How to Improve Financial Literacy: A Practical 30-Day Guide

Before you can build a solid financial future, you must understand your starting point. Improving your financial literacy begins with a quick, honest check-in—no judgment allowed. This isn't a test you can fail; it's about creating a personal map to guide your learning, ensuring you focus your energy where it will have the most impact. Think of it as drawing a personal map to guide your learning so you're not wasting time on things you've already mastered.

Assess Your Current Financial Knowledge

First, let's take a personal inventory of your financial know-how. The goal is to get a real-world snapshot of where you stand. Forget generic online quizzes; we need to ask practical questions that reveal how you actually feel and act when it comes to money. A clear-eyed self-assessment is the best way to focus your energy where it'll do the most good.

Remember, this isn't about beating yourself up over past mistakes. It's a forward-looking exercise to lay the groundwork for everything you're about to learn.

Key Questions for Your Self-Assessment

Let’s get practical. Grab a notebook or open a new note on your phone and jot down your honest, gut-reaction answers to these questions.

- Surprise Expense: An unexpected car repair sets you back $1,000. What’s your immediate plan? Do you pull it from a dedicated emergency fund, or does this send you scrambling for a credit card or a loan?

- Explaining a Concept: If a friend asked you to explain compound interest, could you do it clearly in just a minute or two? Being able to teach something is the ultimate test of understanding it yourself.

- Debt Confidence: Take a look at your credit card statements or any loan balances. Do you feel like you're in the driver's seat with a clear plan to pay them off? Or does looking at those numbers just make you feel overwhelmed?

- Investing Hesitation: When you hear "stock market," what’s the first word that comes to mind? Is it "opportunity" or "casino"? Your immediate feeling reveals a lot about your comfort level.

Your honest answers here are gold. They'll help you see which pillars of personal finance feel solid and which ones need a little work.

Expert Insight: I've found that the biggest thing holding people back isn't a lack of information—it's a lack of clarity on where to start. A truthful self-assessment is the single most powerful first step you can take on this journey.

Identifying Your Focus Areas

Now, let's sort through your reflections. Most people's financial lives fit into a few main buckets. See which of these descriptions sounds most like you right now.

| Financial Area | You Feel Confident If… | You Need to Focus Here If… |

|---|---|---|

| Budgeting & Cash Flow | You know exactly where your money is going and can confidently tell it where to go next. | You get to the end of the month and wonder where your paycheck went. |

| Debt Management | You know your interest rates by heart and have a strategy to knock out your debt. | Your credit card balances keep creeping up, and you’re stuck making minimum payments. |

| Investing & Growth | You have accounts like a 401(k) or IRA and a basic idea of how they work to grow your money. | The thought of investing feels intimidating, and you wouldn't know the first step to take. |

| Future Planning | You're putting money away for retirement and have thought about creating other income sources. | Retirement feels like a problem for "future you," and you aren't saving for it yet. |

If you're just starting to build these skills, a good guide to financial literacy for young adults can be a fantastic resource. Thinking about the long term is also key, which means you’ll want to learn more about what is passive income and how it can secure your future.

By picking just one or two of these areas to tackle first, you make the whole process feel achievable instead of overwhelming.

