How to Create a Monthly Budget That Actually Works

At its heart, creating a monthly budget is pretty straightforward. You just need to track your income, figure out your expenses, and then give every dollar a job before the month even starts. That’s it. This simple habit changes your money from a constant source of stress into a tool that you control. It's not about restriction; it's about being intentional.

Why a Monthly Budget Is Your Financial Roadmap

Try to think of your budget less like a financial straitjacket and more like a personalized map to your goals. Seriously, it's the most powerful tool you have for closing the gap between where your finances are today and where you want them to be. Whether the goal is buying a house, traveling the world, or just getting to the end of the month without that familiar knot of anxiety, a budget gives you the clarity to make it happen.

Moving From Reactive Spending to Proactive Planning

Let's be honest, without a plan, most of us are just reacting. A bill comes, we pay it. We see something we want, we buy it. Then, the end of the month rolls around, and we're left scratching our heads, wondering where all the money went. A monthly budget completely flips that script. It puts you in the driver's seat.

Instead of just reacting, you start telling your money where to go ahead of time, channeling it toward the things that actually matter to you. This shift from unconscious spending to conscious decision-making is how you start aligning your daily habits with your biggest dreams.

Understanding the Numbers That Matter

Imagine this: you grab your coffee on the first of the month and map out exactly where every dollar will go. That’s the feeling of control a budget gives you. And the numbers show why this is so important.

Data from the U.S. Bureau of Labor Statistics for 2024 showed the average household had annual expenditures around $78,535 against an average pre-tax income of $104,207. Monthly, that breaks down to about $6,545 in spending versus $8,684 in income. That might seem like a healthy gap, but without a plan, it can disappear surprisingly fast.

"A budget is telling your money where to go instead of wondering where it went." This shift in perspective is the first and most important step toward building wealth and reducing financial stress.

This guide is all about helping you build a budget that doesn't feel like a chore, but like a real tool for building the life you want. With the economy always changing, getting a handle on your personal finances is more critical than ever. To get a better sense of what's coming, you can learn more about the inflation forecast for 2025 in our detailed article.

