What is Dollar Cost Averaging? A Clear Guide to Smarter Investing

Dollar Cost Averaging (DCA) is a straightforward, yet incredibly effective, way to invest. It simply means you invest a fixed amount of money at regular times, like every week or every month.

Instead of trying to outsmart the market by guessing the perfect time to buy, you just stick to a schedule. This disciplined habit naturally leads you to buy more shares when prices are low and fewer shares when they're high. Over time, this smooths out what you pay on average.

Understanding Dollar Cost Averaging In Simple Terms

At its heart, dollar cost averaging is all about consistency. It's a strategy that favors discipline over trying to time the market perfectly.

For a lot of investors, especially when they're just starting out, the biggest question is, "Is now the right time to invest?" The fear of putting a big chunk of money into the market right before it takes a nosedive is real, and it can stop you from ever getting started. DCA takes all that guesswork and emotional stress off the table.

Here’s an everyday analogy: think about how you buy gas for your car. You probably fill up your tank on a regular schedule—say, every Friday—no matter what the price per gallon is. Some weeks, prices are up, and your money gets you a little less gas. Other weeks, prices are down, and that same amount of money buys you a lot more. You don't stress about timing the absolute lowest price of the year; you just consistently get the gas you need, and your average cost per gallon evens out.

How DCA Smooths Out Market Bumps

DCA applies that same steady logic to investing. When you commit to investing a fixed dollar amount on a set schedule, you start to see market volatility as an opportunity, not a threat. When the market dips, your regular investment suddenly has more buying power. That means you get to scoop up more shares at a discount.

Dollar Cost Averaging is less about chasing the highest possible returns and more about managing risk and building wealth with a calm, disciplined approach. It frees you from the anxiety of trying to predict the unpredictable.

This systematic process helps lower your average cost per share over time, which is a powerful advantage compared to buying a fixed number of shares at each interval. It’s a foundational concept for anyone looking to build wealth steadily and with less stress. For more ideas on getting started, check out our guide on how to invest money for beginners.

The Core Concepts At A Glance

To make this crystal clear, let's quickly recap the main ideas behind what makes dollar cost averaging work.

This table breaks down the key principles that make the strategy so effective for so many people.

Dollar Cost Averaging at a Glance

| Concept | Explanation |

|---|---|

| Fixed Investment Amount | You invest the same amount of money each time (e.g., $100), not a fixed number of shares. |

| Regular Intervals | Your investments happen on a consistent schedule, like weekly, bi-weekly, or monthly. |

| Market Independence | The strategy works on autopilot, regardless of whether the market is up or down. |

| Reduced Emotional Investing | It helps prevent impulsive decisions driven by fear (selling low) or greed (buying high). |

Ultimately, these core concepts work together to create a disciplined, automated investing habit that can serve you well over the long haul.

Seeing Dollar Cost Averaging in Action with Real Numbers

It’s one thing to talk about a strategy in theory, but seeing how dollar cost averaging works with actual numbers is what really makes it click. This is where the abstract concept becomes a practical tool you can use to build your wealth over time.

Let's walk through a simple, year-long example to show you exactly how powerful this can be.

Imagine you decide to invest in a broad market index fund. Instead of trying to pinpoint the "perfect" day to buy in, you commit to investing $100 on the first of every month. Rain or shine, you stick to the plan. This is the heart of dollar cost averaging—a disciplined, almost automatic approach that takes emotion and guesswork completely out of the picture.

Your fixed $100 will naturally buy a different number of shares each month as the fund's price goes up and down.

A Hypothetical $100 Monthly Investment

To see how this plays out, we'll track this hypothetical investment over 12 months. Pay close attention to how your consistent $100 buys more shares when the price is low (like in March) and fewer shares when the price is high (like in December). This is the magic of the strategy at work.