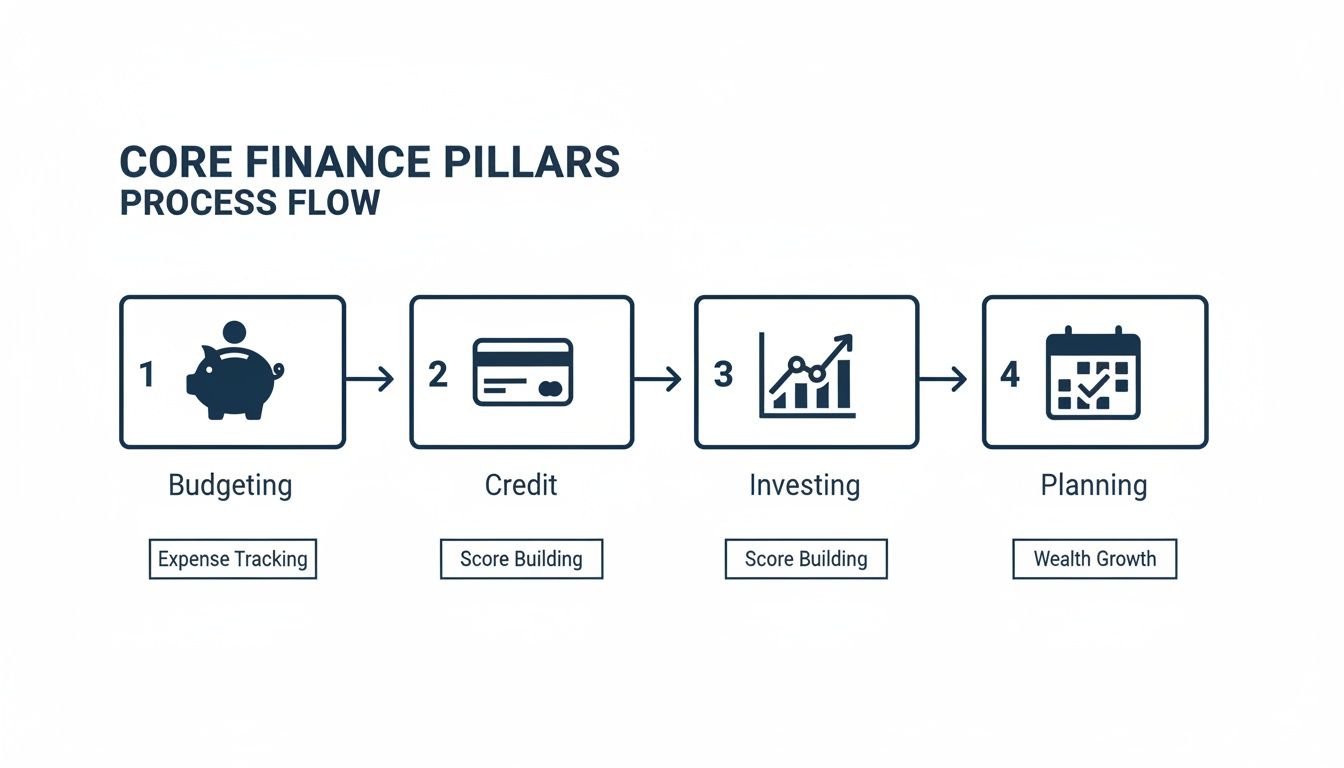

Master the Core Pillars of Personal Finance

Getting a handle on your finances can feel overwhelming, but it really just boils down to a few key areas that all fit together. Once you get the hang of Smart Budgeting, Credit Management, Investing Fundamentals, and Future Planning, you'll have a solid foundation for building real wealth and feeling secure. This isn't about memorizing complex formulas; it's about practical know-how you can start using today.

The tough reality is that many people are struggling. The TIAA Institute-GFLEC Personal Finance Index found that U.S. adults are only getting about 49% of financial literacy questions right—a number that hasn't improved since 2017. What’s more concerning is that Gen Z averaged a score of just 38%. For everyone, understanding risk was the biggest weak spot. You can see more details from these financial literacy findings on tiaa.org.

This just goes to show how crucial it is to nail down the basics, starting with the most fundamental skill of all: budgeting.

Smart Budgeting: Your Financial Blueprint

Let’s get one thing straight: a budget isn’t a financial straitjacket. It’s a tool for freedom. It gives you permission to spend your money confidently because you know your goals are covered. The 50/30/20 rule (50% for needs, 30% for wants, 20% for savings) is a great place to start, but the best method is the one that actually works for you.

This chart from Investopedia gives a great visual breakdown of how the 50/30/20 rule splits up your income.

:max_bytes(150000):strip_icc()/50-30-20-budget-rule-v2-01-52642594a1014a938b8137286358352b.png)

It's a simple way to see how your after-tax pay can be divided between essentials, personal spending, and your financial goals.

For some people, a more detailed approach like zero-based budgeting provides a much stronger sense of control. Let's look at how they stack up.