Getting a Clear Picture of Your Finances

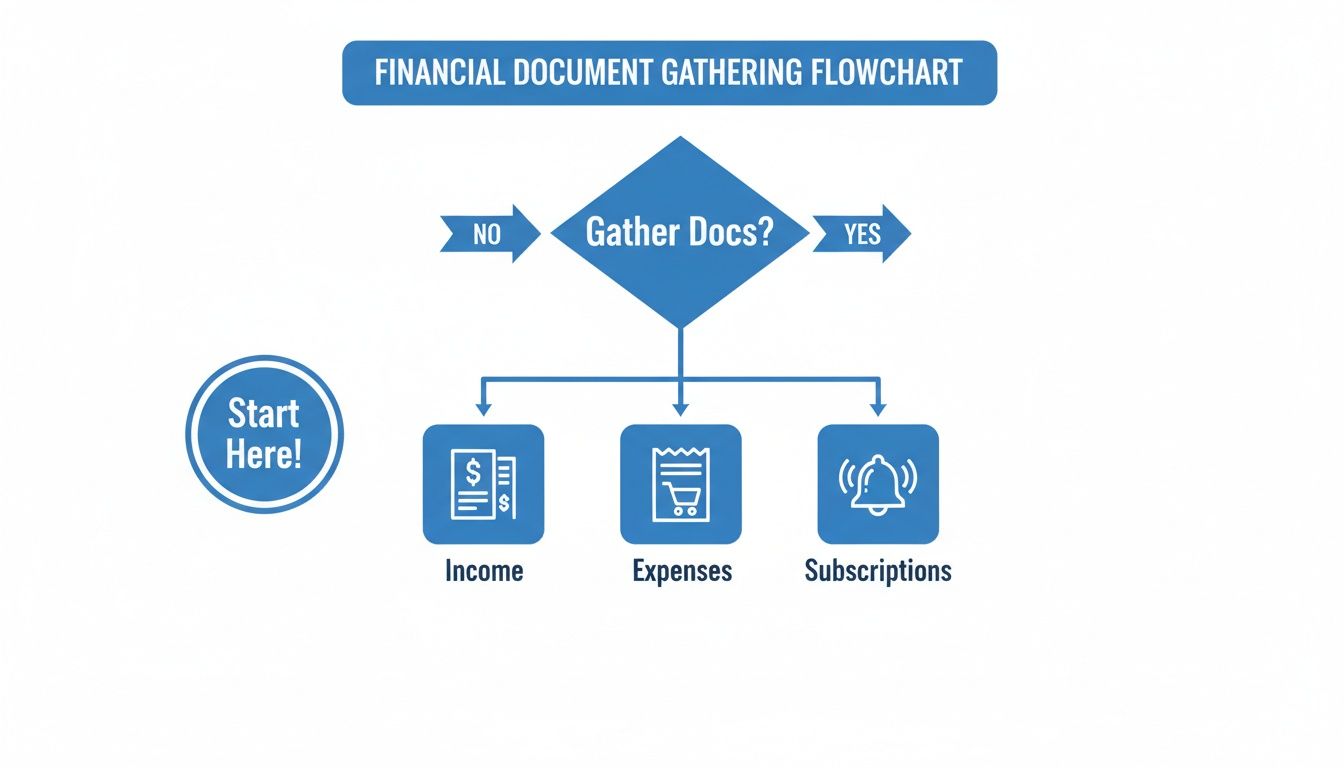

Before you can tell your money where to go, you have to know where it’s been. A good budget starts with an honest, no-judgment look at what’s really happening with your cash. Think of it as laying all your cards on the table.

To get a truly accurate snapshot, you'll want to look back at the last two to three months. Why? Because a single month can be an anomaly. Looking at a slightly longer period smooths out the weird spikes and lulls, giving you a much more realistic average to work with.

Tallying Up Your Income

First things first, let’s figure out exactly how much money you have coming in each month. This isn’t just your main paycheck—it’s every single dollar that finds its way to you.

You'll need to grab a few things to get a complete picture:

- Pay Stubs: The key number here is your net pay (what you take home after taxes), not your gross pay. That’s the real amount you have to work with.

- Side Hustle Earnings: If you do any freelance work or have a side gig, pull up your records from PayPal, Stripe, or just your bank deposits.

- Other Cash Flow: Don't forget other sources like child support, rental income, or government benefits. It all counts.

If your income isn't the same every month (hello, freelancers and commission-based workers!), just calculate your average monthly take-home pay over the last three months. Pro tip: It’s always safer to build your budget around your lowest-earning month. That way, you create an automatic buffer for yourself.

Tracking Down Your Spending

Now for the part that can be a real eye-opener: figuring out where all that money goes. This is less about accounting and more about detective work. The goal here is just to gather the facts, not to feel guilty about that third coffee run last week.

Here’s how to hunt down every last expense:

- Bank & Credit Card Statements: Your best friend. Download or print the last two to three months for all of your accounts. This is where you'll find most of your spending habits laid bare.

- Recurring Bills: Make a quick list of all the predictable stuff: rent or mortgage, utilities, insurance, car payments, etc.

- Digital Payments: Don't forget to check your transaction history on services like Apple Pay or Google Pay. And if you're frequently sending money to friends, our guide on everything you need to know about Cash App can help you track those payments, too.

- Receipts: For all those cash purchases, it's time to empty out that folder, wallet, or cup holder in your car.

The biggest surprise for most people? It's the little things. That daily coffee, the quick online purchase, the vending machine snack—these "spending leaks" can quietly drain hundreds from your account each month and sabotage an otherwise perfect budget.

Once you have all this info, you’re in business. You’ve moved past guesswork and now have a solid, fact-based foundation. From here, you can build a budget that actually works for your real life.

Choosing the Right Budgeting Method for Your Lifestyle

A budget isn't some rigid, one-size-fits-all punishment. Think of it as a personal roadmap for your money, and the best one is the one you’ll actually use. It has to fit your personality, your goals, and how you live your life.

Let's break down three popular approaches to help you find your perfect match. Before you can decide on a method, though, you need a clear picture of what's coming in and what's going out.

This process—gathering your income statements, bills, and subscription lists—is your true starting line. Once you have the numbers, you can choose a system to manage them.

The 50/30/20 Rule: Simplicity and Flexibility

If you're just dipping your toes into budgeting or simply hate getting bogged down in tiny details, the 50/30/20 rule is a fantastic place to start. Popularized by Senator Elizabeth Warren, it splits your after-tax income into three simple buckets.