Here’s a breakdown of that year:

Hypothetical $100 Monthly Investment Over 12 Months

| Month | Investment Amount | Share Price | Shares Purchased | Total Shares | Total Invested | Average Cost Per Share |

|---|---|---|---|---|---|---|

| Jan | $100.00 | $20.00 | 5.00 | 5.00 | $100.00 | $20.00 |

| Feb | $100.00 | $18.00 | 5.56 | 10.56 | $200.00 | $18.94 |

| Mar | $100.00 | $15.00 | 6.67 | 17.23 | $300.00 | $17.41 |

| Apr | $100.00 | $17.00 | 5.88 | 23.11 | $400.00 | $17.31 |

| May | $100.00 | $21.00 | 4.76 | 27.87 | $500.00 | $17.94 |

| Jun | $100.00 | $23.00 | 4.35 | 32.22 | $600.00 | $18.62 |

| Jul | $100.00 | $22.00 | 4.55 | 36.77 | $700.00 | $19.04 |

| Aug | $100.00 | $20.00 | 5.00 | 41.77 | $800.00 | $19.15 |

| Sep | $100.00 | $24.00 | 4.17 | 45.94 | $900.00 | $19.59 |

| Oct | $100.00 | $25.00 | 4.00 | 49.94 | $1,000.00 | $20.02 |

| Nov | $100.00 | $26.00 | 3.85 | 53.79 | $1,100.00 | $20.45 |

| Dec | $100.00 | $28.00 | 3.57 | 57.36 | $1,200.00 | $20.92 |

Take a look at the results. Even though the share price ended the year at $28.00—much higher than where it started—your average cost per share was only $20.92. By staying consistent, you effectively used the market's ups and downs to your advantage. If you're curious about this type of fund, our guide to investing in the S&P 500 index is a great place to start.

