development experts advise against it. Paying for grades can shift a child's motivation from intrinsic (love of learning) to extrinsic (desire for cash), potentially undermining their natural curiosity. A better approach is to reward the effort and dedication, not just the A on the report card. Celebrate their hard work with a family activity or special meal, keeping academic achievement separate from financial compensation for chores.

5. How Do I Get My Teen Interested in Investing?

Connect investing to their world. Explain that owning a stock is like owning a tiny piece of a company they already know and love, like Spotify or Nike. The best way to learn is by doing. Open a custodial investment account and let them invest a small amount (even just $50) in a low-cost S&P 500 index fund (an ETF). This gives them skin in the game and makes concepts like market fluctuations and compound growth real and engaging.

6. What if My Kid Wastes Their Money on Junk?

Resist the urge to intervene. This is a critical learning opportunity. A low-stakes mistake now—like spending their entire allowance on a cheap toy that breaks immediately—can prevent a much larger financial blunder later in life. Instead of saying "I told you so," ask open-ended questions like, "Are you happy with your purchase?" or "Would you buy it again?" The feeling of buyer's remorse is a far more powerful teacher than any lecture.

7. How Do We Handle Money Talks When Co-Parenting?

A united front is essential. You and your co-parent must agree on the fundamental rules for your child's money, even if your personal spending habits differ. Schedule a time to talk (without the kids) and establish a consistent plan for allowance, chores, and spending rules. This prevents confusion and keeps the child from pitting one parent against the other. For more on this, our guide on how to have effective parenting talks can help.

8. My Kid Just Isn't Interested in Money. What Now?

Connect money to their passions. If your child is a gamer, discuss the budget for new games or in-app purchases. If they love art, help them create a savings goal for high-quality art supplies. Frame financial planning as the tool that helps them achieve what they truly want. Once money becomes the means to unlocking their personal goals, their interest will naturally follow.

9. How Can I Teach My Kids to Be Generous?

Integrate giving into their financial life from the start. The "Save, Spend, Share" jar system is perfect for this. Help them research and choose a cause they genuinely care about, whether it's a local animal shelter or a global environmental organization. Let them be the one to physically or digitally make the donation. This act teaches a profound lesson: money's power extends beyond personal consumption to making a positive impact on the world.

10. What's the Single Biggest Money Mistake Parents Make?

The most common mistake is avoidance. Many parents feel they aren't "experts" or worry about saying the wrong thing, so they don't talk about money at all. You don't need to be a financial wizard. Your role is to be an open and honest guide. Starting the conversation, modeling responsible behavior, and being willing to learn alongside your child are infinitely more valuable than having all the perfect answers.

At Everyday Next, we provide insights to help you navigate life's big questions, from personal finance to parenting. For more practical guides and analysis, visit us at https://everydaynext.com.