The idea is to allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It’s less about tracking every penny and more about making sure your spending is balanced and aligned with your priorities.

How it looks in real life:

Imagine a couple, Sarah and Tom, bringing home a combined $6,000 a month. They're saving for a wedding but don't want to give up their social life entirely.

- 50% Needs ($3,000): This bucket covers their non-negotiables like rent, utilities, groceries, and car payments.

- 30% Wants ($1,800): Here’s their fun money for date nights, hobbies, and weekend getaways.

- 20% Savings ($1,200): This portion goes straight into their wedding fund, no questions asked.

This gives them clear guardrails without making them feel suffocated.

Zero-Based Budgeting: Total Control

For anyone who wants to know exactly where every single dollar is headed, zero-based budgeting is your method. The concept is straightforward: income minus expenses equals zero. At the beginning of each month, you give every dollar a job to do.

This approach forces you to be incredibly intentional. There’s no room for mindless spending because every dollar is already accounted for, making it a powerful tool for anyone serious about hitting big savings goals or crushing debt fast.

How it looks in real life:

Let's take Alex, a freelance graphic designer with a fluctuating income. Last month, he earned $4,500, but this month he’s projecting $5,200.

With his $5,200 income, he sits down and plans:

- First, he covers all his fixed costs—rent, insurance, software subscriptions.

- Next, he allocates money for variable expenses like groceries, gas, and client meetings.

- Then, he directs funds toward his big goals: retirement, taxes, and saving for a new computer.

- Even if there’s just $50 left over, he gives it a purpose, like making an extra payment on his credit card.

This hands-on style is perfect for wrangling an unpredictable income.

The Envelope System: Hands-On Discipline

The envelope system is a classic for a reason: it works. It’s a cash-based method that gives you a very real, tangible way to control your spending, especially in those tricky variable categories.

You simply withdraw cash for the month and physically divide it into labeled envelopes—"Groceries," "Gas," "Entertainment," and so on. Once an envelope is empty, that’s it. You can't spend any more in that category until next month. It’s a powerful psychological trick.

And don't worry, this system has adapted to our digital world. Many budgeting apps now feature digital "envelopes" or "jars" that let you partition funds in your bank account for the same effect. Building this kind of discipline takes practice, and using one of the best habit tracking apps can help you stay on track as you build this new financial muscle.

Comparison of Popular Budgeting Methods

So, which system is right for you? It really boils down to your financial personality. Are you looking for simple guidelines, total control, or tangible limits? This table breaks it down.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| 50/30/20 Rule | Beginners and those who want flexibility and simple guidelines. | Easy to start, less time-consuming, promotes balanced spending. | Can be too broad, may not be aggressive enough for big goals. |

| Zero-Based Budget | Detail-oriented people, those with irregular income, or aggressive savers. | Gives you total control, eliminates wasteful spending, great for goals. | Time-intensive, can feel restrictive, requires monthly setup. |

| Envelope System | Visual spenders, those trying to curb overspending, people who prefer cash. | Physically prevents overspending, increases spending awareness. | Can be inconvenient to carry cash, not ideal for online bills. |

At the end of the day, the best budget is the one you can stick with. Don't be afraid to test-drive a method for a few months. If it isn't working, switch it up. The goal is progress, not perfection.

Building Your Budget and Setting Smart Goals

Alright, you’ve gathered your financial info and picked a budgeting style that feels right. Now for the fun part—actually building your budget and giving your money a mission. This is where you move from just tracking numbers to creating a concrete plan that actually works for your life.

And don't worry about fancy software just yet. A simple spreadsheet is all you need to get started.

The whole point is to assign every single dollar of your income to a specific job. Doing this brings an incredible amount of clarity. You’ll stop wondering where your money disappeared and start telling it exactly where to go.

Start With Your Expense Categories

First things first, let's sort your spending into logical piles. This gives you a bird's-eye view of your financial habits and shows you exactly where you can make adjustments. Your expenses really fall into two main buckets: fixed and variable.

- Fixed Expenses: These are the predictable costs that don't really change month to month. Think of them as the foundation of your budget—rent or mortgage, car payments, insurance, and any loan payments.