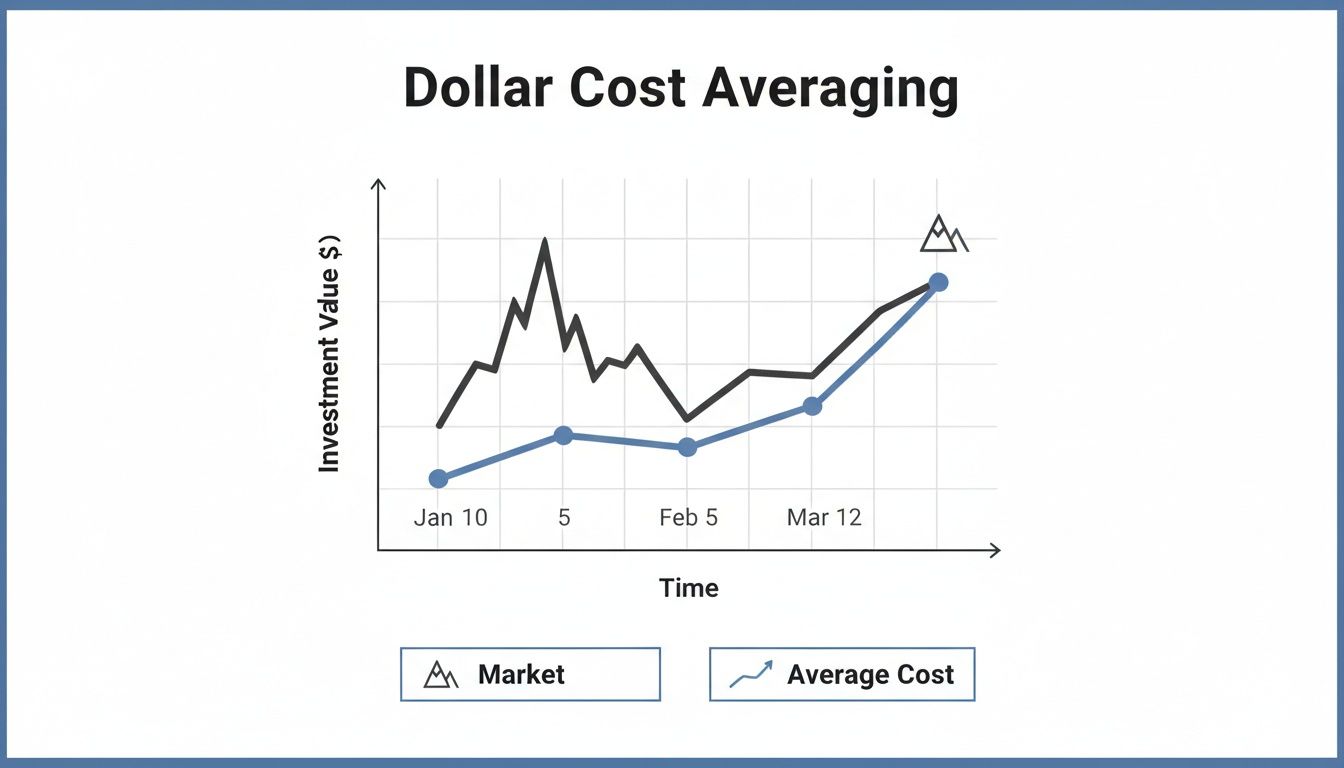

This chart helps visualize what’s happening. Your average cost smooths out over time, while the market price itself is much more erratic.

The key takeaway is simple: while the market price bounces all over the place, your average cost line is much less dramatic. This helps insulate you from the shock of buying at a market peak.

DCA vs. Lump Sum Investing: Which Strategy Wins?

It’s the classic investing showdown. You’ve got a chunk of money ready to go—do you put it all in the market at once, or do you feed it in slowly over time? This is the heart of the debate between Lump Sum (LS) investing and Dollar Cost Averaging (DCA).

Each approach has its die-hard fans, and honestly, the "winner" often has less to do with a spreadsheet and more to do with your personality and financial situation.

On paper, the case for lump sum investing looks pretty solid. Studies from Vanguard and Morningstar have consistently shown it beats DCA about two-thirds of the time. One analysis of U.S. markets from 1976 to 2022 found that putting your money in all at once came out ahead roughly 68% of the time. Why? Because historically, markets go up more than they go down.

But that statistic doesn’t tell the whole story. The choice often comes down to a trade-off: are you trying to squeeze out every last potential penny of return, or are you more interested in managing risk and sleeping well at night? Before making a call, it's wise to compare the DCA method with strategies that detail how to invest a lump sum.

The Mathematical Case for a Lump Sum

The logic here is simple and powerful: time in the market beats timing the market. When you invest your money all at once, you give every single dollar the maximum amount of time to grow and compound. Since the market’s long-term trend is upward, getting your capital working for you as soon as possible usually produces the best results.

The catch? This strategy comes with a big psychological hurdle. Pouring a huge sum of money into the market right before a major crash can be gut-wrenching. It's the kind of event that makes people panic and sell at the absolute worst time, locking in devastating losses.

The Behavioral Case for Dollar Cost Averaging

This is where DCA really shines. While it might not always deliver the highest possible number on paper, it's often a far more sustainable and less stressful strategy for the average person. It takes the guesswork and emotion out of the equation.

By spreading your investments out, DCA acts as a kind of emotional safety net. You're protected from the massive regret of going "all in" right at a market peak. This steady, disciplined approach builds healthy investing habits and makes it much easier to stay the course when things get choppy. For many, that peace of mind is worth far more than the potential for a slightly higher return.

If you're still figuring out what works for you, our overview of different investing strategies for beginners can provide more guidance.

The best investing strategy is the one you can actually stick with. For many investors, the psychological comfort of DCA makes it the better choice for long-term success, even if it doesn't always win on paper.

A Head-to-Head Comparison

To help you figure out which strategy fits your goals and temperament, let's put them side-by-side. This table breaks down the key differences between DCA and lump sum investing.