Choosing the Right Budgeting Method for You

A side-by-side comparison of two popular budgeting strategies to help you choose the best fit for your lifestyle.

| Feature | 50/30/20 Rule | Zero-Based Budgeting |

|---|---|---|

| Simplicity | High. It's easy to set up and track broad categories. | Lower. It requires tracking every single dollar of income. |

| Control | Moderate. Good for a general overview of spending habits. | High. Every dollar has a specific job, leaving no room for waste. |

| Best For | Beginners who want simple guidelines and less tracking. | People who want to optimize savings and find "extra" money. |

| Potential Drawback | Can be too simplistic; "wants" vs. "needs" can be blurry. | Can be time-consuming, especially at the beginning. |

At the end of the day, the 50/30/20 rule is perfect for getting started without feeling bogged down. But if you're serious about plugging financial leaks, the zero-based budget is where you'll see the biggest impact.

Real-Life Example: Sarah, a freelance graphic designer with a monthly take-home pay of $4,000, was using the 50/30/20 rule but always felt she was just scraping by. She switched to a zero-based budget and discovered she was spending over $350 on forgotten subscriptions and impulse online purchases. By reallocating that money, she was able to "find" an extra $250 each month to accelerate her student loan payments, cutting her payoff timeline by nearly two years.

Credit Management: The Key to Financial Access

Your credit score is so much more than a three-digit number; it's your financial reputation. It influences whether you can get a loan, how much interest you'll pay, and can even affect things like your car insurance rates. Understanding how it works is non-negotiable.

Pro Tip: Here’s a simple trick I’ve seen work wonders for boosting a credit score: make two smaller credit card payments a month instead of one big one. Pay about half your balance two weeks before the due date, and the rest just before it’s due. This helps keep your credit utilization—a huge factor in your score—consistently low.

Investing Fundamentals: Making Your Money Work for You

Investing might sound intimidating, but the concept is beautifully simple: you're putting your money to work so it can make more money for you. When you're just starting out, it helps to understand the difference between casting a wide net with funds versus picking individual winners.

- Index Funds: Think of buying an index fund as buying a tiny piece of every single store in a giant shopping mall. You get instant, broad diversification. If one store has a bad year, it barely makes a dent because the other 499 are still doing their thing.

- Individual Stocks: Now, imagine you buy stock in just one single coffee shop in that mall. If that little shop becomes the next big thing, you could make a fortune. But if it goes out of business, your investment is gone.

For most people, kicking things off with low-cost index funds is a smart, effective, and much less stressful strategy. As your confidence grows, you can always explore other avenues. If you feel ready for that first step, our guide on how to start investing lays out a clear path forward.

Future Planning for Long-Term Security

Finally, being financially literate means playing the long game. Planning for the future is essential, and retirement accounts are the cornerstone of that plan. For young earners, in particular, a Roth IRA is an incredibly powerful tool.

Real-Life Example: Alex, 24, lands his first job and decides to contribute $200 per month to a Roth IRA. Because Roth contributions are made with after-tax money, all of the investment growth is completely tax-free in retirement. If Alex continues this for 40 years and earns an average 8% annual return, his account could grow to over $620,000. When he retires, he can withdraw every penny of that without paying any taxes. That tax-free growth is an absolute game-changer for building long-term wealth.

Turn Financial Knowledge into Daily Habits

It’s one thing to understand compound interest or know the difference between a Roth and a Traditional IRA. That’s a fantastic start. But the real, life-changing progress happens when that knowledge gets out of your head and into your hands, shaping what you do every single day. This is all about building small, consistent financial habits that become as automatic as brushing your teeth.

Forget about marathon study sessions. We're going to focus on building "financial muscle memory" through simple, repeatable routines. The whole point is to make smart financial behavior your default setting, not something you have to grit your teeth and force yourself to do.

This visual shows how the core pillars of your financial life build on one another, starting with the foundational habit of budgeting.

As you can see, solid budgeting habits are the bedrock for managing credit well. That, in turn, opens the door to effective investing and smart long-term planning.