- Variable Expenses: This is where things get a bit more fluid. Groceries, gas for the car, entertainment, and personal spending all fall in here. It's also where you have the most control to cut back or reallocate funds.

Once you have these categories, just start plugging in the numbers from the spending data you already collected.

If you’re trying the 50/30/20 rule, you’ll want to make sure your "needs" (which are a mix of fixed and crucial variable costs) don’t creep past 50% of your take-home pay. For those using a zero-based budget, you’ll assign a dollar amount to every category until your income minus your expenses equals zero.

Your budget isn't just for paying bills; it's the financial engine that powers your ambitions. The budgets that stick are the ones tied to meaningful, exciting goals that keep you fired up.

Set Goals That Actually Work: The SMART Method

A budget without goals is really just a glorified spending tracker. To turn it into a powerful tool, you need to connect it to what you really want to achieve in life. This is where the SMART framework is a game-changer, transforming vague wishes into real, actionable targets.

A SMART goal is:

- Specific: Nail down exactly what you want. "Save for a down payment" is okay, but "Save $15,000 for a down payment on a house" is much better.

- Measurable: You need a number to aim for. How will you track your progress?

- Achievable: Is your goal realistic with your current income? It's good to aim high, but setting yourself up for failure will just kill your motivation.

- Relevant: Does this goal truly matter to you? Make sure it aligns with your bigger life plans.

- Time-bound: Give yourself a deadline. "I'll do it in 18 months."

Putting it all together, that vague idea of "saving for a down payment" becomes a powerful SMART goal: "I will save $15,000 for a house down payment in 18 months."

Suddenly, you know you need to put away $833.33 every single month. That number now becomes a non-negotiable line item in your budget, just as important as your rent.

A Quick Example: Putting It All Together

Let's look at Maya, a young professional who brings home $4,000 a month. Her big goal is to crush a $5,000 credit card debt in 10 months. Here's what her zero-based budget could look like:

| Category | Type | Budgeted Amount | Notes |

|---|---|---|---|

| Rent | Fixed | $1,200 | Non-negotiable housing cost. |

| Utilities | Variable | $150 | Average for electricity, water, internet. |

| Car Insurance | Fixed | $100 | Fixed premium. |

| Groceries | Variable | $400 | Based on past spending, but trimmed slightly. |

| Gas | Variable | $150 | Commute and weekend travel. |

| Subscriptions | Fixed | $50 | Streaming services, gym. |

| Dining Out | Variable | $200 | Cut back from $300 to hit the debt goal faster. |

| Personal Care | Variable | $100 | Haircuts, toiletries, etc. |

| Credit Card Debt | Goal | $500 | The SMART goal: $5,000 / 10 months. |

| Investing/Savings | Goal | $1,150 | All remaining funds go to future goals. |

| Total | $4,000 | Income – Expenses = $0 |

By treating her debt payoff like a required bill, Maya guarantees she's making progress every month. This same approach works for any goal, whether it's saving for a dream vacation or making a major financial decision. For example, debating whether to pay off your mortgage early or invest the extra cash gets a lot easier when you can see exactly how much money you can throw at that goal in your budget.

Keeping Your Budget Alive and Thriving

So you've built a monthly budget. That's a huge win, but it's just the starting line. The real magic isn't in creating the budget—it's in living with it.

Think of your budget not as a static document you file away, but as a dynamic financial co-pilot. It needs to evolve right along with your life. The secret to making it work long-term is to build a process that’s sustainable, not stressful.

One of the best things you can do right away is to put as much of your financial life on autopilot as you can. This simple move takes a ton of the manual work off your plate and helps build powerful money habits without you even trying.

Put Your Money on Autopilot

Automation is your single best ally for sticking to a budget. It takes the daily guesswork and flawed human memory out of the equation for your most critical financial tasks.

Start by setting up automatic transfers for two key areas:

- Your Savings Goals: The moment your paycheck lands, have a set amount automatically whisked away to your savings account. This is the classic "pay yourself first" strategy, and it works because it ensures you're making progress on your goals before you even get a chance to spend that money somewhere else. To really make this count, dig into whether high-yield savings accounts are the right choice for you.

- Your Bill Payments: Get all of your fixed expenses—rent, car insurance, loan payments, you name it—set up on autopay. Not only does this save you time, but it's also a great way to dodge late fees and protect your credit score.