DCA vs. Lump Sum: A Head-to-Head Comparison

| Factor | Dollar Cost Averaging (DCA) | Lump Sum (LS) Investing |

|---|---|---|

| Risk Management | Lower Risk. Smooths out the ride by preventing you from investing everything right before a big market drop. | Higher Risk. Your entire investment is immediately exposed to whatever the market does next. |

| Potential Returns | Often slightly lower. Some of your cash sits on the sidelines, which can create a "cash drag" in a rising market. | Often higher. Maximizes your time in the market, which historically has led to better long-term returns. |

| Emotional Ease | Easier. Automates your investing and removes the stress of trying to pick the "perfect" day to buy. | More Difficult. Can be nerve-wracking to see a large investment immediately lose value in a downturn. |

| Best for… | New investors, anyone investing a windfall (like an inheritance), or those who prefer a disciplined, low-stress method. | Confident long-term investors who have a lump sum ready and can stomach short-term volatility without panicking. |

In the end, this is a personal decision. If you have the discipline to invest a lump sum and tune out the market's daily drama, history suggests you'll likely come out ahead. But if the thought of a market crash right after you invest keeps you up at night, the slow-and-steady path of dollar cost averaging is a fantastic way to build wealth with confidence.

The Pros and Cons of a DCA Strategy

No single investing strategy is perfect. Dollar cost averaging is a fantastic tool for some goals, but like any tool, it’s not the right one for every job.

Knowing where DCA shines—and where it falls short—is the key to deciding if it fits your financial plan and, just as importantly, your personality.

The Advantages of Dollar Cost Averaging

The biggest wins with DCA are often behavioral. It’s a strategy designed to build good, sustainable habits, which can be far more valuable than trying to squeeze out every last percentage point of return.

- Takes Emotion Out of the Equation: Investing becomes automatic. By sticking to a schedule, you sidestep the temptation to panic-sell during a downturn or FOMO-buy at a market peak. It’s a built-in discipline machine.

- Lowers Your Average Cost: As we saw in the examples, you naturally buy more shares when prices are low and fewer when they're high. Over time, this can smooth out your purchase price, especially in choppy markets.

- Makes Investing Easy to Start: You don’t need a huge pile of cash to begin. DCA lets you start building wealth with whatever you can set aside, whether it’s $50 a week or $200 a month.

- Reduces "Bad Timing" Risk: The number one fear for many investors is dumping all their money into the market the day before it crashes. DCA dramatically lowers this risk by spreading your investments over time.

The real magic of dollar cost averaging is how it turns market volatility from your enemy into your friend. A dip in the market isn't a crisis; it's a sale.

The Disadvantages of Dollar Cost Averaging

While DCA is great for managing risk and emotions, it’s not a free lunch. There are some trade-offs to be aware of, especially in certain market conditions.

The main drawback is something called "cash drag." When you use DCA, you're intentionally leaving cash on the sidelines to invest later. In a runaway bull market that just keeps going up, that uninvested cash isn't earning returns, which means you could end up with less money than if you had invested it all at once.

Transaction fees can also be a factor. If your broker charges you for every trade, making lots of small investments can add up. Thankfully, with so many platforms now offering commission-free trading, this is less of an issue than it used to be. To see how DCA can fit into a broader strategy, it helps to understand how to diversify your portfolio as well.

At the end of the day, choosing DCA is a conscious decision to prioritize steady, disciplined investing over chasing the highest possible gains.

How to Put Dollar Cost Averaging into Practice

Theory is one thing, but turning knowledge into action is where real wealth is built. The good news is that putting dollar cost averaging into practice is probably a lot simpler than you think. It's really all about creating a systematic plan that runs on autopilot, making disciplined investing your new default setting.

This section is your roadmap. We'll walk through how to get you from just learning about DCA to actually doing it. We'll cover picking the right investments, choosing a platform, and setting up your schedule so you can start with confidence.

Step 1: Choose Your Investments

First things first, you need to decide what you want to buy consistently. While you can certainly use DCA to buy individual stocks, the strategy really shines when you pair it with broad-market funds that already have diversification built right in.

Here are a few of the most common choices for a DCA strategy:

- Index Funds: These funds simply track a major market index, like the S&P 500. Think of them as a low-cost way to own a tiny piece of hundreds of top companies all at once. For a deeper dive, check out our complete guide on how to start investing in index funds.