The Daily Money Minute

The most powerful way I’ve seen people start is with a micro-habit I call the "Daily Money Minute." It's simple. Before you check social media or even roll out of bed, take just 60 seconds to review and categorize yesterday's spending. That's it.

This tiny action does two critical things:

- It Creates Instant Awareness: You immediately see where your money went, which stops small leaks from turning into huge floods. Did that morning coffee run also include a pastry you forgot about? Now you'll catch it.

- It Prevents Backlog: Doing it daily means you never face that dreaded task of sorting through weeks of transactions. That's the kind of overwhelming chore we all procrastinate on.

Most budgeting apps make this almost effortless. You just open the app, swipe a few transactions into the right categories, and you’re done. The key here is consistency, not intensity.

The Weekly Wealth Check-In

While the daily minute keeps you on track, the "Weekly Wealth Check-in" is where you actually steer the ship. Carve out a protected, 20-minute block of time every week—maybe Sunday evening—to look at the bigger picture.

This is your personal finance ritual. During this time, you’ll:

- Review Your Budget vs. Actuals: How did your spending last week really line up with your plan?

- Celebrate a Win: Did you hit a savings goal or knock down a bit of debt? Acknowledge it!

- Plan for the Week Ahead: Any big expenses coming up? Now’s the time to adjust your plan.

This isn't about judging yourself; it's about making small course corrections. Think of it as a calm, weekly meeting with your most important client: your future self. For those who want to cement these routines, exploring some of the best habit tracking apps can give you the structure and reminders you need to make them stick.

A lasting financial habit is formed at the intersection of what is important and what is sustainable. A daily 60-second review is sustainable. A weekly 20-minute check-in is sustainable. A three-hour monthly spreadsheet session is not.

How Micro-Habits Compound Over Time

It might not feel like you’re doing much at first, but these tiny habits create massive momentum. Let's look at how this could realistically transform your finances in just one month.

| Week | Daily Money Minute | Weekly Wealth Check-In | Compounding Result |

|---|---|---|---|

| Week 1 | You catch $35 in unplanned food spending. | You find and cancel one unused $15/mo subscription. | You've already "found" $50 this month. |

| Week 2 | You're more mindful, spending 10% less on impulse buys. | You automate an extra $25 weekly transfer to savings. | Your awareness is turning into proactive saving. |

| Week 3 | You've categorized over 100 transactions with zero friction. | You use your check-in to plan ahead for a birthday gift. | You feel completely in control and prepared. |

| Week 4 | The habit is now automatic. You feel off if you miss it. | You look back and see you saved an extra $150 this month. | You've transformed financial anxiety into confidence. |

By committing to these small, repeatable actions, you are doing so much more than just managing money. You are building a system that makes financial progress inevitable, turning a source of stress into a source of personal empowerment and control.

Your Personal Finance Learning Toolkit

Turning abstract financial knowledge into real-world action is where the magic happens, but you need the right tools for the job. With a tsunami of advice online, it's easy to get overwhelmed. This guide will help you assemble a small, powerful toolkit of resources that actually work for you, so you can stop scrolling and start doing.

Let's be honest, most people are flying blind. Globally, only about one-third of the world's population is considered financially literate. And while technology has opened doors—with 79% of adults now having bank accounts—that access doesn't automatically translate to understanding. Without a solid knowledge base, many people are left vulnerable to things like high-interest debt and predatory loans. The World Bank offers some eye-opening insights on global financial access.

The key isn't to consume everything. It's to find a handful of high-quality resources you can return to again and again.

Building Your Financial Bookshelf

Books provide a level of depth that a blog post or tweet simply can't match. They give you the foundational "why" behind the "how." For a deeper dive, exploring the best personal finance books is a great starting point.

But not every book is for every person. Here's how to pick one that speaks your language:

- If you learn through stories: Grab a copy of The Richest Man in Babylon by George S. Clason. It teaches timeless financial truths through simple, engaging parables. It feels less like a finance lesson and more like uncovering ancient wisdom.