By automating the big stuff, you free up a ton of mental energy. Instead of worrying about due dates and savings deposits, you can focus on managing your day-to-day spending and thinking about your bigger financial picture.

Find Your Review Rhythm

Just like you’d glance at a map during a long road trip, you need to check in on your budget regularly. This doesn't have to be some monumental, time-sucking chore. The key is to find a simple, repeatable rhythm that works for you.

Here's a two-part approach that I've found really effective:

- The Weekly Check-In (15 Minutes): Once a week, maybe on Sunday night, just sit down and categorize your recent transactions. This quick check-in helps you catch any mistakes, spot if you're starting to overspend, and just generally stay in touch with where your money is going.

- The Monthly Review (30-60 Minutes): At the end of each month, take a slightly deeper look. Compare what you actually spent against your plan. Celebrate the wins (like staying under budget on groceries!) and pinpoint the problem areas. This is your chance to make smart adjustments for the month ahead.

It's not just a nice idea; historical spending patterns show that consistent reviews are what turn financial chaos into control. Just look at recent data from the NY Fed's Survey of Consumer Expectations. It reported that while median household spending growth slowed to 4.1% year-over-year in August 2025, a whopping 60.8% of households still made large discretionary purchases like vacations. This really drives home how important it is to stay engaged with your budget so you can balance today's wants with tomorrow's goals. You can see more of these household spending trends on the New York Fed's site.

Learn to Bend, Not Break

Life is unpredictable, and your budget has to be flexible enough to handle it. A budget that's too rigid is a budget that's doomed to fail the first time an unexpected expense pops up. The goal is to create a plan that can bend without breaking.

When life throws you a curveball—or a lucky break—it's time to adjust.

| Life Event | How to Adjust Your Budget |

|---|---|

| A Pay Raise | This is exciting! But before you start spending, make a plan for that new income. Dedicate it to savings, investments, or debt so you can avoid "lifestyle creep." |

| An Unexpected Bill | This is what your emergency fund is for. Use it, and then immediately tweak your budget to start replenishing that fund over the next few months. |

| A New Financial Goal | Time to revisit your budget categories. See where you can trim from your "wants"—even temporarily—to free up cash for this new priority. |

Start treating your budget as your most valuable financial ally. If you give it regular attention and are willing to adapt, it will guide you through every twist and turn, keeping you on track to hit your most important goals.

Frequently Asked Questions About Monthly Budgeting

Look, even the most detailed budget plan is going to bring up questions once you start living with it. That’s not just normal; it’s a sign you’re actually engaging with the process. Let’s tackle some of the most common hurdles people face so you can keep moving forward with confidence.

1. What if my income is all over the place?

Budgeting with an irregular income feels tricky, but it's absolutely doable. You just need a different game plan. The trick is to anchor your budget to your lowest-earning month from the last year. Think of this as your "baseline" income.

This baseline covers your non-negotiable expenses—rent, utilities, the essentials. Any money you make above that baseline is bonus cash. Instead of just letting it disappear, you get to be intentional. Throw it at your debt, beef up your emergency fund, or fast-track that vacation savings. A zero-based budget works wonders here because it forces you to assign a job to every single dollar that comes in, whether it's a little or a lot.

2. How long does this actually take to get used to?

Give yourself about three months. Seriously. No one gets this perfect on day one.

- Month One is all about discovery. Just track everything without judgment. You're simply gathering data on where your money is really going.

- Month Two is for fine-tuning. You have a month's worth of real data now, so you can start making realistic adjustments to your spending categories.

- Month Three is when it should start to feel less like a chore and more like a routine. You'll feel more in control because you are more in control.

The goal is to build a habit that lasts, not to achieve overnight perfection. Be patient with yourself.

3. Should I use a spreadsheet or an app?

Honestly, the best tool is the one you'll actually use. There's no magic bullet here; it all comes down to what fits your personality.

| Tool | Who It's For | The Good Stuff | The Catch |

|---|---|---|---|

| Spreadsheets | The DIY-er who wants total control and customization. | Infinitely flexible, no fees, great for getting into the nitty-gritty. | It's all on you—manual entry can be tedious and formulas can break. |

| Budgeting Apps | Someone who wants automation, convenience, and a real-time overview on their phone. | Links to your bank, sends alerts, creates cool charts to track progress. | Can have subscription fees, less customizable, and you're trusting them with your data. |

My best advice? Pit them against each other. Spend one month with a free spreadsheet template and the next with a free trial of a popular app like YNAB or Mint. You’ll know pretty quickly which one feels less like work.