- ETFs (Exchange-Traded Funds): ETFs are a lot like index funds—they bundle together many stocks or bonds—but they trade throughout the day like a single stock. They’re known for their flexibility and broad diversification.

- Mutual Funds: These are professionally managed funds that pool money from tons of investors to buy a portfolio of stocks, bonds, or other assets.

If you're leaning toward diversified funds, learning how to invest in ETFs is a great next step. The main takeaway here is to pick an investment you feel comfortable holding for the long haul.

Step 2: Select a Brokerage Platform

To start investing, you’ll need an account with a brokerage firm. Thankfully, modern platforms make setting up automatic investments incredibly easy. As you compare your options, keep an eye out for features that make a DCA strategy work seamlessly.

Here are the key features to look for:

- Automatic Investing: This is a must-have. Your platform needs to let you schedule recurring buys—say, weekly or monthly—directly from a linked bank account.

- Low or No Commissions: You'll be making a lot of smaller trades, and transaction fees can seriously drag down your returns over time. Many top brokers now offer $0 commission on stock and ETF trades.

- Fractional Shares: This is a game-changer. It lets you invest a specific dollar amount, like $50, even if that’s not enough to buy a full share of a fund. This ensures every single one of your dollars is put to work.

Step 3: Decide on Your Amount and Schedule

Next up, you need to figure out how much you can realistically invest and how often. I can't stress this enough: consistency is far more important than the amount.

The best plan is one you can actually stick to. It’s much better to automate $50 a month without fail than to aim for $500 and constantly have to pause your contributions.

Take a hard look at your budget and find an amount that won't strain your finances. Then, pick a frequency. Weekly, bi-weekly, or monthly are the most popular choices. A great trick is to align your investment schedule with your paydays—the money is invested before you even have a chance to miss it.

Step 4: Set It and Forget It

Okay, you've made the key decisions. Now it’s time to log into your brokerage account and set up the automatic investment plan. You'll just need to specify the investment you chose, the dollar amount, and the schedule you decided on.

Once it's set up, your most important job is to let the system work its magic. You have to resist the urge to tinker with the plan or pause it because of a scary headline. The entire point of dollar cost averaging is to take emotional decision-making out of the equation and just focus on building wealth steadily over time.

Is Dollar Cost Averaging the Right Move for You?

Figuring out how to invest your money is a personal decision. It's not just about crunching numbers; it's about finding a strategy that fits your personality, your financial goals, and how much risk you can stomach.

So, how do you know if dollar cost averaging is the right call? The best way is to see where it truly excels. By looking at a few common situations, you can quickly tell if its steady, disciplined approach feels right for you.

Who Benefits Most From a DCA Approach?

While just about anyone can use dollar cost averaging, it's a game-changer for a few specific types of investors. It’s a strategy that turns market anxiety into a simple, automated plan.

Here are a few real-life scenarios where DCA excels:

Real-Life Examples of DCA in Action

| Scenario | Investor Profile & Goal | Why DCA is a Great Fit |

|---|---|---|

| The New Grad | Sarah, 22, just started her first job. Her goal is to build long-term wealth but she only has $200/month to invest and is nervous about market timing. | DCA allows Sarah to start immediately with a small amount. By automating her $200 investment, she builds a disciplined habit and avoids the paralysis of waiting for the "perfect" moment to invest. |

| The Windfall Recipient | David, 45, inherited $100,000. He wants to invest it for retirement but is terrified of investing it all right before a market crash like the one in 2008. | David decides to invest $10,000 per month over 10 months. This DCA approach mitigates the risk of bad timing and eases his anxiety, making it psychologically easier to put the large sum to work. |

| The 401(k) Contributor | Maria, 35, contributes 10% of every paycheck to her company's 401(k). She doesn't even think about it; it just happens automatically. | This is classic DCA. Every two weeks, Maria's contribution buys shares in her chosen funds, regardless of whether the market is up or down. Over 30 years, this will smooth out volatility and build significant wealth. |

| The Crypto Investor | Ben, 28, believes in the long-term potential of cryptocurrencies but is wary of their extreme volatility. | Ben sets up a weekly buy of $50 into a major cryptocurrency. DCA helps him build a position over time, averaging out the wild price swings and reducing the risk of buying his entire stake at an all-time high. |

DCA Is Probably Already Part of Your Plan

Here’s something interesting: millions of us are already using dollar cost averaging, often without even knowing it. This strategy is the default setting for most workplace retirement plans, like a 401(k) or 403(b).