- If you're an analytical thinker: You'll appreciate a classic like The Intelligent Investor by Benjamin Graham. This isn't light reading; it's the definitive guide to making logical, evidence-based investment decisions. To get a handle on its core ideas, check out our detailed summary of The Intelligent Investor.

Essential Podcasts for Learning on the Move

Podcasts are fantastic for squeezing in financial education during your commute, workout, or while doing chores. They excel at breaking down intimidating topics into bite-sized audio lessons.

Instead of subscribing to a dozen shows, find one or two that click with you. An episode that explains asset allocation using a "financial pizza" analogy, for example, can make a complex idea stick in just 20 minutes. A good rule of thumb is to look for hosts who are certified financial planners (CFPs) to ensure the advice is solid.

My Two Cents: Don't just listen. When you hear a great tip about automating your savings or an interesting investment idea, pause the episode and jot it down in your phone's notes app right then and there. This small action transforms you from a passive listener into an active learner.

Mastering Your Financial Apps

Apps like YNAB (You Need A Budget) and Mint are incredibly powerful, but most people only use about 10% of their features. It’s like owning a sports car and only ever driving it to the grocery store.

Let’s look at how to take your usage from basic to pro-level:

| Feature | Standard Use | Pro-Level Use |

|---|---|---|

| Transaction Tagging | Just categorizing expenses as "Groceries" or "Gas." | Creating specific tags like #kids-sports or #work-lunch to see exactly where money is going without cluttering your main budget. |

| Goal Setting | Setting a vague goal like "Save $5,000 for vacation." | Breaking that down into concrete monthly targets. YNAB is brilliant for this, as it makes you "give every dollar a job" toward that goal. |

| Alerts & Notifications | Using the default alerts for low balances or upcoming bills. | Setting custom alerts for unusual spending in a specific category. This helps you spot a budget leak the moment it happens, not a month later. |

By really mastering one or two key features, you can transform these apps from simple expense trackers into proactive tools that actively guide your financial decisions. This curated toolkit of books, podcasts, and apps will give you the ongoing education and practical support needed to truly level up your financial life.

Track Your Progress and Stay Motivated

How can you tell if all this effort to improve your financial literacy is actually paying off? It's not just about watching your bank account number inch upwards. Real progress is also about how you feel—that growing confidence, the quiet subsiding of money anxiety, and the sense of being in the driver's seat of your own future.

Let's get into how to set goals that actually mean something and celebrate every win, no matter how small. When you track both the numbers and your mindset, you build unstoppable momentum.

Moving Beyond Vague Financial Goals

"I want to save more money" is a nice thought, but it’s a wish, not a goal. To see real change, your targets need to be specific, measurable, and realistic. This is how you turn a fuzzy desire into a concrete plan you can follow.

Instead of thinking in general terms, frame your objectives with clear numbers and deadlines. It makes it so much easier to know if you're on the right path.

Examples of Specific vs. Vague Goals

| Vague Wish | Specific, Actionable Goal |

|---|---|

| "I want to get better with money." | "I will track my spending every day for the next 30 days using a budgeting app." |

| "I need to pay down my debt." | "I will make an extra $100 payment on my highest-interest credit card each month for the next six months." |

| "I should save more." | "I will bump my savings rate by 1% this quarter by automating an extra transfer on payday." |

Setting these kinds of concrete targets gives you a clear finish line for each small step. Honestly, focusing on consistent progress—not perfection—is the secret to staying motivated for the long haul.

Measuring What Truly Matters

Your net worth is an important number, but it definitely doesn't tell the whole story. Your emotional well-being is just as critical an indicator of your financial health. As you learn more about money, you'll find it has a direct, positive impact on your mental state.

Recent findings show that people with strong financial literacy are 9% less likely to feel stressed about money and even report better overall health. That’s huge, especially when you consider that only 29% of people globally feel hopeful about their financial future, a sharp drop driven by inflation and housing costs. You can discover more insights about financial wellbeing from the IMF.

To get a handle on this, try this simple check-in once a month:

- Financial Stress Check-In: On a scale of 1 to 10, how anxious do you feel about your finances today?

- Confidence Score: How confident do you feel about handling an unexpected $500 expense?