4. How do I handle expenses I didn't see coming?

Life is full of surprises, and so are our bank accounts. The trick is to plan for the unplanned. Your best defense is a dedicated emergency fund.

Think of your monthly contribution to this fund as another bill you have to pay, just like your rent. It’s non-negotiable. Aim for at least three to six months' worth of essential living expenses tucked away. For those smaller, annoying "surprises" that aren't full-blown emergencies (like a last-minute wedding gift), create a "Miscellaneous" or "Stuff I Forgot" category in your budget and stick a little cash in there each month.

5. I've tried and failed at this before. Why will it work now?

So what? Most people have. The number one reason budgets fail is because they're built on wishful thinking instead of reality. People get aggressive, cut out everything fun, and then burn out in two weeks.

To make it stick this time, shift your strategy:

- Start small. Don't try to overhaul your entire financial life at once. Pick one or two categories where you know you can make a small, painless cut.

- Give your money a purpose. "Spend less" is a terrible, uninspiring goal. "Save an extra $100 a month for that beach trip in June" is a goal you can get excited about. Connect your budget to something you want.

- Find a tool you don't hate. If you despise spreadsheets, stop trying to force it. Find an app that feels intuitive and maybe even a little fun to use. Consistency is everything.

6. My partner and I are stuck. Separate budgets or a joint one?

There’s no right answer here, only what’s right for your relationship. Many couples land on a hybrid "yours, mine, and ours" system and find it works beautifully.

With this approach, you each keep your own account for personal, guilt-free spending. Then, you both contribute an agreed-upon amount to a joint account that covers all the shared stuff—mortgage, groceries, saving for goals. The absolute key, no matter what system you choose, is talking about it. Openly, honestly, and without judgment.

7. How often do I need to look at this thing?

A budget isn’t a crockpot—you can’t just set it and forget it. It's a living, breathing plan. I’ve found a simple rhythm works best:

- Weekly Check-in (5-10 minutes): Hop in, categorize your latest transactions, and see how you’re tracking. It keeps things from piling up.

- Monthly Review (30-60 minutes): At the end of the month, take a look back. Where did you nail it? Where did things go off the rails? Adjust your plan for the upcoming month based on what you learned.

And of course, any time a big life change happens—a new job, a baby, a move—it's time for a deeper review to make sure your budget still fits your life.

8. What's the big deal about "fixed" vs. "variable" expenses?

Getting this concept down is a game-changer for budgeting. It's pretty simple:

- Fixed Expenses: These are the predictable bills that are the same every month. Think rent, a car payment, or your phone bill. They’re the foundation of your budget.

- Variable Expenses: This is all the stuff that fluctuates. Think groceries, gas for your car, entertainment, and how much you spend on coffee.

Why does it matter? Because your variable expenses are where your power is. When you need to free up cash, that’s the first place to look for places to cut back.

9. Should I focus on cutting costs or making more money?

Why not both? They are two different levers, and you should be pulling on both of them.

Cutting expenses gives you an immediate win. You can do it today and see more money in your account this month. But there's a limit to how much you can cut. You still have to eat and live.

Increasing your income, on the other hand, has unlimited potential. It's the long game. Whether it’s asking for a raise, starting a side hustle, or learning a new skill, boosting your earnings is what really builds wealth. Start by trimming the fat, then use that momentum to focus on growth.

10. How do I stay motivated when I just want to buy the thing?

Motivation is a muscle. You have to build it. The best way is to give yourself small, frequent wins. Did you stick to your grocery budget? Awesome. Celebrate with a special home-cooked meal you love.

And don't forget to keep your "why" front and center. Put a picture of your big goal—that trip to Italy, the down payment on a house—on your fridge or your phone's lock screen. Seeing that every day is a powerful reminder of what you’re working for, and it can make saying "no" today a whole lot easier.

At Everyday Next, our goal is to give you practical insights for your financial life and everything beyond. Keep exploring our guides to build a more secure and fulfilling future. https://everydaynext.com