Every time a slice of your paycheck automatically goes into your retirement account, you're using dollar cost averaging. That consistent, automated investment is one of the simplest and most powerful ways to build wealth over the long haul.

This system is designed to keep you investing through thick and thin, no matter what the market is doing. It takes the guesswork out of the equation and lets your wealth grow through steady, disciplined contributions.

At the end of the day, if you value consistency and want a systematic way to build wealth that takes emotion out of the picture, dollar cost averaging is likely an excellent move for you. It provides a clear, simple framework that’s perfectly suited for long-term financial success.

Your Top Dollar Cost Averaging Questions, Answered

Here are answers to the 10 most frequently asked questions about dollar cost averaging.

1. Can you actually lose money with dollar cost averaging?

Yes, absolutely. DCA is a strategy for how you invest, not a magic shield that guarantees a profit. If the asset you're consistently buying goes down in value and stays down for good, you'll lose money. DCA mitigates timing risk, but not the fundamental risk of the investment itself.

2. How often should I invest? What's the best frequency?

The best frequency is the one you can stick to consistently. For most people, aligning investments with paychecks (weekly, bi-weekly, or monthly) is most effective. The difference in returns between weekly and monthly investing is minimal over the long term; consistency is far more important than frequency.

3. Is DCA a good strategy for my 401(k) or IRA?

It’s not just a good strategy; it's the default strategy for most retirement accounts. When you contribute a portion of each paycheck to your 401(k), you are using dollar cost averaging. This automated approach is perfect for long-term goals like retirement as it enforces discipline and smooths out market volatility over decades.

4. Does DCA work for anything besides index funds, like single stocks?

Technically, yes. You can use DCA for individual stocks, ETFs, mutual funds, and even cryptocurrency. However, it's most effective for broadly diversified assets with a historical upward trend, like an S&P 500 index fund. Using it for a single stock is riskier because if that one company fails, your investment may not recover.

5. How much money do I need to get started?

You can start with very little. Thanks to commission-free trading and fractional shares, many brokerage platforms allow you to start a DCA plan with as little as $5 or $10. The key is to build the habit, not to start with a large amount.

6. What if I have to stop my DCA plan for a while?

Life happens. If you need to pause your contributions due to a job change or emergency, you can. Simply turn off the automatic transfers. The money you've already invested will remain in the market. The goal is to resume your plan as soon as you are financially able.

7. Is there a bad time to start a DCA plan?

No. The entire point of DCA is to eliminate the stress of trying to find the "perfect" time to start. Because you are buying at regular intervals, you will inevitably buy during market highs, lows, and everything in between. The best time to start is now.

8. How long should I use a DCA strategy?

DCA is a long-term strategy. It's designed for accumulating wealth over years or decades, not for short-term trading. The benefits of averaging your costs and compounding returns become more powerful the longer you stick with the plan.

9. What is "Value Averaging" and how is it different from DCA?

Value Averaging is a related but more complex strategy. With DCA, you invest a fixed dollar amount each time. With Value Averaging, you invest a variable amount to ensure your portfolio's value increases by a fixed amount each period. It forces you to invest more aggressively in down markets and less in up markets, but it requires more active management.

10. Does DCA protect me from a market crash?

DCA does not protect you from portfolio losses during a market crash. Your existing investments will still decline in value. However, it helps you manage the risk of a crash by ensuring you continue to buy shares at progressively lower prices during the downturn, which can lead to a faster recovery and better long-term returns.

Ready to put these insights into action? Everyday Next provides clear, practical guides on wealth, investing, and personal development to help you make smarter financial decisions. Explore our resources today at https://everydaynext.com.