- Knowledge Milestone: What's one financial concept you understand now that you didn't last month?

Jot the answers down in a notebook or a notes app. Seeing your stress level drop from an 8 to a 5 over a few months is just as rewarding as seeing your savings grow. This journey takes resilience, and building the right outlook is key. It might be helpful to check out our guide on how to develop a growth mindset to stay positive and focused on what's ahead.

Key Takeaway: Celebrate your progress, not just your performance. Did you stick to your budget for a whole week? That's a win. Did you finally open that retirement account you’ve been putting off? That’s a huge win. Acknowledging these small victories is the fuel that will keep you going when things get tough.

Frequently Asked Questions (FAQ)

Got questions? Good. It means you’re digging in and getting serious. As you start putting all this into practice, you’ll inevitably hit a few roadblocks or wonder if you’re on the right track.

1. How long does it take to become financially literate?

It is a lifelong learning process, but you can build a strong foundational knowledge in just a few months. By dedicating 20-30 minutes a day to learning and application, most people feel significantly more confident about budgeting and credit management within 90 days. The goal is consistency, not speed.

2. What is the single most important financial habit to develop?

Consciously tracking your spending. You cannot effectively manage your money until you know where it is going. Use an app or a simple notebook to track every dollar for one month. This single action provides the clarity needed to create a budget, increase savings, and invest with purpose.

3. Should I pay off debt before I start investing?

For high-interest debt (e.g., credit cards with rates above 8%), the answer is almost always yes. The guaranteed return from paying off a 22% APR credit card is an unbeatable investment. A balanced approach is to build a small emergency fund ($1,000), then aggressively pay down high-interest debt. The exception is to always contribute enough to your 401(k) to get the full employer match—it's a 100% return you don't want to miss.

4. How can I teach my kids about money?

Start early and make it tangible. Use a clear jar for young children so they can physically see their savings grow. Introduce the core concepts of earning, saving, and giving. As they get older, help them open a student checking account, let them budget for their own wants, and include them in age-appropriate family financial discussions, like planning for a vacation.

5. Are financial advisors only for rich people?

No, this is a common myth. Many fee-only Certified Financial Planners (CFP®) work with clients at all income levels. They are fiduciaries, meaning they are legally obligated to act in your best interest. Many offer hourly rates or project-based fees, making professional advice accessible without a large portfolio.

6. What is the biggest mistake beginners make?

Getting stuck in "analysis paralysis." With so much information available, it's easy to become overwhelmed and do nothing. The second biggest mistake is trying to master everything at once. Pick one area, like tracking your spending, and focus on it for a month. Small, consistent actions build momentum.

7. Is it ever too late to improve my finances?

Absolutely not. While starting early provides more time for compounding, starting later means you bring wisdom and life experience to your financial decisions. The principles of sound money management are effective at any age. The best time to start was yesterday; the second-best time is today.

8. How do I know if online financial advice is trustworthy?

Be a healthy skeptic. Use a three-step check: 1) Look for credentials (like CFP® or CFA®). 2) Understand the motive—are they educating you or selling a product? 3) Cross-reference the information with reputable sources like government sites (Investor.gov), non-profits, or established financial news outlets before acting on it.

9. What is the difference between financial literacy and financial planning?

Financial literacy is the knowledge of financial concepts (the "what"). Financial planning is the personalized strategy for applying that knowledge to your life (the "how"). For example, literacy is understanding what a 401(k) is; planning is determining how much you need to contribute to it to reach your retirement goals.

10. What role does mindset play in financial success?

A huge role. Your beliefs about money directly impact your actions. Shifting your mindset from one of scarcity or fear to one of empowerment and control is critical. See a budget as a tool for freedom, not a restriction. Forgive past mistakes and focus on making positive changes today. A proactive, growth-oriented mindset is the engine of financial progress.

At Everyday Next, we're committed to providing clear, actionable insights to help you build a secure and prosperous future. Our guides on wealth, personal development, and technology are designed to give you the knowledge you need to make informed decisions for your work and life. Explore more at https://everydaynext.com.